Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 20, 2026

February flash PMI signals strengthening UK economic growth, but job losses persist

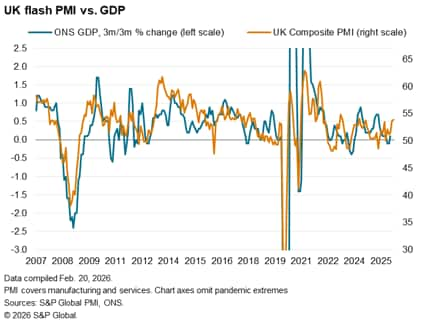

The early PMI data for February bring further signs of an encouraging start to the year for the UK economy. A solid rise in output across manufacturing and services has been reported in both January and February, with the rate of expansion gaining pace to beat economists' expectations. The survey data so far this year are consistent with GDP rising by just over 0.3% in the first quarter if this performance is sustained into March.

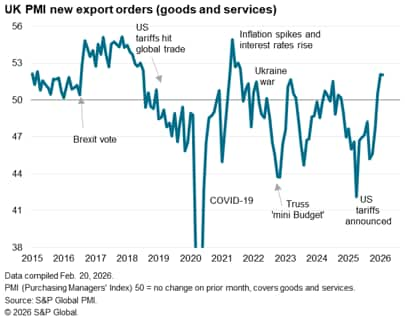

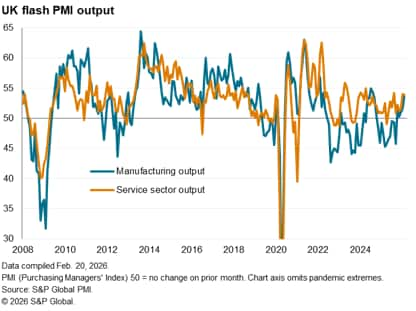

The upturn continues to be led by the service sector but there are signs that manufacturing is regaining momentum to join in the recovery, reporting a surge in export orders of a magnitude not seen since the pandemic.

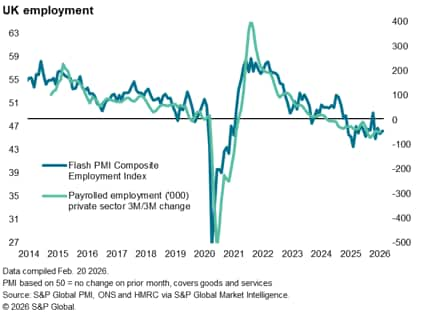

Despite enjoying higher demand for goods and services, companies remain focused on boosting productivity to cut costs, resulting in yet another month of steep job losses to prolong the continual jobs downturn that was initiated by the 2024 autumn Budget.

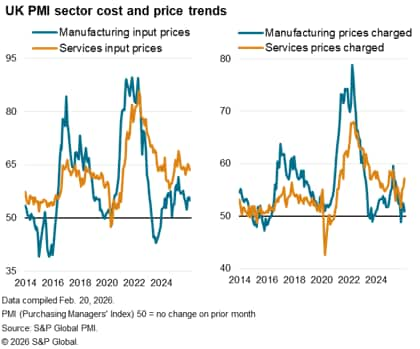

Higher staffing costs, often attributed to Budget policy changes, meant service sector inflation remained elevated. However, increased competition, especially in the manufacturing sector, is helping keep a lid on inflationary pressures.

Bank of England policymakers will be encouraged by the indications of stronger economic growth, but the relatively modest price pressures being signalled and ongoing worrying labour market weakness will likely result in a growing call for further rate cuts.

Business growth beat expectations

UK businesses are showing further signs of a solid start to 2026, with output rising at an encouragingly robust rate for a second successive month in February. The PMI headline Composite PMI Output Index increased from 53.7 in January to 53.9 in February, according to the preliminary 'flash' reading, its highest since April 2024 and beating expectations of a drop to 53.3, as per a Reuters' poll of economists.

