Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 17, 2020

Daily Global Market Summary - 17 November 2020

Equity markets closed mixed across APAC, Europe, and the US. US and European benchmark government bonds closed higher, while iTraxx and CDX indices ended their sessions close to flat across IG and high yield. Crude oil closed higher, while the US dollar, Brent, gold, and silver were all lower on the day.

Americas

- Most US equity markets closed lower except for the Russell 2000 +0.4%; DJIA -0.6%, S&P 500 -0.5%, and Nasdaq -0.2%.

- 10yr US govt bonds closed -4bps/0.86% yield and 30yr bonds -6bps/1.61% yield.

- CDX-NAIG closed +1bp/53bps and CDX-NAHY +1bp/329bps.

- DXY US dollar index closed -0.2%/92.44.

- Gold closed -0.1%/$1,885 per ounce and silver -0.6%/$24.65 per ounce.

- Crude oil closed +0.2%/$41.43 per barrel.

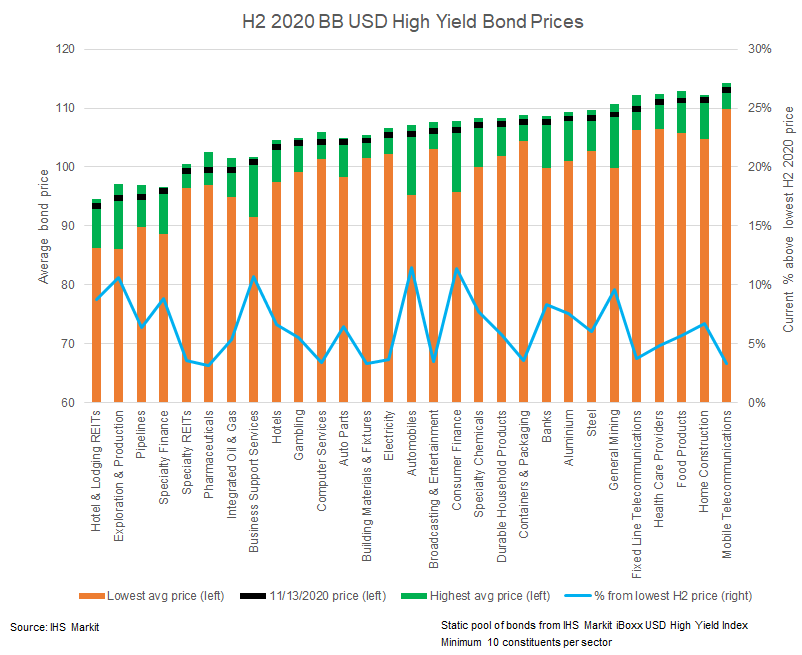

- The below chart shows the average current, minimum, and maximum

bond prices during the second half of 2020 (as of 13 November) and

the percent the current price is above the lowest price during the

period for a static pool of BB-rated bonds from the IHS Markit

iBoxx High Yield USD Corporate Bond Index. The chart highlights

that the BB-rated hotel & lodging REITs average bond price is

currently the lowest at 93.86 and the automobile sector has

increased the most (+11.4%) from the lowest average price of

95.20.

- About 300 companies that received as much as half a billion dollars in pandemic-related government loans have filed for bankruptcy, according to a Wall Street Journal analysis of government data and court filings. Many of the companies, which employ a total of about 23,400 workers, say the funds from the Paycheck Protection Program weren't enough to keep them going as the coronavirus and lack of additional stimulus payments weighed on their businesses. The Journal only analyzed the big borrowers from the program, which accounted for about half of the overall loans though only about 13.5% of the total participants. And many small businesses simply liquidate when they run out of cash rather than file for bankruptcy. (WSJ)

