Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 20, 2020

Daily Global Market Summary - 20 October 2020

US equity markets closed modestly higher, while APAC and European markets were mixed. US and European benchmark government bonds closed lower across both regions. European iTraxx credit indices closed slightly wider and CDX-NA was tighter across IG and high yield. Copper prices broke through a new two-year high, with oil, gold, and silver also higher on the day, and the US dollar lower.

Americas

- US equity markets closed higher; S&P 500 +0.5%, DJIA +0.4%, and Russell 2000/Nasdaq +0.3%.

- 10yr US govt bonds closed +2bps/0.79% yield and 30yr bonds +3bps/1.59% yield.

- CDX-NAIG closed -1bp/58bps and CDX-NAHY -7bps/375bps.

- DXY US dollar index closed -0.4%/93.02.

- High grade copper futures closed +1.9%/$3.15 per pound, which is its highest price in over two years.

- Gold closed +2.0%/$1,950 per ounce and silver +1.1%/$24.98 per ounce.

- Crude oil closed +1.6%/$41.70 per barrel.

- US single-family permits have rebounded by an unprecedented

453,000 annualized and seasonally adjusted units in the past five

months and jumped 7.8% (+/- 1.1%; statistically significant) in

September, surging to levels last seen in March 2007. Single-family

permits matter more than single-family starts because they are much

better measured, are less influenced by weather, and are forward

looking. Single-family construction accounts for 80% of spending on

total new construction. (IHS Markit Economist Patrick Newport)

- Quarterly permits soared 27.5% in the third quarter, crossing the 1.5-million threshold for the first time since 2007. The single and multifamily categories were up 39.2% and 7.0% in the third quarter.

- Housing starts inched up 1.9% (+/- 8.8%, not statistically significant) in September as single-family starts climbed 8.5% (+/- 9.2%, statistically significant), offsetting a 16.3% plunge in multifamily starts.

- Housing starts were up 32.5% in the third quarter as the single and multifamily categories scored whopping 35.8% and 24.5% increases.

- All four regions have staged solid rebounds; both the single- and multifamily categories have rebounded smartly. But activity in recent months has shifted toward the South and the single-family category—it is too soon to say if this is a byproduct of telework.

- The months' supply of unsold homes sank to a record-low 3.3 months in August; a third of new homes sold in August had not been started; units authorized but not started were last higher in 2008. Bottom line: Builders are not ramping up fast enough—the surge in single-family new construction will not peter out soon.

- Volvo Trucks has announced receiving a grant award of USD21.7 million from the US Environmental Protection Agency (EPA) and California's South Coast Air Quality Management District (AQMD) to deploy Class 8 VNR electric zero-emission trucks. According to the company statement, Volvo will deploy 70 VNR electric trucks in southern California for regional freight distribution and drayage. Of the funding, USD20 million is coming from the EPA's Targeted Air Shed Grant Program and USD1.7 million from California's South Coast AQMD. The trucks will be delivered to southern Californian fleet operators between 2021 and the third quarter of 2022. This is intended to allow for at least a full year of operation, prior to the project ending in 2023. Volvo has already delivered 25 trucks in the region through its Volvo LIGHTS (Low Impact Green Heavy Transport Solutions) project. The new program means the company will eventually deploy nearly 100 electric trucks in the region. Peter Voorhoeve, president of Volvo Trucks North America, said, "This grant provides Volvo Trucks with an excellent opportunity to further expedite the success of the ecosystem designed through the Volvo LIGHTS project to support the wide-scale deployment of battery-electric heavy-duty trucks. We applaud the EPA and South Coast AQMD for addressing the key issues in advancing electromobility and incentivizing technology investments in the region, and are proud they continue to trust in Volvo Trucks North America to lead the acceleration of Class 8 zero-emission vehicles." In addition, Volvo will gather data from the deployment that will help to improve and refine calculations of total cost of ownership of electric trucks, including vehicle maintenance and fuel cost savings. The announcement by Volvo Trucks follows the truck-maker's statement earlier this year on deploying VNR electric trucks in southern California through its TEC dealership. (IHS Markit AutoIntelligence's Stephanie Brinley)

- As concerns over climate change from multiple stakeholders increase pressure on oil and gas players to reduce the greenhouse gas (GHG) emissions associated with their operations, the industry is paying particularly close attention to methane owing to its more potent global warming potential versus carbon dioxide.[1] A critical step for oil companies in reducing methane emissions from their operations is improving the ability to more readily detect and quantify releases as they occur in the field. Technology and broader forms of innovation will be a critical part of this effort. Two technology development activities announced during second quarter 2020 are aimed at moving the industry in this direction: BP Ventures's investment in technology startup Satelytics and the Project ASTRA partnership between ExxonMobil, Pioneer Natural Resources, the University of Texas, the Gas Technology Institute, and the Environmental Defense Fund. Both activities seek to enable near continuous methane monitoring and measurement from oil and gas operations. By facilitating earlier detection and mitigation of emissions, producers should be able both to reduce the carbon intensity of their operations and to quantify the impact of their methane reduction efforts. (IHS Markit Upstream Costs and Technology's Judson Jacobs and Carolyn Seto)

