Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

COMMENTARY

Jan 09, 2026

US manufacturers report weak end to 2025 with first drop in orders for a year

Although manufacturers continued to ramp up production in December, suggesting the goods producing sector will have contributed to further robust economic growth in the fourth quarter, growth prospects for the start of 2026 are looking less rosy.

Production exceeds demand

Something of a Wile E. Coyote scenario has developed, according to S&P Global's Manufacturing PMI data. Just like the cartoon character continues to run despite chasing the Road Runner off a cliff - factories are continuing to produce goods despite suffering a drop in orders.

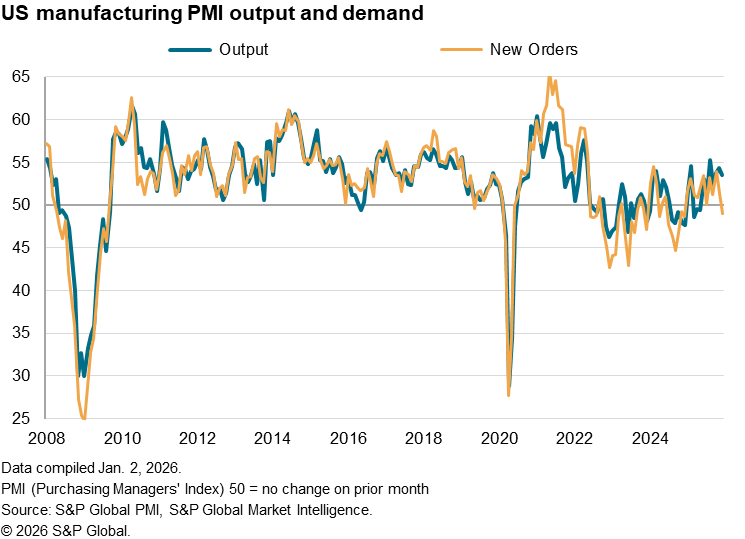

While manufacturing output rose for a seventh successive month in December, new orders fell for the first time since December 2024.

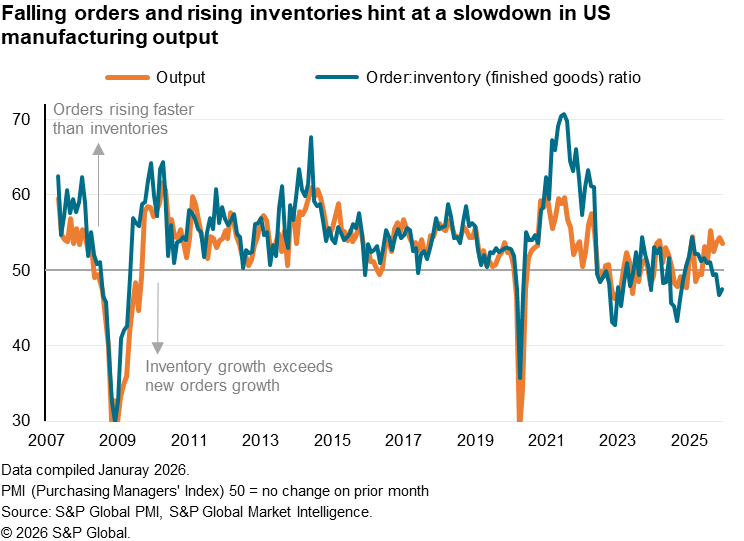

The gap between growth of production and the drop in orders in fact represents the widest disparity between what's being made and what's being sold since the height of the global financial crisis back in 2008-9. In other words, unless demand improves, current factory production levels are clearly unsustainable.

Backlogs of work are already falling, down for a fourth month in a row in December, but the growing gap between production and new order inflows suggest these backlogs of work will start dropping more sharply in the new year absent a pick-up in new sales.

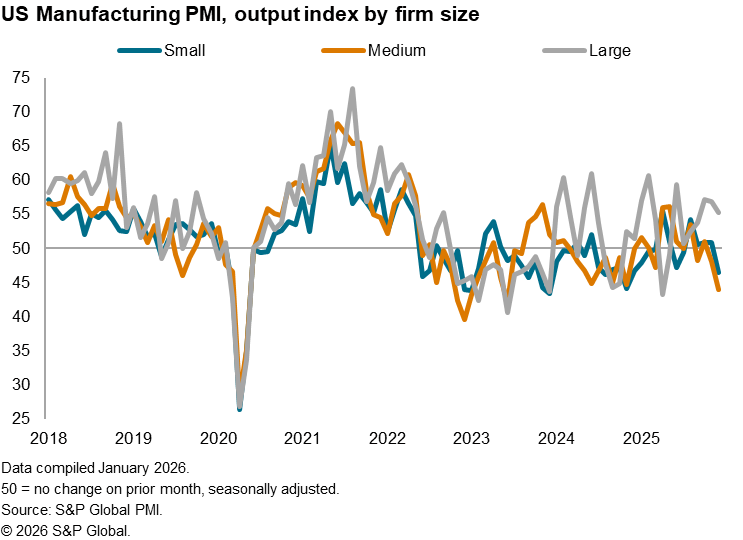

Smaller firms hit hardest

Small and medium sized manufacturers are struggling the most, where production is already falling in response to deteriorating sales. While larger manufactures have proven more resilient, even here firms have reported a weakening of new order inflows in December.