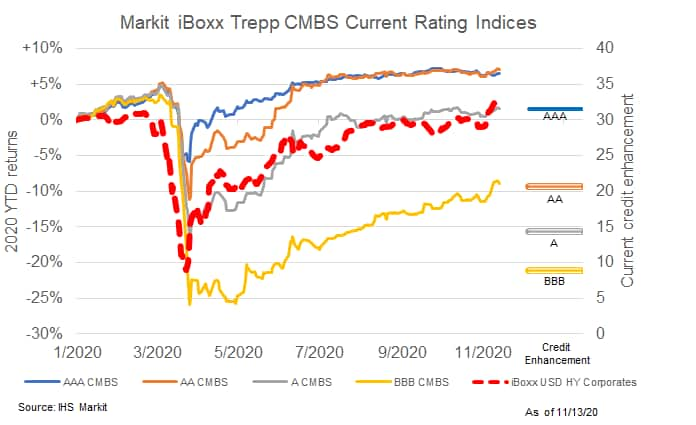

- The chart below shows that AA-rated CMBS (average credit

enhancement of 20.6%) is the best performing current rating

category across the IHS Markit iBoxx Trepp CMBS Current Rating

Indices, returning +7.11% year to date (YTD) as of 13 November. The

current BBB-rated index (average credit enhancement of 8.9%) is the

worst performer at -8.97% YTD. It's worth noting that the A-rated

index has been closely tracking the IHS Markit iBoxx High Yield

Index and is currently outperforming the high yield indices by 2bps

at a +1.55% YTD total return.

- Total retail trade and food services sales edged up 0.3% in

October, a downshift from the 1.6% gain in September.

Stronger-than-expected core retail sales through October resulted

in a 1.8-percentage-point upward revision to our fourth-quarter

forecast of real personal consumption expenditures (PCE) growth,

from 3.4% to 5.2%. (IHS Markit Economists James Bohnaker and David

Deull)

- Nonstore retail sales (mostly online) rose 3.1% from an already-elevated level, bringing the 12-month gain to 29.1%. Some of this strength was due to Amazon Prime Day moving from its usual July calendar slot to October this year; many retailers are encouraging early holiday shopping to avoid a last-minute delivery rush. After seasonal adjustment, we may see declines in nonstore sales over November and December.

- Several other outperforming categories continued to do well. Motor vehicle and parts dealers enjoyed another positive month with a sales increase of 0.4%, stepping the 12-month gain up to 10.7%. Elevated demand for home improvement was evident with building material and garden supply stores seeing a 0.9% increase in October to move sales up 19.5% over 12 months.

- The food services industry may have reached an inflection point in its recovery, as sales at restaurants and bars edged down 0.1%. Cooler weather and restrictions on indoor dining will likely limit activity over the winter.

- Retail sales beat our expectations in October but we believe a slowdown is imminent. An unmitigated rise in COVID-19 cases and resulting containment measures are the primary reasons. Without additional stimulus, consumers are unlikely to maintain the current pace of spending on large durable goods.

- Total industrial production (IP) rose 1.1% in October, about as

expected. Growth over recent months was revised higher. The

headline increase in October reflected increases in manufacturing

(1.0%) and utilities (3.9%), partially offset by a small decline in

mining (0.6%). (IHS Markit Economists Ben Herzon and Lawrence

Nelson)

- The details in this report that inform our GDP tracking were, on balance, slightly stronger than we had assumed. However, unseasonably mild temperatures so far in November led us to lower our estimates of personal consumption expenditures (PCE) on electric and gas utilities for November and the fourth quarter. The net effect was a downward revision to our forecast of fourth-quarter GDP growth of 0.1 percentage point to 4.4%.

- Total industrial production has come a long way from a low reached in April. From April through October, increases in total IP have reversed two-thirds of the pandemic-induced decline.

- Much of the recovery to date has reflected essentially a full recovery in IP of motor vehicles and parts. The pace of output in most other industries has yet to recover pre-pandemic levels.

- The monthly profile of total IP is one of rapid growth over June (6.0%) and July (4.2%) followed by a sharp slowdown since. From August through October, IP rose at an average monthly rate of 0.5% per month.

- This slowing profile is consistent with our forecast of a sharp slowing in GDP growth from our estimate of 34.0% in the third quarter to 4.4% in the fourth quarter (both expressed at annual rates).

- The recent surge in new COVID-19 infections in the US and the

possibility that state and local governments could materially

re-engage containment efforts pose some downside risk to this

forecast.

