Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 25, 2020

Daily Global Market Summary - 25 September 2020

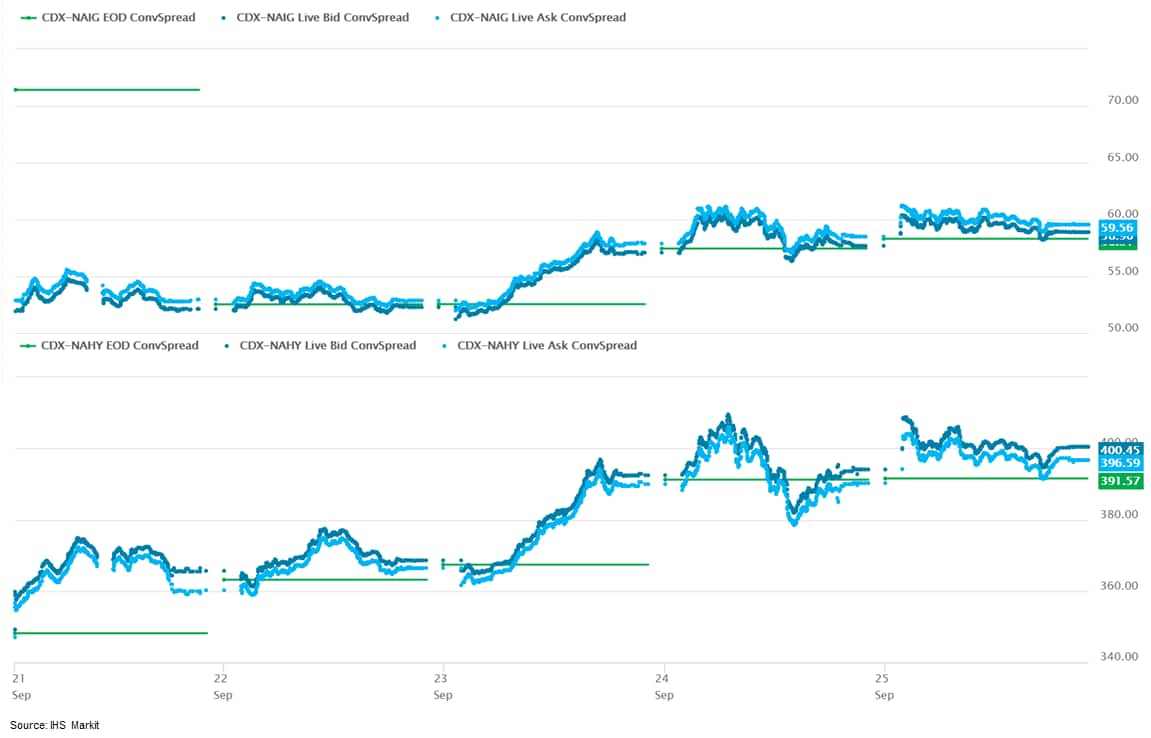

US equity markets closed higher and near the peak levels of the day, while APAC and European markets were mixed. iTraxx and CDX high yield credit indices continued to come under pressure in both Europe and the US, while IG indices closed almost flat. Benchmark European government bonds closed mixed, while US bonds and the dollar were both modestly higher. Gold, silver, and WTI/Brent were all lower on the day.

Americas

- US equity markets closed higher on the day; Nasdaq +2.3%, S&P 500/Russell 2000 +1.6%, and DJIA +1.3%. The S&P ended the week -0.6% vs last Friday's close, which is its fourth consecutive week of losses.

- 10yr US govt bonds closed -1bp/0.66% yield and 30yr bonds -1bp/1.40% yield.

- CDX-NAIG closed +1bp/59bps and CDX-NAHY +7bps/399bps.

- DXY US dollar index closed +0.2%/94.58.

- Gold closed -0.6%/$1,855 per ounce and silver closed -0.5%/$23.09 per ounce.

- Crude oil closed -0.1%/$40.25 per barrel.

- California is seeing early signs of rising virus case counts and emergency-room visits after several weeks of improvement, with forecasts showing that hospitalizations may jump 89% in a month, according to a top health official. Some of the uptick may be tied to an increase in infections over Labor Day weekend, Mark Ghaly, California's health and human services secretary, said at a briefing Friday. (Bloomberg)

- US manufacturers' orders for durable goods rose only 0.4% in

August following large gains over the prior three months that

reversed most of the precipitous spring decline. Orders and

shipments of core capital goods were both robust, and inventories

declined less than we assumed. (IHS Markit Economists Ben Herzon

and Lawrence Nelson)

- In response to the details in this report that inform our GDP tracking, we raised our estimate of third-quarter GDP growth by 0.5 percentage point to a 30.1% annualized rate of increase.

