Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 08, 2020

Daily Global Market Summary - 8 October 2020

US, European, and most major APAC equity markets closed higher. European and US government bonds were also higher on the day. iTraxx and CDX IG ended the day close to flat, while high yield was tighter across both indices. Brent/WTI and gold closed higher, silver slightly lower, and the US dollar almost unchanged.

Americas

- US equity markets closed higher today; Russell 2000 +1.1%, S&P 500 +0.8%, Nasdaq +0.5%, and DJIA +0.4%.

- 10yr US govt bonds closed -2bps/0.78% yield and 30yr bonds closed -2bps/1.57% yield.

- CDX-NAIG closed -1bp/55bps and CDX-NAHY -8bps/373bps.

- DXY US dollar index closed flat/93.60.

- Gold closed +0.2%/$1,895 per ounce and silver -0.1%/$23.88 per ounce.

- Crude oil closed +3.1%/$41.19 per barrel.

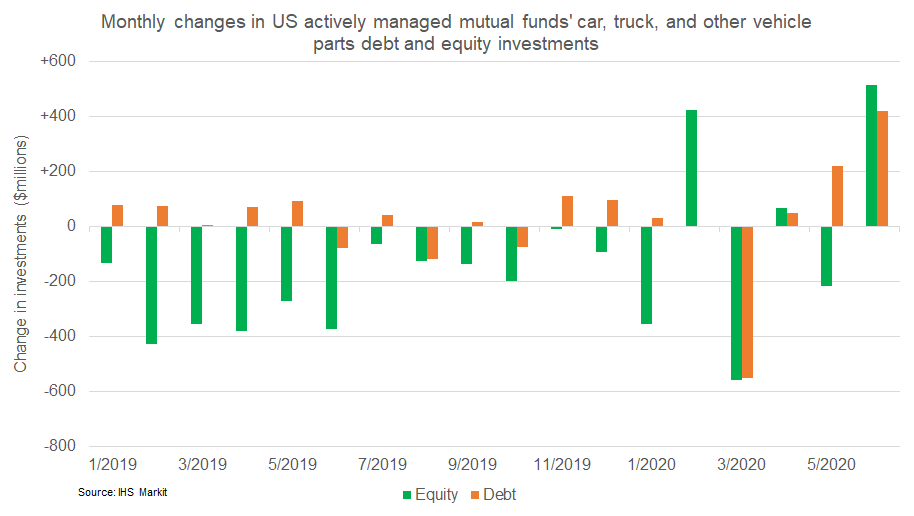

- Similar to yesterday's chart on E&P debt and equity flow of

funds, the below chart shows the Jan 2019 - June 2020 monthly

investment value changes (estimated net value of buys/sells) of

auto part manufacturers debt and equity held by a static pool of US

actively managed mutual funds that report their holdings monthly in

IHS Markit's fund holdings database. The data indicates that there

were monthly equity outflows from January 2019 - January 2020,

while there were debt outflows only three months during that same

time period. There were almost equal outflows of both debt and

equity investments in March 2020, with sizable inflows into both

debt and equities occurring in June.

- Seasonally adjusted (SA) US initial claims for unemployment

insurance fell by 9,000 to 840,000 in the week ended 3 October.

Initial claims remain at historically high levels, although well

below the all-time high of 6,867,000 in the week ended 28 March.

The not seasonally adjusted (NSA) tally of initial claims rose by

5,312 to 804,307. (IHS Markit Economist Akshat Goel)

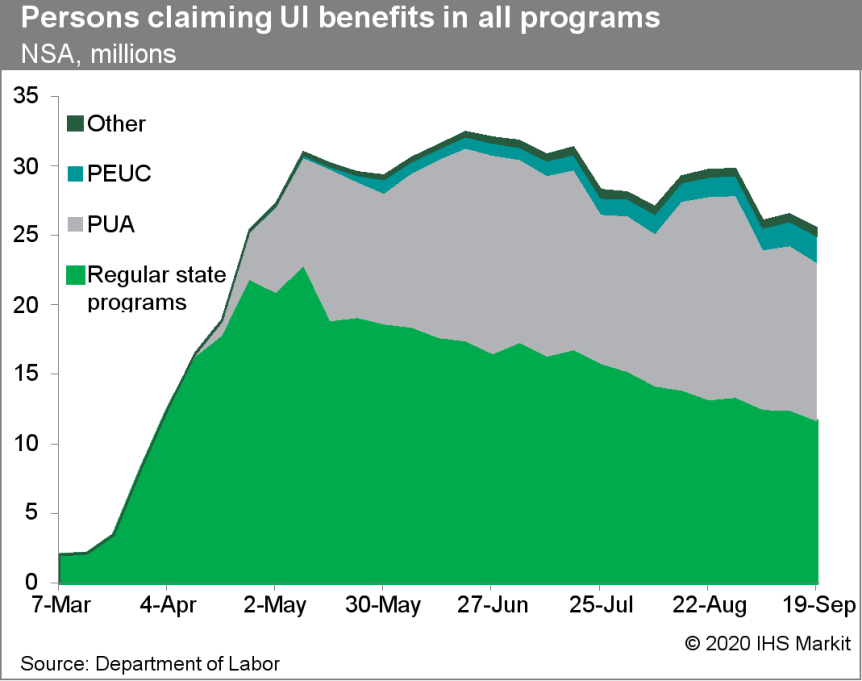

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 1,003,000 to 10,976,000 in the week ended 26 September. Prior to seasonal adjustment, continuing claims fell by 1,010,280 to 10,612,021, marking the largest two-week decline since mid-May. The insured unemployment rate in the week ended 26 September was down 0.7 percentage point to 7.5%.