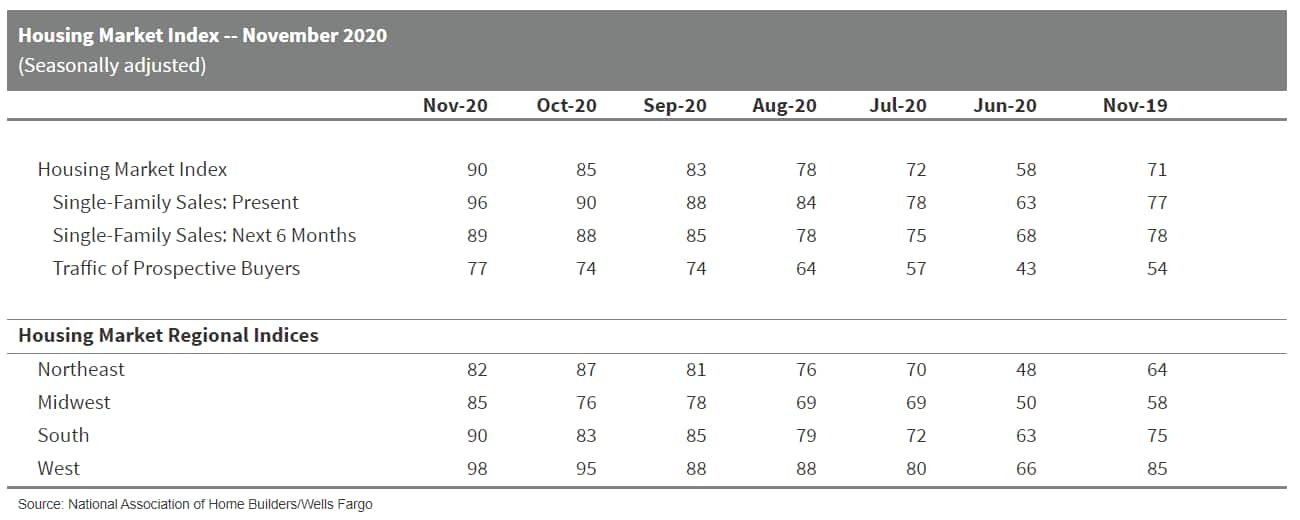

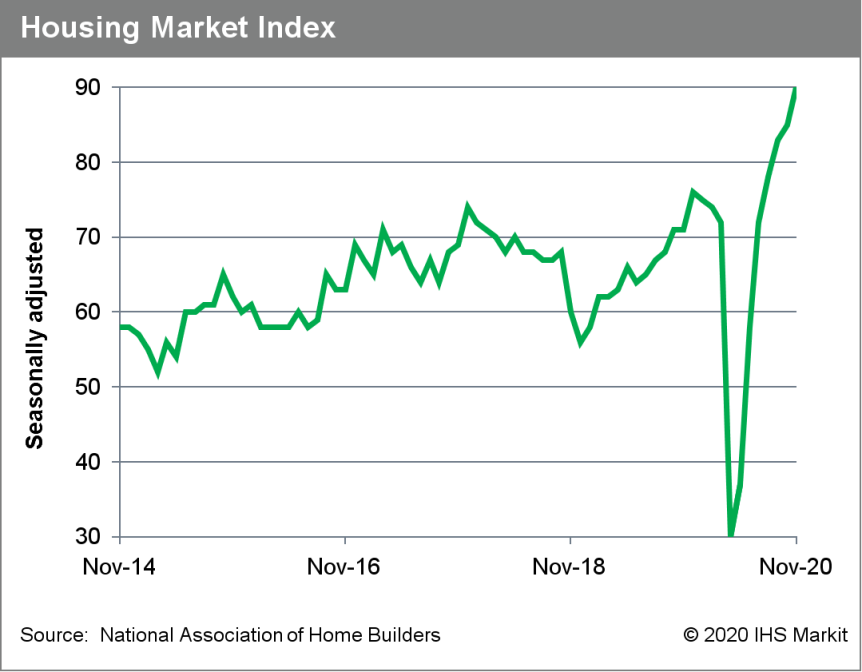

- In April, the US housing market index and its three sub-indexes

plunged to record lows. In October, all four indexes set or tied

record highs. In November, all four indexes exceeded the October

record high. Why the historic reversal? Part of the story is

mortgage rates dropping to all-time lows; another is that social

distancing is possible in building homes; a third is bidding wars

brought about by record-low interest rates and inventories, and

pent-up demand from bidders displaced from the market earlier this

year. And a fourth, perhaps pivotal—but hard to measure—is

demand from those working remotely because of the pandemic wanting

to relocate. (IHS Markit Economist Patrick Newport)