- Scientists from the USDA's Agricultural Research Service have begun experimenting with alfalfa as a sustainable alternative to traditional fishmeal. According to the USDA, formulating aquafeeds with plant-based proteins could help reduce the need for fishmeal in aquafeeds. This could subsequently cut aquaculture's impact on aquatic natural resources. Using alfalfa as a fishmeal alternative could ease the burden on oceanic fish populations, which are key members of the marine ecosystem. Alfalfa has a crude protein content of 15-22% and contains a rich combination of vitamins and minerals. It is commonly fed to cattle and horses as silage, hay or forage. The plant can also be 'juiced' for its protein concentrate - a process used by USDA and University of Minnesota research collaborators, for feeding trials in yellow perch. Juicing involves squeezing alfalfa leaves in a screw press, then heating and centrifuging the juice. This process forms alfalfa protein concentrate (APC), which is then dried and processed into small pellets along with other ingredients. The trials in yellow perch have shown that fish given pellets containing APC gained less weight than those fed fishmeal. However, there was little difference between their health, longevity and overall wellbeing. Additionally, fillet yields, quality, composition and flavor were similar between fish fed APC and fishmeal. Deborah Samac, the ARS Plant Science Research Unit lead, noted additional studies are underway to perfect the APC concentrations used in aquafeed formulation, evaluate other processing methods and examine uses for byproducts of the juicing process. The USDA is also expanding its feeding trials, which include rainbow trout. The USDA collaborated on the yellow perch trials with the University of Minnesota-St Paul, the University of Wisconsin-Milwaukee, the University of Wisconsin-Madison and the US Fish and Wildlife Service's Bozeman Fish Technology Center. A company currently developing alternative fish feed solutions is Netherlands-based Veramaris. The firm produces natural marine algal oil for fish as an alternative source of eicosapentaenoic acid and docosahexaenoic acid. Dutch firm Corbion recently entered a deal with seafood producer Thai Union for the latter to use its algae feed ingredient - AlgaPrime DHA - in its shrimp feed. (IHS Markit Animal Health's Daniel Willis)

- Nova Chemicals has agreed to sell its expandable styrenics business to a subsidiary of Alpek (Monterrey, Mexico) for an undisclosed sum. The transaction is expected to close in the fourth quarter. The sale encompasses Nova's expandable polystyrene (EPS) and Arcel-brand resin product lines, with manufacturing facilities at Monaca, Pennsylvania, and Painesville, Ohio, as well as commercial operations in Asia, it says. The plant at Monaca has an EPS production capacity of 123,000 metric tons/year, with 36,000 metric tons/year of capacity for Arcel, as well as an R&D pilot plant. The facility at Painesville has an EPS capacity of 45,000 metric tons/year, according to Alpek subsidiary Styropek, which is acquiring Nova's business. Nova, a wholly-owned subsidiary of Mubadala Investment Co. (Abu Dhabi), says the sale is an "important step" in its plan to focus on its olefin and polyethylene (PE) business, which includes additional investments to advance a circular economy for plastics. The transaction, if it proceeds to completion, would see Nova entirely exit the styrenics sector. The sale will provide Nova with "immediate cash generation to further strengthen our balance sheet," says Luis Sierra, president and CEO. It will also enable the company to focus on the completion and start-up of a 450,000-metric tons/year PE plant under construction in Ontario, Canada. The new plant, as well as the expansion of the company's Corunna, Ontario, steam cracker that will supply ethylene feedstock to the adjacent PE facility, is scheduled for completion in late 2021. The company says it will optimize costs at the newly acquired facilities and that the additional sites will allow it to serve existing and new customers with increased efficiency and lower logistics costs. Alpek intends to continue growing its business in the construction and reusable packaging segments, both of which require long-term use of EPS, as well as developing more sustainable products such as biodegradable EPS, it adds. Alpek operates two main business segments: polyester, and plastics and chemicals. It is a leading producer of purified terephthalic acid (PTA) and polyethylene terephthalate (PET). It is also the largest manufacturer of EPS in the Americas.

- PPG Industries today reported third-quarter net income from

continuing operations up 21% year-on-year (YOY), to $442 million,

on sales down 4%, to $3.69 billion. Adjusted earnings totaled

$1.93/share, slightly ahead of analysts' consensus estimate of

$1.92/share, as reported by Refinitiv (New York, New York). Selling

prices rose 1.3% YOY, but volumes fell on continuing negative

impacts from the COVID-19 pandemic.

- Performance coatings segment sales declined 3% YOY, $2.25 billion, while segment income increased 12%, to $426 million. Architectural coatings segment sales grew across the world, with the strongest increases in EMEA, where volumes rose by 10%. Volumes in aerospace coatings fell 35% YOY, however, due to lower commercial aerospace demand, and automotive refinish coatings volumes declined 10% YOY but increased sequentially.

- Industrial coatings segment sales fell 5% YOY, to $1.43 billion, while segment income was up 23%, to $253 million. Segment volumes were down 5% YOY, but increased 40% sequentially as demand improved from the second-quarter's trough. Volumes improved on a sequential basis in automotive OEM and industrial coatings, though volumes remained down on a YOY basis.

- PPG expects fourth-quarter sales volumes to fall by "a low-to-mid-single digit percentage," with differences by business line and region. Adjusted earnings for the fourth quarter are forecast to total $1.50-1.57/share.

