Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 11, 2024

Week Ahead Economic Preview: Week of 14 October 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

ECB meeting, UK inflation and employment data, China GDP in view

The week ahead sees the European Central Bank likely to cut interest rates to support the struggling eurozone economy amid cooling inflation. Economic conditions in the US and mainland China will also be tracked via industrial production and retail sales data for both, with the latter also releasing third quarter GDP numbers.

The new UK government and Bank of England will meanwhile be eager to assess the health of the UK economy via updates to inflation, retail sales and labour market statistics.

Japan's inflation rate will be under scrutiny on Friday as markets weigh up the possibility of further rate hikes by the Bank of Japan after the central bank hiked rates in March and July to 0.25%.

The week also sees policy meetings in Turkey, Indonesia, the Philippines and Thailand.

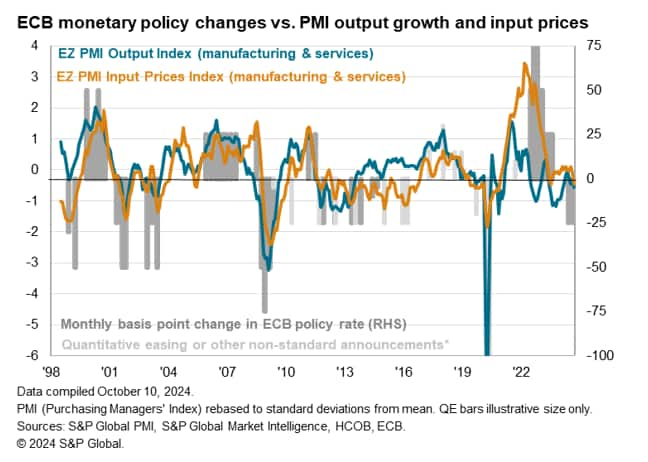

Recent survey data have shown eurozone inflationary pressures continuing to cool into September, accompanied by a drop in headline eurozone inflation below the European Central Bank's (ECB) 2% target to 1.8% (final CPI data will be released in the coming week). But the news on economic growth has been less encouraging. The PMI data hint at the eurozone economy stalling amid a likely recession in Germany. Hence the expected 25 basis point rate but by the ECB at its Thursday meeting will likely be followed by another cut at the end of the year, though ECB officials have stressed that future decisions will be made on a month-by-month basis. The ECB has already cut its main deposit rate twice so far this year, in June and September, from a high of 4.00% to 3.50%.

Clues as to whether the Bank of England (BoE) has scope to also cut interest rates, with a quarter point reduction widely anticipated in November, will meanwhile be sought from updated economic data in the coming week. The BoE has only cut rates by 25 basis points so far this year after hiking its main Bank Rate to 5.25% in August of last year, its highest since 2008, and is widely expected to follow a less aggressive rate cutting path than the Federal Open Market Committee (FOMC) and the ECB due to stickier inflation. Hence the updated consumer price inflation numbers for September, published on Wednesday, will be keenly awaited, as will wage data published on Tuesday.

Just how resilient the US economy remained in September will meanwhile be assessed form retail sales and industrial production data. Judging by recent PMI data, a soft manufacturing sector is likely to be contrasted by underlying consumer strength.

Investors in mainland China will likewise seek clues on the pace of economic growth, both from third quarter GDP numbers and monthly updates to retail sales, industrial production and investment. Our economic forecasting team expects the economy to have grown at a 5.0% annual rate in the third quarter, representing an improvement on the 4.7% pace seen in the second quarter.