- The headline index increased five points to 90—the highest reading in its 35-year history. A reading above 50 says that more builders view conditions as good rather than poor.

- All three sub-indexes set record highs. The current sales conditions index climbed six points to 96, the index measuring sales prospects over the next six months rose one point to 89, and the traffic of prospective buyers' index climbed three points to 77.

- All four regions set monthly three-month average record highs. The West ranked highest with a score of 94, followed by the South (86), the Northeast (83), and the Midwest (70).

- The report usually highlights an issue. This month's: "Though builders continue to sign sales contracts at a solid pace, lot and material availability is holding back some building activity. Looking ahead to next year, regulatory policy risk will be a key concern given these supply-side constraints." The report also noted that the National Association of Home Builders (NAHB) expects interest rates and construction costs to go up as the pandemic is brought under control.

- Despite these burning numbers, we believe that the recent strength in the single-family market for new construction is temporary and that housing starts will overshoot their long-run trend over the next three quarters before dipping and stabilizing to a level set by increases in the number of households.

- Frito-Lay survey projects 300% increase in online shopping for holiday foods. As they prepare for the holiday season, as many as half of US consumers plan to purchase their groceries online - a steep increase from 15% who shopped online in 2019, according to the latest edition of Frito-Lay North America's US Snack Index survey. The survey polled more than 2,200 US adults October 16-18 and found that concerns over the COVID-19 pandemic are increasingly pushing US shoppers to shop for food online, shop early for holiday food items and add more snacks to their shopping lists. Maintaining health and safety is a top concern for more than a third of US shoppers (37%) and that is the main force driving consumers to online grocery shopping channels, the survey found. According to the survey, the average content of US grocery shoppers' online baskets is up 32% over last year's and three-quarters of consumers intend to repeat purchases from their most recent online grocery provider in the next 30 days. The pandemic has also caused a shift in in-person shopping as more consumers now are buying groceries during the workweek, the survey found. With respect to online groceries, snacks are the most likely category to be purchased online for the holidays and 77% of survey participants indicated they plan to get their snacks online. "Consumers have shifted their behavior with 58 percent snacking more since COVID-19, and shopping through new channels with online adoption up 40 percent," said Mike Del Pozzo, senior vice president of sales and chief customer officer at Frito-Lay North America. And while the Thanksgiving holiday gatherings are expected to be smaller, the majority of consumers (83%) plan to spend as much or more than they did on their Thanksgiving meal last year, the survey found. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- Canada's province of Quebec has announced a new 2030 Plan for a Green Economy (2030 PGE), which includes prohibiting the sale of gasoline (petrol)-powered vehicles from 2035, as well as targeting 1.5 million electric vehicles (EVs) on the road by 2030 and increasing government purchases of EVs. The 2030 PGE is a multilayered, multi-year program and does include government investment of CAD6.7 billion from 2021 to 2026 for the first phase of the implementation plan; CAD3.6 billion is earmarked for the transportation sector. A statement released by the provincial government reads, "With the 2030 PGE, the government is laying the groundwork for a green economic recovery and reiterating Québec's commitment to reduce its greenhouse gas (GHG) emissions by 37.5% below 1990 levels by 2030. In so doing, it is charting the course that will lead Québec to carbon neutrality in 2050." Quebec expects its "ambitious electrification and climate change project" will add CAD2.2 billion to Quebec's GDP in 2030 and create more than 15,500 new jobs. In addition to the CAD3.6 billion planned for the transportation sector, the province aims to invest CAD15.8 billion into public transportation from 2020 through 2030, including electrification of light trains, city and school buses, taxis, cars and trucks. Measures Quebec intends to take include renewing rebates for individuals buying or leasing EVs or charging stations, as well as support programs for businesses and the taxi industry. By 2030, Quebec aims to have 100% of its cars, vans and sport utility vehicles (SUVs) and 25% of its light trucks run on electricity by 2030. Quebec has also said that it will raise the requirements of the standard on zero-emission vehicles to encourage manufacturers to supply the Quebec market with a greater number of vehicles and a greater variety of models. (IHS Markit AutoIntelligence's Stephanie Brinley)