- There were 464,437 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 3 October. In the week ended 19 September, continuing claims for PUA fell by 433,506 to 11,394,832.

- In the week ended 19 September, there were 1,959,953 such claims for Pandemic Emergency Unemployment Compensation (PEUC) benefits.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 19 September, the unadjusted total fell by 1,003,179 to 25,505,499.

- Technical note: The state of California has announced a

two-week pause in its processing of initial claims for unemployment

benefits, starting 19 September. To avoid weekly swings in the

national numbers, California's numbers will be held constant at the

level reported prior to the pause. The numbers will be revised

after the pause.

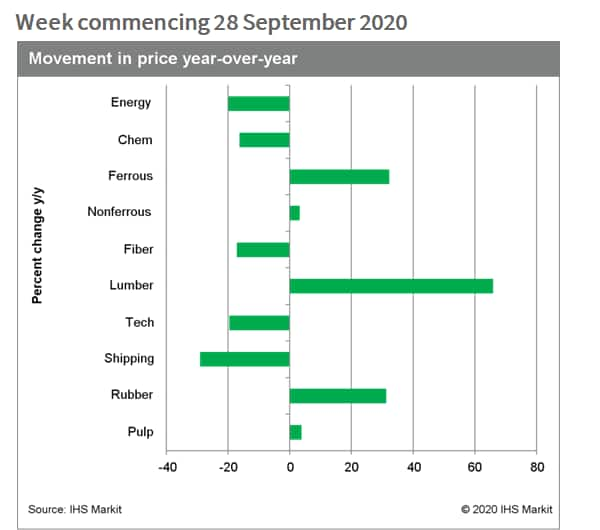

- The recent decline in the IHS Markit Materials Price Index

(MPI) accelerated last week with a 1.5% drop. While markets have

become more unsettled in September, mainland China's absence from

commodity markets because of its Golden Week holiday may have

contributed to the softening in prices. (IHS Markit Pricing and

Purchasing's William May)

- Chemicals prices led the MPI lower last week falling 5.1%, driven by declines in all three components: propylene (-1.7%), benzene (-3.0%), and ethylene (-8.4%). Ethylene's weakness came from a 38.4% plunge in European prices. US prices across all three products fell as capacity, temporarily shuttered by a series of hurricanes, came back online.

- Pulp fell 2.0%, a fourth consecutive weekly decline, although prices are still up 3.5% year to date. Paper manufacturers are noting, however, that global activity has increased recently, with supply tightening because of maintenance stoppages.

- Nonferrous prices fell sharply midweek on demand concerns but then rallied on Friday, ending the week down 1.5%. Better news on a possible second round of fiscal stimulus in the US and renewed interest in Democratic candidate Joe Biden's infrastructure plan seem to have buoyed markets after metals sold off midweek.

- Steel raw materials prices fell 1.5% as mainland Chinese buying slowed for the Golden Week holiday and Turkish scrap prices eased lower.

- Energy, lumber, and freight prices were the only subcomponents to rise last week. Energy rose 1.4% because of a small rise in thermal coal prices of 0.6% and a large rise in liquefied natural gas (LNG) prices of 9.2%.

- Oil prices fell 2.0% on the same demand concerns that pulled

most prices down last week.

- Housing starts in Canada declined 20.1% month on month (m/m) in

September, reaching 208,980 units. (IHS Markit Economist Jeannine

Cataldi)

- Urban starts declined 21.1% m/m to 195,909 units as multifamily starts pulled back after recording strong growth in the previous two months. Rural housing starts were lower by 1.9% m/m at 13,071 units. Alberta and Nova Scotia were the only provinces with m/m growth in starts in September.

- Housing starts recovered in the third quarter, increasing 25.3% quarter on quarter (q/q) following an 8.7% q/q decline in the second quarter. Growth was robust in both the single-family and multifamily segments.

- Year-to-date housing starts are above 2019 levels by 0.7%, with Ontario, Quebec, Saskatchewan, and New Brunswick experiencing growth over the year.

- Starts are expected to remain firm in the fourth quarter while the bounce in the third quarter fades and COVID-19 continues to have an impact on economic and housing conditions.

- Total housing starts fell in September as the multifamily segment, which had shown robust growth over the previous two months, pulled back by 27.0% m/m to reach 146,005 units. Alberta, Newfoundland, and Nova Scotia were the only provinces to record increased multifamily starts during the month. Declines were sizable across the remaining provinces, led by the 38.7% m/m plunge in Ontario.

- Single-family housing starts posted growth of 3.4% m/m to reach 49,904 units. While strong gains in Alberta, Quebec, and New Brunswick led the overall growth, the 2.0% m/m decrease in Ontario, which was a second consecutive drop, and sizable declines in British Columbia and Newfoundland and Labrador after jumping for three successive months limit the gains.

