Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 28, 2020

Daily Global Market Summary - 28 September 2020

US and European equity markets closed higher, while APAC closed mixed. iTraxx and CDX indices closed tighter across IG/high yield, and precious metals and oil were also higher on the day. In addition to Q3 quarter-end on Wednesday, markets will be focused on Friday's US nonfarm payroll report to gauge the pace of recovery in US employment in the wake of the limited improvement in the weekly jobless claims numbers.

Americas

- US equity markets closed higher today; Russell 2000 +2.4%, Nasdaq +1.9%, S&P 500 +1.6%, and DJIA +1.5%.

- 10yr US govt bonds closed flat/0.66% yield and 30yr bonds closed +2bps/1.42% yield.

- CDX-NAIG closed -2bps/58bps and CDX-NAHY series 35.1 began trading today and closed at 404bps.

- DXY US dollar index closed -0.4%/94.26.

- Gold closed +0.9%/1,882 per ounce and silver +2.2%/$23.60 per ounce.

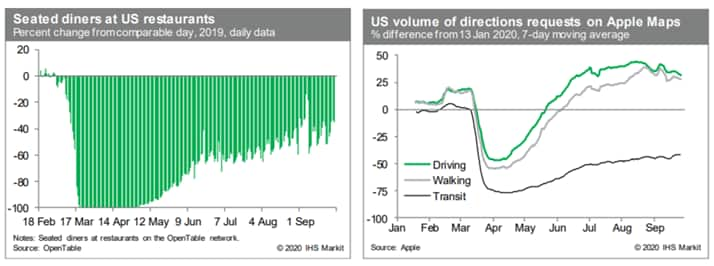

- The count of seated diners on the OpenTable platform last week

averaged about 42% below the year-earlier level, an improvement

over the prior week's average of 44% down. Meanwhile, requests for

driving directions on Apple Maps declined last week broadly in line

with seasonal norms. These data do not raise any new concerns about

internal mobility. However, gross movie receipts during the week

ending 24 September were 95% below the comparable week last year,

down from the prior week's year-on-year comparison of 90% down.

Activity at movie theaters has yet to gain traction. (IHS Markit

Economists Joel Prakken and Ben Herzon)

- Crude oil closed +0.9%/$40.60 per barrel.

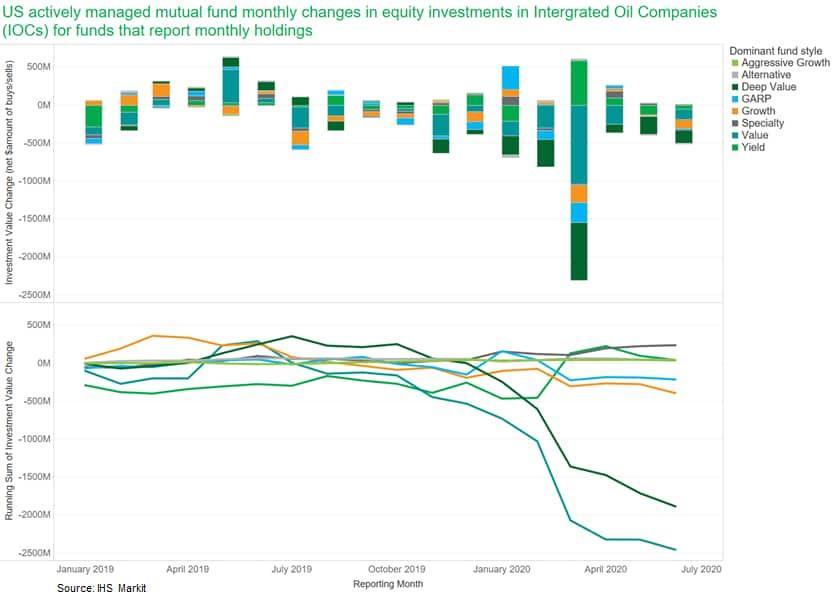

- The below charts show the Jan 2019 - June 2020 monthly

investment value changes (estimated net value of buys/sells) by

fund investment style for US actively managed mutual funds that

report their holding monthly. The data is based on a static group

of over 2,000 mutual funds that reported holdings every month

during the period and totaled $2.9 trillion in AUM across all

equity holdings as of June 2020. The top chart shows the monthly

net change in investment value by fund style and the bottom chart

shows the cumulative change during the entire 18-month period. The

most notable trend was the sharp divestment of IOC's equity by

value funds starting in July 2019 and deep value in August 2019.

