Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 18, 2020

Daily Global Market Summary - 18 November 2020

All major European and most major APAC equity markets closed higher today, while US markets were lower. US government bonds were close to flat on the day, while yields increased modestly for most benchmark European bonds. iTraxx-Xover closed tighter, while CDX-NA was wider across both IG and high yield. The US dollar ended the day flat, oil closed higher, and gold/silver were lower on the day. New restrictions aimed at slowing the spread of COVID-19 continue to be rolled out in the US, with the NYC public school system announcing today that it's 1.1 million students will move to full remote learning until further notice starting tomorrow.

Americas

- US equity markets closed lower across the region; Russell 2000 -1.3%, S&P 500/DJIA -1.2%, and Nasdaq -0.8%.

- 10yr US govt bonds closed +1bp/0.87% yield and 30yr bonds -1bp/1.60% yield.

- CDX-NAIG closed +2bps/54bps and CDX-NAHY +6bps/334bps.

- DXY Us dollar index closed flat/92.41.

- Gold closed -0.6%/$1,874 per barrel and silver -0.8%/$24.45 per barrel.

- Crude oil closed +1.4%/$42.01 per barrel.

- Given the rise in COVID-19 infections citywide all NYC public schools will go fully remote until further notice starting tomorrow 19 November (NYC DOE)

- On Wednesday, New York's Metropolitan Transportation Authority said it will have to slash subways and buses by 40% and decrease commuter rail service by half if aid doesn't come from Washington. Fares and tolls will increase and roughly 9,300 jobs will also be eliminated. (Bloomberg)

- The total level of global indebtedness has increased by $15 trillion this year, leaving it on track to exceed $277 trillion in 2020, said the IIF, which represents financial institutions. It expects total debt to reach 365% of global gross domestic product by the end of the year, surging from 320% at the end of 2019. Debt burdens are especially onerous in emerging markets, having risen by 26 percentage points so far this year to approach 250% of GDP, the IIF said. (FT)

