Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 09, 2020

Daily Global Market Summary - October 9, 2020

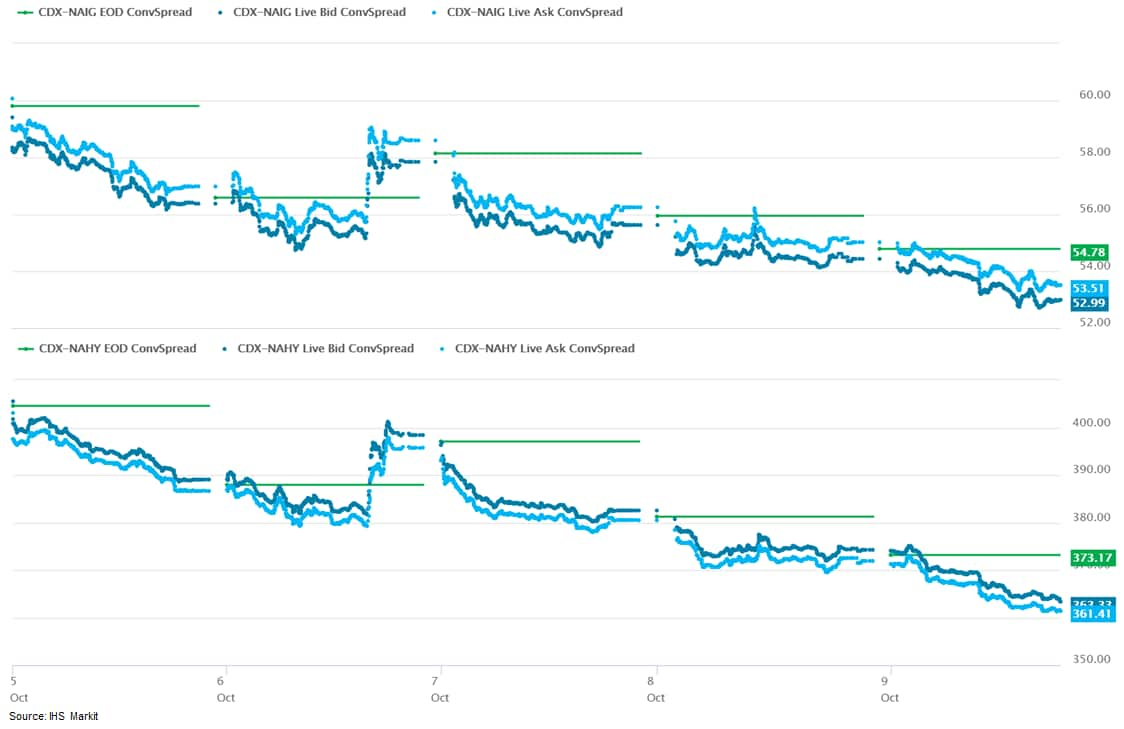

US equity markets closed higher today and capped off the best weekly performance since early-July, while APAC and European markets closed mixed. Most benchmark European government bonds closed higher, and US bonds were close to flat on the day. iTraxx and CDX indices closed tighter across IG and high yield, with CDX-NAHY tightening significantly on the week. The US dollar and oil closed lower, while gold and silver were higher. It's worth noting that the forecasts for orange production in both Florida and Brazil is beginning to look particularly dire as flu season approaches alongside increasing numbers of COVID-19 cases.

Americas

- US equity markets closed higher today; Nasdaq +1.4%, S&P 500 +0.9%, and DJIA/Russell 2000 +0.6%. The S&P 500 closed +3.8% week-over-week, which is its largest weekly gain since early-July.

- 10yr US govt bonds closed flat/0.78% yield and 30yr bonds -1bp/1.56% yield.

- CDX-NAIG closed -2bps/53bps and CDX-NAHY closed -11bps/362bps,

which is -7bps and -42bps, respectively, week-over-week.

- DXY US dollar index closed -0.6%/93.03.

- Gold closed +1.6%/$1,926 per ounce and silver +5.2%/$25.11 per ounce.

- Crude oil closed -1.4%/$40.60 per barrel.

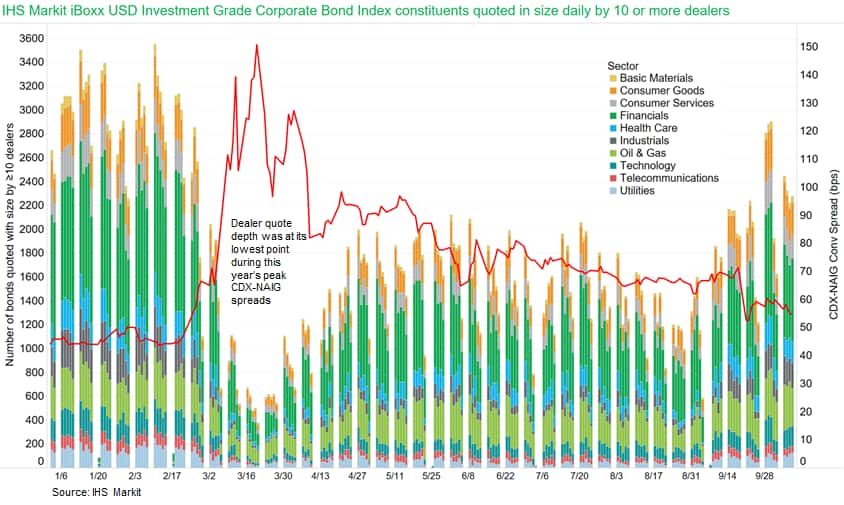

- The below chart shows the daily number of corporate bond

constituents in the IHS Markit iBoxx USD Investment Grade Index

that were quoted in sizes ≥$1 million by 10 or more dealers versus

the CDX-NAIG closing spread. The chart highlights the sharp drop

off in quote depth in mid-March, but also indicates that liquidity

improved significantly in late-September to levels last seen in

late-February.