- Concern are growing over next year's orange juice supply as a result of droughts in Brazil. European supermarkets are now asking juice suppliers to tender for 2021 contracts, to be called off from January, and the drought in Brazil is confusing prospects for orange juice supply. This is an earlier start than usual. The coronavirus pandemic may have something to do with this, and UK supermarkets are anxious to secure their supplies and build up stocks in advance of Brexit because of fears of WTO default duties and delays at UK ports. With buyers anxious to cover themselves, and perhaps add more for safety's sake, prices look certain to rise. IHS Markit has already heard of offers for Brazilian FCOJ starting at USD2,000 per ton duty unpaid Rotterdam. "The market has not yet realized that the 2021/22 season is already affected by the weather," commented a source. "The flowers and small oranges on the trees cannot support more than five consecutive days above 35-36° and we have been getting temperatures between 36-42° for over three weeks." Some rain is forecast, but a return to normal seasonal rainfall is not anticipated until mid-November, which may be too late. The drought and heat is also affecting ratios, which are too low for the time of year at between 9 and 11. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- Light-vehicle (LV) registrations in Brazil decreased 11.1% year on year (y/y) in September, according to data from the National Association of Motor Vehicle Manufacturers (Associação Nacional dos Fabricantes de Veículos Automotores: Anfavea). Brazil's LV exports dropped 18.6 y/y in September, while LV production declined 11.0% y/y. However, the figures represent an improvement from the data in August. The outlook for the Brazilian LV market is gloomy as the spread of the COVID-19 virus is likely to affect sales in October, followed by a weak recovery phase until 2025. Brazil's LV sales were 2.66 million units in 2019 and are forecasted to decrease 29.2% to 1.88 million units in 2020. Brazil's LV exports continue to be affected by an economic crisis in principal export market Argentina as it also struggles with the COVID-19 virus pandemic. IHS Markit forecasts Brazil's LV production will reach 3 million units in 2024, compared with 2.80 million units in 2019. (IHS Markit AutoIntelligence's Tarun Thakur)

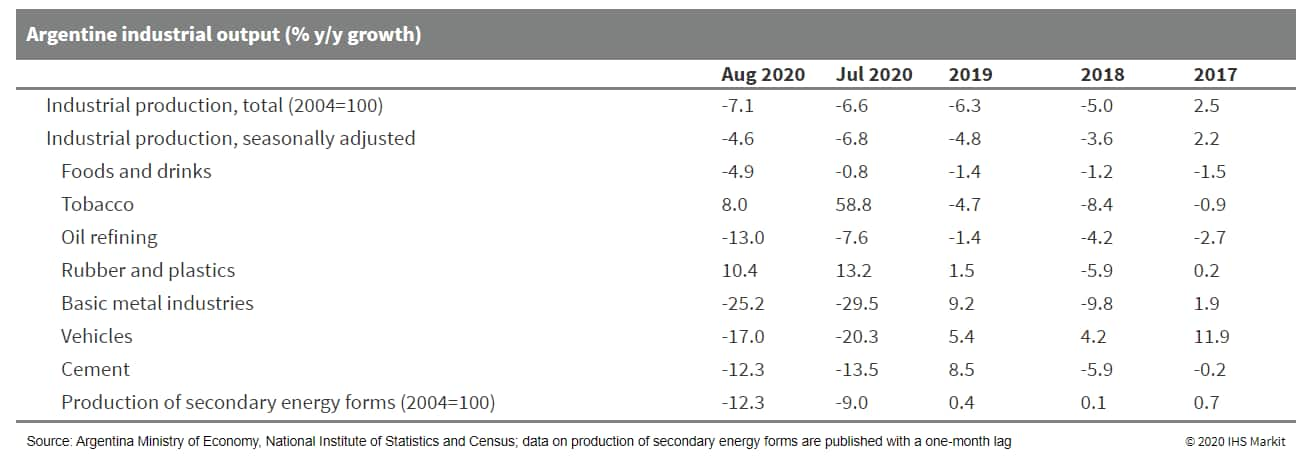

- Argentine industrial production fell 7.1% year on year (y/y) in

August, according to the National Institute of Statistics and

Census (Instituto Nacional de Estadística y Censos: INDEC).

Seasonally adjusted data show a 0.9% month-on-month (m/m) decline

in August, compared with a 1.4% m/m increase in July (revised

figure). The cumulative change for the first eight months of 2020

is a decline of 12.5% y/y. (IHS Markit Economist Paula

Diosquez-Rice)

- The biggest annual decreases in August were in transport equipment, clothing and apparel, other machinery and equipment, basic metals, vehicle assembly, and textiles, among others. Three sectors posted a y/y expansion in August - the tobacco product sector, the chemicals sector, and the general machinery and equipment sector.

- A qualitative industrial poll of companies conducted by INDEC shows that 39% of respondents estimate that demand will deteriorate in September-November compared with the same period in 2019 (down from 47% in the previous month's survey). The percentage of respondents expecting demand to pick up decreased to 26%, while 45% of respondents expect exports to fall during the period.

- Construction activity decreased by 1.0% m/m in seasonally adjusted terms in August and dropped by 17.7% y/y; construction employment in the formal sector, registered, decreased by 28.0% y/y in August, while cumulative job losses in the sector stood at 23.2% in the first eight months of the year. Approximately 30% of the construction firms that responded to the qualitative survey expect activity to shrink in the private sector in the next three months, whereas 52% expect no change in activity.

- Argentina's manufacturing utilized capacity increased to 56.8%

in July. Tobacco products had the highest utilized capacity at

79.5%, followed by chemicals, oil refining, and non-metal minerals.

The sectors with the least utilized capacity were the automotive

industry, at 29.8%, and the textiles industry, at 43.1%.