- "Looking ahead, we are likely to experience normal seasonal trends in the fourth quarter, especially in our European and North American architectural coatings businesses," says Michael McGarry, PPG chairman and CEO. "Even with the continued uncertainty from the pandemic we expect overall economic activity to continue to recover, but in an uneven manner."

- A U.S. judge on Friday ruled that Venezuelan state oil company Petroleos de Venezuela's [PDVSA.UL] 2020 bonds are "valid and enforceable," a court document showed, in a setback for opposition leader Juan Guaido. The bonds are backed by half of the shares in the parent company of U.S. refiner Citgo Petroleum Corp [PDVSAC.UL], and Guaido's team had sued last year to declare them invalid on the grounds that the Venezuelan government had issued them without the approval of the opposition-held National Assembly. (Reuters)

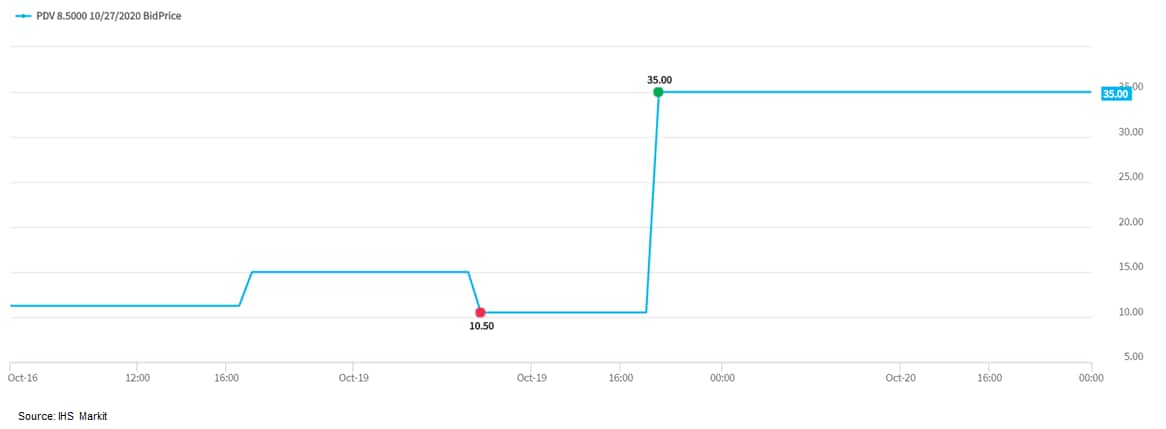

- The below IHS Markit Price Viewer screen shows that the bid

price for PDVSA's 8.5% 10/2020 issue increased 233% (10.50 to 35.00

price) yesterday as a result of Friday's ruling.

- EDP Brazil SA, a Brazilian electric utility company and subsidiary of Energias de Portugal (EDP Group), has partnered with car rental company Unidas to promote electric cars in Brazil, reports Valor Econômico. Unidas will purchase vehicles and rent them out, while EDP will offer charging infrastructure. According to the source, in the first phase of the project, 100 electric vehicles (EVs) will be available for rent in São Paulo (Brazil) and Curitiba, Paraná state (Brazil). The company aims to expand the fleet to 600 vehicles in 2021. This is EDP's first commercial-scale partnership with a car rental company to promote electric cars in Brazil. Last year, EDP announced the setting up of 30 fast-charging stations for EVs in the country. It said that it will invest BRL32.9 million (USD5.8 million) in partnership with Volkswagen (VW), Porsche, and Audi. Volkswagen Trucks and Buses (Volkswagen Caminhões e Ônibus: VWCO) and CPFL Energia, an electric energy generation and distribution company in Brazil, entered into a partnership in the domain of electric mobility in the country (see Brazil: 28 July 2020: VWCO and CPFL sign agreement on EV mobility research in Brazil). In March, BMW launched a smart charging network in partnership with national startup Incharge in Brazil. In January, Brazil's EV charging infrastructure was boosted with 30 different proposals from the Efficient Electric Mobility Solutions program. (IHS Markit AutoIntelligence's Tarun Thakur)

- Continued recovery in August left the monthly production index

at 13% lower than the same month in 2019, up from -35.4% in April.

The rate of recovery, however, lost considerable momentum, with

production advancing by just 2.4% m/m compared with an average of

10.2% from May to July. (IHS Markit Economist Jeremy Smith)

- Peru endured the sharpest GDP decline of any major economy in the second quarter, following especially rigorous and protracted quarantine measures intended to slow the spread of the coronavirus disease 2019 (COVID-19) virus.

- The only sectors experiencing year-on-year (y/y) growth in August were telecommunications (5.1% y/y), and finance and insurance (19.7%). The service sector is most responsible for the decline, with the most notable contractions in hotels and restaurants (60.1% y/y) and transport and storage (27.9%), but manufacturing (12.1%) and mining (11.2%) remain far from pre-pandemic levels.

- Meanwhile, INEI reported that employment in Metropolitan Lima rose by 3.8% m/m to 3.7 million in the quarter ended in September, down from a 23% increase in the prior month. Employment in the Peruvian capital fell by more than half from March to June. Nonetheless, the unemployment rate rose from 15.6% in August to 16.5% in September as the number of workers re-entering the labor force outpaced new hires.