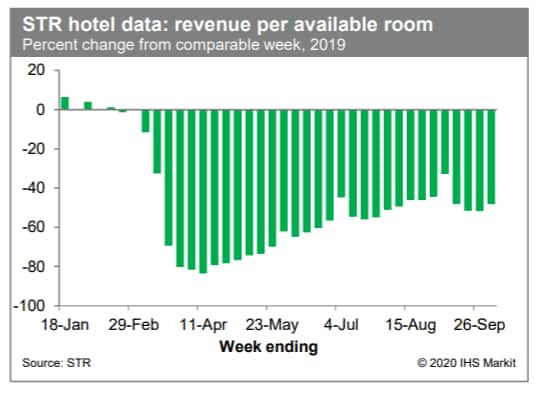

- Revenue per available room at US hotels last week was 48.1%

below the year-ago level, according to STR. This is close to most

readings dating back to early August, reinforcing the notion that

travel-related spending has been slow to recover. (IHS Markit

Economists Ben Herzon and Joel Prakken)

- The 2020-21 Florida all orange forecast released today by the USDA Agricultural Statistics Board is 57.0 million boxes, down 15% from last season's final production and worse even than the Steger forecast of 61 million boxes. The non-Valencia forecast of 23.0 million boxes is 22% less than last season's production. The estimated number of bearing trees (without Navels) is 19.1 million, down 25from the previous season. The estimated fruit per tree for early-midseason oranges is 590, a decrease of 24% from last season, and the lowest in a series dating back to the 1964-65 season. The Valencia forecast of 34.0 million boxes is 10% lower than last season's production. The estimated number of bearing trees is 30.2 million, up 2% from the previous season. The estimated fruit per tree is 441, a decrease of 18% from last season and the lowest since the 2006-07 season. Projected fruit size is below average, requiring an estimated 243 pieces of fruit per box. Droppage rate for both early/midseasons and Valencias is 27%, above average. The Navel forecast of 700,000 boxes is 13% less than last season's production. The estimated number of bearing trees is 902,000, down 2% from the previous season. The estimated fruit per tree is 194, a decrease of 18% from last season. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- CPChem says it is now taking steps to increase circular polyethylene (PE) production by working with proven suppliers of pyrolysis oil, a feedstock made from waste plastic. CPChem is also pursuing certification of its circular PE through the International Sustainability and Carbon Certification Plus (ISCC Plus) approach, which employs a mass-balance methodology. "We are exceptionally proud to be the first company to announce production of a circular polyethylene on this scale in the US," says Jim Becker, vice president/polymers and sustainability. Upon certification, CPChem intends to market its new circular polyethylene products under the trade name Marlex Anew Circular Polyethylene. CPChem says it has been exploring the technical viability of producing circular polymers from waste plastic for two years. (IHS Markit Chemical Advisory's Clay Boswell)

- Torc Robotics has announced that it plans to start testing its Level 4 self-driving technology in the US Southwest in early 2021, using a second generation of the Freightlner Cascadia prototype that Torc has been using with Freightliner parent Daimler. According to Torc's statement, the new-generation Cascadia prototype bolsters Torc's capability to develop and test the Level 4 self-driving technology. Torc says the test trucks are known within the company as 'Gen 2'. The partners say the ultimate goal is to reinvent the truck by co-developing a Level 4 Freightliner Cascadia with safety-critical redundancy components and seamless integration of additional computations and hardware to support the self-driving technology. Michael Fleming, Torc CEO, said, "To meet the redundancy and performance requirements of a self-driving truck, the traditional truck chassis must be reinvented. Just like any major innovation, it requires a stair-step approach toward the final product. We are taking this one step at a time, with safety as our guiding principle… We knew from the outset that self-driving technology cannot be commercialized without an OEM. In trucking, there are only a handful of OEMs and we were fortunate to join the industry leader." The companies say that market-ready self-driving trucks must emulate the actions of the most experienced truck drivers, including the way an experienced driver is able to 'feel' component failures. Fleming said, "Our software engineers are working with highly skilled truck drivers to understand this experience and transition this human intuition into embedded sensors and algorithms." The two companies also state that they expect to develop multiple iterative test truck models before they release a commercial version, so the Gen 2 will not be the final truck configuration. Among the updates this second iteration has, Torc states, is a design to bolster the testing effort and accelerate data collection to assist in machine learning and algorithmic development. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Waymo has announced that it is beginning to open its fully autonomous ride-hailing service to the public in Phoenix, Arizona (United States). Last year, the company's driverless service, Waymo One, was limited to selected customers, known as "early riders", who signed non-disclosure agreements. The company initially plans to offer fully driverless trips to Waymo One customers only, who can now bring their friends and family along for the ride, reports Reuters. Over the next several weeks, residents can hail a ride in the service's minivans with no human attendant on board within a 50-square-mile area of the city by downloading the Waymo One app. John Krafcik, CEO of Waymo, said, "Members of the public service can now take friends and family along on their rides and share their experience with the world. We'll start with those who are already a part of Waymo One and, over the next several weeks, welcome more people directly into the service through our app." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- BorgWarner yesterday (8 October) provided further details of its acquisition of Delphi Technologies, announced on 2 October, purchased through an all-stock transaction of USD1.5 billion, with the new company reportedly valued at USD3.3 billion. Following the acquisition, BorgWarner is targeting USD175 million of cost synergies, up from USD125 million planned when the deal was originally announced. The new BorgWarner has a stronger position in propulsion systems, as Delphi has brought complementary expertise and products to the company's portfolio. Delphi has also brought an established customer base. With the acquisition, BorgWarner now expects to see increased cost synergies, mostly in the SG&A expenses category, which should free up capital for continued development of its propulsion systems in the longer term. The new, larger BorgWarner will also need to fund more technology and other research and development to support the new, complementary systems in the larger portfolio. There is also the opportunity for increased revenue from the larger portfolio, as well as to improve the company's ability to provide more comprehensive propulsion systems. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Even though the IHS Markit September net employment forecast

for Canada was above consensus, the 378,200 net employment gain and

the 1.2-percentage-point reduction in the jobless rate to 9.0% beat

market expectations. (IHS Markit Economist Arlene Kish)

- The large upswing in fulltime positions at 334,000 was the biggest since June, and part-time workers advanced 44,200. Self-employment fell again, marking the seventh monthly loss so far this year.

- The net employment gains in both the overall goods-producing and services-producing industries were stronger in September.

- The labor force participation rate edged up to 65%, coming in just 0.5 percentage point shy of February's pre-pandemic level.

- Labor market conditions are proving to be solid, but the onset of the second wave and changing demand conditions can alter the recovery path.

- Canada's job recovery is proving to be more resilient than expected as employment is about 720,000 positions below February levels and the unemployment rate is down 4.7 percentage points from May's 13.7% peak.

- There are several industries, like utilities; professional,

scientific, and technical services; and education, where employment

has returned to pre-pandemic levels.

