Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 13, 2026

US equity market investors’ risk appetite wanes amid shifting sector preferences

The latest S&P Global Investment Manager Index (IMI) indicated that risk sentiment has moderated since the start of the year. This reduction in risk appetite was accompanied by renewed pessimism regarding near-term US equity market returns and a notable shift in sector preferences.

Meanwhile, recent US equity market movements have helped equity market trends align better with macro fundamentals, reflected by PMI data. That said, divergences between sentiment and actual output continue to highlight uncertainties ahead.

US equity investor risk appetite slips to four-month low

The February S&P Global Investment Manager Index survey, which tracks views from a panel of just under 300 participants employed by firms that collectively represent approximately $3,500 billion assets under management, revealed that risk sentiment moderated for the first time in four months.

The IMI's Risk Appetite Index fell to +13% from an over one-year high of +41% in January. While this marks the fifth consecutive month in which US equity investors are risk tolerant, the reading is the lowest since last October. The reduction in risk sentiment was accompanied by fresh pessimism over expectations regarding near-term US equity market returns. This is according to the IMI's Equity Returns Index which fell noticeably from a survey record level in January.

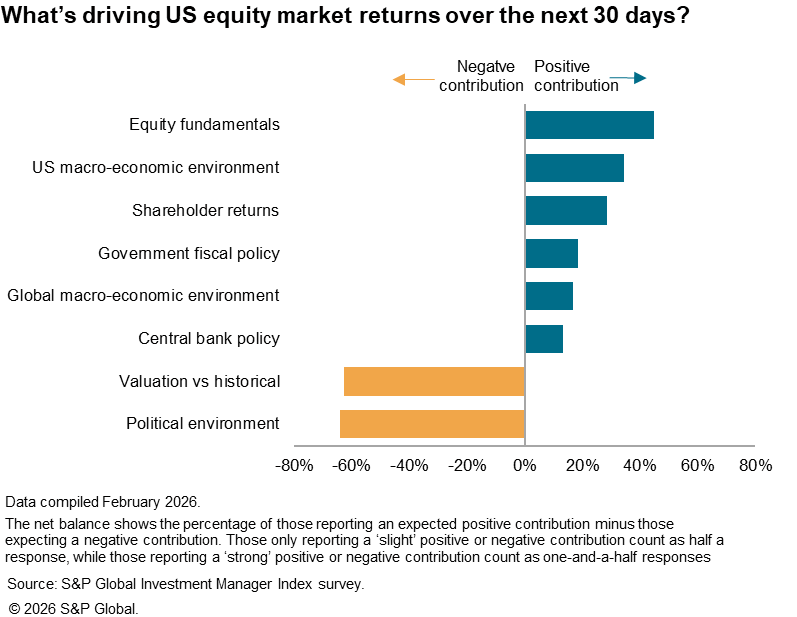

An assessment of what is driving returns in the near-term showed that US equity investors remain highly concerned about the political environment and valuations at the start of February. However, positive expectations regarding central bank policy were also greatly pared back from January as markets priced in a lower chance of rate cuts in the few months of the year.