- In April, Peru unveiled the largest stimulus package in Latin America, worth around 12% of GDP, to counteract the collapse in economic activity. Prior to the crisis, Peru had enjoyed a greater fiscal space than many of its regional peers, but its large informal sector - accounting for more than 70% of the workforce, along with low levels of financial inclusion, have complicated the delivery of government support.

Europe/Middle East/Africa

- European equity markets closed mixed; Germany -1.0%, France -0.3%, UK +0.1%, Italy +0.6%, and Spain +1.0%.

- 10yr European govt bonds closed +2bps for France, Germany, Italy, Spain, and the UK.

- iTraxx-Europe closed +1bp/55bps and iTraxx-Xover +3bps/331bps.

- The UK government is said to be considering measures that would compel OEMs to sell a growing share of battery electric vehicles (BEVs) as it moves towards phasing out internal combustion engine (ICE) passenger cars, reports The Times. The article states that government ministers believe a "zero-emission vehicle mandate" could be the most efficient way of delivering its ambitious targets, while at the same time allowing grants and other support measures currently available for BEVs, such as zero road tax, to be phased out. The scheme would also require OEMs to sell more zero-emission vehicles as a share of their overall sales, or purchase credits from other vehicle manufacturers. (IHS Markit AutoIntelligence's Ian Fletcher)

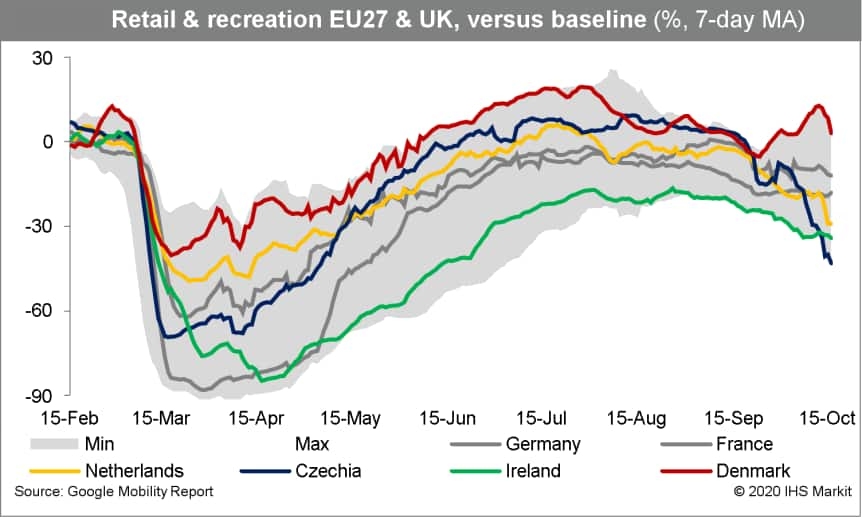

- Ireland is currently set to have the most severe restrictions

in Europe, with hospitality and non-essential services closed and

gatherings banned until early December. We will incorporate the

latest developments into our November baseline, including a

contraction in underlying activity in the fourth quarter of 2020

and a more protracted recovery. (IHS Markit Economist Daniel Kral)

- Just two weeks after Ireland was moved to Level 3 national restrictions for three weeks, the government has decided to move the country to the highest Level 5 restrictions for six weeks, from the night of Wednesday 21 October to Wednesday 2 December. This comes after daily new COVID-19 cases increased three-fold in less than three weeks, from 415 new cases on 1 October to almost 1,300 on 19 October, although deaths have remained in low single digits.

- The full scale of Level 5 restrictions will not be rolled out yet, with the government calling it "soft" Level 5 instead. This means that the overall severity of the restrictions is set to be less severe than during April and early May, the peak months of the first lockdown.

- New measures include the complete closing of the hospitality sector, such as restaurants, bars, and cafes, with only take-away or delivery services allowed. Under Level 3, these places were allowed to have outdoor seating of up to 15 people.

- All non-essential services will be closed, although the list of exemptions is sizeable. This is a major difference with Level 3, when they were allowed to operate while safeguarding social distancing rules.

- All indoor gatherings will now be banned. Only meetings in an outdoor setting, which is not a home or a garden, such as a park, can take place with one more household. No organised outdoor gatherings are allowed.

- Attendance at weddings is capped at 25 people and funerals at 10 people. Most sports will be banned, apart from a few elite championships. Children are allowed to train in small groups.

- Restrictions on internal mobility have also been tightened. While under Level 3 people could travel within their county, Level 5 means strict stay-at-home orders and people can only exercise within 5 km of one's home. Public transport will be capped at 25% of capacity for essential workers and essential purposes, while everyone is advised to walk or cycle where possible.

- A key difference with the lockdown in April-May is that schools and early learning and childcare facilities will remain open. School transport will also continue unaffected.

- Ireland is currently set to have the most severe restrictions in Europe, although many countries across the continent are faring much worse. The Irish government's severe pre-emptive measures are likely driven by a combination of factors, including relatively limited healthcare capacity, particularly beds in intensive care units, and pressure from its scientific advisers

- The impact of Level 3 restrictions can already be seen in

real-time activity indicators, with Ireland's retail footfall

remaining among the lowest in Europe throughout the COVID-19 virus

crisis.