It's also worth noting that there was over $131 million of net

purchases into yield funds in March 2020 across the group of

funds.

- In a press release, Devon Energy Corp. announced the signing of an agreement to acquire WPX Energy Inc. in an all-stock transaction valued at $6.34 billion. The transaction is expected to close in the first quarter of 2021. Under the deal, WPX shareholders will receive 0.5165 common shares of Devon for each WPX share. Based on 560.9 million WPX shares outstanding and Devon's closing price on 25 September 2020, the total equity offer value is $2.55 billion or $4.55 per share. The offer price is a 2.5% premium to the 25 September closing price of WPX. The total transaction value includes the assumption of WPX's 30 June 2020 working capital surplus of $135 million and $3.92 billion of long-term debt and liabilities. On closing, WPX shareholders will own approximately 43% of the combined company. Devon expects the synergies from the merger to result in $575 million in annual cash flow improvements by year-end 2021. The enlarged company is expected to hold 400,000 net acres in the Delaware Basin, which accounts for 60% of total oil production. The remaining assets are located in the Anadarko Basin, Williston Basin, Eagle Ford Shale and Powder River Basin. Devon said the acquisition will drive immediate synergies and enable them to accelerate free cash flow growth and return of capital to the shareholders. In March 2020, WPX Energy completed the acquisition of Delaware Basin focused Felix Energy II LLC in a stock and cash transaction valued at $3.5 billion. WPX Energy is an independent exploration and production company, focused in the Permian and Williston basins. The company is based in Tulsa, Oklahoma. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- The below IHS Markit Price Viewer chart shows intraday prices

for the WPX Energy 5.250% 9/24/2024 bond issue increased as much as

9% at approximately 10:00am EST today on the merger

announcement:

- The US Army Corps of Engineers (USACE) has reissued water-crossing permits for the Mountain Valley Pipeline natural gas project in Virginia and West Virginia two years after they were by a federal appeals court. In 2018, a three-judge panel of the 4th Circuit Court of Appeals count found that the USACE-issued permit violated a West Virginia regulatory requirement that pipeline stream crossings much be completed within 72 hours to limit environmental impact. The US Forestry Service has also made a Draft Supplement Environmental Impact Statement (DSEIS) for the pipeline available for public comment. The DSEIS covers the siting of the Mountain Valley Pipeline in the George Washington and Jefferson National Forest. The DSEIS was prepared in the wake of a 2018 4th Circuit Courts ruling that vacated the Bureau of Land Management's Right of Way and Forest Service's Forest Plan amendment. The Mountain Valley Pipeline is an under construction 490 kilometer natural gas link between northwestern West Virginia to southern Virginia in the eastern United States. (IHS Markit Upstream Costs and Technology's Chris Alexander)

- LyondellBasell (Houston, Texas) has issued its 2019 Sustainability Report, including plans to produce and market 2 million metric tons (MMt) of recycled and renewable-based polymers annually by 2030. The company currently possesses 11.5 MMt/y of polyolefins capacity. Other objectives highlighted by the report include reducing carbon dioxide (CO2) emissions by 2030 to 15% of the levels recorded in 2015; advancing workplace diversity, inclusion, and equity initiatives; and working with American Chemistry Council and Plastics Europe industry peers to ensure 100% of plastic packaging is reused, recycled, or recovered by 2040. "Our goals underscore what we see possible in the next decade, and our sustainability ambitions require us to adapt our business models," says Jim Seward, senior vice president/research and development, technology, and sustainability. "When viewed through the lens of technology and innovation, our track record demonstrates our capacity to advance new collaborations and partnerships for the benefit of society." Earlier this month, LyondellBasell successfully started up a pilot chemical recycling facility in Ferrara, Italy. The plant, which employs the company's MoReTec technology, is capable of processing 5-10 kilograms/hour of household plastic waste.