There are a few other industries that will soon join the recovery, like finance, insurance and real estate, manufacturing, public administration, and health care and social assistance. The main laggard is accommodation and food services. - For total hours worked, educational services is the only industry that is exceeding February's level given the extensive adjustments within the industry to accommodate changing in-person and on-line learning.

- As such, the catch-up in hours worked will be longer. Plus, the moderate improvement in the youth unemployment rate below 20% ground the overall jobless rate lower.

- Canada's federal and Ontario provincial governments have announced that each will contribute CAD295 million (USD222 million) to Ford's CAD1.8-billion planned investment in its Oakville assembly plant, Ontario, to support production of battery electric vehicles (EVs) beginning in 2024. The combined funding of CAD590 million, according to a joint statement from the Canadian federal and Ontario governments, is part of the total USD1.8-billion investment, not in addition to Ford's investment. The governments' statement says that the investment will help to secure 5,400 jobs across Ford's production workforce in Canada and grow Canada's green economy. The statement also says, "Electrification will allow us to position the innovative Canadian automotive industry as a global leader in BEV manufacturing." Dean Stoneley, president and CEO of Ford Motor Company Canada, is reported as saying, "With this investment, Ford will expand its award-winning portfolio to include a family of battery-electric SUVs built at Oakville Assembly, marking the first time ever that a full-line automaker has produced full BEVs in Canada for the North American market." An Automotive News Canada report quotes Stoneley as saying that the governments' participation was important in Ford's decision to invest in EV production in Ontario, specifically saying, "This is a vital step toward Ford's larger multibillion dollar investment in producing electric vehicles for consumers around the world." Ford's commitment to convert the Oakville plant to EV production was revealed last month during the negotiations on a new labor contract with the union representing Ford workers in Canada, Unifor. Unifor has since moved on to negotiations with Fiat Chrysler Automobiles, and the union is also looking for a product investment commitment from FCA. (IHS Markit AutoIntelligence Stephanie Brinley)

- According to the Central Bank of Costa Rica (Banco Central de

Costa Rica: BCCR), Costa Rican GDP contracted by 8.6% year on year

(y/y) in the second quarter, driven by declines in all major

sectors of the economy. Based on this contraction, as well as our

expectation that recovery will be slow given the results of more

recent high-frequency indicators, we are revising down our 2020 GDP

forecast this month. (IHS Markit Economist Lindsay Jagla)

- Recently published data by the BCCR show that GDP declined 8.6% y/y in the second quarter. In quarterly terms, GDP contracted by 10.8% quarter on quarter (q/q) during the quarter following a 1.4% q/q contraction in the first quarter.

- Measures to combat the spread of the coronavirus disease 2019 (COVID-19) virus domestically, including curfews and mobility restrictions, have had a significant impact on Costa Rica's internal demand and domestic consumption. The closure of borders and restrictions on tourism have exacerbated these effects, resulting in an overall 11.7% q/q drop in private consumption and a 16.7% q/q decline in imports during the second quarter.

- Global lockdowns in response to the COVID-19 virus pandemic have played a significant role as major trading partners, especially the United States, have also experienced significant economic contractions, resulting in a 27.6% q/q decrease in exports during the second quarter.

- Government efforts to stimulate the economy and boost activity included a package that provided loans to micro, small, and medium-sized businesses, bonuses for those who lost their jobs, and a moratorium on certain taxes. Overall, government spending increased 6.0% q/q in the second quarter.

- Nearly all economic sectors declined in the second quarter compared with the first, with the largest quarterly contractions stemming from accommodation and food services (-62.0%), transportation and storage (-32.1%), manufacturing (-20.4%), and wholesale and retail sales (-15.6%), in line with expectations following the enactment of various COVID-19 virus-related isolation measures that restricted operations and lowered demand for many services. Only two sectors grew in the second quarter: construction (+9.0%) and teaching, health, and social services (+0.6%).

Europe/Middle East/Africa

- Most European equity markets closed higher except for Spain -0.6%; France/UK +0.7% and Italy/Germany +0.1%.

- Most 10yr European govt bonds closed higher; Spain/Italy -4bps, UK/France -1bp, and Germany flat.

- iTraxx-Europe closed -1bp/52bps and iTraxx-Xover -4bps/316bps,

which is -6bps and -25bp, respectively, week-over-week.

- Brent crude closed -1.1%/$42.85 per barrel.

- August's limited GDP gains confirm our long-held assessment

that the United Kingdom was never on course for a strong 'V-shaped'

recovery. In addition, the outlook is increasingly challenging,

with the latest developments suggesting that the economy has been

less assured from September. (IHS Markit Economist Raj Badiani)

- The UK economy rose for the fourth successive month in August following a record fall of 19.5% month on month (m/m) in April.

- The UK's Office for National Statistics (ONS) reports that the economy grew by 2.1% m/m in August, preceded by m/m gains of 9.1% in June and 6.4% in July. Nevertheless, it remains 9.2% below the February level, which represents the point before the full impact of the COVID-19 virus pandemic.

- This was broadly in line with our expectations, but the August outcome was short of the 4.6% consensus forecast of economists polled by Reuters.

- The economy grew by 8.0% in the three months to August compared with the three months to May. It had been negative with the comparable three-month growth rates, standing at -19.8% in June and -6.8% in July.

- Nevertheless, the GDP gains in July and August still point to a record gain in the third quarter, probably by around 14.5% quarter on quarter (q/q), spelling the end of the recession in the first half of this year.

- Meanwhile, in annual terms, the economy in August was 11.7% smaller compared with a year earlier.

- A breakdown by output reveals that services increased by 2.4% m/m in August after a 5.9% m/m gain in July, but they were still 9.6% lower than February's level.

- The accommodation and food services sectors provided the largest contribution to rising service activity during August. Specifically, accommodation and food services rose by 69.7% m/m in August, thanks to the continued easing of lockdown measures and the government's 'Eat Out to Help Out' scheme, which provided a 50% discount on food or non-alcoholic drinks to eat or drink in (up to a maximum of GBP10 discount per diner). The accommodation industry also grew by 76% between July and August, with restricted international travel encouraging domestic households to travel in the UK.

- The hospitality and accommodation sectors contributed 1.25 percentage points to the 2.1% growth in total GDP during August. Meanwhile, many other parts of the services sector recorded muted growth.