- Both orders and shipments of durable goods in August were close to their pre-pandemic trends, with orders only 3.5% below the six-month average in February and shipments only 0.8% below the six-month average in February.

- Orders and shipments of core capital goods, key drivers in our estimates of equipment spending in the National Accounts, have both risen above their pre-pandemic trends. This suggests that equipment investment plans may have been delayed by the pandemic rather than canceled. A few more months of data will clarify this point.

- In response to unexpected strength in core orders and shipments, we raised our estimate of growth of equipment spending in the third quarter by almost 8 percentage points to 59.0% (annual rate). This would essentially reverse the second-quarter decline.

- Inventories of durable goods declined 0.1% in August, less of a decline than we had assumed based on our estimates of how fast inventories will need to be pared in the near term for businesses to maintain a desirable ratio of inventories to sales. The unexpected strength in manufacturers' durable inventories raises a risk that our assumptions for inventories in other sectors are also too weak. We will find out next Tuesday!

- Electric vehicle (EV) charging network ChargePoint is planning to go public through a transaction with special-purpose acquisition company Switchback. According to an Automotive News report, the acquisition deal values ChargePoint at USD2.4 billion and the deal is expected to be closed at the end of 2020. Under the deal, the new company is to be named ChargePoint Holdings and its shares are to be traded on the New York Stock Exchange. Switchback CEO Scott McNeill is reported as saying, "The EV charging industry is accelerating and it is expected that charging infrastructure investment will be $190 billion by 2030. We believe (ChargePoint) will continue to grow its strong market position as the EV industry evolves." The deal will reportedly raise about USD493 million in proceeds, which ChargePoint will use to expand in North America and Europe. The USD493 million includes USD225 million from other institutional investors. Following the acquisition, current ChargePoint CEO Pasquale Romano will continue in that role. Romano is reported as saying, "Being ready to be public means that you're investing in scaling the platforms you already have because this addressable market is very, very large." ChargePoint reportedly operates more than 115,000 charging ports globally and has said previously that it is looking to reach 2.5 million charging points by 2025. As automakers continue to introduce new EVs, there is expected to be a growing need for a robust public charging network. ChargePoint's move to become a publicly traded company suggests that the investment industry may have an increased interest in such businesses, which may contribute to the growth of the number of EV charging stations and help to increase EV demand and use of public chargers. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Overall US food price inflation is now forecast rise more than

expected in 2020 as price increases seen as a result of the

COVID-19 pandemic have been slow to decline, according to the

latest update from USDA's Economic Research Service (ERS). (IHS

Markit Food and Agricultural Policy's Roger Bernard)

- US food price inflation in 2020 is now seen at 2.5% to 3.5%, up from 2% to 3% ERS forecast one month ago.

- Food away from home (restaurant) prices are now seen rising from 2% to 3%, up from a level of 1.5% to 2.5% that they saw in August. "Prices have been relatively slow to retreat from the highs reached as a result of the pandemic, so some forecasts have been revised upward this month," ERS said.

- However, despite food price forecasts for individual commodities being adjusted upward this month, USDA did not change their grocery store price forecast from the current 2.5% to 3.5% level.

- So far in 2020, USDA said that grocery store prices have risen 3.3% while restaurant prices are up 2.6% compared to the same period in 2019.

- The overall food price inflation has averaged 3% so far in 2020 compared with 2019.

- Of all of the food categories tracked by ERS, beef prices are up 10.5% while fresh fruit prices have fallen 1.4%.

- ERS increased their forecasts for 8 of the 22 CPI categories for 2020 while the outlook for egg prices has been revised down from prior forecast levels.

- "Meat prices have continued to decline, but the pace at which they are declining is not fast enough to achieve average 2020 prices below pre-COVID-19 levels," ERS said. They pointed to beef and veal prices decreasing 8.2% from June to July 2020 and another 4.6% from July to August, but as noted, so far their year they are up 10.5% from 2019 levels.

- Similarly, pork prices are down 1.1% in August compared with July, but remain 6.1% above year-ago, while poultry prices are still 5.1% above year ago despite easing 0.2% in August compared with July."Slaughterhouses have recouped much of the lost slaughter capacity that occurred as a result of the pandemic, and prices are expected to continue to decrease through 2020," ERS said.