US PMI and the S&P 500 index

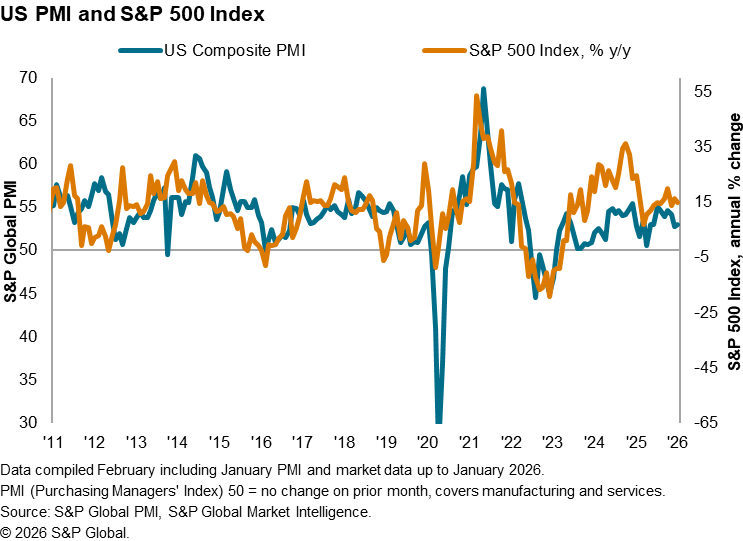

A comparison of the S&P 500 index and the US PMI from S&P Global meanwhile showed a lingering gap between the two, with growth of the former remaining elevated going into the first quarter of the year relative to the PMI's business activity gauge.

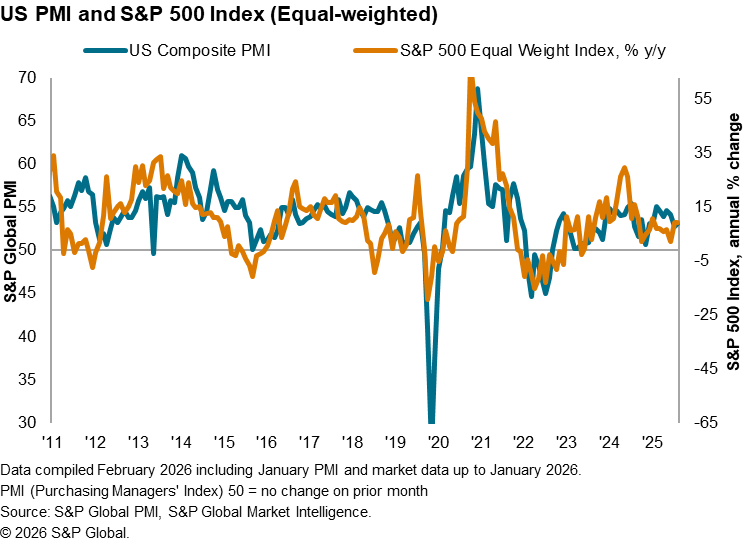

Cross-comparison of the US PMI and the equal-weighted S&P 500 index revealed convergence at the start of the year, notably with the year-on-year change of the equal weighted S&P 500 index rising at a quicker pace around the turn of the year with more broad-based gains on the index.

The latest movements across the S&P 500 index therefore reflected a shift away from some of the large-capitalization names and towards other parts of the market, thereby corresponding better with underlying macro fundamental trends. Further moderations of the market capitalization weighted S&P 500 index performance should not be ruled out with the latest IMI findings of lower market returns expectations, whether via of a broad-based pullback or declines on the index level as investors shift between sectors.

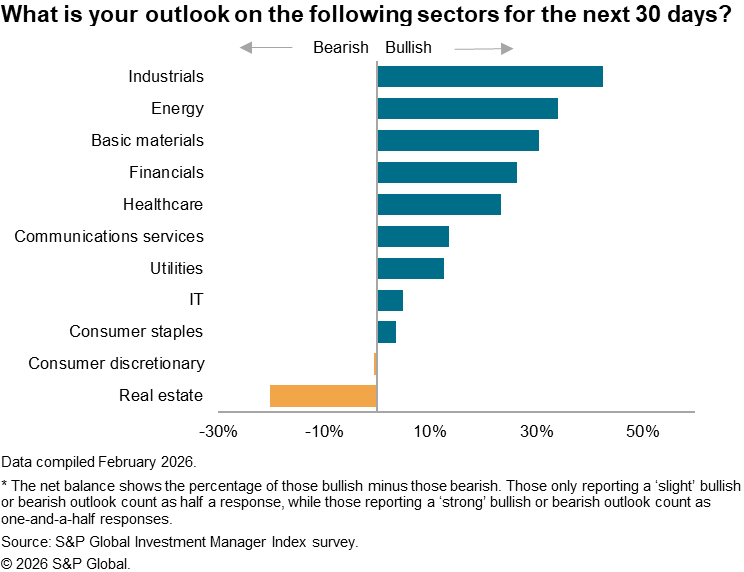

Industrials, energy and basic material sectors in favour

Looking at sector preferences among US equity investors, a notable change has been observed midway through the first quarter, as the strongest performers in late-2025 - the financial and healthcare sectors - alongside technology stocks have been knocked down the rankings and replaced by industrials, energy and basic materials as the top three favored sectors. Industrials has now reclaimed the lead among the 11 sectors tracked for the first time in six years.