The PMI is broadly consistent with GDP growing at a 0.35% quarterly rate so far in the first quarter, representing a marked improvement on the meagre 0.1% gain signalled for the fourth quarter, which was subsequently corroborated by official GDP data.

New orders growth across goods and services also improved, reaching the fastest since September 2024, boosted by rising exports. Although export orders grew at an unchanged rate in February, January's rise had been the strongest since August 2021.

Manufacturing closes the gap with services as PMI 18-month high

While the expansion continued to be led by the service sector, where business activity growth eased only marginally to remain one of the strongest seen over the past two years, manufacturing closed the gap.

The headline manufacturing PMI struck a one-and-a-half year high as factory output grew for a fifth successive month, rising in February at the fastest rate since September 2024.

New orders placed at factories rose for the third consecutive month, notching up the best back-to-back monthly gains seen for almost four years. Improving foreign trade contributed to this upturn in orders. Overseas demand for goods rose for a second month, rising at the sharpest pace since August 2021.

Pressure on headcounts persists

Higher output and rising inflows of new orders failed, however, to generate a rise in employment. Headcounts were instead cut sharply again in February, continuing the sustained decline that has been recorded by the PMI since October 2024. Businesses have commonly reported the need to cut staffing levels in response to policy measures announced in the 2024 autumn Budget, with the 2025 Budget announcements resulting in further pressure to cut staffing costs. These measures include hikes to the National Minimum Wage and increased employer National Insurance contributions.

This 17-month continual loss of jobs represents the most prolonged period of job cutting recorded by the PMI since the global financial crisis (which triggered a 23-month spell of job shedding up to March 2010).

February's cut to employment was slightly less marked than seen in January, but still steep by historical standards and consistent with around 15k job losses during the month. An especially marked drop in employment was recorded in the service sector, though the decline in manufacturing payrolls was the smallest reported over the past 16 months.

Stubborn inflation

Pressure to reduce headcounts stemmed from rising staff costs, which were in turn reflected in a further elevated rate of service sector input cost inflation in February. These higher costs in turn led to an acceleration of selling price inflation in the service sector to the highest since April of last year.

In contrast, input cost and selling price inflation rates moderated in the manufacturing sector, helping keep a lid on overall price pressures. Average prices charged for goods and services nonetheless rose at the fastest rate for ten months, the rate of inflation picking up for a third successive month.

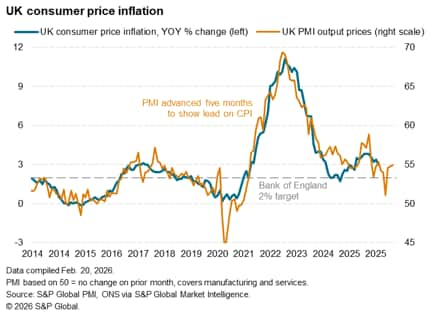

Comparisons with official inflation data suggest that the PMI survey's selling price gauge is broadly indicative of consumer price inflation falling below the Bank of England's 2% target in the coming months, but then rising again to around 3% into the second half of 2026.

Optimism around outlook dips but remains resilient

Looking ahead, future output expectations fell among businesses in February, but held close to the survey's long-run average to still represent one of the most upbeat assessments seen over the past year and a half.

Read the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffebruary-flash-pmi-signals-strengthening-uk-economic-growth-but-job-losses-persist.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffebruary-flash-pmi-signals-strengthening-uk-economic-growth-but-job-losses-persist.html&text=February+flash+PMI+signals+strengthening+UK+economic+growth%2c+but+job+losses+persist+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffebruary-flash-pmi-signals-strengthening-uk-economic-growth-but-job-losses-persist.html","enabled":true},{"name":"email","url":"?subject=February flash PMI signals strengthening UK economic growth, but job losses persist | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffebruary-flash-pmi-signals-strengthening-uk-economic-growth-but-job-losses-persist.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=February+flash+PMI+signals+strengthening+UK+economic+growth%2c+but+job+losses+persist+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffebruary-flash-pmi-signals-strengthening-uk-economic-growth-but-job-losses-persist.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}