- Tesla CEO Elon Musk has reportedly said that the company's next new plant, under construction in Germany, will use the new battery technology and manufacturing recently announced. Automotive News says that the executive added that this plan could result in a "significant production risk". Along with the Model Y to be built in Germany, Tesla is reportedly considering building battery cells at a nearby site. Automotive News reports that Musk said it will take about two years for the factories in Fremont, California (United States) and Shanghai (China) to shift to the new batteries. It would make sense to build the new plant to accommodate the new batteries, and Tesla has reportedly revived plans for battery production at the German facility. (IHS Markit AutoIntelligence's Stephanie Brinley)

- French industrial production rose by 1.3% month on month (m/m)

in August. This follows rises of 12.7% m/m in June and 3.8% m/m in

July. August's figures still point to a large rebound in production

during the third quarter, but the 'carry over' for the fourth

quarter of 2020 will be modest. (IHS Markit Economist Diego Iscaro)

- Industrial output had collapsed by 34.1% between February and April, and output in August was still 6.3% below its pre-COVID-19 virus level.

- Manufacturing production rose at a slightly weaker pace of 1.0% m/m in August, following an increase of 4.5% m/m in July. Manufacturing output was still 7.4% below its pre-COVID-19 virus level in February.

- The breakdown by product shows production of transport equipment being the main driver of the m/m growth rate in August, rising by 5.9% m/m (see chart). However, production of transport equipment remained around 18% below its pre-pandemic level, representing the most sluggish recovery among all production sectors.

- Meanwhile, production of goods classified as 'Other' also rose by a solid 2.4% m/m in August, boosted by higher production of basic metals and rubber and plastic products. On the other hand, production of food and beverages (-2.0% m/m), coke and petroleum (-6.9% m/m), and machinery and equipment (-4.0% m/m) all declined in August.

- August's figures suggest that, although industrial production will rebound strongly during the third quarter, the 'carry over' for the fourth quarter of 2020 is likely to be muted. With increasing number of COVID-19 cases triggering new containment measures in France and other European countries, the risk of production being weaker than expected during the final months of 2020 is considerable.

- The Eolmed Floating Wind Farm pilot project is off to a good start as Total announced that it has taken up a 20% stake in France's first offshore wind farm located in the Mediterranean Sea. The 30 MW wind farm, developed by majority shareholder Qair (formerly known as Quadran Énergies Marines) is located approximately 18 km off the coast of Gruissan, and near Port-La-Nouvelle in the Occitanie Region. Just four days ago, Qair awarded the supply of three V164-10.0 MW wind turbines to MHI Vestas. The turbines will be installed on foundations provided by Ideol, a pure-play floating foundations company, which has a patented Damping Pool foundation. This is MHI Vestas' third floating offshore wind project in France and its sixth project globally. (IHS Markit Upstream Costs and Technology's Melvin Leong)

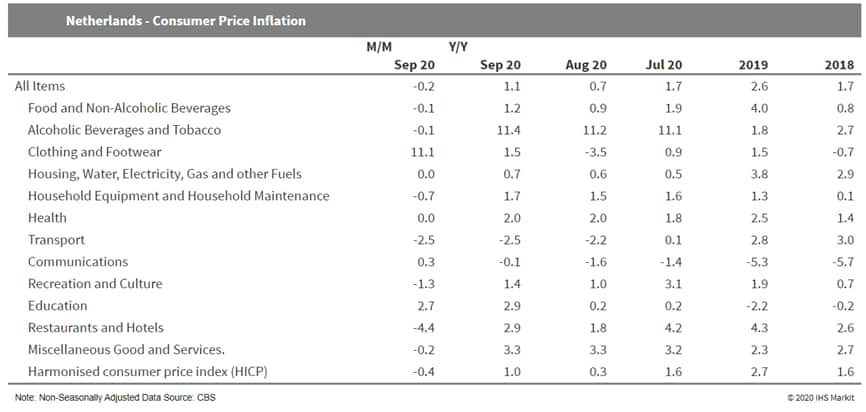

- Dutch consumer prices increased by 1.1% year on year (y/y) and

dropped by 0.2% month on month (m/m) in September, according to the

national consumer price index (CPI) measure, and grew by 1.0% y/y

and fell by 0.4% m/m according to the EU-harmonised measure. This

is after the sharpest monthly fall in headline inflation in 11

years. (IHS Markit Economist Daniel Kral)

- A large positive contribution to September's headline inflation came from clothing and footwear, which increased by 11.1% m/m. This is because summer sales in 2020 lasted well into August, unlike in 2019, while autumn collections were introduced in September.

- The largest downward pressure came from restaurants and hotels, which dropped by 4.4% m/m, and transport, down by 2.5% m/m. On an annual basis, the largest increases were in alcohol and tobacco, due to tax increases earlier in 2020, and miscellaneous goods and services.

- Statistics Netherlands (Centraal Bureau voor de Statistiek: CBS) notes that prices covering roughly 3% of the consumption basket, such as airlines or events, had to be estimated, due to an insufficient number of recorded transactions.

- Core inflation went up to 1.7% y/y in September from 0.8% y/y in August, even as core inflation in the eurozone dipped to a record low of 0.2% y/y. This means that the Dutch differential versus the eurozone widened significantly again

- The increase in the unemployment rate has so far been very

limited, from 2.9% in March to 4.6% in August. This reflects the

success of the government's stimulus measures to sustain

employment, despite the record contraction in first-half 2020

GDP.

- A new "blacklist" of the most contaminated foods that were discovered on sale in Italy has been unveiled by Italy's farmers' group Coldiretti on 1 October. The group said it developed its list based on reports published by EFSA and Italy's ministry of health. The Italian group warned that chili peppers originating from the Dominican Republic and India, which have a 20% rate of non-conformity, were the least safe food products on Italian tables. The organization attributed this grouping to the presence of pesticides such as dicofol, acephate, permethrin, chlorfenapyr and methamidophos in the chili peppers. The second place in the danger ranking was awarded to goji berries imported from China, which reportedly contained carbofuran in 13% of tested samples, followed by third-ranked Pakistani rice that had an irregularity rate of 12.5% due to the detection of acetamiprid and tricyclazole in tested samples. "These are all products that arrived in Italy with high levels of irregularities because they have been contaminated by the presence of insecticides, many of which are banned by Italian use by national and European legislation, as is the case for dicofol, acephate, permethrin, chlorfenapyr, methamidophos that were found in chili peppers, tricyclazole in rice from Pakistan, isoprothiolane in exotic dragon fruit and fenpropimorph, procymidone, propoxur and methamidophos in Brazilian dried beans," according to a Coldiretti release. More than 9% of samples of Turkish pomegranate have been found to be irregular because they contained a variety of pesticides, including prochloraz, acetamiprid, cypermethrin and boscalid, said Coldiretti. The group stated that its focus on imported goods is warrantied and necessary as the results of the sample tests show that food products imported into Italy contain an average of 1.9% of irregularities, which is a level that is "three times more dangerous than the comparable one for products of national origin, as only 0.6% of such samples did not comply with the legal thresholds for pesticides". Coldiretti is devotes special attention to risk from products of non-EU origin for which the percentage of irregularities, according to EFSA, rises to 5.8%, "which is an eight times higher level than was detected for Made in Italy products". (IHS Markit Food and Agricultural Policy's Jaroslaw Adamowski)