- In a unique demonstration, electric vehicle (EV) startup Canoo displayed its upcoming EV platform as a basic go-cart, driven by a professional racing driver. Canoo produced a video demonstrating the event. Canoo says its skateboard can support dual, front or rear motor configurations, capable of up to 500 hp and more than 300 miles of range. The rear unit delivers a maximum of 300 hp and 450 Nm of torque, while Canoo says the front unit is designed to deliver a maximum of 200 hp and 320 Nm of torque. When optimized for urban driving environments, Canoo says the efficiency of the motors is designed to peak at 97%. Canoo also describes its steer-by-wire as the industry's first true steer-by-wire, and inspired by racing cars, for a highly responsive experience and versatility in the company's future line-up. Canoo notes that without any mechanical connection, it is "able to demonstrate for the first time how the steering wheel can be moved to suit any cabin design or driver positioning. This versatility is well suited to accommodate full autonomy once commercially available, as well as for right hand drive and Canoo's future delivery vehicles." The demonstration was clever for helping to show how flat the skateboard is and its power and configuration versatility, although so far, Canoo has indicated plans for its vehicles to serve transport and goods delivery. While Canoo demonstrated the skateboard, it did not provide an update on timing for vehicle production, from previous plans for 2021. Of interest is the demonstration's focus on dynamic performance and high horsepower ratings; for the environment the first Canoos are expected to play, speed is less important than range. However, the specifications speak to the wide range of configurations possible and the capability that Canoo has harnessed. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Spot block cheese settled slightly lower at USD2.5550 per pound, down USD0.0725 from last Friday, and barrels settled at USD1.6600, up USD0.0250 compared with last week. The spread between the block/barrel market narrowed to USD0.8950 per pound compared with last week on six trades total. Cheese cold storage numbers were neutral to bearish for cheese prices. Stocks did not draw down much during August compared to normal, despite a falling pricing environment. USDA estimated total cheese in cold storage at the end of August was 1,378 million pounds, down 13 million pounds from July, but up 14 million pounds (or 1%) from a year ago. The five-year average seasonal cheese cold storage drawdown between July and August is 23 million pounds. American style cheese inventory rose five million pounds during the month to 790 million pounds, up 23 million pounds from a year ago. Midwest cheesemakers are finding milk supplies plentiful and running plants near full capacity. Some plants are doing seasonal maintenance. Most cheese plants are just working through contractual milk supplies but finding extra spot milk loads near class prices is obtainable. The extreme level of the block/barrel cheese price spread is creating nervousness about the sustainability of the rally in the block market. Inverted cheese/class III futures are problematic for cheese makers holding on to unpriced inventory. Western cheese plants are running strong but are cognizant of the inverted futures market when making decisions. Demand has been more uneven in the Western US because of weakness in food service. Retail remains mostly strong and export has been hit or miss depending on how US prices stack up against global markets. The current US block price near USD2.60 is starting to choke off price sensitive export business to global markets. US block prices will likely fall soon in order to get competitive again with world markets. US milk production trends remain bearish and domestic demand should be levelling off heading into the fourth quarter. IHS Markit forecasts barrel prices to hit USD1.50 per pound and blocks USD1.75 per pound by first quarter 2021. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