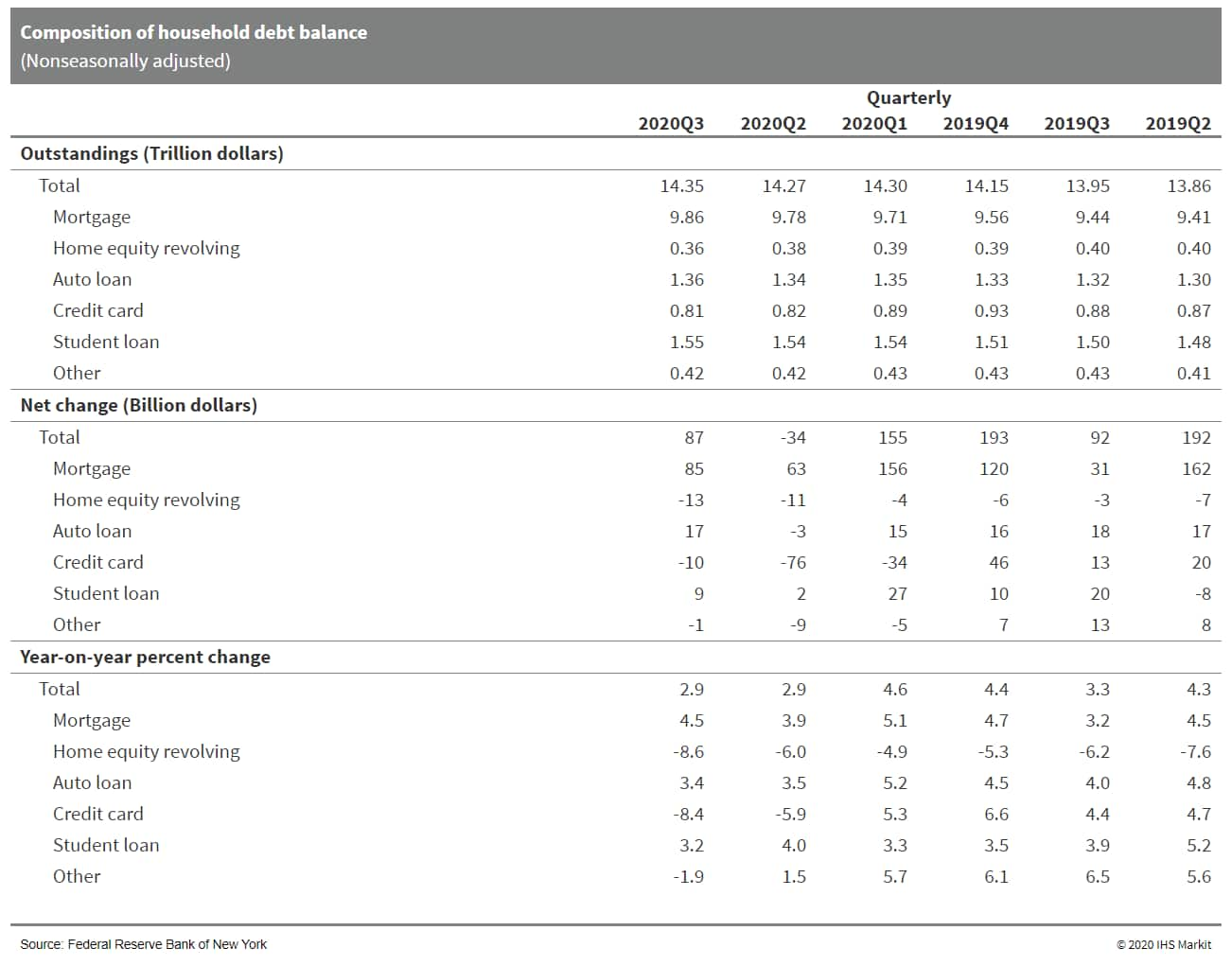

- Total US household debt rose in the third quarter by $87

billion (0.6%), erasing a $34 billion decline in the second

quarter—the first decline since 2014. The four-quarter change

in total household debt was unchanged at 2.9%. Outstanding

household debt totaled $14.35 trillion. (IHS Markit Economist David

Deull)

- Mortgages, the largest category of debt, were also the largest source of increase in the third quarter, rising $85 billion for a four-quarter increase of 4.5%.

- Mortgage originations, which include refinances, jumped by $203 billion to $1,049 billion, the most since the third quarter of 2003 and the second-most on record.

- Non-housing debt rose by $15 billion in the second quarter as credit card balances declined for the third consecutive quarter, by $10 billion, which was offset by rising student and auto loan balances. Credit card debt was 8.4% below its year-ago level and the lowest since the second quarter of 2017.

- Auto loans rose by $17 billion (1.3%), while student loans added $9 billion (0.6%). Four-quarter growth for these categories was 3.4% and 3.2%, respectively.

- The overall delinquency rate (the share of balances delinquent by 30 days or more) fell by a further 0.2 percentage point to 3.2% after plunging 1.0 percentage point the quarter before. These declines reflect forbearances, which insulate credit records from notations of skipped or deferred payments.

- Bankruptcy notations were added to about 132,000 consumers'

credit reports in the third quarter, a new record low.

- The US FDA has granted its first EUA for a home-use self-testing COVID-19 diagnostic kit. The EUA was granted to US firm Lucira Health for its single-use Lucira COVID-19 All-In-One Test Kit, which allows real-time detection of SARS-CoV-2 from nasal swab samples in people aged 14 and over and provides results within 30 minutes. The tests can also be used in recipients aged under 14, but only by a healthcare provider. The product is intended to be dispensed in the US on prescription only to at-risk cases. Although there are several COVID-19 tests that allow at-home sampling, this is the first that enables processing of results entirely at home, Reuters quoted FDA Commissioner Stephen Hahn as saying. (IHS Markit Life Science's Janet Beal and Brendan Melck)

- Amazon Pharmacy's US launch poses an immediate challenge to about 50,000 traditional pharmacy retailers, including CVS Health (US), Walgreens Boots Alliance (US), Walmart (US), and Rite Aid (US). The e-global commerce giant is offering large price discounts and price comparison information, with up to 80% discounts on some generic medications for Amazon Prime subscribers without insurance. The business models also offer up to 40% price discounts for certain branded pharmaceutical products with health insurance. Uniquely, subscribers can still avail of the heavy price discounting on non-insurance drug purchases even if they collect from traditional pharmacies rather than having items delivered free of charge (or with a premium payment for a two-day delivery order). The value of the US pharmacy sector is estimated at about USD312 billion, of which 3% (or about USD9.5 billion) is in online activity and home delivery. Online purchases of prescription medicines in the US are set to rapidly acquire market share. This trend is likely to be even more pronounced during the COVID-19 virus pandemic, when customers in vulnerable groups or in lockdown are more willing to switch to Amazon Pharmacy. Access to Amazon Pharmacy will initially be restricted to 45 states but will expand nationwide. (IHS Markit Life Sciences' Eóin Ryan)