- The Danish passenger car market improved during September,

according to the latest data published by the Danish Car Importers'

Association (De Danske Bilimportører). Registrations increased by

7.6% year on year (y/y) to 17,197 units during the month. (IHS

Markit AutoIntelligence's Ian Fletcher)

- The results for traditional types of passenger cars - hatchbacks, sedans, and station wagons (estates) - were flat or weak, with the exception of the B sub-compact category, which posted an increase of 9.9% y/y to 4,067 units. However, the standalone sport utility vehicle (SUV) category increased 29.8% y/y to 5,650 units.

- When the SUV category is broken down by segment, this growth is centered on the sub-compact B segment and compact C segment, the former up 49.7% y/y to 2,364 units and the latter up 28.0% y/y to 2,205 units.

- The gain recorded in September means that registrations in the year to date (YTD) are now down 18.1% y/y at 142,165 units, compounded by the COVID-19 virus-related declines earlier in the year.

- As for the commercial vehicle categories, the trade association has reported that light commercial vehicle (LCV) registrations grew 20.6% y/y in September to 2,971 units, although YTD sales in this category stand at 21,674 units, down 11.8% y/y.

- Danish registrations of medium and heavy commercial vehicles (MHCVs) slipped by 0.8% y/y to 365 units in September and are now down 28.6% y/y at 2,807 units in the YTD.

- Scania has announced that it is working with partners on using trailers with solar panels installed to increase fuel efficiency. According to a statement, a plug-in hybrid Scania truck is being combined with an 18-metre-long trailer clad with solar panels with a total area along the roof and sides of 140 square meters. The project is partly funded by Sweden's Vinnova innovation agency, while Scania is also working with solar panel manufacturer Midsummer, Uppsala University, energy company Dalakraft, and Swedish hauler Ernst Express, which is operating the vehicle on daily assignments. Scania is already researching a large number of options in an effort to reduce the emissions of its vehicles. In this instance, it will take advantage of the vast real estate on the side and roof of box trailers, which is typically used for little other than marketing for the company that runs them. After initial tests, the company is already reportedly seeing benefits, with fuel savings from this configuration of between 5% and 10% in Sweden, where the panels are expected to generate 14,000 kWh of energy annually. However, there is even greater potential in more sun-rich markets, with the company suggesting that the figure could be double that in southern Spain. (IHS Markit AutoIntelligence's Ian Fletcher)

- Einride, the Sweden-based transportation company, has launched a new range of autonomous electric transport (AET) vehicles. They are the next generation of company's electric and autonomous vehicles, known as Einride pods, that can be remotely controlled by drivers and do not have a cabin. The AET vehicles come in four different variations, AET 1 to AET 4, and each model has a unique design. The company claims that these vehicles are capable of SAE Level 4 autonomous operation, and would help businesses to reduce transport costs by up to 60% and CO2 emissions by 90%. Einride's smaller pods - the AET 1 and AET 2 - are suitable for fenced facilities as they have low top speeds of 30 km/h. The AET 3 and AET 4 have top speeds of 45 km/h and are well suited to long-distance highways and use in large distribution centers. Robert Falck, founder of Einride, said, "We can already see a strong traction from the market to start using autonomous and electric transport. The benefits are clear and we want to be the player in the market that can help our customers to make the transition to a better future of transport happen". Einride focuses on designing and building technologies for freight mobility. The company recently raised USD10 million in funding, bringing Einride's total capital to USD42 million. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Niger has reached an agreement with the International Monetary

Fund (IMF) on the sixth review of its Extended Credit Facility

(ECF). Niger showed mixed results in the sixth and final review

under the IMF's ECF, which was initially approved in 2017. (IHS

Markit Economist Thea Fourie)

- An IMF mission team and the Nigerien authorities reached a staff-level agreement on the completion and review of the sixth and final review of the IMF's ECF support program. Niger's ECF was approved on 23 January 2017.

- Progress under the ECF has been mixed, with progress made in clearing the remaining domestic payment arrears and allowing for prudent acquisition of external debt, while 2019 fiscal spending overruns and the improvement in the mobilization of domestic government revenue lag program objectives.

- The IMF expects Niger's GDP to grow by 1% in 2020, supported by COVID-19-pandemic-related food assistance and credit support to the private sector. GDP growth is expected to increase to 6.9% in 2021, while the commencement of oil exports expected in 2022 could leave growth at 9% over the medium term.

- Niger's fiscal deficit is expected to widen to 5.8% of GDP in 2020, from 3.6% of GDP in 2019, reflecting COVID-19-pandemic-related spending and revenue losses, combined with critical spending on security and development. The draft budget for 2021 shows a contraction in the fiscal deficit to an estimated 4.4% of GDP and is considered as a first step towards spending normalization that will guard against "increased deficits becoming entrenched", the IMF states.

- The IMF urges the Nigerien authorities to uphold structural reforms, which include the development of the private sector, increasing access to affordable credit, improving training and education, especially for girls, and stepping up investment in digital infrastructure and literacy.

Asia-Pacific

- APAC equity markets closed mixed; China +1.7%, India +0.8%, South Korea +0.2%, Japan -0.1%, and Hong Kong -0.3%.

- The Chinese onshore renminbi closed +1.4% ¥6.69/USD today, which was its best daily performance since being pegged to the US dollar in 2005. The rally comes on the heels of markets reopening today from the Golden Week holiday to improving poll numbers for US Presidential candidate Joe Biden.