- In October, light-vehicle sales in Mexico continued to decline y/y on COVID-19 impacts, although the situation has improved since April. However, as the US looks to replenish inventories, production (up 8.8%) and exports (up 8.2%) increased y/y in October. In the YTD, all metrics are down from the same period of 2019. In addition, production of passenger cars continues to decline as LCV production improves. Mexico's light-vehicle sales declined in 2018 and 2019, and started off 2020 soft prior to the COVID-19 pandemic. In October, light-vehicle demand continued its double-digit percentage y/y decline, although continued to be better than in prior months since the COVID-19 virus outbreak. The year-to-date results are still down by 29.6% y/y. Our October forecast revision sees the country's full-year 2020 light-vehicle sales falling 27.2% to 934,498 units. IHS Markit also sees production in Mexico slipping to 3.00 million units in 2020, compared with 3.82 million units in 2019. The forecast decline in production is not as steep as expected at earlier points of 2020. (IHS Markit AutoIntelligence's Stephanie Brinley)

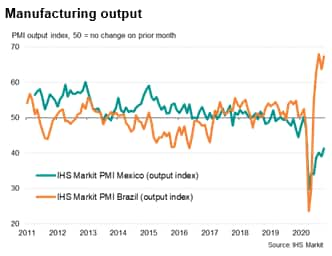

- Although the JPMorgan Global Manufacturing PMI, compiled by IHS

Markit from its proprietary business surveys, rose from 52.4 in

September to 53.0 in October, its highest since May 2018, the

recovery of the manufacturing sector has by no means been

universal. Of the 31 countries covered by the surveys, factory

output rose in 22 but fell in nine during October. However, most

striking is the divergence between the two countries which have sat

at opposite ends of the PMI ranking table in recent months: Brazil

and Mexico. (IHS Markit Economist Chris Williamson)

- In the three months to October, the manufacturing PMI output index for Brazil has averaged 66.4, surpassing any rate of expansion seen since the survey began back in 2006 by a wide margin. By comparison, the output index for Mexico has averaged just 40.2 over the same period, indicating a contraction of production the severity of which has been exceeded over the past decade only by that seen at the height of the pandemic earlier in the year.

- The divergent performance is also reflected in the official data, which are only available with a delay compared to the PMI and hence only currently show the situation up to September. However, these data already indicate that output in Brazil had risen 2.5% above levels of a year ago whereas output in Mexico continued to run some 5% below September of last year, corroborating the divergent trends signaled by the PMI surveys.

- One index that has shown in interesting divergence has been the survey gauge of new export orders. While exports have now returned to growth for two consecutive months in Brazil, rising in October to the greatest extent seen in the 14-year history of the PMI survey, Mexico's exports continued to fall at a rate only exceeded over the past decade by the decline seen at the height of the pandemic. Brazil's superior export performance likely in part reflects the depreciation of the real, which has plunged by around 35% against the US dollar since earlier in the year; a far greater fall than the 13% drop seen for the Mexican peso.

- Importantly, not only has the currency fall made Brazil's

imports more competitively priced in foreign markets, the weakened

exchange rate has also raised the cost of imported goods, which has

led to import substitution as buyers favor cheaper domestically

sourced goods. Domestic demand consequently appears to have also

benefited, with overall new orders growth in Brazil running far

ahead of that seen for just export orders. The opposite is apparent

in Mexico, where domestic demand appears to be acting as a drag on

manufacturing alongside falling exports.