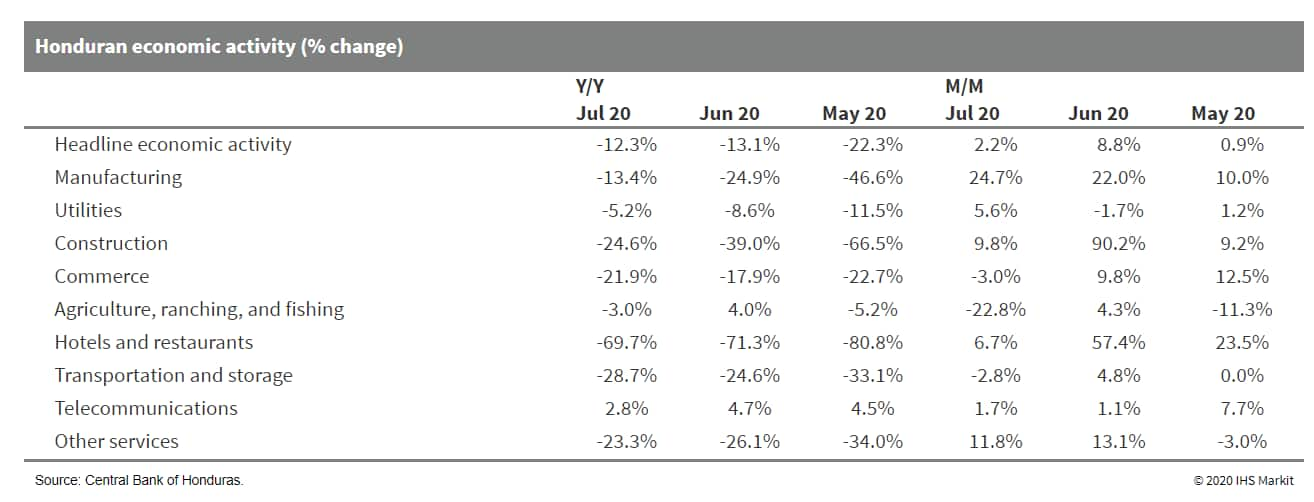

- Honduras's monthly economic activity index remained low in

July, even as sectors such as manufacturing, construction, and

hospitality began to reactivate slowly, signalling a sluggish

recovery through 2020. (IHS Markit Economist Lindsay Jagla)

- In July, the monthly index of economic activity (IMAE) grew by only 2.2% month on month (m/m), according to the Central Bank of Honduras (Banco Central de Honduras), resulting in an overall 12.3% year-on-year (y/y) contraction of the IMAE.

- Most sectors hit lows in April and May, and have begun a gradual m/m recovery, including manufacturing (+24.7% in July), construction (+9.8%), and hotels and restaurants (+6.7%). However, these sectors have been the hardest hit by the economic shutdown and remain well below pre-coronavirus disease 2019 (COVID-19) levels.

- Compared with Costa Rica, Guatemala, and El Salvador, Honduras's IMAE experienced the largest contraction up to June.

- The government's slow rollout of its economic reopening plan and the continued enforcement of curfew and quarantine measures have had a significant impact on the country's IMAE. The first phase of Honduras's economic reopening plan began at the end of July and the second phase is set to begin on 28 September.

- As firms scale up their operations further and more quarantine measures are lifted for citizens, IHS Markit assesses that there are likely to be increased upticks in economic activity in the second half of the year. The IMAE signals the direction of the country's GDP growth and although the second-quarter GDP data have not yet been published, we expect a significant contraction followed by gradual quarter-on-quarter improvements through 2020, in line with the higher frequency IMAE data.

- Overall, based on significant contractions in economic

activity, we are likely to revise down our GDP forecast for

Honduras, resulting in an overall decline close to double digits in

2020.

Europe/Middle East/Africa

- European equity markets closed sharply higher; Germany +3.2%, Italy/Spain +2.5%, France +2.4%, and UK +1.5%.

- 10yr European govt bonds closed mixed; Italy -2bps, France/Spain/Germany flat, and UK +1bp.

- iTraxx-Europe closed -2bps/59bps and iTraxx-Xover -18bps/344bps.

- Brent crude closed +1.1%/$42.87 per barrel.