The reshuffling in preferences among sectors has been driven by recent skepticism over AI investment, with the loss of favor toward AI-related stocks continuing into mid-February at the point of writing.

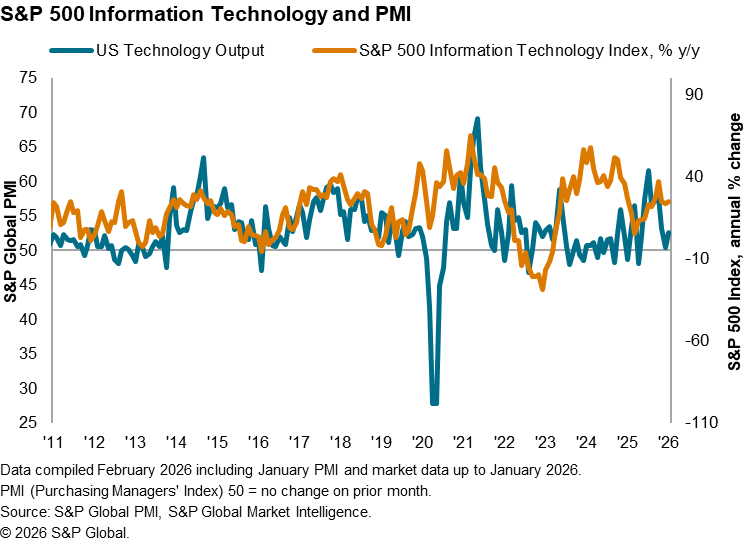

While the S&P 500 technology sector exhibited resilience in January, reduced preference towards the IT/tech sector, according to the IMI index, and a subdued US Technology Sector PMI Output Index suggest that tech stock prices are still elevated.

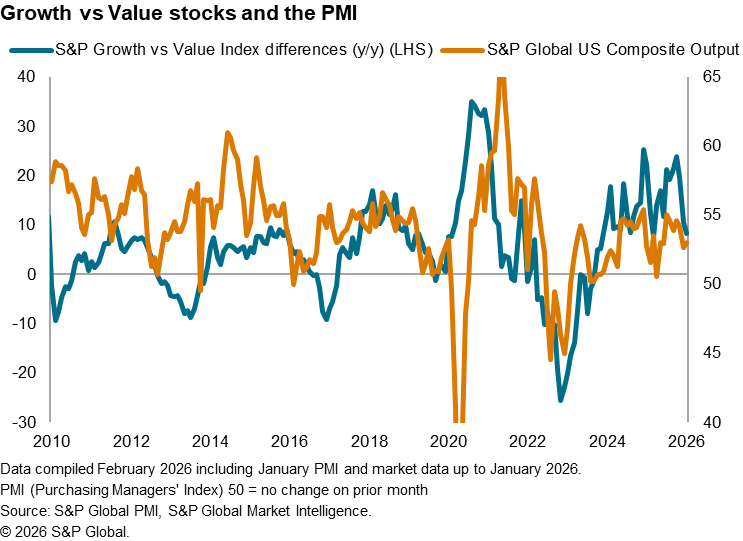

More positively, we have seen the comparison of the S&P 500 Growth and Value index converging with fundamentals, as reflected by the S&P Global US PMI Composite Output Index. While the current state of US economy is supportive of growth stocks, their performance relative to value stocks is no longer overstretched with the recent market movements.