- The Hyundai-Aptiv JV called Motional has reportedly received approval to test its autonomous vehicles in the US state of Nevada without a human safety driver. According to the report, Laura Major, who is Motional's chief technology officer, said, that it will begin operating Chrysler Pacifica minivans in the area without a human driver in the coming months. There will still be a person onboard to stop the car if something goes wrong. Although Aptiv has been offering rides in Las Vegas since 2018, its test vehicles had a person in the passenger seat. In addition, Automotive News cites Major as saying that the company intends to offer autonomous taxi fleets beginning in 2022, although she did not indicate which fleets Motional will partner with. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The US safety agency, the National Highway Traffic Safety Administration (NHTSA) is upgrading a probe into potential touchscreen failures on the Tesla Model S and X to the status of engineering analysis, Automotive News reports. NHTSA opened a preliminary investigation in June 2020. According to a report on 17 November, the NHTSA's probe also now covers 2012 to 2018 model year Model S and 2016 to 2018 model year Model X vehicles, increased from the initial investigation into 63,000 Model S cars. The NHTSA at this point says the failure does not affect voice control. These Tesla vehicles use Nvidia's Tegra 3 processor, and the NHTSA reportedly says the flash devices have a finite lifespan based on the number of programs or erase cycles. The NHTSA has reviewed 12,523 complaints, including some indicating that the failure led to loss of charging ability and that other safety alerts could be affected. The Automotive News report also says that Tesla said it has received 2,399 complaints and field reports, 7,777 warranty claims and 4.746 non-warranty claims to replace the MCU part. The NHTSA is quoted as writing in its report that the data showed "failure rates over 30 percent in certain build months and accelerating failure trends after 3 to 4 years-in-service." Tesla has implemented over-the-air updates "to mitigate the effects of MCU failure." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nestlé-owned children's food brand Gerber has entered the frozen sector in the US with a range of organic bowls and snacks made with vegetables and whole grains, for 12 months and up infants. The products, marketed under the Freshful Start brand, can be prepared in minutes and are free from preservatives, artificial flavors and colors. The bowls come in three: tomato basil whole grain pasta, mac & cheese, and southwest style. "Families with busy schedules are looking for quick meal options for toddlers that provide the nutrition their growing bodies need. Parents can take comfort knowing Gerber Organic Freshful Start bowls and bites are nutritious mealtime options for toddlers," said Erin Quann, head of medical affairs at Gerber/Nestlé Nutrition. Frozen snacks are sold under the name of Freshful Start Organic Veggie Bites with two different variants: yellow carrot, kale, lentil & quinoa, and broccoli, lentils & cheddar. The products will be available in selected Target stores. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Plus is to use BlackBerry's QNX operating system (OS) to develop its next-generation automated Class 8 trucks. Plus, in partnership with Chinese truck-maker FAW, will commercialize automated trucks deployed with BlackBerry QNX technology starting in 2021. Shawn Kerrigan, the chief operating officer and co-founder of Plus, said, "Self-driving systems consist of the most complex and powerful software and hardware to go into a Class 8 truck. Every technology choice we make has to contribute to the overall safety and security of heavy-duty trucks integrated with the Plus automated driving system. The operating system is an important foundation for the rest of the system. Our engineering team has done an exceptional job in completing the transition to the industry's highest standard of safety-certified technology as we move from product development to commercial deployment." Plus, which was founded in 2016, aims to make commercial freight transport safer, more efficient, and less expensive for its customers. The company has raised USD200 million in funding over three rounds. In 2017, the company obtained a license from the California Department of Motor Vehicles (DMV) to test its autonomous trucks. In May 2018, Plus completed its first test of a driverless truck in Shanghai (China). In November 2018, the company announced an exclusive strategic partnership agreement with Full Truck Alliance Group in the field of autonomous vehicles (AVs). Plus has recently partnered with Chinese truck manufacturer FAW Jiefang to develop a Level 3 automated heavy-duty truck, the J7. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Canada's monthly inflation rates were slightly stronger yet

mild in October, with a 0.3% gain on a seasonally adjusted basis

(sa) and 0.4% increase on a non-seasonally adjusted basis (nsa).

(IHS Markit Economist Arlene Kish)

- Annual inflation advanced 0.7% year on year (y/y) nsa and sa, exactly as expected.

- The core consumer price index (CPI)-trim and CPI-common (nsa) accelerated by 0.1 percentage point while the CPI-median measure was unchanged at 1.9% y/y, pushing up the three-core average to 1.8% y/y.

- Food price inflation accelerated above 2% y/y once again and annual energy price deflation accelerated with larger declines in gasoline and home fuel oil prices.

- The Bank of Canada and IHS Markit expect inflation to remain below 2% y/y in 2021 despite the slow upward trend in core inflation. Containment restrictions brought on by the pandemic's second wave will slow demand, resulting in excess economic capacity that will keep inflation pressures mild for a while longer.

- Food price inflation was significantly higher as the inflation rate for fresh vegetables more than doubled to 9.5% y/y in the month, but the fast run-up is typical in October. Meat prices were 1.7% y/y higher as prices for chicken jumped from lower production.

- Gasoline prices declined at a faster pace in October, falling 12.4% y/y, and they are positioned to decline at a similar rate in November.

- Outside these two main categories, shelter prices are inching closer to 2% with advancing homeowners' replacement costs, jumping 3.6% y/y as factors like sharp increases in building material costs and new home prices contribute to the calculation of this sub-index. Overheated regional housing markets will continue to put more upward price pressures on consumers.