- "However, they will likely decrease at a slower rate than they did this spring." As for egg prices, USDA now expects those to rise 6% to 7% in 2020, down from their month-ago outlook for an increase of 7% to 8%. "Egg prices reached a high in April 2020 but have been trending downward in the months since," USDA observed. "These declines are influenced at least in part by decreased demand from foodservice."

- USDA has kept its forecasts for food prices in 2021 steady this month compared with their release in August, forecasting overall food prices to rise 2% to 3% with increases of 1.5% to 2.5% for restaurant prices and 1% to 2% for grocery store prices. USDA made no adjustment to price forecasts within the various commodities they track relative to food prices.

- Mexico's central bank yesterday (24 September) cut the policy

rate from 4.50% to 4.25% in an effort to support the economy as it

is recovering only very slowly. (IHS Markit Economist Rafael Amiel)

- The central Bank of Mexico (Banco de México: Banxico) yesterday (24 September) cut the policy rate by 25 basis points to 4.25%. At each of its previous five meetings it had cut the rate by 50 basis points.

- By slowing the pace of the rate cuts, Banxico is implicitly acknowledging that there is not much room for additional reductions as inflation has increased; as of mid-September it amounted to 4.1%.

- This is the 11th rate cut in as many meetings since August 2019 and the sixth during the COVID-19 virus pandemic. At the beginning of this year the policy rate stood at 7.25%, while inflation was 2.8%.

- Deteriorating economic and financial conditions have prompted further action from Mexico's monetary authority. Back in April, Banxico announced additional measures to strengthen credit channels, provide liquidity, and foster an orderly functioning of financial markets. Combined with measures previously announced, the monetary stimulus now amounts to MXN750 billion (USD30.7 billion), or 3.3% of GDP.

- In terms of risks, the bank has not changed its view significantly and points to several upside risks: a further depreciation of the exchange rate; increases in costs due to the disruption of supply chains, which may lead to scarcity of some goods; higher costs related to extraordinary sanitary measures needed because of the COVID-19 virus outbreak; and persistently high core inflation.

- Banxico also highlights downside risks to inflation: widening slack of the economy; lower global/external inflationary pressures; and social-distancing measures, which will further reduce demand for services.

- Data for July on retail sales, construction, and sales of services show that the pace of the recovery remains slow. Although all three of these indicators expanded in July compared with June, they were all still significantly below their July 2019 values, by at least 10%.

- Another 25-basis-point cut would make the real policy rate (nominal minus inflation) negative; at IHS Markit we assess that the bank does not want to be in this position. Moreover, the bank will factor in the possibility of capital outflows due to low interest rates; this in turn may prompt the depreciation of the Mexican peso, which may pass through onto domestic prices and fuel inflation.

- The below chart is historical 5yr Mexico CDS spreads from IHS Markit's Price Viewer portal and indicates that spreads have widened almost 60bps since 2 Sept.

- Audi has launched a subscription program called Audi Luxury Signature for renting 0-km cars for up to 24 months, reports Automotive Business. According to the source, the subscription will include monthly payments of around BRL10,000 (USD1,796.6) which include Motor Vehicle Property Tax (IPVA), insurance, 24-hour vehicle assistance, and regular maintenance. Customers will have the option to purchase the vehicle at the end of the contract along with a 12% discount on the Fipe table quote (a valuation table of average vehicle prices announced by sellers in the domestic market, which serves as a parameter for negotiations on vehicles). The vehicles can also come with armor (bullet-proofing), for a higher price. The vehicles can be rented via Audi dealerships, while the lease will be made by Fleet Solution, a fleet management partner company. As a part of the pilot signature program, 20 vehicles, including Q8, A6, A7 and the E-Tron electric sport utility vehicle (SUV) will be placed on the program until December 2020. Johannes Roscheck, president of Audi in Brazil said, "It is the first time we have done this, there is nothing similar to Audi anywhere in the world. So, we have established a small number of vehicles to start with. It may seem small, but 20 cars make a big impact for us. With this we can give more attention to customers and thus learn from the program. If it works well, we can extend this format to other Audi cars, including cheaper ones." He added, "After this pilot, we will also be able to offer other plans, such as 12 or 36 months." This initiative is aimed at offering flexible payment options to high-end vehicle buyers. In the conditions of the subscription, if a customer withdraws from the rental program before 12 months, the contract provides for a fine equivalent of 50% of the remaining payments, and if the withdrawal occurs after that, then the fine is equivalent to 35% of the rent due. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- Most European equity markets closed lower except for UK +0.3%; Italy/Germany -1.1%, France -0.7%, and Spain -0.2%.