- An International Monetary Fund (IMF) mission arrived in

Argentina on 6 October to start official debt renegotiations with

the government. Argentina is restructuring its USD44-billion debt

with the IMF, generated under a stand-by arrangement (SBA) granted

to the previous government of Mauricio Macri in 2018. (IHS Markit

Country Risk's Carla Selman)

- As with the agreement with private-sector bondholders in August, the government is seeking to delay repayments and obtain a grace period of three years (the first IMF repayments are scheduled in September 2021).

- Economy Minister Martín Guzmán has said that the government will not seek additional funds.

- Issues likely to be raised during the staff visit include Argentina's capital controls and the 2021 national budget, which proposes a primary fiscal deficit target of 4.5% of GDP, with the government advocating its gradual reduction.

- This stance - which does not propose spending cuts - has received the backing of IMF managing director Kristalina Georgieva, indicated by statements that the Fund will not demand deep spending cuts while countries deal with the COVID-19 virus pandemic.

- Instead, tax increases are likely. A government-sponsored one-off tax on the wealthy is currently being reviewed in Congress, and although it targets individuals, the bill is also likely to place levies on shares and productive equipment and inputs. The government is also considering increasing corporate tax rates back to 35%, from the current 30%, effectively reversing Macri's 2017 tax reform that gradually reduced the rate from 35% to 25%; President Alberto Fernández halted this reduction upon taking office in December 2019.

Europe/Middle East/Africa

- European equity markets closed higher across the region; Spain +1.2%, Germany +0.9%, Italy +0.8%, France +0.6%, and UK +0.5%.

- 10yr European govt bonds closed higher across the region; Spain -4bps, Italy/France/Germany -3bps, and UK -2bps.

- iTraxx-Europe closed flat/54bps and iTraxx-Xover +4bps/322bps.

- Brent crude closed +3.2%/$43.34 per barrel.

- France reported 18,129 new coronavirus cases on Thursday and is placing more cities on maximum alert, with restrictions to expand beyond Paris and Marseille. The seven-day rolling average of new infections rose to 13,448, the highest since the start of the outbreak. (Bloomberg)

- Key takeaways from the account of the European Central Bank's

(ECB)'s most recent policy meeting, which concluded on 10

September, are as follows below. (IHS Markit Economist Ken Wattret)

- The second quarter's collapse of activity was followed by a significant rebound but not yet a full recovery. Incoming data pointed to a strong rebound in the third quarter's GDP but momentum had slowed in the services sector recently.

- Although consumer spending had increased strongly since April, its recovery remained far from complete. Survey data indicated that the perceived lack of demand was increasingly becoming a drag on investment.

- The degree of uncertainty remained exceptionally high. This was seen to weigh down on consumption, with precautionary dependent on household confidence. Lingering uncertainty surrounding the fallout from the pandemic could keep household savings elevated for some time.

- By and large, risks to global activity and trade remained on the downside. Among those risks is a no-deal Brexit, the probability of which seemed to be increasing.

- The latest readings of measures of underlying inflation pointed to a moderate weakening. However, it was notable that services inflation - which was much more closely linked to domestic developments and had a high wage content - had declined further.

- Headline inflation was likely to remain negative over the coming months before turning positive again in early 2021, but this would be a mechanical rebound due to base effects from energy prices and Germany's VAT reductions.

- The inflation outlook in September's staff projections might be too optimistic, partly owing to lower wage growth. Phillips curve estimates tended to show lower inflation compared with the baseline. Reference was made to the risk of debt deflation and possible cliff effects as fiscal and supervisory measures came to an end.

- The functioning of euro area financial markets had, by and large, been restored. Stress symptoms had largely dissipated and liquidity had returned.

- In light of normalizing market conditions and subsiding risks of fragmentation, the role of the PEPP was highlighted. The PEPP envelope would likely have to be used in full, in line with prevailing market expectations. It was important to remain firm on prior announcements regarding the overall PEPP envelope.

- Uncertainty was a potential impairment to the transmission of monetary policy, which had to be monitored carefully. The full effects of the pandemic had yet to become evident in corporate balance sheets, with possible adverse repercussions for bank balance sheets. The crucial role of government guarantee schemes in underpinning bank loan provision to the real economy was stressed. The potential materialization of adverse real-financial feedback loops called for vigilance.

- The account can be succinctly summarized as follows: the ECB is temporarily in a holding pattern, awaiting more economic data and information about the COVID-19 virus pandemic but retaining a clear easing bias and has its proverbial finger on the trigger.

- Germany's Federal Statistical Office (FSO) external trade data

for August (customs methodology; seasonally adjusted; nominal)

reveal that exports and imports increased by 2.4% and 5.8% month on

month (m/m) in August, respectively. Notwithstanding an

uninterrupted recovery phase since May, trade levels were still

roughly 8% below where they had been a year ago. (IHS Markit

Economist Timo Klein)

- The seasonally adjusted trade surplus, which had almost returned to its monthly average of 2019 (EUR18.8 billion) in July, corrected to EUR15.7 billion in August. Nevertheless, this is far above April's near-20-year low of EUR3.1 billion.

- The regional breakdown in August reveals an outperformance in trade with EU countries and especially with the sub-group of non-eurozone countries. The latter presumably reflects mostly EU member states in Eastern Europe, which have shown above-average economic resilience to knock-on effects of the pandemic (at least until August).

- Both exports to and imports from the rest of the world outside the European Union were relatively weak, despite trade with China being supportive (exports -1.1%; imports flat year on year [y/y]). The main drag on the export side was the United States (-21.1% y/y), while for imports it was the United Kingdom that restrained activity (-22.2% y/y). This reflects both the sub-par COVID-19-virus situation in the UK and foreshadowing effects from an increasingly likely hard Brexit, which induces German firms to divert their supply chains away from the UK.