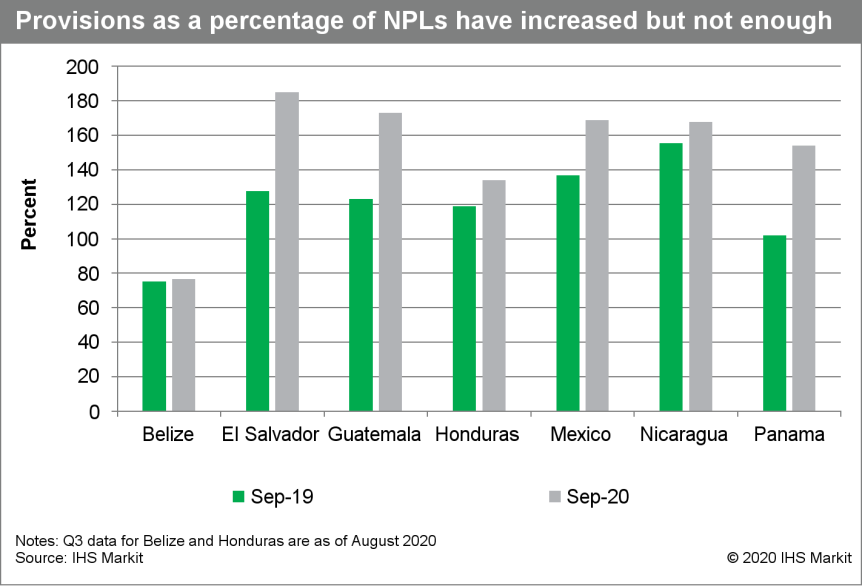

- IHS Markit analyses the main banking risk metrics for Belize,

El Salvador, Guatemala, Honduras, Mexico, Nicaragua, and Panama.

Our key findings highlight a stagnant credit growth for most

countries and a still-frozen non-performing loan (NPL) ratio.

However, this indicator is expected to increase over the following

quarters, leading banks to rise their provisions, and consequently

profitability has fallen. (IHS Markit Banking Risk's Alejandro

Duran-Carrete)

- After recording growth in the first and second quarters - led mostly by forbearance measures and expectations that the COVID-19 virus pandemic would be short lived - credit contracted in September 2020 on a quarterly basis (q/q) in most countries of the region, including Costa Rica (-0.8% q/q), El Salvador (-1.3% q/q), Guatemala (-1.4% q/q), Honduras (-2.7% q/q), Mexico (-3.0% q/q), and Panama (-3.8% q/q). Only Nicaragua displayed some growth at 1.5% q/q, likely as a consequence of very sharp contraction in previous quarters, which facilitated some growth during September.

- The reduction of credit growth in the other countries is likely due to banks' skittishness in disbursing new credit. Our reasoning stems from the fact that, despite having experienced a sharp increase in their liquidity metrics followed by interest rates, banks are holding their funds.

- Moreover, according to credit-sentiment surveys, banks still prefer not to engage in new investments because they foresee a complicated scenario over 2021. The ending of some of the forbearance measures instituted to mitigate the impact of COVID-19 will likely induce a further contraction in growth over the rest of 2020 and part of 2021.

- Moreover, the storm disasters experienced in Central America (primarily in Belize, Guatemala, Honduras, and Nicaragua) during the current will further limit loan disbursement in the affected countries over the rest of the year.

- Impairment is still low, although it is likely to increase since a substantial proportion of loans at risk have been rising. Replicating the results of the first and second quarters of the year, the NPL ratio is still at very contained levels. Meanwhile, banks have increased their provisions to cover future losses. On average, they have increased their coverage ratio by 31 percentage points in expectation of a future increase in NPLs.

- Profits have contracted as a result of COVID-19-related measures, increased provisioning and reduced interest rates. Because of credit delays, loan restructurings, lower interest rates, and increased provisioning, profitability has contracted significantly. The return on average assets (ROA) has fallen on average by 0.32 percentage point in the abovementioned countries.

- Credit growth is likely to experience further contractions

throughout the following quarters, due to the low expectations of

banks for 2021. Moreover, the ending of some of the forbearance

measures instituted to mitigate the impact of COVID-19 and the

storm disasters experienced in Central America (primarily in

Belize, Guatemala, Honduras, and Nicaragua) will further limit

lending growth.

Europe/Middle East/Africa

- European equity markets closed higher across the region; Italy +0.9%, Spain +0.6%, Germany/France +0.5%, and UK +0.3%.

- 10yr European govt bonds closed mixed; Italy +2bps, UK/Germany +1bp, and Spain flat.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover -6bps/280bps.

- Brent crude +1.3%/$44.34 per barrel.

- The Office for National Statistics (ONS) reports that UK

12-month-rate consumer price index (CPI) rose for the second

straight month to 0.7% in October after falling to the five-year

low of 0.2% in August. (IHS Markit Economist Raj Badiani)

- During the first 10 months of 2020, inflation averaged 1.0%, well below the Bank of England's (BoE)'s target of 2.0%.

- A major development was that clothing and footwear prices were unchanged from a year ago in October after falling for the seventh straight month in September. The ONS reported higher clothing prices because of the "return to their normal seasonal pattern after the disruption this year", namely the launch of new autumn ranges triggering reviving prices after the continuous fall since March.

