Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 20, 2026

Eurozone upturn buoyed in February as flash manufacturing PMI hits 44-month high

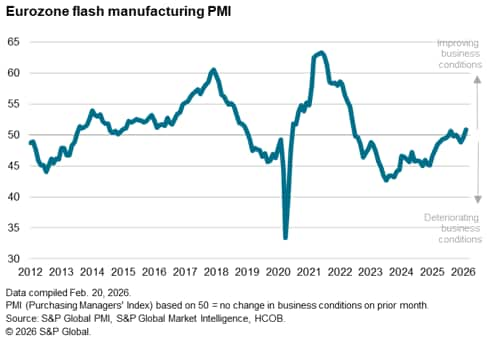

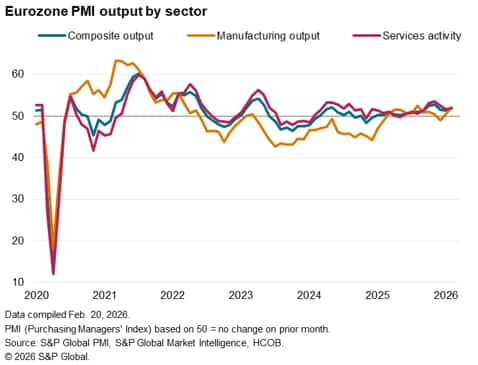

The flash Eurozone PMI signalled improved economic growth midway through the first quarter of 2026. The growth dynamic showed further signs of shifting in favour of manufacturing, where output rose at one of the strongest rates seen over the past four years, matched by a four-year high level of business optimism. The headline Manufacturing PMI - a composite indicator based on five survey variables - is now at its highest since June 2022.

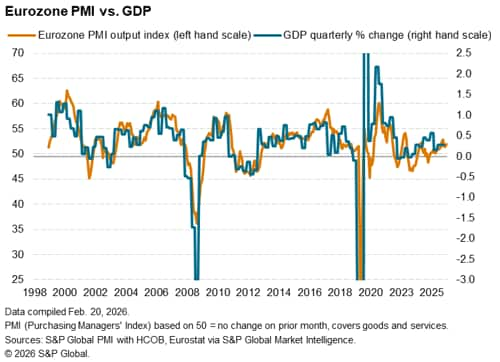

While the service sector has lost some momentum in 2026, it nevertheless also continued to see one if its best growth spells in recent years, hinting at a broad-based, though still sluggish economic upturn. The combined survey data for manufacturing and services are signaling quarterly GDP growth of 0.2% so far this year.

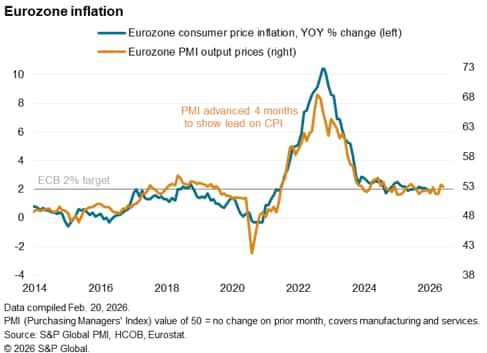

Price pressures meanwhile remained largely contained around the central bank's target, albeit with signs of inflation having picked up in recent months, notably in Germany. Rising prices were often blamed on higher wage costs, which were also a contributor to stalled hiring across the eurozone; a factor which could limit the region's further recovery.

Eurozone economy set for 0.2% growth in first quarter

Eurozone business activity grew at an increased rate midway through the first quarter. The seasonally adjusted HCOB Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, rose from 51.3 in January to a three-month high of 51.9 in February, according to the preliminary 'flash' reading. Although below the highs seen in October and November of last year, February's reading was the third-highest since May 2024.

While the PMI over the fourth quarter as a whole was consistent with quarterly GDP growth of 0.3%, the survey data for the first quarter so far are indicative of a slightly weaker 0.2% rate of growth.

An acceleration of growth in the manufacturing economy meant the goods-producing sector outpaced the service sector for the first time since last August and contrasted with much of the post-pandemic period, during which manufacturing has generally acted as a significant drag on the eurozone economy. The February increase in manufacturing output was the largest since March 2022 barring last August's expansion. While service sector growth lagged that of manufacturing, it nevertheless also saw the rate of activity pick up slightly.

Weak demand hits hiring

New orders growth was more disappointing. Although manufacturers reported the largest monthly rise in orders since April 2022, the increase was only modest. Meanwhile, service sector new business inflows rose only very marginally, posting the smallest rise for six months, pointing to subdued demand conditions.

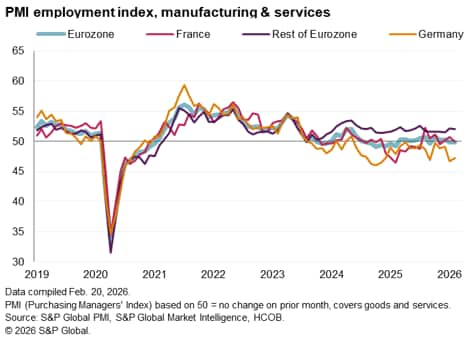

The sluggish order book growth was met by a reluctance to hire new staff. Employment fell marginally across the eurozone for a second successive month after three months of modest gains late last year.