- In unadjusted terms, both the trade and current accounts registered a narrowing surplus in August compared with July (see table below). However, the picture differs in y/y terms, as the trade surplus shrunk from EUR16.4 billion in August 2019 to EUR12.8 billion in August 2020, whereas the current-account surplus increased slightly from EUR15.9 billion to EUR16.5 billion owing to improving balances of invisibles (services and primary and secondary incomes).

- Mercedes-Benz brand passenger car sales posted a recovery in

the third quarter, with a 3.9% year-on-year (y/y) increase to

613,730 units after the COVID-19 virus hit the automotive industry

in the first half of the year, according to a company press

release. (IHS Markit AutoIntelligence's Tim Urquhart)

- They were still down by 10.2% y/y in the first nine months of 2020 to 1,584,859 units owing to the impact of the pandemic on the global economy.

- Sales in the third quarter were almost on a par with many European markets, with sales only down by 0.4% in the region.

- Impressively from a regional sales mix point of view, the company managed to record positive growth in the Asia-Pacific region from the start of the year, with a 2.1% y/y increase to 746,603 units. This was driven by China, which experienced an 8.3% y/y increase since January, which is a remarkable performance in view of the pandemic. Sales in China in the third quarter were up by 23.4% y/y to 223,631 units, helped by strong sport utility vehicle (SUV) sales and the company's expanded production footprint in the country.

- In the United States, Mercedes-Benz sold 69,631 units from July to September, which was a decline of 9.4%. For the full-year 2020, IHS Markit is projecting Mercedes-Benz passenger car sales to stand at 1.94 million units, down from 2.18 million units in 2019.

- Continental is looking to sell its Vitesco and Contitech units as part of a cost-cutting program that will cut its headcount by up to 30,000 units by 2023, according to a Reuters report. The news agency cited an interview with Continental CEO Elmar Degenhart with German newspaper Frankfurter Allgemeine Zeitung. The CEO was quoted as saying that the company was already in talks with a number of potential buyers that are interested in some of the divisions. Continental had previously been looking to spin off the Contitech business into a separate listing but it seems the company may be favoring the option of a sale instead. ContiTech combines the wider Continental Group's expertise in making for products and systems made of rubber, polyamide, metal, textile, and electronic components. Vitesco is focused on 48V electrification solutions, electric drives, and power electronics for hybrid and battery-electric vehicles. The company recently approved a major cost-saving and restructuring program aimed at future-proofing the business and as a response to the current economic environment. (IHS Markit AutoIntelligence's Ian Fletcher)

- State Secretariat for Economic Affairs (SECO) data reveal that

Switzerland's seasonally adjusted unemployment declined by 297

people, or 0.2% month on month (m/m), to 155,191 in September. This

follows a level of 155,488 in August, revised down by almost 700.

These recent improvements reflect the loosening of COVID-19-virus

related restrictions from May onwards, but it is worth noting that

September's level remains above the peak of the previous cycle near

150,000 (mid-2016) and is 50% above the low-point of around 103,000

seen in mid-2019. (IHS Markit Economist Timo Klein)

- The seasonally adjusted unemployment rate, which had hovered at a 17-year low of 2.3% in 2019, slipped from the July-August interim high of 3.4% to 3.3% in September. The cyclical high of 4.1% seen in 2009 due to the global financial crisis (GFC) will probably not be reached this time, but some upward potential remains in the pipeline owing to the recent resurgence of COVID-19 cases and an expected increase in company insolvencies in late 2020 and early 2021 once fiscal support measures are scaled back. Note that Switzerland's unemployment rate is measured against a fixed labor force figure used as the denominator, which is currently at 4,636,100 (2015-17 average; used for rates since January 2017).

- Among other labor market indicators, seasonally adjusted job vacancies stayed in recovery mode, increasing by almost 1,000, or 3.2% m/m, to 31,688 in September. However, this is driven by the downward revision of the August number from 31,345 to 30,702, and the year-on-year (y/y) decline broadly remained at -9%.

- The number of short-time workers - lagging by two months and unadjusted for seasonal variations - declined markedly anew in July. Having reached an all-time high of 1,077,000 in April, it fell from 488,312 in June to 347,638 in July (-28.8%). That said, this remains massively above a mere 4,000 in February. The number of lost working hours similarly declined by 28.1% m/m in July, from 28.4 million hours to 20.4 million hours. This compares with April's peak of 90.2 million hours but also just 5 million hours at the height of the GFC in 2009. This reflects the huge impact that the pandemic has had on the service sector in the current recession.

- Further increases in Switzerland's unemployment are likely in late 2020 and early 2021 because companies that have initially kept their heads above water with short-time work schemes and various forms of public support might find out that they either cannot survive with much reduced demand until a vaccine has become widely available or that their business model no longer works in a post-pandemic environment.