- Higher non-processed food prices also provided a positive contribution to the higher 12-month rate during October.

- Restaurant and café prices rose for the second straight month by 1.2% year on year (y/y) in October. This was unexpected after the VAT rate was cut from 20% to 5% in the hospitality, accommodation, and tourist attraction sectors from mid-July.

- On the flipside, energy-related prices continued to slide on an annual basis, with transport fuel and lubricant prices being 10.2% lower than a year earlier. A key driver was global crude oil prices, which fell by 32.7% y/y to average USD40.19 per barrel (pb) in October.

- The ONS also reported that falling household energy prices pulled back the 12-month rate in October. Natural gas and electricity prices dropped by 12.3% and 3.2% in September and October, respectively, in line with energy regulator Ofgem's latest six-month energy price cap, which came into effect on 1 October.

- Meanwhile, all-services price inflation was unchanged at 1.4% in October, compared with 0.6% in August; for goods, it stood at 0.0%, from -0.3% in September.

- Core inflation, excluding energy, food, alcoholic beverages, and tobacco prices, increased from 1.3% in September to 1.5% in October.

- We expect inflation to be just below 1.0% in the next few months. IHS Markit's November update forecasts that inflation is likely to average 0.8% in 2020 after standing at 1.8% in 2019.

- A combination of unpreparedness for Brexit, retailers stocking up for another wave of the coronavirus, and further stockpiling in advance of post-Brexit tariffs is creating chaos for importers. Not all ports are affected. Freight seems to be moving normally through the Port of Dover, though warnings have been sounded that the port still does not have enough parking space for the trucks that are expected to be delayed both coming into and leaving the UK. Tilbury also seems to be running normally. Whether haulers have all their paperwork ready is another matter: the French authorities in Calais have already warned that haulers whose papers are not 100% in order will be refused entry into France. The problem seems centered on Felixstowe, which handles some 40% of container traffic into the UK. A labor shortage is forcing vessels to wait outside the port for a berthing slot, and unloading ships is taking longer. As happened earlier in the year when there was an import rush because of the unexpected panic buying and stocking up, there is now a shortage of warehouse space. This is being exacerbated by the boom in e-commerce, which (according to commercial estate agents Knight Frank) is calling for another 30 million square feet (about one square mile) of warehouse space per year. Hutchison Ports UK, which owns Felixstowe, said in a prepared statement: "The imbalance in UK trade and Brexit stockpiling exacerbate current operational challenges", adding that part of the problem was "the large number of empty containers and a large amount of unusually long-stay containers held at the port". (IHS Markit Food and Agricultural Commodities' Neil Murray)

- UK Prime Minister Boris Johnson has confirmed that the country will end of sales of light vehicles solely fuelled by gasoline (petrol) and diesel by 2030 as part of the his new 10-point plan for a "green recovery" from the COVID-19 virus pandemic. Initial details published by the Financial Times (FT) focus on the creation of 250,000 jobs underpinned by "GBP12 billion of government investment and potentially three times as much from the private sector" to achieve this. Regarding the automotive sector, and giving few details, the piece written by Johnson states: "Four - we'll invest more than GBP2.8 billion in electric vehicles, lacing the land with charging points and creating long-lasting batteries in UK gigafactories. This will allow us to end the sale of new petrol and diesel cars and vans in 2030. However, we will allow the sale of hybrid cars and vans that can drive a significant distance with no carbon coming out of the tailpipe until 2035." This indicates that plug-in hybrids (PHEVs) will also be phased out by 2035 and conventional hybrid powertrains at the same time as gasoline and diesel. This announcement confirms the pull-forward of the end of sales of gasoline and diesel fueled vehicles to well before 2040, which been put forward by the previous administration. This is also well ahead of an earlier proposal put forward by Johnson earlier this year. However, this is not entirely unexpected as even following Johnson's announcement in February, there was a suggestion that this could take place even earlier. (IHS Markit AutoIntelligence's Ian Fletcher)

- Eurostat's release of final HICP data for October have

confirmed the main takeaways from the prior 'flash' release. (IHS

Markit Economist Ken Wattret)

- The headline inflation rate remained negative for the third successive month, unchanged at -0.3%. Energy remained the key driver of sub-zero inflation (-8.2% year on year [y/y]).

- The rate excluding food, energy, alcohol, and tobacco prices was also unchanged from September and unrevised at 0.2%, matching its record low.

- The inflation rate for non-energy industrial goods remained negative for the third straight month but ticked upwards (from -0.3% to -0.1%), in line with the 'flash' estimate, while services inflation slipped to a new record low (from 0.5% to an unrevised 0.4%).

- With the full breakdown of October's eurozone HICP by item now available, we have updated our "super core" measure of inflation. It remained unchanged at 0.9%, again a record low.