- 10yr European govt bonds closed mixed; UK/Germany -3bps, France -2bps, Spain flat, and Italy +2bps.

- iTraxx-Europe closed flat/62bps and iTraxx-Xover +4bps/360bps.

- Brent crude closed -0.1%/$42.41 per barrel.

- Industry's reactions to the UK government's new Job Support

Scheme have been mixed. The most exposed sectors to the COVID-19

virus shock, namely hospitality, events, accommodation, and retail,

want better-targeted assistance to prevent mass redundancies after

the furlough scheme ends. (IHS Markit Economist Raj Badiani)

- A new support plan to try to stop mass redundancies has been announced in the aftermath of the government's introduction of tighter COVID-19 virus protocols to tackle the rise in COVID-19 cases.

- The government has addressed the impact of its Coronavirus Job Retention Scheme (furlough) ending on 31 October 2020. The furlough scheme currently entails the government paying 70% of wages up to a maximum cap of GBP2,187.50 for a furloughed worker per month. Employers will top up employees' wages to ensure that they receive 80% of their wages (up to GBP2,500 per month).

- The furlough scheme is still likely to cover about 3 million workers by the end of October from a peak of 9.6 million during the height of the national lockdown. The scheme has cost a lower-than-expected GBP36 billion in April-August.

- Chancellor of the Exchequer Rishi Sunak has announced a new

replacement scheme to subsidize workers who work at least one-third

of their usual hours while demand remains subdued. The scheme will

begin on 1 November 2020 and will run for six months. Details of

the new scheme are as follows:

- The government and the employer will each cover one-third of the lost pay due to hours not worked. The state subsidy will be capped at GBP697.92 per month. Clearly, the new scheme will reduce the burden on the taxpayer while asking employers to pay more to support jobs affected by the COVID-19 virus pandemic.

- Employees unable to work any of their normal hours will not be eligible.

- All small and medium-sized enterprises (SMEs) can apply, while larger businesses can participate if they can demonstrate falling turnover during the COVID-19 virus crisis.

- The scheme will be open to employers across the UK even if they have not used the furlough scheme.

- At the end of the furlough scheme, the level of state subsidy will be at 60% of wages for people not at work. This will fall to a maximum of 22% under the new wage subsidy scheme, with Treasury sources suggesting that the scheme will cost GBP1 billion per month if 3 million workers join the scheme.

- Companies can also claim a GBP1,000 Job Retention Bonus per worker if they retain workers returning from the furlough scheme until the end of January 2021.

- Restaurants, hotels, and cinemas' reduced VAT from the usual 20% to 5% has been extended by several months to 31 March 2021, at an estimated cost of GBP835 million.

- Industry's reactions to the government's new Job Support Scheme are mixed. The most exposed sectors to the COVID-19 virus shock, namely hospitality, events, accommodation, and retail, want better-targeted assistance.

- Some business leaders even argue that the new wages scheme increases the likelihood of mass redundancies at the end of October. Worryingly, Rob Paterson, CEO of Best Western Hotels GB, notes that the hourly rate for workers on the new scheme will increase by keeping them for 33% of the time and paying them 55% of their wages.

- Passenger car production in the United Kingdom dropped by 44.6%

year on year (y/y) during August, according to the latest data

published by the Society of Motor Manufacturers and Traders (SMMT).

Output dropped from 92,153 units in August 2019 to 51,039 units in

August. Of this total, 43,244 units were designated for exports, a

decline of 41.1% y/y, and 7,795 units were for domestic sale, down

by 58.3% y/y. (IHS Markit AutoIntelligence's Ian Fletcher)

- Volumes in the year to date (YTD) were down by 40.2% y/y to 518,092 units, exacerbated by the stoppages caused by the COVID-19 virus pandemic earlier in the year.

- According to the SMMT, commercial vehicle production also dipped during August, declining by 11.5% y/y to 4,915 units. Of this total, the number of vehicles built for exports dropped by 29.6% y/y to 2,546 units, although those for domestic sale rose by 22.3% y/y to 2,369 units.

- Output of vehicles in this category was down by 20% y/y in the YTD to 36,570 units.

- Although the big difference in the data this month relates to a higher base of comparison in August 2019 owing to maintenance stoppages earlier in the year to compensate for the threat of a no-deal Brexit, the SMMT has suggested that the industry is also seeing a stalled increase in production following the COVID-19 virus stoppages.

- IHS Markit currently expects that production in 2020 will fall by 33.6% y/y to under 867,700 units, although light commercial vehicle (LCV) production will grow by 16.8% y/y to 65,400 units as Groupe PSA's Luton site surpasses 2019 output levels.