- The Swiss flavor, fragrance and essential oil company Givaudan

reported that its Q3 sales were stagnant year-on-year at CHF1.559

billion (USD1.7 billion), although January-September sales rose by

2.7% in Swiss Francs and by 3.7% like-for-like basis (LFL) to

CHF4.8 billion. The taste and wellbeing division sales fell by 2.1%

to CHF826 million but from January-September 2020 increased by 3.1%

to CHF2.6 billion. The fragrance and beauty division sales were

CHF743 million, 2.3% more y-o-y, and totaled CHF2.2 billion between

January and September 2020, 4.5% more y-o-y on LFL. Within

fragrance and beauty, fine fragrance sales decreased by 11.3% LFL

against strong comparable of 8.0% growth in 2019, with the results

continuing to be impacted by the COVID-19 pandemic. (IHS Markit

Food and Agricultural Commodities' Jose Gutierrez)

- Sales in Asia-Pacific fell slightly by 0.2%, against a comparable growth of 6.7% in 2019 as India, Indonesia and Malaysia were strongly impacted by the Covid-19 pandemic. Meanwhile, China delivered strong double-digit performance, followed by solid single-digit growth in Thailand and the Philippines.

- Sales in Europe, Africa and the Middle East rose by 2.0%. Russia, Turkey and North African markets were the drivers of growth with double-digit rises.

- Sales in North America increased by 4.6% thanks to the strong performance of global as well as local and regional customers, especially in beverages, snacks and sweet goods.

- Sales in Latin America increased by 10.0% against a strong comparable growth of 19.7% in 2019. The growth was led by strong double-digit growth in Brazil and Argentina and single-digit growth in Columbia, Chile and Mexico, especially in the segments of beverages, dairy and savory.

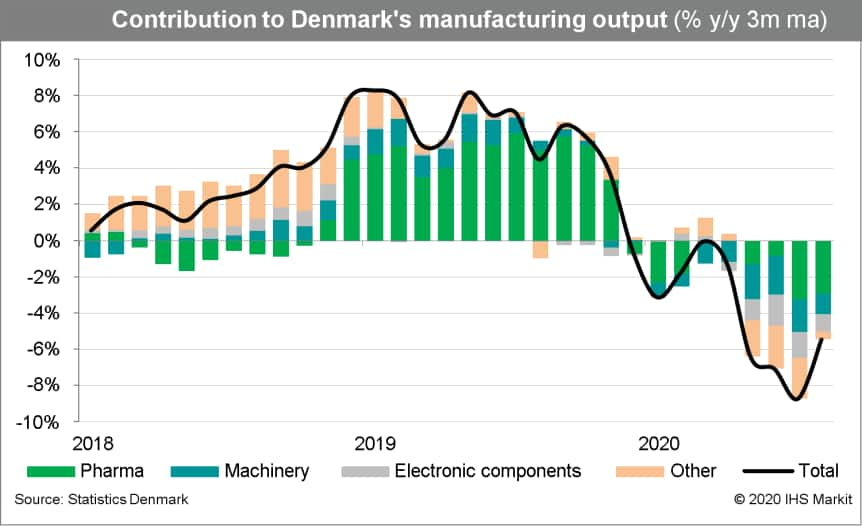

- After several months of declines, in August Denmark's

industrial and manufacturing output grew by 4.5% and 5.9% month on

month (m/m), respectively. On a three-month rolling basis,

industrial output is down by 6.9% year on year (y/y) and

manufacturing output by 5.5% y/y. (IHS Markit Economist Daniel

Kral)

- Among the main sub-components, manufacture of furniture and other manufacturing grew by 11.3% y/y, although this is partially driven by a base effect, as August 2019 was extremely weak. Manufacture of chemicals was up by 6.3% y/y.

- The manufacture of pharmaceuticals, which have the largest weight in the index (20.1%), was down by 10.7% y/y. This also reflects the base effects from 2019, when pharmaceuticals rose by 15.3% for the full year and were the main growth driver in the whole index (Chart 2).

- In August, there were also large drops in the manufacture of electrical equipment, by 12.5% y/y, basic metals, by 11.7% y/y, manufacture of electronic components, by 9.3% y/y and machinery, by 4.5% y/y.

- Despite the improvement in August, industrial and manufacturing output remains 3.5% and 3.3% below February levels, prior to the impact of the COVID-19 virus pandemic.

- Danish manufacturing PMI remained in expansion territory in September at 54.4, a remarkable turnaround from the April low of 38.7. The output sub-component was up to 66.3 in September, from 33.0 in April, indicating a continued strong rebound in production in the coming months.

- The Danish manufacturing sector fits into a broader trend of a

strong rebound in the manufacturing sector across European

economies. We expect the positive momentum in the Danish

manufacturing sector to continue into the fourth quarter, in line

with the leading indicators.

- Finland's consolidated general government (comprising the

central and local governments and the social security funds) budget

in the second quarter of 2020 registered a deficit of EUR3.7

billion (USD4.3 billion), which marks significant deterioration

compared with the surplus of EUR1.7 billion posted in the second

quarter of 2019. (IHS Markit Economist Venla Sipilä)

- General government consolidated total revenue decreased by 8.4% year on year (y/y), with central government revenues falling particularly rapidly. Seasonally adjusted data show revenues falling by 4.6% from the first quarter.

- Overall economic weakness was reflected in sharp falls of income taxes, taxes on production and imports, and property income, in particular.

- Meanwhile, total general government expenditures increased by 7.8% y/y and by 5.0% quarter on quarter (q/q). Central government spending increased particularly clearly due to rising subsidies and current transfers.

- General government consolidated gross debt reached EUR163.4 billion, having increased by 5.5% over the second quarter and by 14.6% since the beginning of the year. Relative to GDP, total debt stands at 68.6%. The central government accounts for some 83% of total government debt.

