Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 08, 2020

The Portfolio Trading Paradigm Shift: What’s Driving the Intrigue?

With Covid-19 causing turmoil for the global economy and logistical workplace disruption, numerous sectors within the capital markets have been forced to shift their mindset towards electronic trading. That said, with nearly $10 trillion dispersed across the corporate bond market, volatility and index turnover during this period have forced many on the buy-side to explore new trading protocols as standard list trading has become more challenging due to the lack of liquidity depth and the accompanying price dislocation.

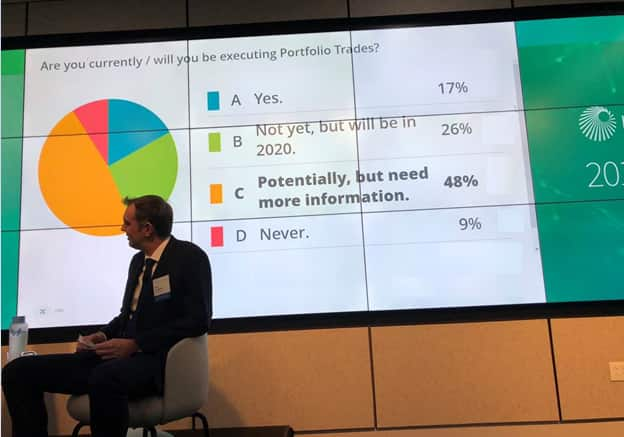

Portfolio trading, on the other hand, offers a discreet and highly efficient way to trade a basket of bonds with varying liquidity profiles in a single transaction. With the rapid electronification of the global bond market and a surge in fixed income exchange-traded funds (ETFs), portfolio trading is tipped to become one of the most efficient ways to deal with large, complex and multi-faceted bond transactions. With swelling interest observed over a very recent period, we dedicated a session to the topic at our inaugural Index Conference in Q4 of 2019 and found that 17% of our attendee firms had already executed portfolio trades in 2019 and over 25% who had not were planning to do so in 2020.

Source: IHS Markit - 2019 Index Conference, 14 Nov 2019

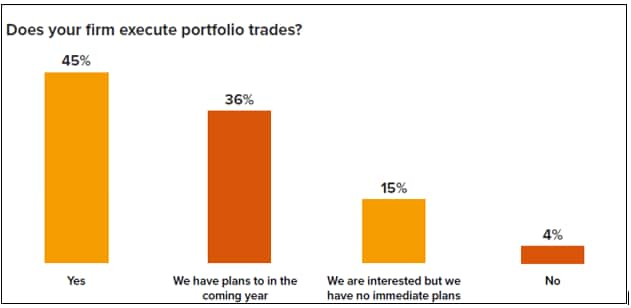

Flip the calendar to 2020, and the data point understated the trend. In Q2 of 2020, WBR Insights and Jane Street surveyed 100 buyside Heads of Fixed Income trading and the numbers already looked quite different, with more than 80% of the firms polled planning to leverage the protocol within the year. To further underscore the substantial ascent, some of the largest fixed income asset managers are now forecasting that 10-25% of their enterprise credit trading volume will be executed through portfolio trades by mid-2021.

Source: WBR & Jane

Street; Fixed Income Trading in 2020: How COVID-19 Has Changed the

Game

Source: WBR & Jane

Street; Fixed Income Trading in 2020: How COVID-19 Has Changed the

Game

Both sides of the Atlantic have observed a momentous uptick in portfolio trading this year. The current climate has both accelerated the growth and acceptance of the protocol across the buy-side community and has ultimately led to a step change in associated resource and technology spend at investment banks as well. Highlighting these themes, JP Morgan's credit trading desk reported volumes had already more than doubled from 2018 levels and TradeWeb surpassed $100 billion in cumulative trading volume just 18 months after it launched the protocol.

What's the attraction?

There are several dimensions and market structure benefits to consider. Portfolio trading provides both customization flexibility and efficiency gains, in that it serves as the mechanism to execute a diversified basket of bonds with a single counterparty. Given the complexity of their mandate and demands on their time, multi-asset execution professionals require tools and insights that will serve to optimize efficiency in their multi-step workflows. With portfolio trades, these professionals can deal baskets with hundreds of line items consisting of different durations, credit quality, liquidity dynamics and trade directions in a single aggregate transaction. If that trader then decides to proceed with an electronic protocol, every line item can be fed back into the client's order management system with the associated time stamp and comprehensive audit trail.

