Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 14, 2024

Emerging market economies expand at slowest pace in nearly a year

Emerging market economic growth decelerated again at the end of the third quarter, according to S&P Global's PMI surveys. While growth remained relatively broad-based with both manufacturing and service sectors remaining in expansion, the slowdown of manufacturing output growth to near-neutral levels will be worth monitoring. This is especially with forward-looking PMI indicators signalling the potential for manufacturing sector conditions to further moderate.

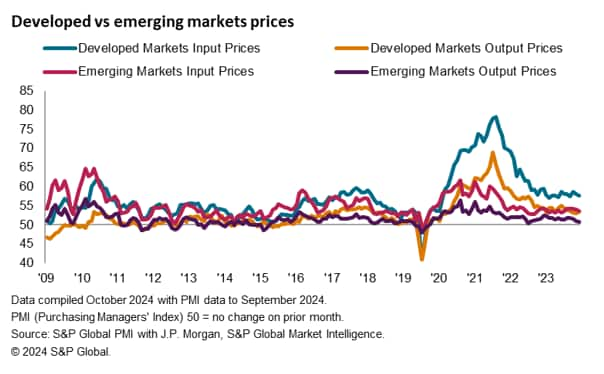

Turning to prices, cost pressures eased for emerging market businesses including for both goods producers and service providers in September. While selling prices therefore rose at a slower pace as a result of lower cost pressures, it also reflected the reduction in pricing power as emerging market businesses grapple with heightened competition amid lower demand.

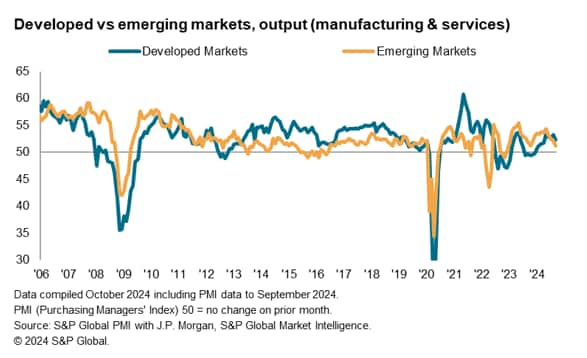

Emerging markets continue to lag developed economies' growth

The PMI surveys compiled globally by S&P Global found that rate at which output expanded across the emerging markets collectively slowed for a fourth successive month. The GDP-weighted Emerging Market PMI Output Index fell to 51.1 in September, down from 52.1 in August. This is the lowest reading seen since October 2023, but nevertheless extended the sequence of growth that commenced in January 2023.

While developed markets also grew at a slower rate, it retained the lead upon emerging markets for a third straight month and to the widest degree since May 2022.

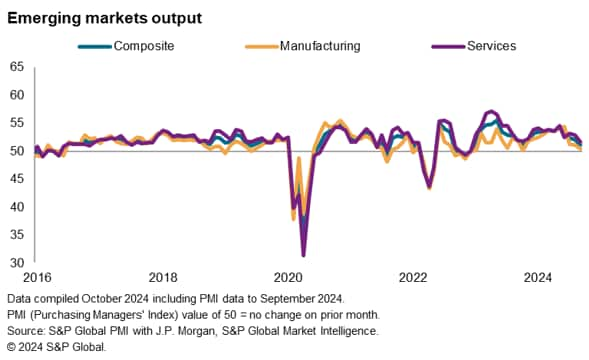

Emerging market manufacturing output growth softest since October 2023

September's global growth was supported primarily by the service sector in September, but both the manufacturing and service sectors continued to expand for emerging markets. This marked the twenty-first successive month of broad-based expansion for emerging markets. That said, the respective rates of expansion slowed across both sectors, with manufacturing output growth notably sliding to the softest in 11 months and was only marginal.