- Falling revenues reflect impact of the recession, while the EUR15-billion stimulus package to support businesses is pushing up spending. The latest data also confirm our expectations that the weakening impact on government finances from the COVID-19 virus crisis has been enough to push the ratio of gross debt to GDP far above the upper limit of the Maastricht criteria, at 60%.

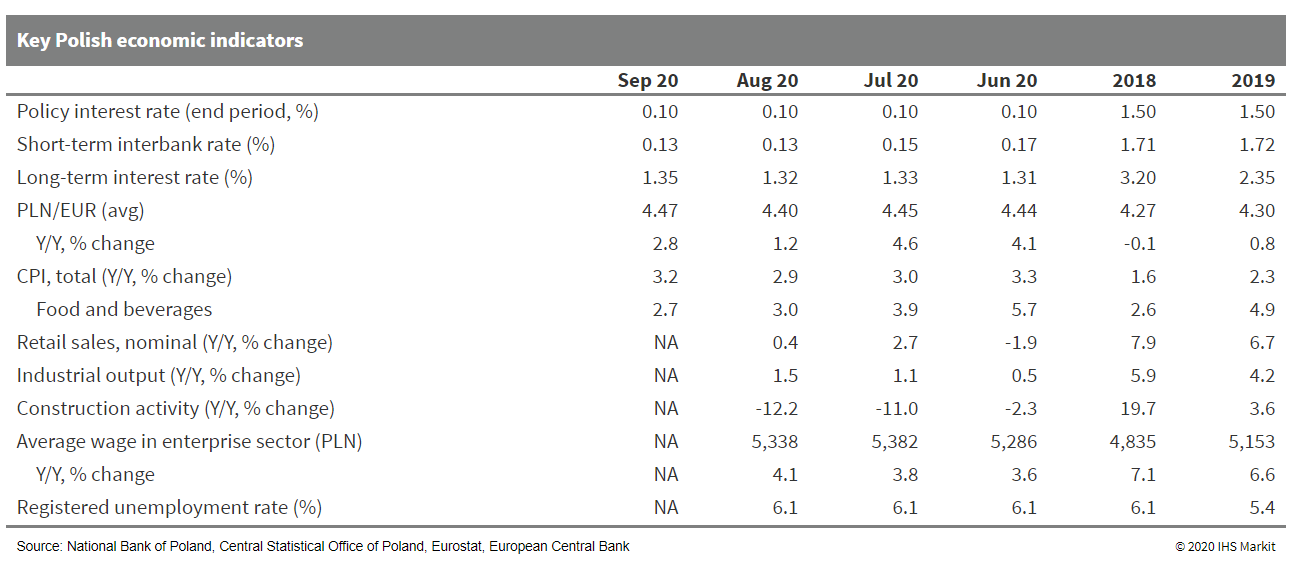

- As expected, Poland's monetary policy council maintained the

policy interest rate at a record low of 0.1% during its September

session. The National Bank of Poland (NBP) announced plans to

continue purchasing government and government-guaranteed debt

securities as part of open market operations, while also offering

discount credits aimed at refinancing enterprise loans. (IHS Markit

Economist Sharon Fisher)

- After a steep drop in second-quarter GDP, the Polish economy showed signs of revival in the third quarter, although the pace of recovery slowed in August (see Poland: 22 September 2020: Poland's August output data signal stabilization of the post-lockdown economic recovery). Despite declining pressures from food prices, inflation reached a four-month high of 3.2% year on year (y/y) in September.

- Although the NBP expects a further recovery into the fourth quarter, the pace of growth is likely to decelerate in comparison with third-quarter results. Indeed, the rising number of COVID-19 infections in Poland and abroad present renewed risks for the coming months, threatening to undermine confidence and trigger new restrictions.

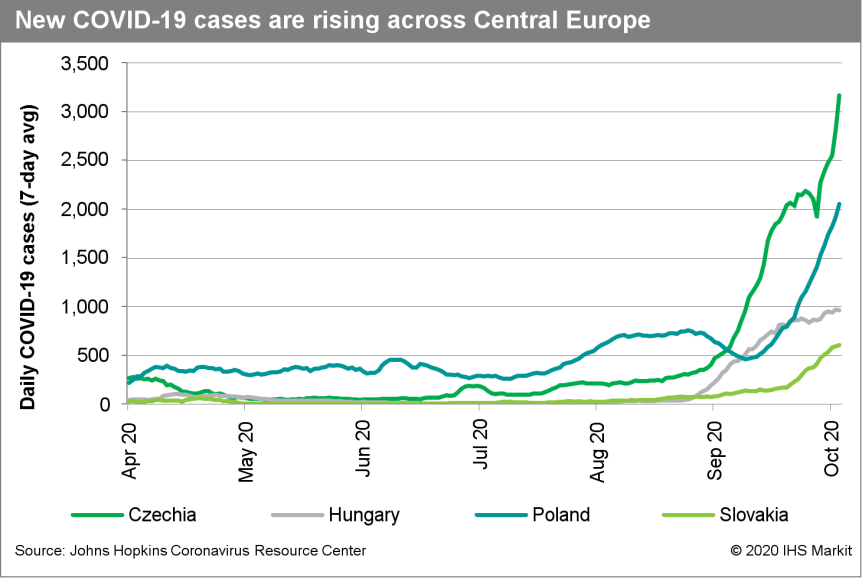

- Although COVID-19 cases have risen sharply across Central

Europe since early September, the total number of cases per capita

is currently considerably higher in Czechia than in the other three

Visegrad countries (Poland, Hungary, and Slovakia). As of 6

October, Slovakia had the lowest cumulative number of cases per

capita, followed by Poland.