- Siemens AG has spun off 55% of Siemens Energy AG to Siemens' shareholders and thereby made the corresponding number of shares available for free-float ownership. A further 9.9% were transferred to Siemens Pension-Trust e.V. Siemens AG intends to further reduce its direct stake of 35.1% in Siemens Energy significantly within 12 to 18 months. Going forward, the independent Siemens companies Siemens AG, Siemens Healthineers AG, and Siemens Energy AG will work together within an ecosystem of common interests. Each company will focus on the priorities and characteristics of their specific businesses and industries. With some 240,000 employees, Siemens AG will primarily concentrate on technologies in digital transformation, in smart infrastructure and in sustainable transportation. Siemens Energy will locate its Corporate Center in Berlin, returning to its roots, where Werner von Siemens and Johann Georg Halske founded their company in Berlin in 1847 and with the discovery of the electrodynamic principle in 1866 laid a foundation for Siemens Group and today's Siemens Energy. Berlin is one of Siemens Energy's largest locations worldwide. The decision, as to which of its Berlin locations will serve as headquarters, remains open and a more detailed concept will be developed in the coming months. The establishment of the Corporate Center will begin during the next fiscal year (1 October 2020 to 30 September 2021). The CEO, CFO, and a few teams, will initially move into their offices in Berlin. Siemens Energy's administrative headquarters will remain in Munich, Germany, where the company is listed on the Commercial Register. The company's decentralized approach will remain valid after the end of the Covid-19 pandemic. The energy technology company employs 91,000 employees worldwide and generated revenue of EUR29 billion (USD32 billion) in 2019. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- After earlier saying it would drop the battery cell and battery pack production from its Germany plans, reports indicate that Tesla has revised that decision. Reuters reports that Tesla indicated on 24 September that it still intends to build batteries and packs at the facility, though it will have to start a new approval process, and no timeline for the application was indicated. Reuters says that the Ministry for Agriculture, Environment and Climate Protection in the state of Brandenberg, where the facility is located, is expected to approve factory plans by the end of 2020. Environmentalists and local residents have expressed objections to the new factory, in part on water usage concerns. Tesla's Berlin plant will build the Model 3 and Model Y for the European market, as Tesla's CEO Elon Musk has recently been advocating that it is more efficient and profitable to build a vehicle as close to where you are going to sell it as possible. The company had reportedly pulled back on planning to produce batteries at the location in July. At Tesla's recent battery day, Musk indicated that the company is planning to supply as much as 20 million EVs globally, though did not indicate a timeframe for such a target. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Volkswagen (VW) has partnered with Uber to launch a pilot project with electric vehicles (EVs) in Berlin (Germany). This partnership will allow Uber car rental partners to use Volkswagen's e-Golf cars for a sustainable ride with "Uber Green". The objective of the pilot project is to use up to 100 pre-owned e-Golf cars that are more than a year old to achieve zero-emission transport service. Holger B. Santel, head of sales and marketing in Germany for the VW Passenger Car brand, said, "Through our cooperation with Uber, we are helping improve air quality in urban areas with our locally carbon-neutral electric vehicles. In addition, with the demanding continuous operation of battery-electric vehicles in a ride hailing service, we will gain valuable experience which we will be able to use for future vehicles." The VW brand plans to offer EVs in all major segments by 2022 and expects to produce 1.5 million of these cars in 2025. To attain this, VW plans to invest EUR33 billion (USD38 billion) group-wide by 2024. VW has also been using the e-Golf cars for its all-electric free-floating car-sharing service WeShare. Uber has announced a target of 2040 for 100% of its ride-hailing fleet globally to be zero-emission vehicles. By 2030, the company has set a goal of converting all its cars to EVs in the United States, Canada, and Europe. To achieve this, the company has partnered with General Motors (GM) and Renault-Nissan, and has also earmarked USD800 million on programs to help drivers switch to EVs. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- UK-headquartered private equity investment company Permira has announced that a company backed by its funds has made an agreement to acquire German generics manufacturer Neuraxpharm from funds advised by another UK-based private equity investment group, Apax Partners. No financial details of the transaction were made available. Neuraxpharm specialises in drugs used in the treatment of disorders of the central nervous system (CNS). Permira has stated in a press release that its funds will support Neuraxpharm's goals of becoming "the leading CNS-focused specialty pharmaceutical platform in Europe" and will back the company's successful "buy-and-build strategy". The closing of the acquisition is subject to customary regulatory conditions and is expected in the final quarter of 2020. Neuraxpharm has annual sales revenues of about EUR450 million (USD523 million) and employs 850 people; it is one of the major players on the European market for CNS medicines. In recent years, Neuraxpharm has been active in acquisitions, building its presence in the central European region, as well as launching sales on the UK market. (IHS Markit Life Sciences' Brendan Melck)