- Peru's National Institute of Statistics and Information

(Instituto Nacional de Estadística e Informática) reports that the

monthly production index grew at a seasonally adjusted rate of 1.5%

on a month-on-month (m/m) basis in September 2020. (IHS Markit

Economist Jeremy Smith)

- After averaging a 10.2% m/m growth from May to July, output rose just 2.5% in August and further slowed to 1.5%, leaving the production index down -11.5% year on year (y/y) with considerable loss in momentum.

- This pattern has been even more pronounced in the labor market, where employment growth slowed dramatically from an average of 28.3% m/m in the moving quarters ending in July and August to 3.6% in the moving quarters ending in September and October. As of October, employment in the Lima metropolitan area remains 23.1% below the peak in January, and the unemployment and underemployment rates stand at 16.4% and 45.2% respectively.

- Sector-specific recovery has been uneven. Cumulative through September, the sectors contributing the most to the year-on-year decline in production are wholesale and retail (-2.37 percentage points), manufacturing (-2.14 percentage points), and mining and hydrocarbons (-2.05 percentage points). The sectors making the greatest positive contribution to growth have been finance and insurance (0.64 percentage point), driven by rapid credit expansion; and telecommunications (0.21 percentage point), fueled by an increase in mobile phone and internet activity.

- Slowing recovery in production and employment continues to be in line with our expectation that the rebound effects of Peru's economy reopening are fading. Our overall growth forecast for 2020 is -12.58%, followed by an 8.74% growth in 2021.

Europe/Middle East/Africa

- European equity markets closed mixed; Italy +0.6%, France +0.2%, Germany flat, Spain -0.7%, and UK -0.9%.

- 10yr European govt bonds closed higher across the region; UK -3bps and France/Italy/Spain -2bps.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover +1bp/286bps.

- Brent crude closed -0.2%/$43.75 per barrel.

- With the UK government apparently looking to accelerate its

original deadline for the banning the sale of pure internal

combustion engine (ICE) vehicles from 2035 to 2030, Chancellor of

the Exchequer Rishi Sunak has something of a problem. The United

Kingdom has one of the world's highest rates of light vehicle (LV)

taxation and indeed among the Organisation for Economic Development

and Cooperation (OECD) group of countries it has the highest, with

the current fuel duty for gasoline (petrol) and diesel 57.35 pence

per liter. (IHS Markit AutoIntelligence's Tim Urquhart)

- The average national UK price for a liter of gasoline currently stands at GBP1.14, so the UK exchequer currently takes almost exactly half the value of a tank of gasoline at the pumps. So if it takes around GBP100-120 to fill the tank on a larger sport utility vehicle (SUV), the government takes GBP50-60 of that figure every time that vehicle is filled up.

- With a current UK light-vehicle parc 36.1 million which translates to a density of 532 cars per thousand people in the country, the UK government generates significant revenue from fuel taxation; GBP28 billion in 2019, or around 1.3% of total tax receipts, according to the institute of fiscal studies. That may not sound like a great deal but if it were to rapidly to disappear it would have to be sourced from other areas of taxation, especially at a time when there is significant pressure on public finances as a result of furlough programs and other public stimulus efforts in response to the COVID-19 virus pandemic.

- The proposed acceleration of the deadline for banning ICE passenger car sales from the already aggressive target of 2035 to 2030 requires a solution from the UK government to plug the hole in the public finances that will result from losing fuel duty income.

- The issue of the move to electrification, which is a major component for many global governments' plans to meet Paris Agreement emissions, is not a straightforward one for those governments that take a relatively high percentage of overall tax from fuel duty.

- One of the main pull factors for consumers is that it is hugely cheaper to charge an EV than it is to fill the tank of an ICE car and governments do not want to directly put extra tax burdens on BEVs to replace loss fuel duty as this will make them less attractive.

- The first tower has been installed on the world's largest floating wind farm. MHI Vestas confirmed the installation of the first of five V164 9.5 MW turbines at the installation harbor of the Kincardine floating offshore wind farm. The turbines are sitting on WindFloat semisubmersible foundations designed by Principle Power. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Germany's Federal Statistical Office (FSO) data show that total

German employment in the third quarter was at 44.644 million, down

slightly further from the second quarter's 44.692 million and down

648,000 from year-ago levels, a decline of 1.4% year on year (y/y).