Asia-Pacific

- Most APAC equity markets closed higher except for Hong Kong -0.2%; Australia +1.1%, Japan +1.0%, India +0.8%, and South Korea +0.2%.

- Japan's current-account surplus rose by 70.8% from the previous

month to JPY1.6 trillion (USD15.5 billion) on a seasonally adjusted

basis in August, recording the largest trade surplus since

February. However, the surplus of JPY2.1 trillion on a

non-seasonally adjusted level remained below the year-earlier level

by 1.5% or JPY32.3 billion. (IHS Markit Economist Harumi Taguchi)

- A year-on-year (y/y) decline in the current-account surplus was due largely to a deficit of the service balance, which widened from JPY1.5 billion a year earlier to JPY317 billion, reflecting a narrower surplus for the travel balance and a larger decline in receipts from the use of intellectual property. The travel balance remained in surplus but declined by 87.0% y/y to JPY206 million, reflecting entry bans. Primary income remained the major source of the current-account surplus, but this softened because of weaker portfolio income.

- These weaknesses were largely offset by the improved trade surplus, which widened by JPY382.8 billion from a year earlier to JPY413.2 billion. The contraction of exports softened to 15.5% y/y from a 19.6% y/y drop in July while imports remained sluggish, recording a 22.0% y/y drop.

- The improved trade balance is likely to contribute to a rebound of real GDP growth in the third quarter of 2020. However, further improvement of current-account surplus as well as the trade surplus could be limited over the near term. The resurgence of COVID-19 infections could soften the momentum of economic recoveries in Japan's major trade partners, weighing on Japan's exports. Imports will probably pick up at a faster pace in line with the progress in destocking and the resumption of domestic economic activity.

- Ramboll has been awarded by China Steel Power Corporation a contract for the Zhong Neng Offshore Wind Farm project to provide the concept, FEED, and detailed designs for the jacket and foundations structures, piles and transition pieces. The scope also includes parts of the metocean assessment, and manufacturing and installation support. Zhong Neng Offshore Wind Farm, located about 20 kilometers off the West Coast of Changhua County, Taiwan, is jointly developed by China Steel Power Corporation (CSC) and Copenhagen Infrastructure Partners (CIP). The 300 MW phase f this project is slated for completion in 2024. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Hyundai has delivered the first seven units of its XCIENT Fuel

Cell truck to customers in Switzerland, according to a company

press release. Hyundai plans to deliver a total of 50 XCIENT Fuel

Cell trucks to Swiss companies this year, and the number will be

increased to 1,600 units by 2025. "Today's delivery is just a

beginning as it opens endless possibilities for clean mobility.

With successful delivery of the first XCIENT Fuel Cell trucks, we

proudly announce our plan to expand beyond Europe to North America

and China where we are already making great progress," said In

Cheol Lee, executive vice-president and head of the commercial

vehicle division at Hyundai Motor. (IHS Markit AutoIntelligence's

Jamal Amir)

- In the US, Hyundai is collaborating with logistics leaders to supply mass-produced fuel-cell heavy-duty trucks. Hyundai revealed the fuel-cell-powered HDC-6 NEPTUNE Concept Class 8 heavy-duty truck at the North American Commercial Vehicle (NACV) Show in October 2019. In line with its plans, the automaker is partnering with companies to build a complete hydrogen value chain covering everything from hydrogen production and charging stations to service and maintenance. The North American market will also receive a 6x4 tractor model. By 2030, Hyundai aims to have more than 12,000 fuel-cell trucks on US roads.

- Hyundai is also working with various parties in China, which aims to get 1 million hydrogen vehicles on its roads by 2030 as the country's hydrogen industry is on a sharp growth trend, creating massive potential. Initially, Hyundai will focus on China's four major hydrogen hubs: Jin-jin-ji, Yangtze River Delta, Guangdong Province, and Sichuan Province. It is currently discussing co-operative initiatives such as a joint venture (JV) with local partners. The automaker plans to launch three fuel-cell trucks in China - a medium-duty truck in 2022, a heavy-duty truck in a couple of years, and another heavy-duty truck strategically designed for the Chinese market. With these models, Hyundai's goal is to achieve aggregate sales volumes of 27,000 units by 2030.

- Thailand's Industry Ministry is pushing ahead with its plan to bring prices of electric vehicles (EVs) closer to those of internal combustion engine (ICE) vehicles by reducing the import duty on auto parts used to assemble EVs in the country, reports Bangkok Post. The Office of Industrial Economics is conducting a feasibility study on tax reduction options and will forward its findings to the National Electric Vehicle Policy Committee, known as the EV board, for consideration this month. "The government believes tax reductions will make EVs inexpensive," said Thai Industry Minister Suriya Jungrungreangkit, adding that the current tax rate stands at 80% of auto part prices. The study team will consider tax reduction for auto parts and completely built EVs. Other factors taken into consideration include the state's plan to increase the number of EVs in the country and make EVs affordable for buyers. The price of EVs may range from THB700,000 (USD22,364) to THB800,000. "We will then know how much tax should be cut to make EV prices equivalent to internal combustion engine cars," said Jungrungreangkit. The taxation measure will help increase demand for EVs in Thailand, which are still costly, and at the same time support the country's measures to curb hazardous PM2.5 emitted by old car engines, according to Jungrungreangkit. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-october-2020.html&text=Daily+Global+Market+Summary+-+8+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 8 October 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+8+October+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}