Key diary events

Monday 14 Oct

Canada, Japan, Thailand Market Holiday

Singapore GDP (Q3, advance)

India Inflation (Sep)

United States Consumer Inflation Expectations (Sep)

Tuesday 15 Oct

Indonesia Trade (Sep)

Japan Industrial Production (Aug, final)

China (Mainland) PBoC 1-Year MLF Announcement

Germany Wholesale Prices (Sep)

Sweden Inflation (Sep)

United Kingdom Labour Market Report (Aug)

France Inflation (Sep, final)

Spain Inflation (Sep, final)

Eurozone Industrial Production (Aug)

Germany ZEW Economic Sentiment (Oct)

Canada Inflation (Sep)

United States NY Empire State Manufacturing Index (Oct)

Wednesday 16 Oct

New Zealand Inflation (Q3)

South Korea Unemployment (Sep)

Japan Machinery Orders (Aug)

United Kingdom Inflation (Sep)

Philippines BSP Interest Rate Decision

Thailand BoT Interest Rate Decision

Indonesia BI Interest Rate Decision

Italy Inflation (Sep, final)

Canada Housing Starts (Sep)

United States Export and Import Prices (Sep)

Thursday 17 Oct

Japan Trade (Sep)

Australia Employment Change (Sep)

Singapore Non-oil Domestic Exports (Sep)

Eurozone Trade (Aug)

Eurozone Inflation (Sep, final)

Italy Balance of Trade (Aug)

Turkey TCMB Interest Rate Decision

Eurozone ECB Interest Rate Decision

United States Retail Sales (Sep)

United States Manufacturing Production (Sep)

United States Business Inventories (Aug)

Friday 18 Oct

Japan Inflation (Sep)

China (Mainland) GDP (Q3)

China (Mainland) Industrial Production, Retail Sales, Fixed Asset

Investment, Unemployment Rate (Sep)

Malaysia GDP (Q3, prelim)

United Kingdom Retail Sales (Sep)

South Africa Inflation (Aug)

Spain Balance of Trade (Aug)

United States Building Permits (Sep, prelim)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US retail sales, industrial production, building permits data; Canada inflation

As the earnings season heat up in the US, Fed policymaker comments will be watched alongside key economic data releases including retail sales, industrial production and building permits.

A divergence in US sectoral performance was observed in the latest September S&P Global PMI data, whereby strong services activity growth contrasted with the sharpest fall in manufacturing output in 15 months. This was underscored by detailed sector figures showing varying performances within the US economy. The divergences hint at the potential for varied performance for the incoming US retail sales and industrial production data releases, which will be followed closely for clues on further Fed cuts especially after the latest payrolls surprise and hotter than expected CPI print.

In Canada, September's inflation data will be updated on Tuesday. Prices data from the latest S&P Global Canada PMI, which precedes the trend for official CPI, outlined a further easing of selling price inflation.

EMEA: ECB meeting; Eurozone inflation, industrial production, trade; German ZEW; UK inflation, employment and retail sales data

The European Central Bank (ECB) convenes for their October meeting with another rate cut on the table as the market debates the likelihood for October to be part of a plan to gradually lower rates. Arguments for an October cut have so far included an easing inflation trend in September. Additionally, weakness in the manufacturing sector has been increasingly apparent via the decline for the HCOB Eurozone Manufacturing PMI, further hinting at industrial production readings to remain soft.

Over in the UK, inflation, employment and retail sales data will all be released. According to PMI indications, the easing of service sector inflation has brought the Bank of England's target closer to view. On the labour market end, the most up-to-date KPMG / REC UK Report on Jobs, consolidated by S&P Global Market Intelligence, has meanwhile showed further signs of a softening labour market in the UK at the end of the third quarter of the year.

APAC: China GDP, retail sales, production data; Japan inflation; Australia employment; New Zealand CPI; Singapore, Malaysia GDP; BI, BSP, BoT policy meetings

Besides central bank meetings in Indonesia, Philippines and Thailand, a busy data calendar is anticipated with the focus on GDP and activity data out of mainland China. Inflation figures from Japan will also be closely followed amidst the debate on whether the Bank of Japan will shift monetary policy settings again before the end of 2024.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-october-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-october-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+14+October+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-october-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 14 October 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-october-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+14+October+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-october-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}