- Portfolio company Fieldwork Robotics is to develop a cauliflower harvesting robot in collaboration with the giant vegetable processor Bonduelle. "Bonduelle has a strong commitment to sustainable and diversified agriculture in all of the territories where we operate globally," Claudine Lambert, Group Agronomy Director, Bonduelle Prospective & Development said, "New technologies can play an important part in meeting that commitment, so we are delighted to be collaborating with Fieldwork Robotics and excited by the potential of its agricultural robots". Fieldwork, a spin-out from the University of Plymouth, will initially work on the detection and soft robotics technology with a view to creating an early-stage prototype during the second year of the collaboration. Bonduelle will provide access to fields and its expertise in vegetables and knowledge of different growing and harvesting conditions. Co-founder Dr Martin Stoelen's, lecturer in robotics at the University of Plymouth and Associate Professor at the Western Norway University of Applied Science, initially started working on mechanical cauliflower harvesting within a project funded by Agri-Tech Cornwall and by the European Regional Development Fund. This is the second application of Fieldwork's flexible and patented agricultural robot technology to gain food industry backing after a raspberry-harvesting robot realized in collaboration with Hall Hunter Partnership, one of the UK's biggest soft fruit producers. Fieldwork has raised GBP318,000 (USD347,000) so far this year to accelerate development and scale up of the technology. It has also been supported by a GBP547,250 Innovate UK grant as part of a GBP671,484 project to develop a multi-armed robot prototype. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Calgon Carbon (Moon Township, Pennsylvania), a subsidiary of Kuraray, has decided to expand the production of reactivated carbon at Feluy, Belgium. The company intends to expand the capacity by 11,000 metric tons/year and the operations are due to start in the second half of 2022. Reactivated carbon is activated carbon that was previously used, but subsequently reactivated. It is produced from materials such as bituminous coal and coconut shells. In recent years, the use of activated carbon has become increasingly widespread, particularly for applications related to the environment, including water and air purification. In Europe, especially, demand for reactivated carbon is growing for industrial applications, such as gas emission treatment and wastewater purification, bolstered rising environmental awareness, including stricter environmental regulations, sustainable use of natural resources, and reduction of carbon dioxide emissions.

- Evonik Industries says it will carve out its baby care business, which makes superabsorbent polymers for diapers and hygiene products, and tells CW it is "checking strategic options for the business including a sale or a partnership." Bernstein Research (London, UK) expects a deal to be finalized by summer 2021. It says that Evonik may generate €400-450 million ($467-525 million) in proceeds from a sale of the superabsorbents business. Evonik's superabsorbents business "has a workforce of about 800 employees," the company says. Bernstein notes that Evonik transferred the business recently from its nutrition and care division to its performance materials division, where it is prioritizing efficiency and cash flow. The decision to sell the baby care business is in line with Evonik's strategy to become a 100% specialty chemicals company, Bernstein says. Evonik took a big step toward that goal last year when it divested its methacrylates business to private equity firm Advent International. Evonik competes with BASF, LG Chem, Nippon Shokubai, and Sanyo Chemical in the superabsorbents market. Evonik is estimated to be the third-biggest player. Meanwhile, Shokubai and Sanyo are planning to merge, but put those plans on hold last April due to COVID-19.

- The French and Spanish governments plan to collaborate on the development of automated and connected driving, reports Europa Press. The governments of the two countries have signed a memorandum of understanding (MOU) on automated and connected driving aimed at strengthening collaboration on the development of this type of vehicle technology. José Luis Ábalos, Spanish minister of transport, mobility and urban agenda, said that "automated and connected driving is a tool that improves mobility, safety and accessibility". He added that "this memorandum is a great step to join efforts between Spain and France in achieving greater interoperability of systems and regulations in areas such as the development of uses in the field of shared mobility and the introduction of 5G connectivity in transport". According to the news source, Spanish Minister of the Interior Fernando Grande Marlaska provided assurance on co-operation between research projects and facilitation of cross-border autonomous driving tests. The MOU on automated and connected driving is aimed at basing the development of automated and connected driving for the benefit of citizens, ensuring the accessibility of the technology. Spain has been at the forefront of mobility development. (IHS Markit Automotive Mobility's Tarun Thakur)

- After stagnating in August, Czechia's economic sentiment

indicator strengthened markedly in September, even as the rise in

new coronavirus disease 2019 (COVID-19) cases triggers new

restrictions. (IHS Markit Economist Sharon Fisher)

- Czechia's economic sentiment indicator jumped to a six-month high in September, boosted by month-on-month (m/m) improvements in services, construction, consumer, and trade confidence. Only industrial confidence deteriorated, affected by expectations of a decline in production over the next three months.