- As a reminder, the "super core" rate includes only the HICP items sensitive to the eurozone output gap and hence should be more reflective of domestic economic developments than the overall inflation rate.

- We keep a close watch on this inflation metric along with various others, including our deflation vulnerability index (which we will update shortly to reflect the third quarter's data.

- Various factors, including the effects of the COVID-19 virus shock on consumption patterns, the shifts in timing of seasonal price changes, and the 2020 German VAT reductions, complicate the assessment of recent HICP data in the eurozone.

- The German government has announced a EUR3-billion (USD3.6-billion) program of support for the country's automotive industry, according to a Reuters report. The money will help support the industry's shift to electromobility by helping OEMs and suppliers with production and R&D investments in the area of electric vehicles (EV) and components. The measures mean the car industry will be well placed to rise to the challenges it faces, Economy Minister Peter Altmaier said after a summit of carmakers and government ministers held to discuss the package. Additionally, Environment Minister Svenja Schulze said, "We want to join the path out of the economic crisis with the path out of the climate crisis." The summit effectively rubber-stamped a program that Reuters reported the German government had been looking to implement earlier this month. The government would distribute grants to the leading German carmakers such as Volkswagen (VW), BMW, and Daimler for technology R&D, as well as the Tier 1 suppliers such as Bosch and Continental, and smaller players. There will be a focus to promote R&D in areas including the digitalization of supply chains, 3D printing, and the shared use of production data. In addition, the government will support up to 60% of the costs for large companies and 80% for small and medium-sized companies if they carry out work that will make production facilities more environmentally friendly. (IHS Markit AutoIntelligence's Tim Urquhart)

- The volume of French retail sales rose by 6.0% year on year

(y/y) in October, according to seasonally adjusted figures released

by the Bank of France. They recovered strongly following

substantial declines between March and April. By value, retail

sales rose by 6.6% y/y in October. (IHS Markit Economist Diego

Iscaro)

- Sales of food (+5.3% y/y) and industrial goods (+6.2%) rose strongly in October. The latter was boosted by higher sales of consumer electronics (16.6%), DIY goods (+23.8% y/y), and games/toys (+46.6% y/y).

- Households are likely to have increased purchases of these goods in anticipation of the national lockdown announced in late October. Moreover, as the Bank of France mentions in its media release, households are likely to have done some early Christmas shopping for the same reason.

- The increase in retail sales in October was stronger than expected, although it is likely to be followed by a large decline in November. Moreover, it is also likely that the strength in retail will be more than offset by extreme weakness in the consumption of services, which account for 55% of total private consumption

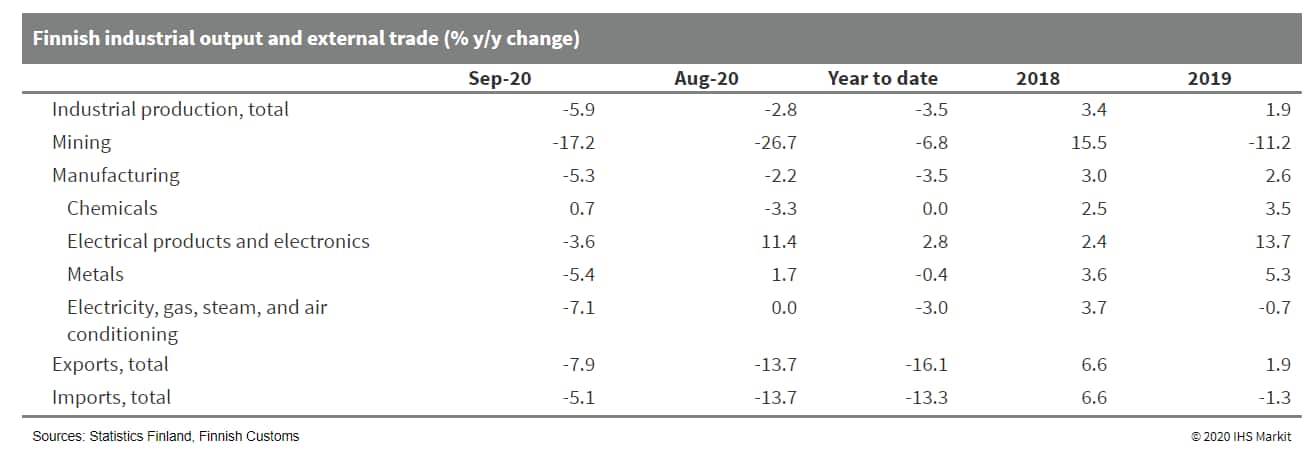

- Finnish industrial contraction, working-day adjusted, in

September fell to nearly 6% year on year (y/y), after a fall of

2.8% y/y in August. Consequently, output contracted by 3.5% y/y in

January-September. Seasonally adjusted fall in September settled at

2.1% month on month (m/m). (IHS Markit Economist Venla Sipilä)

- Nearly all key industrial branches experienced falling y/y output in September, the notable exception being the chemical sector, which achieved a modest increase in September and flat output cumulatively in January-September. Within manufacturing, the electronics industry stood out as it manages to grow in cumulative y/y terms, but it returned to contraction in September.