- Launch of new vegan ice cream products doubled in the last five years as UK consumers find vegan products more appealing. According to a research published by Mintel, launches of vegan ice cream accounted for 7% of all new products entering the market within the category in the last 12 months (2019/20), more than double the 3% of five years ago (2015/16). The focus on the texture of plant-based ice cream is increasing, with products containing nuts, cookie pieces, toffee pieces and cookie dough chunks surging from 2% to 13% over the last four years (2016/17-2019/20). This trend is likely to appeal to the 73% of UK ice cream consumers who said that they like ice cream with different textures. Chocolate (accounting for 26% of innovation over the last 12 months), vanilla (11%) and coconut (9%) remains the most popular in terms of plant-based flavour innovation. The ice-cream is expected to incorporate new ingredients such as quinoa or other seeds, while oat might be included in an increasing number of products' recipes following its popularity in plant-based drinks. About 12% of UK adults agree that the coronavirus outbreak has made a vegan diet more appealing, nearly doubling among under-25s (23%). This is partially due to the fact that protein has gained importance among consumers. The share of new food products featuring high/added protein claims has doubled from 2% to 4%. Meanwhile, high/added protein ice cream claims have increased from under 1% of ice creams to over 2% in the last four years and about 16% of Britons said that they would eat more ice cream if it had added protein. From a global point of view, Japan is one of the largest innovators for ice cream as for other products. In 2015/16 Japan accounted for 7% of launches globally, but since then its innovation has been coming thick and fast and Japan is now responsible for a one in 10 (10%) of product launches, overtaking the US to become the world leader in ice cream innovation. The US now accounts for 9% of new products launched, slipping back from its number one position. With a 6% share of global ice cream innovation, Germany is Europe's number one ice cream innovator and third in terms of global innovation. Meanwhile, the UK has a 4% share. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- A 5G-based autonomous electric mini-bus trial has been launched in Stockholm (Sweden) as part of a two-week pilot project. The project, called 5G Ride, is led by Urban ICT Arena, Keolis, Telia, Ericsson, Intel, and T-Engineering. The bus will carry passengers along the 1.6 km route on the island of Djurgården, stopping at the Biological Museum and Rosendal Castle. The service will operate with limited passengers owing to the COVID-19 virus pandemic and will also follow other precautions and guidelines. A safety driver will also be present in the bus to take control in case of an emergency. The project aims to demonstrate how 5G technology can improve public transport. 5G technology provides high-speed data transfer, low latency, and reliability so that the vehicle can respond to the centralized control tower's commands in real time. For the project, Telia is providing 5G connectivity in collaboration with Ericsson and Intel is providing analytics and processing technology across the network. The autonomous bus is provided by T-Engineering and is operated by Keolis. The initial tests will be followed by further trials in 2021, with the companies aiming to "pave the way towards making 5G-enabled electric driverless public transport services a reality". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Moody's downgraded Kuwait on 22 September, following a

downgrade review period initiated in March. The key rationale is

the likely short-term depletion of the General Reserve Fund (GRF)

before the end of the 2020 fiscal year ending March 2021. (IHS

Markit Sovereign Risk's Ana Melica)

- Parliament recently ended the mandatory transfer of 10% of revenue to the Future Generations Fund (FGF) and reversed last year's transfer, but Moody's points out that this will only extend the availability of GRF funds until December 2020.

- A key risk would be a lack of liquid funds when Kuwait's Eurobond tranche of USD3.5 billion matures in March 2022.

- Meanwhile, parliament rejected the draft debt law in August, so the government remains unable to borrow since 2017. Even if Kuwait's Emir passes the debt law by emergency decree after the National Assembly concludes its session at the end of September but before the election in November, Moody's estimates that the law's KWD20-billion (USD65 billion) debt ceiling will be reached in less than two years.

- Even with an unlimited debt ceiling, Moody's estimates that the government would need to issue KWD27.6 billion (USD90 billion) from fiscal years 2020 to 2023 to fund its deficits, and it is unlikely that it would be able to borrow such a large amount. This would raise sovereign debt from 12% of GDP in 2019 to around 70% of GDP.