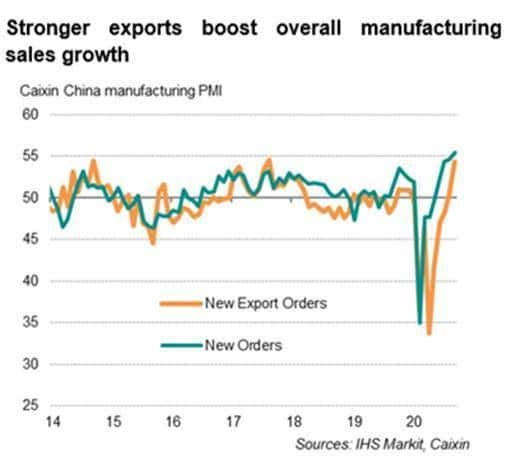

- The Caixin headline Composite PMI for mainland China, compiled

by IHS Markit and covering manufacturing and services, dipped to

54.5 in September, down slightly from 55.1 in August, but

nevertheless indicated a further steady improvement in business

conditions. (IHS Markit Economist Bernard Aw)

- The survey added to evidence that the Chinese economic recovery was solid in the third quarter. At 54.7, the average PMI reading in the three months ending September was above the 52.6 recorded in the second quarter.

- The increase in overall order book volumes also held up well, with the latest expansion supported by a stronger rise in new export orders.

- Backlogs of work continued to increase, albeit more modest when compared to the rise in new orders. This is likely due to strong output growth as firms continued to respond to increased demand following the easing of pandemic restrictions earlier in the year.

- The recovery remained broad-based, with manufacturing and services driving the expansion in business activity. Manufacturing output rose for a seventh straight month in September, though the rate of increase moderated from the over nine-year high seen in August.

- Services business activity expanded for a fifth month in a row, in part reflecting a sustained recovery in consumer demand.

- Seen among the best performers were automakers and producers of household goods, linked to improved consumer behavior and reopened retail businesses as the pandemic has been brought under control. Activity at financial services and technology services also continued to increase.

- A key development driving growth in manufacturing sales was a surge in merchandise export sales. Overseas orders of Chinese manufactured products increased at the fastest rate for three years during September after marginal growth in August. This strong expansion in exports reflected an increase in the number of countries reopening their economies and moving towards more normal market conditions.

- New business in the service sector was fueled primarily by the domestic market, with external demand continuing to deteriorate as many countries still maintained some international travel restrictions despite a recent loosening of border controls in parts of the world.

- The restoration of supply chains remained under way, but the

combination of demand revival and stock shortages at distributors

(linked to reduced capacity) continued to affect the ability of

suppliers to make timely deliveries. While the lengthening of

delivery times was modest, and much improved from February, at the

height of the pandemic in mainland China, a persisting issue with

input availability could impact the extent to which manufacturers

can raise production volumes.

- Geely Auto has announced its sales results for September,

showing that the combined sales volumes of Geely- and Lynk &

Co-branded vehicles were 126,365 units last month, up by 11% year

on year (y/y). (IHS Markit AutoIntelligence's Abby Chun Tu)

- The data include sales in the Chinese market and exports. The group's sales volumes in China were 118,297 units in September, up by 6% y/y. In the year to date (YTD), Geely Auto's total sales volumes were 875,472 units, down by 9% y/y, which represents 66% of the company's target of 1.32 million units in 2020.

- A breakdown of its sales by vehicle type shows that sport utility vehicles (SUVs) are still in high demand, along with sedans. SUV and sedan sales stood at 43,183 units and 79,633 units, respectively, in September.

- The company's sales of multi-purpose vehicles (MPVs) totaled 3,549 units in September. Sales volumes of the Lynk & Co brand surged by 38% y/y to 18,745 units last month.

- In September, Geely's sales continued to be underpinned by its SUV products, the biggest category in its overall sales.

- The group's premium brand, Lynk & Co, experienced a sales growth of 38% y/y in September, owing to additional model lines.

- Electric vehicle (EV) startups NIO and Xpeng Motor have

announced their deliveries in September. NIO reported total

deliveries of 4,708 vehicles last month, comprising 3,210 ES6,

1,482 ES8, and 16 EC6 vehicles. (IHS Markit AutoIntelligence's Abby

Chun Tu)

- In the third quarter of 2020, the combined deliveries of the company's three models, the ES8, ES6, and EC6, were 12,206 vehicles, up 154.3% year on year (y/y).

- As of 30 September, NIO had delivered a total of 58,288 vehicles, of which 26,375 vehicles were delivered in 2020. In a separate statement, Xpeng Motor said it delivered 3,478 vehicles in September, up 145% y/y.

- Thanks to the improved sales results in September, Xpeng's combined deliveries of its two models, the G3 electric sport utility vehicle (SUV) and the P7 electric sedan, increased 266% y/y to 8,578 units in the third quarter.

- Two leading EV startups in the Chinese market, the sales of NIO and Xpeng continued to gain momentum during September thanks to expanded model lines in the market.

- Taiwan's merchandise exports climbed in September at the

fastest pace since February this year, as surging technology demand

from mainland China and the United States provided the key boost to

recent export performance. Looking ahead, the technology sector

will continue to benefit from demand related to distance working

and learning as well as the launch of new products and year-end

holiday demand. However, US-mainland China trade tensions and the

US bans on key mainland Chinese companies will provide some offset,

leading to a possible deceleration in exports during the fourth

quarter. (IHS Markit Economist Ling-Wei Chung)

- Exports jumped 9.4% year on year (y/y) in September, accelerating from an 8.3% y/y increase in August. After expanding for the third consecutive month, the rate of gain in exports marked the fastest since February this year (or since June 2018 when excluding holiday factors).

- Climbing at double-digit paces for the second month, shipments to mainland China and the US remained the key driving forces of strong expansions in exports. In particular, shipments to mainland China jumped 15.1% y/y in September, after surging 22.5% y/y in August. Together with exports to Hong Kong SAR, shipments to both markets surged 22.3% y/y, driven by a 30.3% y/y jump in electronics shipments and a 39.8% y/y surge in shipments of information and communication products.

- Concurrently, exports to the US expanded 14.5% y/y in

September, accelerating from a 13.9% y/y increase in August. It was

led by a 28.1% y/y jump in exports of information and communication

products and a 45.7% y/y surge in shipments of toys and sports

equipment to the territory amid increasing activities from staying

at home.

On the other hand, exports to Japan, Europe, and ASEAN - where non-technology exports accounted for the largest share of the total - remained weak due to the dampening effect from the COVID-19 virus pandemic. Exports to these markets recorded a further contraction of 7.6% y/y, 4.7% y/y, and 4.1% y/y, respectively. - By products, electronic exports continued to provide the key support to overall export growth, surging by 26.1% y/y in September, reaching the highest monthly level on record. The rate of gain marked the eighth straight month of double-digit expansions and also the strongest since February this year. A 27.1% y/y surge in exports of semi-conductor products continued to boost electronics shipments, thanks to robust demand for high-performance chips.