- Finnish Customs reports that goods exports in September fell by 7.9% y/y, while imports decreased by 5.1% y/y, resulting in a trade deficit of EUR380 million (USD450.8 million), up by 57% y/y. For the first three quarters of 2020, exports slid by 15.2% y/y against an imports fall of 11.4% y/y, resulting in the shortfall widening by 173% y/y to reach EUR2.8 billion.

- Exports of oil products, paper, and paperboard fell at double-digit rates y/y, while exports of pulp, industrial machinery and equipment, electrotechnical machinery and equipment, and transport equipment also fell. Meanwhile, growing sawn timber exports placed the forestry sector among the few positive elements in the external trade data in September.

- The setback in the recovery path of Finnish industrial output fits IHS Markit's expectations. An unfavorable base effect in September also supports our projection of a deepening contraction.

- The latest quarterly 'flash' estimate supports our recently

somewhat brightened view of third-quarter performance in Finland

and the eurozone generally. However, this does not change our

persistently muted expectation of the recovery.

Asia-Pacific

- Most APAC equity markets closed higher except for Japan -1.1%; Hong Kong +0.5%, India/Australia +0.5%, South Korea +0.3%, and Mainland China +0.2%.

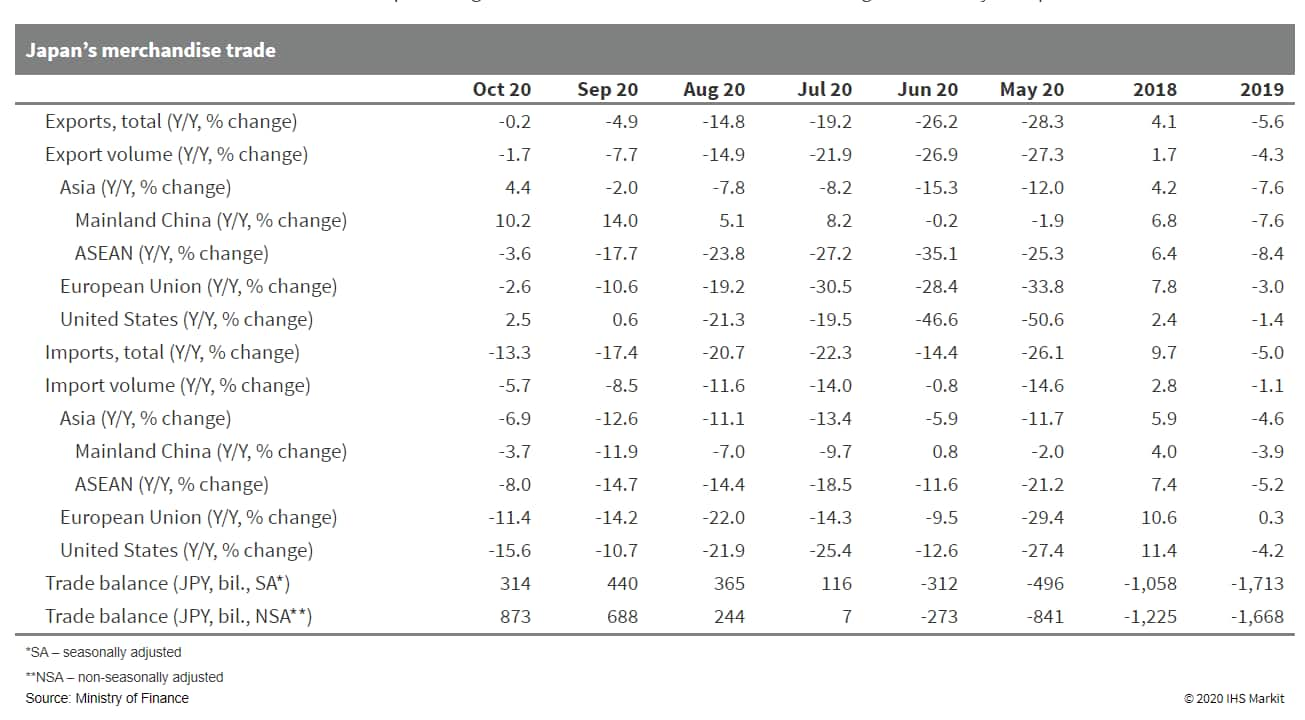

- Japan's trade balance remained in surplus in October thanks to

sustained improvement in exports. Uncertainties over the COVID-19

virus pandemic could suppress recovery in exports and imports over

the near term. (IHS Markit Economist Harumi Taguchi)

- Japan's trade balance fell by 28.6% month on month (m/m) to JPY314.0 billion (US3.0 billion) on a seasonally adjusted basis in October, but rose to JPY873.0 billion from JPY11.0 billion a year earlier. The continued increase in the trade surplus was due to a softer year-on-year (y/y) decline in exports (0.2%) while imports remained sluggish (down 13.3% y/y).