- Netherlands-based ForFarmers is strengthening its position in the poultry feed sector by acquiring De Hoop Mengvoeders. Already one of Europe's largest feed companies ForFarmers will become even more powerful with the addition of a business that generated EUR110 million in revenues last year. De Hoop sold 322,000 tons of poultry feed in 2019, of which 80% went to farmers in the Netherlands, with the remaining 20% exported to Belgium and Germany. The acquired business produces feed at a mill in Zelhem, in the Dutch province of Gelderland. ForFarmers said creating a single organization focused on feed quality and advice for poultry farmers would be of great added value to the poultry sector. The group said the acquisition should be seen in the context of recent trends, where consumers are increasingly interested in the provenance, sustainability and quality of food. ForFarmers will buy De Hoop's compound feed business and its related transport activities, along with the mill and adjacent real estate. Gert-Jan Buunk will manage the new combination, which will be branded ForFarmers-De Hoop, together with Michiel Schreurs, Director Poultry ForFarmers Netherlands. Completion of the transaction, which is pending approval of the Dutch and German competition authorities, is expected to take place in the first quarter of 2021. (IHS Markit Food and Agricultural Commodities' Max Green)

- Despite a full rebound in retail sales and stable construction

sector, IHS Markit keeps below the consensus forecast for the

Romanian economy in 2020 and 2021. (IHS Markit Economist Vaiva

Seckute)

- Retail sales in Romania in July-August were almost at the same level as at the end of 2019, signaling a full rebound from a trough in April. Construction output showed an acceleration in July and August after weakening growth in momentum during the second quarter.

- On the other hand, industrial sector recovery was limited and its volumes in July-August were 5.2% lower than compared with the end of 2019. Exports continued to contract by about 10% year on year (y/y) in July-August.

- The high-frequency data in the service sector suggests only a limited rebound in the third quarter so far, especially for restaurants and hotels and recreational services, which continued to struggle due to restrictions and lack of tourists.

- The Romanian unemployment rate had already started rising in February, but from very low levels, and in August it stood at 5.3% compared with 3.7% in January. The number of employed decreased by 3.5% y/y in the second quarter.

- Wage growth has decelerated during the second quarter, but regained pace in July and August when it rose above 7% y/y.

- Amid the sharp contraction in exports, the trade balance worsened further in 2020 despite the negative shock to domestic demand in the second quarter. IHS Markit expects the trade deficit to rise from 7.8% in 2019 to 8.7% in 2020.

- The current-account deficit is not expected to widen due to improving income balances. Nevertheless, current-account coverage by capital transfers and FDI has deteriorated significantly. Gross external debt increased to EUR116 billion in August, compared with EUR109 billion a year ago.

- Romania's fiscal deficit until August this year increased to EUR11 billion - more than doubling from EUR4.6 billion in August 2019.

- The Romanian fiscal deficit is expected to reach around 11% of GDP in 2020. Persistent twin deficits in the country will continue to challenge the country's ability to attract substantial amounts of financing at a reasonable price, even though risks are diminished by loose monetary policy.

- Dacia has sold out of its entire initial allocation of 100 units of the new Spring electric vehicle (EV) in the Hungarian market, according to a company statement. This was after the preorder slots had been available for just four hours according to the OEM. The first customer deliveries of the low-cost EV will take place in 2021, with the vehicle listing at HUF6.5 million (EUR17,900) in Hungary. However, the Hungarian government has a generous EV subsidy scheme in place that offers a HUF2.5-million subsidy and means that customers can purchase the vehicle for just HUF4.0 million. In May, the Hungarian government introduced a progressive EV subsidy regime which increased the existing subsidy from HUF1.5 million to HUF2.5 million, available for cars with a list price below HUF11 million. The new Spring will be the cheapest EV on sale in Europe when it is launched onto the market next year and will be a good bellwether for how ready consumers really are to adopt EVs, due to its affordability. The Spring is based on the Renault Kwid, and offers a driving range of 225 km under the Worldwide harmonized Light vehicles Test Procedure (WLTP) from its 26.8-kWh battery and 33-kW electric motor. (IHS Markit AutoIntelligence's Tim Urquhart)

- Dacia and Ford have recorded their highest-ever production in a single month in Romania, with a figure of 58,000 units in September, reports Mediafax. According to the report, this output from the two car producers in Romania was 56% higher than the figure the two OEMs posted in September 2019. Ford tripled production at its Craiova plant last month in comparison to September 2019. Dacia has returned to a normal daily output of 1,300 cars a day, compared with 1,400 units before the COVID-19 pandemic. Meanwhile, Ford reached a daily output of 1,000 units of its EcoSport and Puma models in September, as opposed to 300 to 400 units at the same time last year. This output result for Romania's two carmakers is a highly positive result and belies the difficulties the European industry has faced as a result of the COVID-19 pandemic. Dacia's output was boosted in September by the company's launch of the new Sandero and Logan models, while Ford is enjoying healthy demand for the Puma as it is a well-executed and well-designed model in the increasingly popular B-sport utility vehicle (SUV) segment. For the full year 2020, Romanian light-vehicle production is forecast to drop to 436,000 units, down from 490,000 units last year. (IHS Markit AutoIntelligence's Tim Urquhart)