- Concurrently, exports of information and communication products jumped 22.5% y/y in September, accelerating from a 21% y/y expansion in August. Shipments of computer components surged 31.5% y/y, exports of laptop computers and related products jumped 28.2% y/y, and sales of storage devices climbed 25.9% y/y. They mainly benefited from increasing demand for products related to working from home, telecommunicating, and remote learning. These came despite a very high base effect.

- On the other hand, exports of non-technology products continued to contract but at a slower pace. Shipments of machinery and base metals recorded narrower declines in September to single digits, while shipments of plastic products resumed growth for the first time in almost two years, up 0.9% y/y, partly supported by low inventory and higher shipments to mainland China amid reconstruction demand from recent floods.

- The better-than-expected results in August and September helped total exports to resume growth in the third quarter, rising 6% y/y, which reversed a 2.4% y/y fall in the second quarter. Strong export growth in the past two months was mainly attributed to surging demand from mainland China as the stockpiling of necessary components by the mainland Chinese company Huawei has boosted related shipments. The government estimated that Huawei alone could contribute about 40-80% of the monthly increase in shipments during August and September.

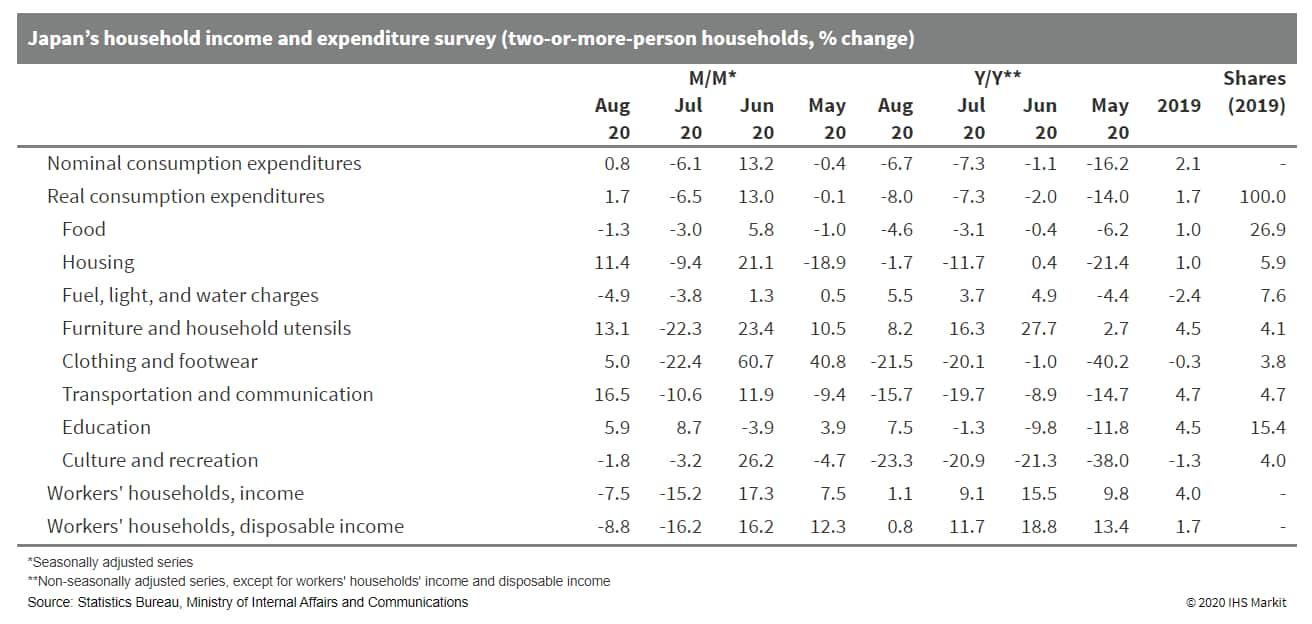

- Japan's household expenditures rebounded in August. The

stabilization of growth in confirmed COVID-19 cases and stimulus

measures could help support household expenditures in the coming

months; however, sluggish cash earnings could weaken the upward

momentum. (IHS Markit Economist Harumi Taguchi)

- Japan's real household expenditures rose by 1.7% month on month (m/m) in August following a 6.5% m/m drop in July, although the level remained below the year-earlier level, recording a 6.9% year-on-year (y/y) decrease. The improvement was thanks largely to rebounds in spending for transportation and communication, furniture and household utensils, and housing. The government's travel subsidies probably helped lift spending in transportation to some extent.

- Monthly cash earnings declined for the fifth consecutive month in August, but the contraction narrowed to 1.4% y/y from 1.8% y/y in the previous month. Although scheduled cash earnings fell by 0.1% y/y for the first drop in 14 months, the softer overall contraction reflected a narrower decline in non-scheduled cash earnings in line with the resumption of economic activity, which helped ease decreases in non-scheduled hours worked. The number of regular employees rose by 0.8% y/y, reflecting a faster increase in the number of full-time employees.

- Japan's household expenditure is likely to improve because of

the stabilization of new confirmed COVID-19 cases and upside from

travel subsidiaries and other stimulus measures over the near term.

A rise in the index of household-related activity of the Economic

Watchers Survey (EWS) for September signals continued increases in

household expenditures, particularly for food and beverages and

services.