Business output and sentiment continue to diverge

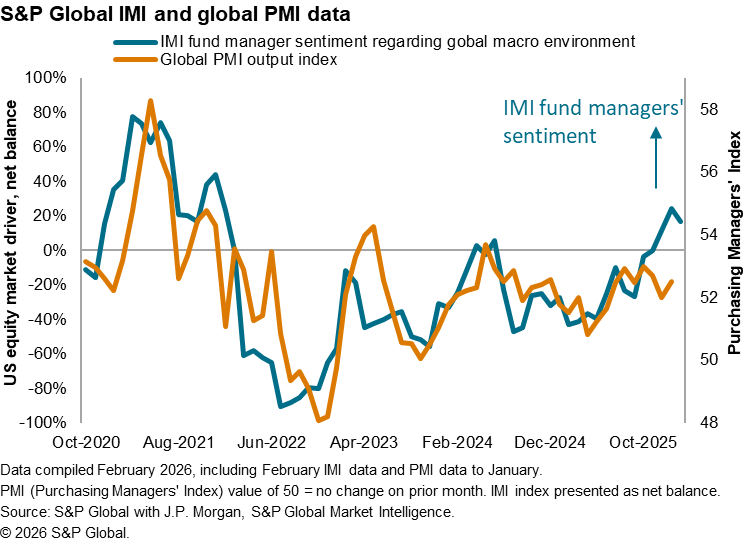

Turning to the IMI drivers data again for indications of how fund managers see the global macroeconomic environment, the latest data revealed that investors continue to see the macroeconomy as supportive of US equity market gains, albeit to a slightly smaller degree compared to the start of the year.

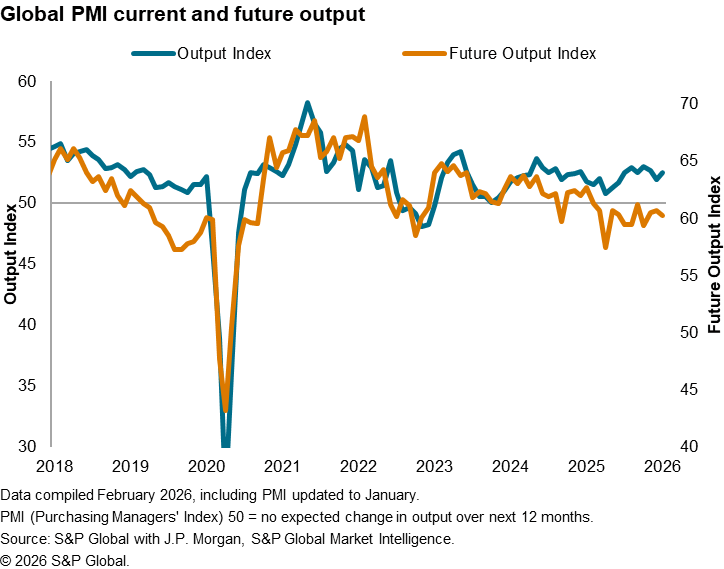

Given the high correlation between fund managers' perception of the global macroeconomic environment and the J.P. Morgan Global Composite PMI Output Index, the latest sentiment data from U.S. equity investors suggest that market participants expect global growth to pick up pace from the improvement we have already seen in the opening month of the year. That said, there is nevertheless a noticeable gap that has opened up between the IMI's sentiment data regarding the global macroeconomic environment and actual output. Perhaps more interesting, this disparity is also present between the PMI's actual and future output gauges, albeit in reverse, indicating that businesses themselves are not optimistic that recent output gains will persist.

With the above in mind, we will be looking closely to the February flash PMI releases across major economies on February 20th for early insights into which way will actual output converge midway through the first quarter.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investors-risk-appetite-wanes-Feb26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investors-risk-appetite-wanes-Feb26.html&text=US+equity+market+investors%e2%80%99+risk+appetite+wanes+amid+shifting+sector+preferences++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investors-risk-appetite-wanes-Feb26.html","enabled":true},{"name":"email","url":"?subject=US equity market investors’ risk appetite wanes amid shifting sector preferences | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investors-risk-appetite-wanes-Feb26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+equity+market+investors%e2%80%99+risk+appetite+wanes+amid+shifting+sector+preferences++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investors-risk-appetite-wanes-Feb26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}