- Russian car-sharing company Delimobil plans to sell up to a 10% stake to investors in a pre-placement, its founder Vincenzo Trani said. This will take place ahead of Delimobil's planned initial public offering (IPO) on the New York Stock Exchange in early 2022. The company had earlier announced that it plans to place 40% of shares during IPO, and this 10% pre-placement would be in addition to that. The company had previously also said that it plans to raise around USD300 million through IPO, but indicated now it may be reviewing that target. In addition, Delimobil said that it is working with Sberbank and Bank of America Merrill Lynch as consultants for IPO, but has not yet signed contracts with them. Delimobil was established in 2015 and currently has a fleet of over 13,000 vehicles with more than 1 million members. The company plans to build up its fleet, primarily outside Moscow (Russia) with an aim to have a fleet of 15,500 cars by the end of 2020 and 28,000 in 2021. Delimobil says despite of suspension of car-sharing service from mid-April to mid-June during the worst of the coronavirus disease 2019 (COVID-19) virus pandemic in Russia, the company's revenue in the remaining months averaged 50% higher than last year. The car-sharing market in Moscow is currently seeing accelerated growth due to high parking fees and limited parking space. Many ride-hailing and car-sharing companies are planning to go public after seeing Lyft and Uber launching their own IPOs. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Israel companies Foretellix and Mobileye have partnered to launch automated lane keeping system (ALKS) verification package that meets new regulatory requirements. Foretellix claims the system to be the world's first commercial solution that will help automakers comply with regulatory and certification requirements of a new UN regulation. The system deploys Mobileye's Responsibility-Sensitive Safety (RSS) to ensure that the tested vehicle responds to dangerous situations. Jack Weast, vice-president of autonomous vehicle standards at Mobileye, said, "Regulators will require proof of a vehicle's ability to avoid reasonably foreseeable and preventable collisions, The Foretellix Foretify approach using RSS gives OEMs a way to demonstrate compliance with the most advanced automated driving regulation in the world." Mobileye, an Israeli-based company acquired by US chipmaker Intel, develops advanced perception systems that enable drivers to detect nearby vehicles, other road users, and unexpected hazards. Recently, Intel acquired Israeli public transit app Moovit to help Mobileye develop robotaxis, with plans to launch them in early 2022. Foretellix is a developer of safety verification software for autonomous vehicles. It recently released its advanced driver-assistance systems and highway solution, a verification package for Level 2 to Level 4 autonomy, which now includes implementation of the new regulation. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Kenya's real GDP contracted by 5.7% y/y during the second

quarter of 2020 as COVID-19 virus outbreak-related lockdown

measures disrupted trade flows, service delivery, and tourism to

the country, the Kenya National Bureau of Statistics (KNBS)

reported. (IHS Markit Economist Thea Fourie)

- Local and regional COVID-19 lockdown measures restricted the movement of goods and individuals across borders, while closures of schools and some businesses, especially those dealing with accommodation and food services, added to the dismal performance of economic activity during the second quarter.

- The Kenyan sectors recording a sharp contraction in output during the second quarter included accommodation and food services, down 83.3% y/y; transport and storage, down 11.6% y/y; and education, down 56.1% y/y. Output in the retail and wholesale industry fell by 6.8% y/y, while manufacturing production dropped by 3.9% y/y.

- The sectors that showed most resilience during the second quarter included the agriculture, forestry and fishing sector, in which output expanded by 6.4% y/y and accounted for 25.6% of GDP, up from 16.2% of GDP at the end of 2019. "The sector's performance was supported by a notable increase in tea production, cane deliveries, milk intake and fruit exports," the KNBS reported. A decline in coffee sales and horticultural exports were recorded during the second quarter.

- Processing and preservation of meat; bakery products, tobacco products, and beer fell during the second quarter. Similarly, non-food manufacturing production contracted by 4.9% y/y during the second quarter. "This was evidenced by a contraction in assembly of motor vehicles and manufacture of galvanized iron sheets," the KNBS reported.

- Growth was recorded in the construction industry (up 3.8% y/y), the information and communications sector (up 4.3% y/y), and the finance and insurance sector (up 4.2% y/y), among other sectors.

- GDP growth in the Kenyan economy is expected to bounce back during the third quarter of 2020. The Stanbic Bank Purchasing Managers' Index (PMI) for Kenya improved above the 50-neutral level in July and since then has continued to strengthen, reaching a reading of 56.3 in September.

Asia-Pacific

- APAC equity markets closed mixed; Mainland China/South Korea +0.5%, India +0.3%, Hong Kong +0.1%, Japan -0.4%, and Australia -0.7%.