- This is based on Moody's expectation of huge fiscal deficits of KWD13.7 billion (38% of GDP) this fiscal year and KWD10.6 billion (26% of GDP) next year, largely a result of continued current expenditure growth in recent years, primarily on salaries, as the government is a primary employer. Weak private-sector development and a growing and youthful population have given the government few alternatives, as it is trying to prevent a rise in unemployment that could lead to social unrest

- Moody's expects that a positive rating action could result from improved governance and policy responses, leading to fiscal consolidation and diversification over the longer term that reduces the reliance on oil. A negative rating action could result from increased liquidity risk, particularly if there is material risk of non-payment as the Eurobond redemption date approaches. Over the medium term, a downgrade could occur if there is a sharp rise in sovereign debt because of a lack of fiscal consolidation and low oil prices.

- Niger's Ministry of Finance presented on 19 September a report

on the context of the drawing up of the 2021 budget, as well as

recent development of the national economy, highlighting that

significant external risks are expected to burden public finances

next year. (IHS Markit Economist Alisa Strobel)

- The finance ministry states that, during 2011-20, the budget allocation to defense and security represented on average 17% of budgetary resources, against the government's forecast of 10%. Regional security challenges are set to continue to build pressure on government expenditure in tandem with ongoing pressure on finances stemming from tackling the COVID-19 virus outbreak and dealing with weather-related hazards, in particular floods.

- In terms of public finances, good performances were recorded between 2017 and 2019, despite the unfavorable security context in the region. The budget deficit, including grants, fell from 4.1% of GDP in 2017 to 3.0% in 2018 and 3.6% in 2019. However, the government raises concern that the COVID-19 crisis will have a severe impact by causing a deterioration of the budget deficit, such as through a loss of tax revenue and an increase in public expenses, which will stretch into 2021.

- The budget framework for the 2021 fiscal year assumes GDP growth of 8.1% and a projected inflation rate of 2.0%, with the 2021 general state budget resources projected at XOF2,644.53 billion (USD4.68 billion) in 2021, against XOF2,422.33 billion in the first collective budget for 2020, an increase of 9.17%.

- State revenue losses are expected to remain high, yet lower than during the start of the crisis, and are estimated at XOF199 billion, compared with the government's forecasts initials of XOF997 billion, including XOF117.6 billion under the General Directorate of Taxes, XOF78.4 billion for the General Directorate of Customs, and XOF3 billion non-tax revenue. Spending in fiscal year 2020 will increase by XOF86.1 billion, predominately because of the implementation of the response plan to the COVID-19 pandemic.

Asia-Pacific

- APAC equity markets closed mixed; India +1.6%, Japan/South Korea +1.3%, Hong Kong +1.0%, Mainland China -0.1%, and Australia -0.2%.