- In a year-on-year (y/y) comparison, the economic sentiment indicator was still down sharply, pulled downwards mainly by worsening services, consumer, and construction confidence. Only retail trade confidence has returned to year-earlier levels.

- Services have been hit the hardest by the COVID-19 virus pandemic, and the m/m surge in September was an encouraging sign, boosted by improvements in the assessment of demand, both currently and over the next three months. The latest survey also indicates that Czech consumers' concerns about household finances and inflation are diminishing.

- Although the latest confidence data were broadly encouraging, the September survey was conducted up until 17 September and therefore only partially captures the current epidemiological situation. In recent weeks, the number of daily confirmed cases has heightened considerably, reaching 1,272 on average from 8-15 September before surging to 2,072 from 16-23 September.

- As per IHS Markit's Commodities at Sea, total coal imports into Pakistan in the first eight months of 2020 is calculated at 10.1mt, up 7% year on year. Imports from South Africa and Indonesia marginally declined from previous year levels to 7.3mt and 2mt, respectively. However, the arrival of coal vessels increased from Russia from just a handysize vessel to 850kt for the reported duration. Most of the Russian coal was loaded at the Taman terminal which is in the Zhelezny Rog Port. Pakistan has domestic gas demand of around 6-7bcf/day, however domestic supply is of 3-4bcf/day which leads to shortages to industrial units, power plants as well as households. There was increased electricity demand in the country because of higher HDDs during Feb 2020 and then higher CDDs since April this year. However, increased electricity demand in absence of enough gas supplies was met by imported coal. During Aug 2020, total electricity generation in Pakistan was 14.6TWh, and out of which fuel mix of coal, hydro, domestic gas, and RLNG was 17percent (versus 13% a year ago), 37% ( versus 40%), 10% (versus 12%) and 26% (versus 23%), respectively. Apart from power plants, other big consumers of imported coal are the cement factories in the country. Due to the COVID-19 pandemic, cement dispatches underwent a sharp decline during Mar-May 2020; however, in June 2020 there was an increase in dispatches versus previous year levels. Overall, during the first half of 2020, total cement dispatches to domestic as well as international market stood at 26.5mt, almost at previous year levels. Pakistan's cement factories have a total installed capacity of 69mtpa. For 3Q20 total coal imports into Pakistan are forecasted at 3.7mt at previous year levels. For 4Q2020, coal imports on the back of increased demand from power as well as from the cement sector are forecasted at 5.4mt (up 0.5mt y-o-y). For full 2020, total coal imports into Pakistan is calculated at 16.9mt, up 1.2mt y-o-y. (IHS Markit Maritime & Trade's Rahul Kapoor and Pranay Shukla)

- The Central Bank of the Republic of Turkey (TCMB) has surprised

markets with a 400-basis-point hike to the main policy rate, the

one-week repo rate. The bank has taken this action to stem the

depreciation of the lira, which has lost more than 12% of its value

against the US dollar since the end of July. Coming sooner than

expected, the rate hike may stave off a more aggressive similar

move to the one taken in September 2018. (IHS Markit Economist

Andrew Birch)

- At its regularly scheduled meeting on 24 September, TCMB's monetary policy committee (MPC) raised its main policy rate, the one-week repo rate, to 10.25%.

- In its press release alongside the move, the TCMB admitted that inflation has been following a "higher-than-envisioned path", forcing the MPC to significantly tighten monetary policy to combat inflationary expectations and reduce risks to the outlook. The TCMB pointed to a faster-than-expected economic recovery, rapid credit growth, and "financial market developments" as the causes of elevated inflation.

- The TCMB was not expected to take any action at the meeting. IHS Markit had not included a rate move in September, expecting that the bank would continue to rely on backdoor monetary policy tightening to stem the recent slide of the lira.

- Since early August, the TCMB has increasingly shifted its funding of the market from the main policy rate - the one-week repo rate - to the late liquidity window. Instead of funding the market primarily at the 8.25% repo rate, the TCMB was pushing out more funding at the 11.25% late liquidity rate. Thus, the average rate of funding rose from about 8% as of early August to 10.6% in the days before the 24 September MPC meeting.

- With the higher rate of funding, commercial bank interest rates across the board have been rising in recent weeks. Previously, since mid-2019, the funding, policy interest, and commercial bank rates had fallen precipitously as the TCMB prioritized recovering economic growth over ensuring lira stability.