Another key driver of popularity is that portfolio trading can also mitigate market impact risk and transaction costs because it allows desks to consolidate liquid and illiquid securities within the same basket. Finding another dealer to execute on specific illiquid bonds is difficult even during the best of times. Portfolio trading provides the ability to bundle these bonds as part of a broader diversified basket. Thus, the impact of moving illiquid bonds or volatile issuer names in general can be vastly diminished.

Finally, engaging via this protocol guarantees execution of the entire list through all-or-none execution. In an interview earlier this year, a large asset manager mentioned that of the more than 130 trades that were initially modeled and projected as portfolio trades, less than 2% of the orders were ultimately pulled back and routed in pieces to different execution protocols. Clearly, "getting done" is the priority and portfolio trading provides that opportunity on a best execution basis.

Are you prepared to participate and what will it take?

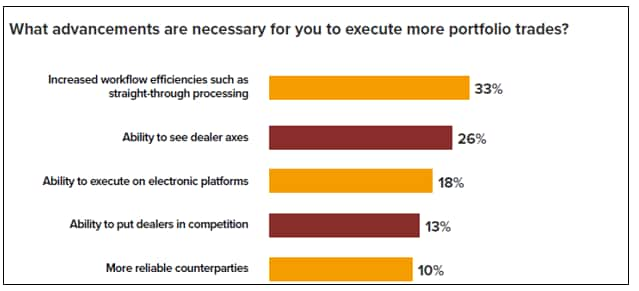

If buy-side firms are to take advantage of these new protocols, it is critical that they have access to tools that facilitate the portfolio construction and basket creation processes. In order to minimize inherent operational and market risk and to maximize efficiencies, participants will be seeking solutions to replace the distribution of spreadsheets via emails and manual workarounds. Per the WBR and Jane Street survey, increasing workflow efficiencies and straight-through processing (STP) was the advancement that most felt was required to unlock further activity. "Third parties will need to ensure that their products are capable of STP and to focus on further improving the trader's workflow to help speed up their trades," said Irene Cerquaglia, Conference Director, Fixed Income Leaders Summit EU.

Source:

WBR & Jane Street; Fixed Income Trading in 2020: How COVID-19

Has Changed the Game

Source:

WBR & Jane Street; Fixed Income Trading in 2020: How COVID-19

Has Changed the Game

IHS Markit's portfolio management system, thinkFolio, provides portfolio managers with the ability to construct their portfolio trading baskets with ease when monitoring inflows and outflows of cash, rebalancing funds or opportunistically managing exposures. Asset managers using thinkFolio can leverage portfolio modelling and basket trading features to facilitate pre-trade analysis and, ultimately, cost of transaction execution. The platform also gives portfolio managers and traders the ability to monitor portfolio trades throughout several stages of the lifecycle, resulting in significant time savings, transparency and reduced operational risk.

As this activity has garnered more attention across the sell-side and buy-side communities, more electronic trading venues have developed portfolio trading protocols and continued to invest in the space. thinkFolio's most recent release of software in June 2020 provides users with the ability to quickly construct and release portfolio trades with those trading partners. Through proprietary automated workflow rules in thinkFolio, portfolio trades can be routed to the electronic platform of choice seamlessly - something that is even more crucial during volatile markets when traders need to distribute risk.

In addition to thinkFolio's workflow and STP value propositions, IHS Markit's bond pricing and liquidity data supports portfolio trading activities by providing timely and accurate data for instruments across corporate and sovereign, securitized and municipal bond products. As part of their pre-trade evaluation, asset managers can leverage streaming data to improve inputs into pricing algorithms and facilitate a dynamic, highly transparent trading environment.

As global corporate bond market structure continues to evolve, participants will both seek and rely on technology solutions that automate their workflows and provide them with a robust and diversified suite of venue connectivity and trading protocols. By delivering the ability to efficiently model and execute portfolio trades within thinkFolio, asset managers will realize significant benefits in terms of time savings, market risk mitigation, operational risk reduction and transaction cost optimization.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-portfolio-trading-paradigm-shift-whats-driving-the-intrigue.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-portfolio-trading-paradigm-shift-whats-driving-the-intrigue.html&text=The+Portfolio+Trading+Paradigm+Shift%3a+What%e2%80%99s+Driving+the+Intrigue%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-portfolio-trading-paradigm-shift-whats-driving-the-intrigue.html","enabled":true},{"name":"email","url":"?subject=The Portfolio Trading Paradigm Shift: What’s Driving the Intrigue? | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-portfolio-trading-paradigm-shift-whats-driving-the-intrigue.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Portfolio+Trading+Paradigm+Shift%3a+What%e2%80%99s+Driving+the+Intrigue%3f+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-portfolio-trading-paradigm-shift-whats-driving-the-intrigue.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}