Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 12, 2026

Emerging markets business confidence remains subdued heading into 2026

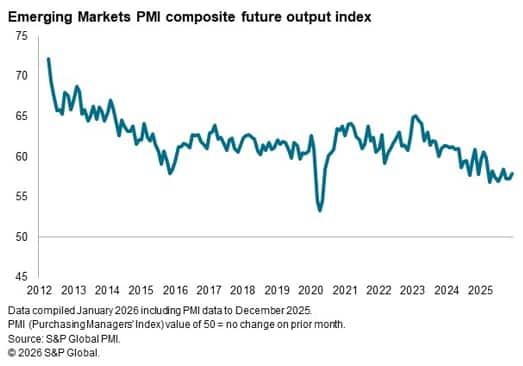

Although December PMI data pointed to sustained improvements in output and new orders across emerging markets at the end of 2025, companies remained relatively cautious regarding the outlook for 2026. Business sentiment has failed to recover from the drop in April 2025, when the US announced widespread tariffs, with 2025 as a whole seeing the lowest confidence since comparable data started being collected in 2012.

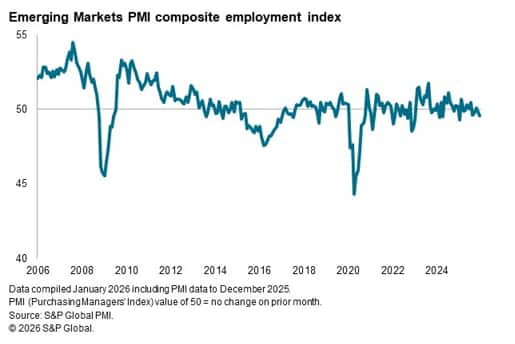

The relatively subdued outlook meant that emerging markets firms continued to cut back on staffing levels at the end of 2025, with a reluctance to hire a key feature of the PMI surveys from last year. These limitations on workforce capacity potentially limit the pace of output growth as 2026 gets underway.

Sentiment in 2025 lowest on record

The PMI surveys compiled globally by S&P Global indicated that emerging markets business confidence remained relatively muted at the end of 2025. Although picking up to a three-month high in December, sentiment was still well below the average since the series began in 2012. In fact, the average reading of the PMI's Future Output Index for 2025 was the lowest annual average on record, even below that seen over the whole of 2020, when business was severely affected by the COVID-19 pandemic.

Confidence in emerging markets has yet to recover the ground lost when optimism dropped sharply in April 2025 following the announcement of widespread tariffs by the US, with sentiment remaining some way below the March reading through the rest of the year.

Looking at the two principal sectors covered by PMI data, there were some encouraging signs of improving confidence in services in December. Here, optimism strengthened to a nine-month high, driving the improvement in overall sentiment at the end of 2025. On the other hand, confidence dipped among emerging markets manufacturers and was the lowest since June of last year.

Overall business optimism in emerging markets has also remained comfortably below that seen in developed markets at the end of 2025, as has been the case for some time. In contrast to the emerging markets picture, sentiment in developed markets recovered to March 2025 levels quickly after the initial drop in April. Recent months have seen an unusually large deficit of confidence among emerging markets firms relative to their developed markets counterparts.

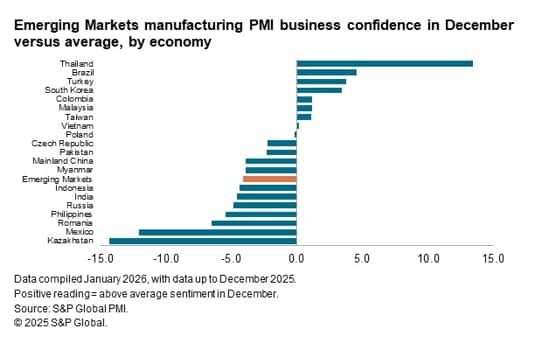

Across manufacturing, most of the emerging economies covered by PMI data saw below-average business sentiment in December. Optimism was particularly weak in Kazakhstan, where firms face uncertainty around the impact of a rise in VAT in January, and Mexico, where tariffs continue to cloud the outlook. Relatively muted optimism was also seen in Mainland China, India and Russia.

More positively, manufacturers in Thailand were buoyant regarding the outlook for production in 2026 amid accelerated growth of output and new orders at the end of 2025. Brazil, Turkey and South Korea also saw relatively strong confidence heading into 2026.

Lack of confidence hits hiring

Subdued confidence among emerging markets companies contributed to a reluctance among them to take on extra staff. Employment decreased for the fourth time in the past five months in December. Although the pace of job cuts was only marginal, it was still the sharpest since last January. Over the course of 2025 as a whole, the seasonally adjusted Employment Index averaged exactly 50.0, pointing to a year of stagnation in emerging markets staffing levels.

Employment was down across both the manufacturing and services sectors in December. In fact, manufacturing workforce numbers increased in only two months of 2025 (March and October).

Falling staffing levels overall were recorded in December despite some positive signs elsewhere in the survey data. Both new orders and business activity continued to rise, albeit at slower rates and backlogs of work increased for the fourth time in the past five months. The latter is something that would normally lead firms to take on extra staff to be able to keep on top of workloads.

Meanwhile, inflationary pressures remained muted, with input cost inflation easing to a six-month low and output prices increasing at the same marginal pace as recorded last November.

The PMI data for January, released at the start of February, will provide the first indication of whether emerging markets business confidence has improved with the turn of the new year, potentially providing the impetus for companies to take on staff in line with rising workloads, or whether sentiment will remain subdued, limiting growth.

Andrew Harker

Economics Director

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-business-confidence-remains-subdued-heading-into-2026.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-business-confidence-remains-subdued-heading-into-2026.html&text=Emerging+markets+business+confidence+remains+subdued+heading+into+2026+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-business-confidence-remains-subdued-heading-into-2026.html","enabled":true},{"name":"email","url":"?subject=Emerging markets business confidence remains subdued heading into 2026 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-business-confidence-remains-subdued-heading-into-2026.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+markets+business+confidence+remains+subdued+heading+into+2026+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-business-confidence-remains-subdued-heading-into-2026.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}