- As a result, the one-week repo rate had fallen below the prevailing rate of annual inflation as of January 2020, exposing the lira to greater volatility. By May, most commercial bank interest rates were also below the prevailing inflation rate.

- At best, this move will stave off further, sharp depreciation over the next weeks, but we do not believe that it will be enough to provide stability for a month or more. Even with the rate hike, the one-week repo rate remains well below the prevailing annual inflation rate, which was 11.8% as of August.

- Immediately after the decision, the lira rallied against the US dollar, rising back to TRY7.6:USD1.0 from closer to TRY7.7:USD1.0. However, it is unlikely that this rate hike will be enough to spark a long rally.

- David Satterfield, the US ambassador to Turkey, warned this week that US pharmaceutical companies could abandon the Turkish pharmaceutical market if debts owed by the public healthcare system are not met. According to various Turkish and international news sources including Reuters, David Satterfield told an online trade conference that Turkey's state hospitals owe global pharmaceutical and other medical supplies companies approximately USD2.3 billion in unpaid, or only partially paid, bills. This reportedly reflects an increase from debt that stood at USD230 million last year. Satterfield added that US Commerce Secretary Wilbur Ross had raised the issue with Turkish President Tayyip Erdogan and other government officials a year ago, and that despite assurances that prompt payments would be made, the debts have escalated. Reuters cites the ambassador, who reportedly warned that, "Companies will consider departing the Turkish market or will reduce exposure to Turkish market. This is not a direction which serves the interests of Turkey." Late payment of debts has become increasingly common in Turkey since 2018, due to increasing fiscal constraints on the healthcare system following sharp currency devaluation and Turkey's widening budget deficit. (IHS Markit Life Sciences' Sacha Baggili)

- On 22 September Zambia's Ministry of Finance announced a

consent solicitation affecting its USD750-million 5.375% 2022

(historical bond price chart below), USD1-billion 8.5% 2025 and

USD1.25-billion 8.97% 2027 notes, requesting debt service

suspension for six months from 14 October and covering coupon

payments due on 14 October 2020, 30 January and 20 March 2021. (IHS

Markit Economist Brian Lawson)

- It cited a "very challenging macroeconomic and fiscal situation" worsened by the COVID-19 virus pandemic as having a "material impact" on its debt service capacity.

- It noted that it previously had applied for relief under the G20 Debt Service Suspension Initiative and was now seeking similar debt service suspension from private-sector creditors.

- It claimed to be negotiating with the IMF for support associated with reforms to stabilize its macroeconomic outlook and fiscal stability. Finally, it claimed that it was seeking a "consensual and collaborative" approach, with further details available on 29 September.

- Zambia has already obtained Paris Club relief on its official debt, requested in early June and granted on 14 August, for the period 1 May-31 December 2020.

- It previously stated that debt service to the Paris Club this

year was a modest USD14 million, but USD100 million was due to

individual members.

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong -0.3%, Mainland China -0.1%, South Korea +0.3%, Japan +0.5%, Australia +1.5%, and India +2.3%.

- Without imposing immediate purchase or resale restrictions,

unveiled measures focus more on stabilizing long-term price

expectations of the local housing market. (IHS Markit Economist Lei

Yi)

- The municipal government of Changchun city (Jilin Province) published a notice on 23 September, aiming to cool potential overheating signs in the local housing market.

- Major adjustment fell into the mortgage policy. The notice required that down payment ratio should be no less than 30% for first-time home buyers and 40% for purchasing a second home, raising both by 10 percentage points. Further, the notice explicitly prohibited the issuance of a third mortgage offer or more.

- The notice marks the second time of tightening personal housing credit policy in Changchun in the second half of this year. Effective 1 August, Changchun's Housing Provident Fund Management Bureau raised mortgage rates by 10% for second housing provident fund loans.