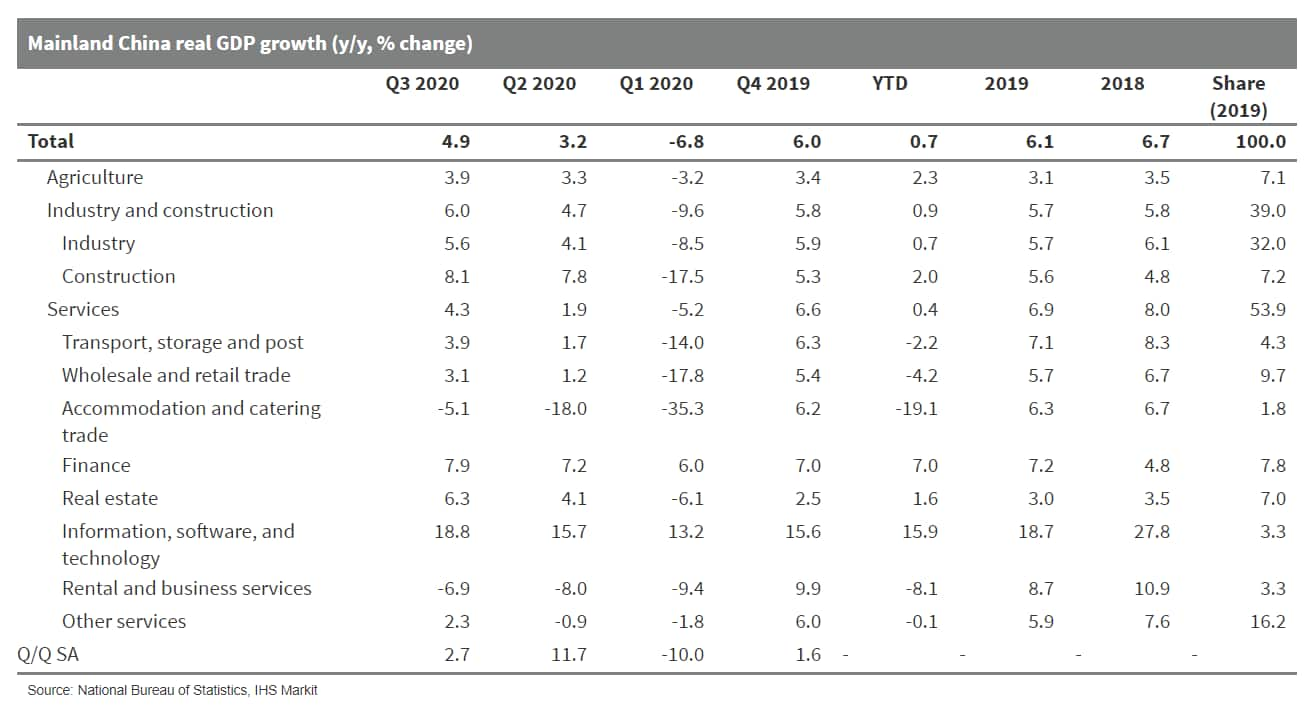

- Mainland China's recovery momentum is expected to moderate

further in fourth quarter 2020; services and consumption are likely

to drive near-term economic growth. China's real GDP expanded 4.9%

year on year (y/y) in the third quarter of 2020, up 1.7 percentage

points from the second quarter, according to the National Bureau of

Statistics' (NBS's) 20 October release. Quarter-on-quarter (q/q)

growth moderated, from 11.7% in the second quarter of 2020, to 2.7%

in the third quarter. (IHS Markit Economist Yating Xu)

- The services sector became the growth engine in the third quarter, taking the mantle from the industry and construction sector. Real growth in services rose by 2.4 percentage points to 4.3% y/y in the third quarter with improvement registered across subsectors, but the growth rate remains below the three-year average.

- The information and software segment continued to lead services growth, and real estate remained an important contributor to the headline acceleration.

- Other services growth improved to expansion as the easing of lockdown measures supported recovery in entertainment, sports, and healthcare.

- Contribution from the finance segment fell as a result of monetary policy fine-tuning, and catering and rental businesses remained in contraction compared with a year ago.

- Industry and construction remained the fastest-growing component of the economy, but its 1.3-percentage-point improvement in the third quarter was lower than the services segment's improvement. However, the 6.0% y/y growth registered in the third quarter surpasses the three-year average figure. The growth in construction, at 8.0%, is far above 5.6% y/y and 4.8% y/y registered in 2019 and 2018, respectively.

- Mainland China's GDP deflator rose 0.7 percentage point to reach 0.6 y/y in the third quarter. Narrowing industrial deflation and rising prices in real estate and finance offset the expansion of deflation in construction and transportation. Given this, nominal GDP expanded at a faster rate of 5.5% y/y in the third quarter of 2020.

- Looking ahead, economic recovery is expected to continue into the fourth quarter, albeit at a slower pace as stimulus measures are eased and effects of pent-up demand gradually fades.

- Services is expected to succeed industry as the main engine of growth. From demand side, recovery in household income in the first half and stabilization of the COVID-19 crisis may continue to support private consumption recovery while the second wave of COVID-19 infections in the United States and European Union may continue to support exports of virus infection-prevention supplies and other necessities.

- Infrastructure investment is likely to accelerate with the increase in local government bond issuance. From supply side, the services sector is likely to lead growth, while industrial growth is expected to stay stable, supported by the demand recovery.

- IHS Markit expects mainland China's real GDP to grow 1.9% y/y

in 2020; any revision to this will likely be upward.

- Although China's relatively robust property market may still

support near-term economic recovery, weakness in home price

inflation is expected to continue as financing restrictions and

sluggish income recovery weigh on sales. (IHS Markit Economist Lei

Yi)

- The average new home price inflation of 70 major cities across mainland China stood at 0.3% month on month (m/m) in September, down 0.2 percentage point from August, according to the National Bureau of Statistics (NBS).