- Chinese electric vehicle (EV) start-up NIO has rolled out a new function to its NIO Pilot system. The Navigate on Pilot (NOP) will enable NIO vehicles to perform certain functions, such as auto-land changing, automatically on designated routes covered by high-resolution mapping. The automaker said the NOP is China's first commercial application of driver assistance technology enabled by high-resolution mapping. NIO also announced its Power Up Plan centered on expanding its charging facilities across China. The company said that its target is to build 30,000 fast charging piles at hotel resorts, tourist attractions, and commercial locations. The aim of NIO's Power Up Plan is to lead to the expansion of its charging network to cover 30,000 25-kW chargers in China. According to its plan, the project will not be financed solely by NIO, instead, it will team up with interested partners who are willing to share charging resources with NIO over the next three years through a subsidy program. NIO said that by the end of September its vehicle owners will have access to 430 NIO authorized charging piles across China. These charging piles, which are operated jointly by NIO and its business partners, provide services to all EVs, not just NIO models. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese electric vehicle (EV) start-up Xpeng will start building a new manufacturing plant in Guangzhou (China) with CNY4 billion (USD587 million) in financing from the local government, reports Reuters. The new plant is expected to have an annual capacity of 100,000 vehicles. According to local media reports, the funds will be provided by an investment company backed by Guangzhou Development District. The investment will be used for the development of Xpeng's new vehicles and the construction of a new manufacturing plant in the city. Xpeng currently produces its G3 sport utility vehicle (SUV) in Zhengzhou under manufacturing contract with Haima Auto. Production of Xpeng's second model, the P7 sedan, has already started at its own plant in Zhaoqing, Guangdong province. The two plants already have a combined capacity of 250,000 units per annum. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Turing Drive in partnership with the government of Taipei (Taiwan) is conducting a midnight trial of an autonomous bus service on the Xinyi bus lane. Taipei residents can participate in the final stage of this service by registering for one of the six road sections ranging from 1 to 1.7 kilometers. The trial service will be available from 12.30 am to 2.00 am every day expect Thursdays and the bus will accept 15 passengers, reports the Taipei Times. Taiwan's government plans to promote the autonomous vehicle (AV) industry and in 2019 unveiled a test field for AVs. In 2019, the Automotive Research & Testing Center (ARTC) unveiled Taiwan's first electric minibus, the WinBus, with Level 4 autonomous driving capabilities. LILEE Systems has launched a commercial autonomous bus service in Tainan (Taiwan) as part of the city's two-year smart transport development plan. In 2018, Acer and Yulon Motor unveiled a co-developed autonomous concept car at the Technology Innovation Summit 2018 in Taiwan. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hyundai has shipped four fuel-cell electric vehicles (FCEVs), two Nexo FCEVs and two Elexity FCEV buses, to Saudi Arabia, reports Newswire. These vehicles will be delivered to Saudi Aramco, a global comprehensive energy and chemical company in Saudi Arabia. In June 2019, Hyundai signed a memorandum of understanding (MOU) with Saudi Aramco for the comprehensive development of hydrogen as energy. The MOU provides a framework to accelerate the expansion of a hydrogen ecosystem in South Korea and Saudi Arabia, which includes the installation of hydrogen refueling stations. The two parties will also explore the use of advanced non-metallic materials in various fields including the automotive industry. The FCEVs supplied this time will be used for demonstration projects such as pilot operations. Hyundai is one of the few automakers that already has a successful fuel-cell offering in the market: it launched the Tucson FCEV in 2013, one of the first mass-produced FCEVs globally, followed by the next-generation Nexo FCEV in 2018. It also has fuel-cell commercial vehicles in its line-up. Hyundai has begun fostering the growth of fuel-cell and other related industries around the world as part of its 'FCEV Vision 2030'. It has announced plans to invest KRW7.6 trillion (USD6.4 billion) in FCEV production facilities and related research and development activities by 2030. (IHS Markit AutoIntelligence's Jamal Amir)

- Indian policy think-tank NITI Aayog has drafted a proposal to offer USD4.6 billion in incentives to companies setting up advanced battery manufacturing facilities, reports Reuters. The recommendation includes incentives of USD4.6 billion by 2030, starting with cash and infrastructure incentives of INR9 billion (USD122 million) in the next financial year, which will then be gradually increased annually. The proposal is likely to be reviewed by the central government in the coming weeks, said an unnamed senior government official with knowledge of the matter. The local manufacturing of batteries, which constitute around one-third of the total cost of an electric vehicle (EV), will help trim the cost of EVs to affordable levels in India, thereby boosting demand. Sales of EVs are yet to pick up in India owing to a lack of charging infrastructure and higher costs. The latest proposal by NITI Aayog is aimed at providing a thrust to EVs, reducing the country's oil dependence, and reducing pollution. The draft proposal cited that India's annual domestic demand for battery storage and market size are currently less than 50 GWh and worth just over USD2 billion. However, these could grow to 230 GWh and more than USD14 billion in 10 years' time. The Indian government has been working to introduce programs to leverage the country's size and scale to develop a competitive domestic manufacturing ecosystem for electric mobility. In 2019, the Indian government approved the setting up of a new program, called the National Mission on Transformative Mobility and Battery Storage, to promote the manufacturing of EV components and batteries in the country (see India: 8 March 2019: Indian government approves new program to promote manufacturing of EV components, batteries). The program includes the creation of a phased manufacturing program (PMP) valid for five years until 2024 to support the setting up of a few large-scale, export-competitive integrated battery and cell-manufacturing 'Giga plants' in India, and the localization of production across the entire EV value chain. The PMP will be finalized by the new program. (IHS Markit AutoIntelligence's Isha Sharma)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-september-2020.html&text=Daily+Global+Market+Summary+-+28+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 28 September 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+28+September+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}