- Chinese electric vehicle (EV) startup Aiways is planning to launch an initial public offering (IPO) in China. According to a Reuters report, Fu Qiang, co-founder and president of Aiways, said that the relative success of IPOs in the United States by its EV startup peers, XPeng and Li Auto, had helped fuel the company's ambitions to list its shares on a stock exchange. "An IPO is also in our plans, and we're planning to push ahead with it," Fu reportedly said, adding that Aiways's shares would most likely be listed in China. Aiways began deliveries its first mass-market model, the U5 electric sport utility vehicle, in the first quarter of this year and, in April, the startup launched sales of the U5 in Europe. In May, the company delivered several hundred units of the U5 to car rental company Filippi Auto in Corsica, according to an electrive report. Details of its overseas orders were not given by the company, although such efforts will help it to build a presence in overseas markets and attract investors. Aiways is not alone in considering joining the recent IPO drive of EV startups. WM Motor, another Chinese startup, has recently expressed an interest in listing its shares on China's NASDAQ-type STAR stock exchange. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese startup Human Horizons unveiled its first mass-market model, the HiPhi X electric vehicle (EV), in China during a pre-show event ahead of the Beijing Motor Show 2020, which begins on 26 September. The HiPhi X is full-size electric sport utility vehicle based on the automaker's HOA open-source EV platform. Two trim versions are available for the HiPhi X with a price starts at CNY680,000 (USD99,760). Due to the application of a new electric architecture, the HiPhi X features the so-called "No-Touch" automatic door-opening system, which allows the driver to customize the vehicle's door-opening modes with up to six different configurations. Inside the vehicle, most functions and the infotainment system have been integrated into three digital screens that run across the dashboard, including the glovebox area in front of the front passenger. The vehicle also provides two seating options: a four-seat two-row configuration and a six-seat three-row configuration. With two 220-kWh electric motors placed on the front- and rear-axle respectively, the HiPhi X can accelerate from 0 to 100 kilometers (km) per hour in 3.9 seconds. Both versions are fitted with a 97-kilowatt-hour battery pack that delivers a range of 550 km. Human Horizons has finally launched its first production model, after introducing the HiPhi brand in August 2019. However, the HiPhi X is positioned much higher in the market than most models introduced by EV startups, making it unlikely to gain the sales volumes of a mass-market vehicle. The HiPhi X is a model that will showcase the automaker's smart vehicle technologies and its in-house capacity to develop an advanced electric architecture and supporting software for EVs. According to the report, the HiPhi X will be produced at Dongfeng-Yueda-Kia's plant in China's Jiangsu province, with deliveries expected to begin in 2021. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese electric vehicle (EV) maker Li Auto signed a strategic partnership with NVIDIA and Desay SV Automotive, a manufacturer of automotive electronics, according to Gasgoo. NVIDIA Orin chips will be used in Li Auto's full-size sport utility vehicle (SUV) to be launched in 2022. Desay SV will provide the domain controller for Li Auto, which will complete program design and algorithm logic setting for its autonomous operation features. The automaker will provide Level 2+ advanced driving assistance functions (with one single Orin chip with 200TOPS of computing power), which will be upgradeable to Level 4 autonomous operation (with two Orin chips with 400TOPS of computing power). In the future, the integration of dGPU is expected to increase the computing power to an expected maximum of 2000TOPS. Nvidia says that the Orin chip has a processing performance seven times higher than that of the Xavier. Nvidia plans to start shipping Orin samples in 2021, with the earliest installation possible in vehicles around the end of 2022. Orin is capable of supporting Level 2+ to Level 5 fully autonomous vehicles. The partnership will enable Li Auto to become the first new energy vehicle (NEV) company in China to develop its own Level 4 autonomous operation system. (IHS Markit Automotive Mobility's Tarun Thakur)

- Hyundai Heavy Industries (HHI), together with American Bureau of Shipping (ABS), has jointly developed a simulation tool that is capable of analyzing the carbon footprint of vessels in the design stage. The simulations allow in-depth evaluation on the impact of a range of energy-saving options, offering a detailed preview of a vessel's performance before key investment decisions are made. This allows shipowners, designers and shipyards to review alternative technologies at the early design stage. The simulations connect to a broad range of inputs from many model types such as computational fluid dynamics models, wave resistance models, and data-validated engine performance models. A multi-physics model unlocks the ability to evaluate the performance. Technologies that can be evaluated in the modeling process include air lubrication systems, energy-saving devices, voyage speed profiles, and engine fuel options. The simulations can also reflect the impact of inputs from a range of data sources and optimization tools allowing comprehensive analysis of the trade-off between different vessel configurations. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Lloyd's Register has granted the Approval in Principal (AIP) for Sumitomo Heavy Industries' (SHI) ammonia propelled A-Max tanker. SHI co-developed the ammonia-propelled A-Max tanker with MISC and Lloyd's Register since July 2019. SHI will develop its own ammonia fuel supply system and detailed ship designs before commercializing the tanker in 2024. The International Maritime Organization (IMO) has adopted mandatory steps to cut emissions of carbon dioxide from ships by more than 30% by 2025 compared with 2008 and 70% by 2050. (IHS Markit Upstream Costs and Technology's Jessica Goh)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-september-2020.html&text=Daily+Global+Market+Summary+-+25+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 25 September 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+25+September+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}