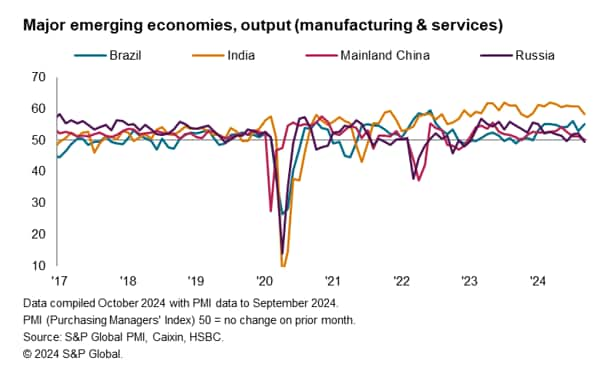

India maintains smallest lead so far in 2024

By economies, only three of the four major emerging market economies expanded at the end of the third quarter with Russia sliding into contraction after two successive months of growth. Mainland China's expansion was meanwhile the shallowest in 11 months, with both manufacturing and services activity rising only marginally in the latest survey period.

On the other hand, Brazil's expansion sped up in September with output rising solidly across both manufacturing and services. Services expansion was especially sharp with underlying demand conditions improving for the sector.

Finally, India remained the fastest growing of the four major emerging market economies. However, India's expansion decelerated to the slowest since last November with both manufacturing and service sector growth easing, albeit remaining steep overall. The slowdown in India's expansion coupled with catch-up by Brazil had therefore resulted in the smallest lead in the year-to-date for India ahead of the second-fastest growing BRICs economy.

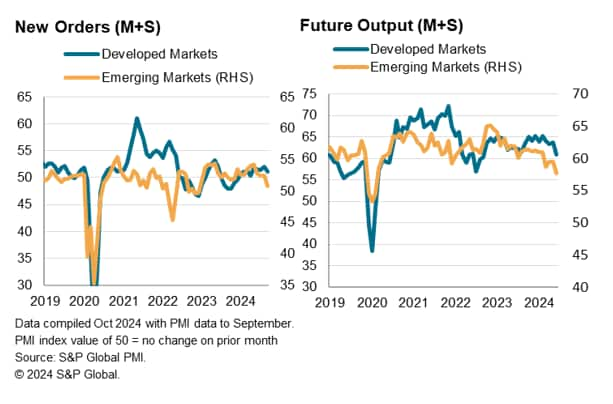

Emerging market manufacturing sector forward-looking indicators hint at softening of conditions ahead

While emerging markets remained in broad-based expansion at the end of the third quarter, forward-looking indicators, especially for the manufacturing sector hint at potential softening of conditions in the coming months. Specifically, incoming new business rose at the slowest pace in the current 21-month growth sequence after decelerating for a fourth consecutive month. The softening of demand growth was attributed to both a slowdown in services new business expansion and the first reduction in manufacturing new orders in 14 months. Additionally, the rate of manufacturing new orders decline was the joint-sharpest in nearly one-and-a-half years with export orders notably falling for a second straight month.

Meanwhile, future output expectations also reflected reduced optimism among emerging markets firms, with businesses being the least upbeat since the initial pandemic period in May 2020. While the slowdown in new orders was concentrated in the goods producing sector, optimism levels across both manufacturing and services had declined to over four-year lows. These forward-looking PMI indicators had therefore signalled that further easing of growth conditions may be anticipated for emerging markets in the coming months.

Selling price inflation at 17-month low

Additionally, the softening of overall new business growth had also affected pricing power among emerging market businesses. Average selling prices increased at a rate that was only marginal and the slowest since April 2023. This contrasted with the trend for developed economies where charge inflation climbed to a three-month high in September.

Although the softening of emerging market output prices partly reflected goods-driven easing of cost pressures, anecdotal evidence also pointed to heightened competition, such as in India, and interests among emerging market firms to support sales as intents for firms to raise selling prices at a slower pace.

Access the global PMI press releases.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-economies-expand-at-slowest-pace-in-nearly-a-year-oct24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-economies-expand-at-slowest-pace-in-nearly-a-year-oct24.html&text=Emerging+market+economies+expand+at+slowest+pace+in+nearly+a+year+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-economies-expand-at-slowest-pace-in-nearly-a-year-oct24.html","enabled":true},{"name":"email","url":"?subject=Emerging market economies expand at slowest pace in nearly a year | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-economies-expand-at-slowest-pace-in-nearly-a-year-oct24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+economies+expand+at+slowest+pace+in+nearly+a+year+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-economies-expand-at-slowest-pace-in-nearly-a-year-oct24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}