Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 13, 2026

Week Ahead Economic Preview: Week of 16 February 2026

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI survey updates accompanied by key GDP and inflation data

The week ahead should provide plenty of insights into economic trends for markets and policymakers in the world's major economies. Flash PMI survey releases for February are accompanied by inflation numbers in the UK, US and Japan, with the latter two economies also reporting fourth quarter GDP.

The flash PMI data on Friday will provide keenly awaited updates on economic conditions around the world. January's data showed US business activity growing at a reduced rate compared to the strong pace seen through much of late last year, while growth accelerated in Japan, the UK and Australia. Although the eurozone underperformed with only modest growth, it saw the business mood brighten markedly to hint at better times to come. The February PMI data will therefore give insights into whether these growth patterns are continuing to shift in favour of Japan and Europe, while also providing fresh clues as to inflation and hiring trends. Prior data showed price pressures lifting higher globally, though jobs data were more mixed: strong job gains in Japan and Australia contrasted with steep declines in the UK and Germany and a modest jobs gain in the US.

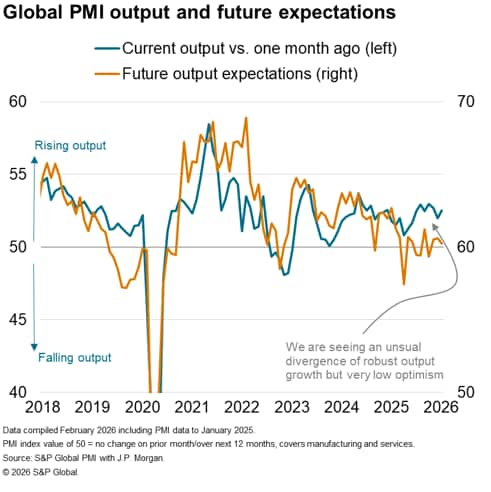

We will also be especially keen to see how overall PMI output levels compare with business sentiment, as a wide disparity continued to persist in January as growth proved resilient despite historically low global confidence (see chart).

Official inflation data are also published in the US on Friday in the form of the Fed's preferred PCE data, which last showed a 2.8% annual rise, alongside the advance estimate of fourth quarter GDP. The Fed's latest decision to hold rates steady will meanwhile be scrutinised through the release of the meeting's minutes on Wednesday. Also watch out for US durable goods orders and industrial production data.

Inflation and fourth quarter GDP data are also published for Japan during the week, with any signs of strong growth and rising inflation likely to tip the balance in favour of an early rate hike by the Bank of Japan.

In Europe, official labour market, inflation and retail sales data will provide more clues as to which way the Bank of England will move after a close decision to hold rates steady at its last policy meeting. The Eurozone benefits from updated consumer confidence and industrial production numbers.

Interest rate decisions are due for New Zealand, Indonesia and the Philippines.

Read more about recent global PMI trends here.

Key diary events

Monday 16 Feb

Americas

Brazil, Canada, US Market Holiday

- Canada Housing Starts (Jan)

EMEA

- Switzerland GDP (Q4, flash)

- Eurozone Industrial Production (Dec)

APAC

China (Mainland), Indonesia, South Korea, Taiwan, Vietnam Market

Holiday

- Japan GDP (Q4, prelim)

- Singapore Non-Oil Domestic Exports (Jan)

- Thailand GDP (Q4)

Tuesday 17 Feb

Americas

Brazil Market Holiday

- US ADP Weekly Employment Change

- Canada Inflation (Jan)

- US NY Empire State Manufacturing Index (Feb)

- US NAHB Housing Market Index (Feb)

EMEA

- Germany Inflation (Jan, final)

- UK Labour Market Report (Dec)

- Italy Balance of Trade (Dec)

- Germany ZEW Economic Sentiment Index (Feb)

- Eurozone ZEW Economic Sentiment Index (Feb)

APAC

China (Mainland), Hong Kong SAR, Indonesia, Philippines, Singapore,

South Korea, Taiwan, Vietnam Market Holiday

- Australia RBA Meeting Minutes

- Thailand Full Year GDP (2025)

Wednesday 18 Feb

Americas

Brazil Market Holiday

- US Building Permits (Nov, prelim)

- US Durable Goods Orders (Dec)

- US Housing Starts (Dec)

- US Industrial Production (Jan)

- US Fed FOMC Minutes

EMEA

- UK Inflation (Jan)

- France Inflation (Jan, final)

APAC

China (Mainland), Hong Kong SAR, Singapore, South Korea, Taiwan,

Vietnam Market Holiday

- Japan Trade (Jan)

- New Zealand RBNZ Interest Rate Decision

Thursday 19 Feb

Americas

- Canada Trade (Dec)

- Canada New Housing Price Index (Jan)

- US Trade (Dec)

- US Wholesale Inventories (Dec, adv.)

- US Pending Home Sales (Jan)

EMEA

- Switzerland Balance of Trade (Jan)

- Spain Balance of Trade (Dec)

- Eurozone Consumer Confidence (Feb, flash)

APAC

China (Mainland), Hong Kong SAR, Taiwan, Vietnam Market

Holiday

- Japan Machinery Orders (Dec)

- Australia Employment (Jan)

- Malaysia Inflation (Jan)

- Philippines BSP Interest Rate Decision

- Indonesia BI Interest Rate Decision

Friday 20 Feb

Australia S&P Global Flash PMI, Manufacturing &

Services*

Japan S&P Global Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Americas

- Canada Retail Sales (Dec)

- US Core PCE (Dec)

- US GDP (Q4, adv.)

- US Personal Income and Spending (Dec)

- US New Home Sales (Dec)

- US UoM Sentiment (Feb, final)

EMEA

- Germany PPI (Jan)

- UK Retail Sales (Jan)

APAC

China (Mainland), Taiwan, Vietnam Market Holiday

- New Zealand Trade (Jan)

- Japan CPI (Jan)

- Malaysia Trade (Jan)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-february-2026.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-february-2026.html&text=Week+Ahead+Economic+Preview%3a+Week+of+16+February+2026+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-february-2026.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 16 February 2026 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-february-2026.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+16+February+2026+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-february-2026.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}