A stalling of service sector jobs growth after five years of continual growth was accompanied by a cooling rate of job losses in manufacturing, adding further to signs that the region's growth engine is moving from services to manufacturing.

Factory optimism at four-year high

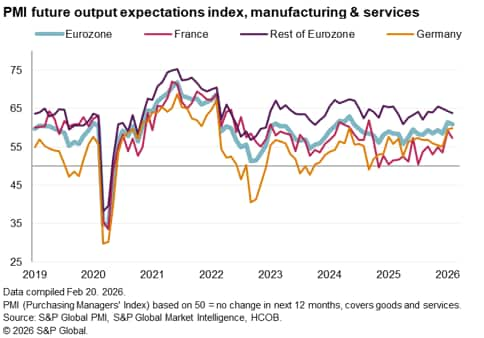

This shifting growth dynamic was further highlighted by the forward-looking expectations data from the flash PMI. While February saw business optimism wane slightly in the services economy, optimism in the goods-producing sector rose to its brightest for four years. That said, optimism in the services sector also remained elevated by recent standards, with February's reading being one of the highest seen over the past year and a half.

Measured across both sectors, business output expectations have been running at their highest since mid-2024 so far this year.

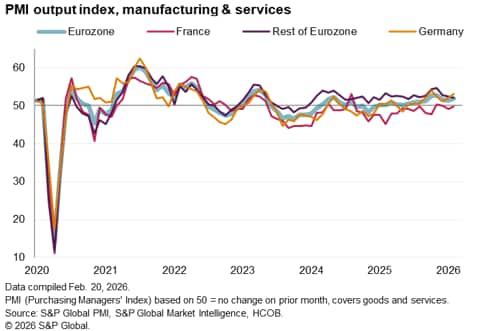

German growth strengthens as France reports output dip

Within the eurozone, growth accelerated in Germany to the strongest since May 2023 barring only the upturn seen last October, fueled by accelerating growth across goods and services.

Output meanwhile fell marginally in France, led by a slight drop in service output. More encouragingly, manufacturing output rose for a second month in France, registering the best back-to-back monthly performance for four years.

The rest of the region combined saw output growth moderate to an eight-month low, despite a renewed upturn in goods production.

Germany also stood out in reporting a rise in future output expectations, to the joint-highest in four years, contrasting with reduced - though still elevated - expectations elsewhere in the region.

It was a different picture for employment, however, with German firms cutting headcounts compared to a flat employment picture in France and a solid rise in staffing levels elsewhere on average.

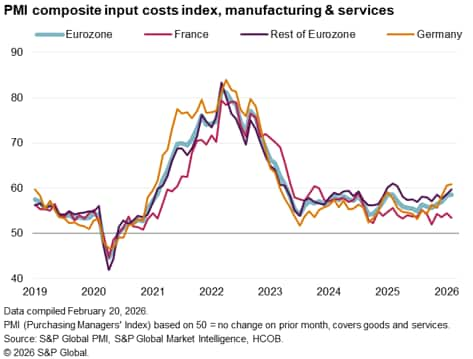

Input cost inflation at 12-month high

The drop in employment in Germany was again linked to the need to reduce costs, and it was notable that German firms reported relatively higher input cost inflation - especially in the service sector. German input costs rose at the fastest rate for three years, with service providers in particular reporting higher wage pressures, in turn partly linked to the higher minimum wage introduced at the start of the year. However, although input cost inflation moderated in France, it also rose across the rest of the eurozone on average, pushing the overall rate of inflation across the region to a 12-month high.

The rate of inflation in output prices meanwhile dipped slightly but remained the second-highest seen over the past year. The current level is nevertheless broadly consistent with inflation running close to the ECB's target of 2%. Although services inflation cooled, manufacturing selling prices rose at the fastest rate since April 2023.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-upturn-buoyed-in-february-as-flash-manufacturing-pmi-hits-44month-high-feb26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-upturn-buoyed-in-february-as-flash-manufacturing-pmi-hits-44month-high-feb26.html&text=Eurozone+upturn+buoyed+in+February+as+flash+manufacturing+PMI+hits+44-month+high+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-upturn-buoyed-in-february-as-flash-manufacturing-pmi-hits-44month-high-feb26.html","enabled":true},{"name":"email","url":"?subject=Eurozone upturn buoyed in February as flash manufacturing PMI hits 44-month high | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-upturn-buoyed-in-february-as-flash-manufacturing-pmi-hits-44month-high-feb26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+upturn+buoyed+in+February+as+flash+manufacturing+PMI+hits+44-month+high+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-upturn-buoyed-in-february-as-flash-manufacturing-pmi-hits-44month-high-feb26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}