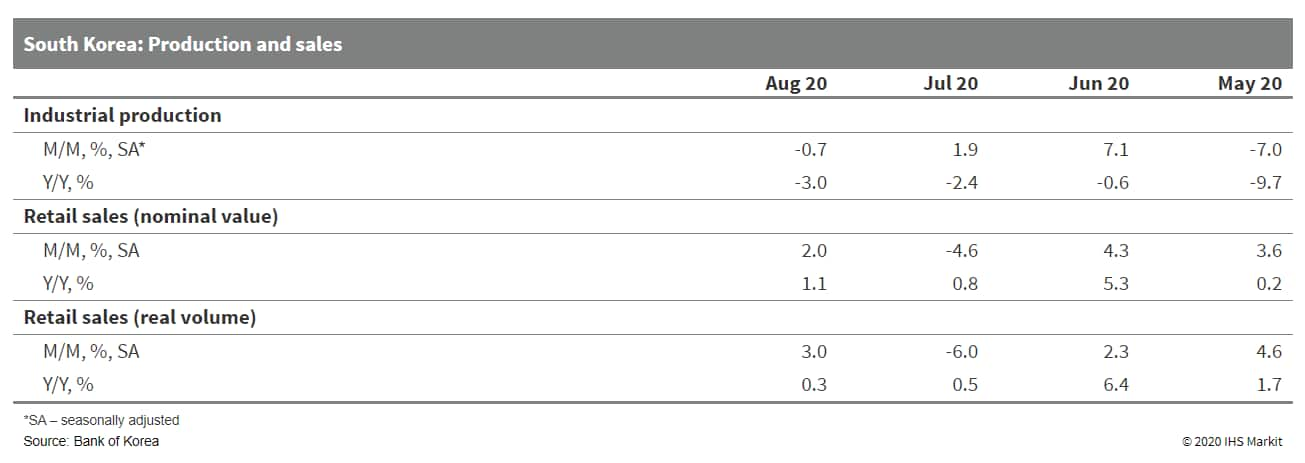

- Recent data are mixed, but overall indicate continued modest

economic growth for South Korea as the country recovers from the

COVID-19 virus pandemic recession. (IHS Markit Economist Dan Ryan)

- Customs clearance exports (seasonally adjusted, dollar basis) surged in September, posting numbers well above the pre-COVID-19 level. Imports were only marginally higher than a year earlier, but this still represented a large September rise.

- This resulted in a large September trade surplus, and is likely to result in a sharp rise in the current account balance when the data become available. Given the strength of the export and manufacturing sector, the current account could exceed USD8 billion, a level last achieved in late 2018.

- Consumer prices have been trending upwards, but at a very slow rate. The overall Consumer Price Index (CPI) has risen faster lately because of volatile components such as food and energy, but the core CPI still shows an inflation rate of below 1%.

- Producer prices remain low on a year-on-year (y/y) basis, but have lately been increasing because of rising oil prices. As the oil price trend flattens, producer prices should resume a slight deflationary pattern, reflecting productivity growth.

- The industrial production index fell slightly in August, and remains down 3% from a year earlier. However, the index is an inexact measure of manufacturing activity; in addition, the Purchasing Manager's Index remains at about 50%.

- Retail sales continue to surprise on the upside. Given the damage done to the service sector by the pandemic, it is impressive that consumer spending has shown y/y gains for several months.

- The labor market had done fairly well during the recession,

with the unemployment rate falling and the labor force rising.

However, the labor force fell in August, as discouraged unemployed

people stopped looking for work, and the labor force remains down

nearly 1% from its pre-COVID-19 levels.

- Mercedes-Benz has launched the all-electric EQC mid-size sport utility vehicle (SUV) in the Indian market at an introductory price of INR9.93 million (USD135,449) for the first 50 customers. According to a company statement, the automaker will roll out the EQC in a phased manner, beginning with 13 locations in six cities including Delhi, Mumbai, Pune, Bangalore, Hyderabad, and Chennai. This will be followed by other cities later. The EQC is powered by two asynchronous three-phase AC motors that have a combined output of 408hp and 765 N.m paired with an 85-kWh lithium-ion battery pack, which is claimed to offer a maximum range of 400 km on a single charge (Worldwide Harmonised Light Vehicle Test Procedure [WLTP]-certified range). The battery can be charged in 21 hours using a 3.4-kW domestic socket, 10 hours using a 7.5-kW wallbox charger provided by Mercedes-Benz, and 90 minutes using a 50-kW DC fast charger. Owners will be able to access over 100 EQ charging points in 48 cities across the country. The EQC shares its underpinnings with the GLC platform and comes with extensively reworked design elements. The model comes with distinct LED headlights with a light strip that stretches across the front end and slim LED taillights, 20-inch 10-spoke alloy wheels, a 12.3-inch configurable digital display for the instrument cluster, and a 12.3-inch touchscreen MBUX infotainment system. In terms of safety, the SUV comes equipped with seven airbags, blind spot assist, attention assist, lane departure warnings, and electronic stability control (ESC). (IHS Markit AutoIntelligence's Isha Sharma)

- Uber has partnered with electric vehicle (EV) fleet operator Lithium Urban Technologies to deploy over 1,000 EVs in India, reports The Tribune. These EVs, all of them sedans, will be available for hire through Uber's premier and rental services on its app in Delhi-NCR, Mumbai, Bengaluru, Hyderabad, and Pune. The company currently has 100 EVs deployed on its platform and plans to expand the fleet size to 2,000 in the next 12 months. Prabhjeet Singh, president of Uber India and South Asia, said, "After our partnerships with Yulu, Mahindra and SUN Mobility, this is our fourth partnership in this space and Uber will always remain committed to providing smarter mobility, building greener cities and creating healthier lives." Uber has announced its goal to have 100% of its ride-hailing fleet globally to be zero-emission vehicles by 2040. Earlier, Uber set out its aim to quadruple its EV fleet to 1,500 in India in 2020. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- According to an IBM statement, the Bank of Thailand (BOT) has

issued USD1.6-billion-worth of domestic debt in recent weeks using

a new blockchain platform for domestic government savings bonds.

(IHS Markit Economist Brian Lawson)

- The platform was announced in September 2020, involving the BOT, the Public Debt Management Office, Thailand Securities Depository, the Thai Bond Market Association and four banks as distribution agents (Bangkok Bank, Krunthai Bank, Kasikorn Bank and Siam Commercial Bank).

- IBM Blockchain was the system's blockchain and technology partner.

- The BOT first announced its intention to replace its traditional distribution system in March 2018, and is now reportedly planning to extend the new platform to cover all other government debt, including distribution to both retail and institutional investors.

- According to the article, at end-2019, Thailand's domestic bond market was worth USD421 billion equivalent, of which 37% was government debt.

- According to IBM, the new system reduces operational complexity and issuance costs substantially, with the process of selling government savings bonds being cut from 15 to just two days.

- It flagged that the new technology reduces "redundant

validation" and "reduces the costs of reconciliation".

Thailand's change in its issuance procedure sets an important positive precedent in the use of blockchain technology to replace traditional issuing procedures, especially where these are relatively slow and reliant on manual inputs. - Further successful expansion of the new platform would be a positive indicator encouraging other countries - especially those in emerging markets with relatively onerous procedures - to consider change, as would expanded international portfolio inflows to the Thai bond market given its faster procedures.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-october-9-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-october-9-2020.html&text=Daily+Global+Market+Summary+-+October+9%2c+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-october-9-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - October 9, 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-october-9-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+October+9%2c+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-october-9-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}