- The decline in m/m new home price inflation was evenly distributed across city tiers, with each tier posting a decline of around 0.2 percentage point in September compared with August's reading. Up to 55 out of the 70 surveyed cities reported m/m new home price gains in September, a decline from 59 cities in the preceding month.

- Year-on-year (y/y) new home price inflation fell to 4.5% on average, a level last seen in 2016. As of September, y/y price inflation has either declined or stayed unchanged for 17 consecutive months in tier-2 cities, and for 18 consecutive months in tier-3 cities.

- A relatively robust real estate market may still support economic growth stabilization in the short term, as housing inventory has been in decline for seven consecutive months.

- However, weak home price inflation is expected to persist despite sustained economic recovery. Although the September decline in home price inflation may be partially due to the promotions offered by housing developers during this historically peak season, housing demand will continue to face headwinds from sluggish income growth and tightening of local governments' housing credit policies

- Chinese ride-hailing giant Didi Chuxing (DiDi) is considering an initial public offering (IPO) in Hong Kong SAR next year, reports Reuters. DiDi started initial talks with investment banks after it began generating profit in the second quarter of this year. DiDi is targeting an IPO valuation of more than USD60 billion, and to boost this, the company is also considering a new fundraising round before the IPO. DiDi has more than 31 million drivers registered on its platform and has attracted 550 million customers, who are using the company's range of app-based transportation options. There have been ongoing reports that DiDi was planning an IPO since July, which the company has been denying. This latest report follows an announcement by Chinese ride-hailing platform Dida Chuxing filing for an IPO on the Hong Kong Stock Exchange. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Toyota is collaborating with KDDI and Telstra for connected car services in Australia, reports ZDNet. The partnership will deploy 4G mobile network connectivity for select Toyota vehicles introduced to Australia later this year. Initially, the connectivity will be used for new safety and security services. Sean Hanley, Toyota Australia's vice-president for sales and marketing, said, "Cars are the ultimate mobility device, so this connected technology will enable us to provide new, convenient and personalized experiences to our customers while delivering on our commitment of continual improvement to safety". KDDI and Toyota have been partnering since 2016 to create a global communications platform for vehicles and rolling the technology by collaborating with local telecommunications company. For instance, in the US, KDDI has teamed up with AT&T to deploy LTE connectivity to Toyota and Lexus vehicles. In 2019, Toyota's Lexus Australia has partnered with Telstra to test cellular vehicle to everything (C-V2X) technology and advanced driver assist features on Victorian roads. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hyundai Motor Group has warned of another KRW3.36 trillion (USD2.93 billion) of provisions in the third quarter of 2020 related to engine issues in the US, reports Reuters. Of the total, Hyundai will account for KRW2.10 trillion, while its affiliate Kia will account for KRW1.26 trillion. The latest provisions bring the automotive group's total hit from the years-long quality problem that has tarnished its credibility to around USD5 billion. Hyundai and Kia recalled around 1.7 million vehicles in 2015 and 2017 in the US in one of their biggest recalls in the country, over an engine issue, but questions remain as to whether the recalls covered enough vehicles or if the fix works. The US National Highway Traffic Safety Administration (NHTSA) has opened more than one investigation; US prosecutors are also investigating whether the recall was handled properly. From 2017 to 2019, the automotive group has earmarked a series of provisions mostly to address engine-related issues. The latest provisions reflect higher-than-expected replacement rates for Theta II GDI engines of old vehicles subject to recalls, as well as growing consumer complaints over the same engine and other engines not subject to recalls, said Hyundai. It is expected that Hyundai and Kia will swing to losses during the third quarter of 2020, mainly due to provisions, as well as sluggish vehicle demand amid the COVID-19 virus pandemic. (IHS Markit AutoIntelligence's Jamal Amir)

- Singapore released its advance estimate for seasonally adjusted

third-quarter GDP, showing a 7.9% increase (actual per cent; not

annual rate) over the previous quarter. This was better than

expected; the consensus among forecasters, including IHS Markit,

was for a growth rate in the low-6% range. (IHS Markit Economist

Dan Ryan)

- This good performance was not due to manufacturing. Unlike other Asian countries, whose rebound was led by manufactured exports, Singapore's manufacturing sector grew only a few per cent.

- The main source of growth was services. This sector was hard-hit by lockdowns and quarantines, but it responded well to the gradual opening that took place in the third quarter.

- Construction also rebounded sharply, rising 39% over the second quarter. However, this was similar to IHS Markit forecast of 34% - thus contributed little to the better-than-expected performance of overall GDP.

- Recent news suggests that the fourth quarter of 2020 and early 2021 will see only marginal growth, as Singapore and other countries fight a resurgence of the COVID-19 virus pandemic. This puts the overall 2020 growth rate at -6.6%. This is a slight improvement - thanks to the relatively good third-quarter 2020 performance - over the previous forecast of -7.4%.

- Next year should see growth in the mid-4% range, assuming the pandemic is brought under control in the middle of the year. This assumption also leads to a strong rebound of 6% growth in 2022.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-october-2020.html&text=Daily+Global+Market+Summary+-+20+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 20 October 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+20+October+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}