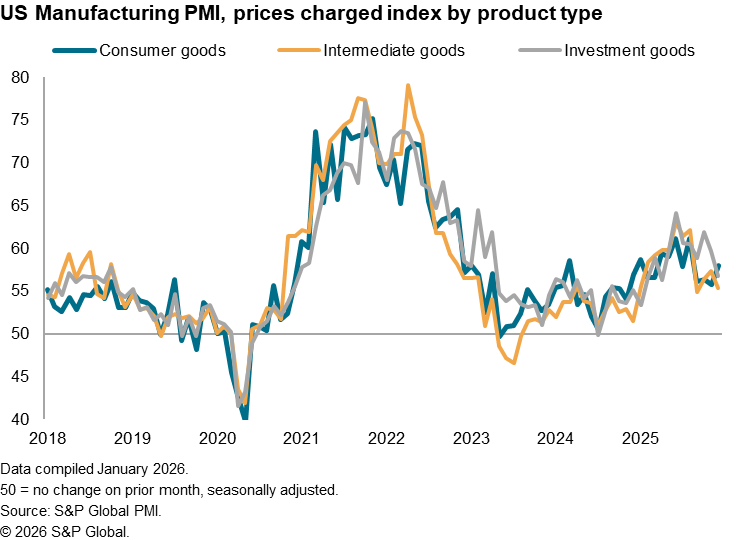

Producers of intermediate goods? are reporting an especially noticeable downturn in demand as their customers seek to pare back excess inventory holdings, but consumer goods producers are growing especially concerned over the outlook.

Price worries

A key factor causing concern over sales is the extent to which producers are having to pass higher costs on to customers in the form of raised prices. These concerns appear most prevalent in the consumer goods sector, though is a common thread across all manufacturers, with higher costs continuing to be overwhelmingly blamed on tariffs.

Word cloud analysis of reasons cited by US manufacturers for higher prices in December 2025

Source: S&P Global PMI, Json Davies.

© S&P Global 2026.

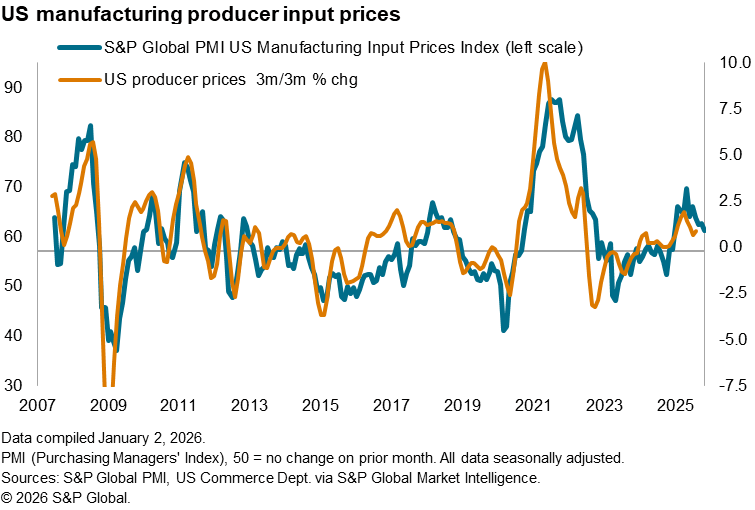

Peak tariff impact on costs?

Some encouragement comes from input cost inflation moderating in December to the lowest recorded since last January. However, while this cost trend suggests the tariff impact on inflation peaked back in the summer, costs are still rising month-on-month at an elevated rate to suggest that US firms continue to face higher cost growth than competitors in most other major economies, as has been the case since last February.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturers-report-weak-end-to-2025-with-first-drop-in-or.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturers-report-weak-end-to-2025-with-first-drop-in-or.html&text=US+manufacturers+report+weak+end+to+2025+with+first+drop+in+orders+for+a+year++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturers-report-weak-end-to-2025-with-first-drop-in-or.html","enabled":true},{"name":"email","url":"?subject=US manufacturers report weak end to 2025 with first drop in orders for a year | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturers-report-weak-end-to-2025-with-first-drop-in-or.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+manufacturers+report+weak+end+to+2025+with+first+drop+in+orders+for+a+year++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturers-report-weak-end-to-2025-with-first-drop-in-or.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}