- The improvement in exports reflected increased exports to Asia and the US and a softer decline in exports to the European Union. Exports to the US (up 2.5% y/y) were driven by exports of autos, auto parts, and electrical power machinery. The rise in exports to Asia (up 4.4%) came on exports of non-ferrous metals, semiconductor machinery, and electrical machinery. The continued decline in exports to the European Union (down 2.6%y/y) largely reflected decreases in exports of autos and machinery.

- The continued weakness for imports was due largely to lower prices for resources and mineral fuels. Mineral fuels contributed 7.4 percentage points to the contraction of imports. Other major contributors to the decline were imports of aircraft, clothing accessories, and medical products.

- The y/y growth of exports is expected to turn positive,

reflecting the resumption of economic activity in Japan's trading

partners. However, upward momentum is likely to ease as the global

resurgence of COVID-19 and related containment measures will

probably weigh on external demand. The yen's recent appreciation

could be a negative factor for Japan's export competitiveness.

- Chinese EV startup NIO has announced its unaudited financial

results for the third quarter of 2020. The startup's total revenues

during this period were CNY4.526 billion (USD666.6 million), an

increase of 146.4% year on year (y/y) and 21.7% quarter on quarter

(q/q). (IHS Markit AutoIntelligence's Abby Chun Tu)

- NIO's vehicle sales revenues totaled CNY4.2668 billion in the third quarter, up 146.1% y/y and 22.4% q/q.

- The company's vehicle sales margin was 14.5% in the quarter, compared with -6.8% in the third quarter of 2019 and 9.7% in the second quarter of 2020.

- The company recorded a gross profit of CNY585.8 million in the third quarter, compared with a gross loss of CNY221.6 million in the third quarter of 2019 and a gross profit of CNY313.1 million in the second quarter of 2020.

- NIO's net loss stood at CNY1.047 billion in the third quarter, representing a decrease of 11.0% from the second quarter. Cash and cash equivalents, restricted cash, and short-term investment totalled CNY22.2 billion as of 30 September.

- Research and development (R&D) expenses stood at CNY590.8 million in the third quarter, representing a decrease of 42.3% y/y and an increase of 8.4% q/q.

- The company said that the drop in its R&D expenses compared with the same quarter of 2019 was mainly because of a high base of comparison due to high costs related to the development of its EC6 and all-new ES8 in the third quarter of 2019. NIO also stressed that it has made an attempt to improve operational efficiency in its R&D functions since the fourth quarter of 2019 as part of its cost-saving efforts.

- NIO's vehicle deliveries continued to increase during the third quarter of 2020. The automaker delivered 12,206 vehicles in the period, comprising 8,660 ES6 models, 3,530 ES8 models, and 16 EC6 models. By comparison, only 4,799 vehicles were delivered in the same quarter of 2019 and 10,331 vehicles were delivered in the second quarter of 2020.

- NIO has set its delivery target for the fourth quarter of 2020 at between 16,500 and 17,000 units. The company expects its revenue to increase by up to 42.2% q/q to CNY6.4358 billion in the fourth quarter.

- NIO aims to record its highest deliveries in the current quarter, having set a target of between 16,500 and 17,000 vehicles. According to the company's sales report for October, it delivered 5,055 vehicles to customers last month, a new monthly record since it began deliveries in mid-2018.

- Autonomous vehicle (AV) simulation startup MORAI has raised USD1.8 million in a Series A funding round. The financing round involves participation from new investors including Kakao Ventures and Korea Credit Guarantee Fund as well as existing investor Naver D2SF. The company will use the infused capital to develop and scale its simulation platform, which is built for the verification and validation of AVs. Jiwon Jung, CEO and co-founder of MORAI, said, "That some of the leading IT companies in Korea have joined us and now share our vision of safety is a great motivator. We plan to continue accelerating our growth, while focusing on further developing our technology and building a product that can help make safe autonomous vehicles a reality." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ride-hailing firm Gojek has secured USD150 million in investment from Indonesian network service provider Telkomsel. This partnership will enable Gojek to benefit from Telkomsel's 171 million subscribers in the Southeast Asia region, and Telkomsel to expand its digital telco position. As part of the partnership, the two firms will explore a broad range of collaboration opportunities "designed to capitalize on the combined scale of both businesses to reach millions of Indonesians throughout the archipelago". Andre Soelistyo, co-chief executive of Gojek, said, "Gojek has always looked up to successful homegrown technology businesses such as Telkomsel and this agreement signifies a real vote of confidence in our platform model and reach in Indonesia and throughout the region". Telkomsel has been reported as being in talks with Gojek on the matter since August. Telkomsel's parent company, Telkom Indonesia, had previously planned to invest USD400 million in Gojek in 2018. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-november-2020.html&text=Daily+Global+Market+Summary+-+18+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-november-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 18 November 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+18+November+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}