This compares with a 1.0% average annual gain during 2010-18, and

it is far greater than the aggregate employment setback of about

200,000 (-0.5%) during March-July 2009 triggered by the recession

due to the GFC. (IHS Markit Economist Timo Klein)

- In seasonally adjusted terms, employment increased by 63,000 or 0.14% versus the second quarter, which matches the average quarterly gain during 2019 but falls short of the long-term average of 0.27% quarter on quarter (q/q) during 2010-18. Separate monthly data show that the rebound started in July already.

- The breakdown by sector shows - as in the second quarter - that the only sectors spared from y/y declines in the third quarter were information and communications, public services/education/health, and construction. Compared with third quarter of 2019, employment suffered the most in manufacturing, agriculture, business services, and "other services".

- The COVID-19 virus crisis had hit the hours worked around six times more severely than employment in the second quarter (-8.9% y/y vs -1.3% y/y), therefore these recovered more strongly in the third quarter than employment did.

- The annual gap for hours worked shrunk to -4.0% y/y as the use of short-time work schemes was scaled back. This applies even more to hours worked per employee, which recovered from -7.7% y/y in the second quarter to -2.6% y/y in the third quarter. This demonstrates the usefulness of Germany's short-time work scheme, as companies were able to retain skilled workers during the crisis, thus enabling them to cope better with the upcoming structural shortages linked to retiring baby boomers.

- The dichotomy between dependent employees (-1.2% y/y) and the self-employed (-4.1% y/y) is more extreme than ever. This extends a trend that already began in late 2012. Self-employment had temporarily seemed to head towards stabilization during 2017 but has deteriorated anew since early 2018, and the pandemic has reinforced the worsening tendency as the self-employed cannot benefit from the short-time work scheme.

- Germany's employment should move broadly sideways in the coming months as the current second wave of the COVID-19 virus pandemic prevents a broad-based employment recovery for now, especially in the service sector. There is support from manufacturing, which benefits from recovering exports (notably to China), and from relatively resilient consumer spending, which is also linked to the financial and psychological support provided by the short-time work scheme. A structurally strong construction sector is also helpful.

- The number of new infections in the Netherlands declined by 14% last week from the previous seven days, slower than the 32% decline the week before, according to health agency RIVM. In the week ending Nov. 17, 37,706 infections were confirmed, down from 43,621. The number of reported hospital admissions also fell. Dutch Prime Minister Mark Rutte and Health Minister Hugo de Jonge are set to host a press briefing later on Tuesday. (Bloomberg)

- A survey carried out in five selected EU countries shows that the public demands better labelling of everyday products containing nanomaterials, including food and drink, as well as more information on the risks and benefits of consuming products containing nanomaterials. The study, commissioned by the EU Observatory for Nanomaterials (EUON), measured and analyzed how people in Austria, Bulgaria, Finland, France and Poland perceive nanomaterials and their potential risks to our health and the environment. It found that despite manufactured nanomaterials being a common part of our everyday lives, general awareness about their nature, characteristics and properties is low. However, the level of awareness has increased compared to earlier surveys and is expected to continue increasing in the future. The study identified some concerns over the safety of some established and newer applications of traditional and more advanced nanomaterials. The general risk perception of nanomaterials was nevertheless lower than for other modern trends and technologies. The results confirm that concerns often correlate with a lack of awareness of nanomaterials. People who know more about nanomaterials tend to be less concerned about the safety of using them in everyday products. The majority (87%) of study respondents want to know if the product they are buying contains nanomaterials, principally through labelling. This particularly holds true for food and food-related products, such as packaging or other food contact materials. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Statistics Norway reports total real GDP (mainland economy plus

petroleum activities, pipeline transport, and ocean transport)

rebounded by 4.6% quarter on quarter (q/q) in the third quarter,

revised from an initially reported 5.1% q/q drop. This was preceded

by the whole economy contracting by 4.7% q/q in the second quarter,

the sharpest drop since the series began in 1978. (IHS Markit

Economist Raj Badiani)

- The mainland economy posted a stronger rebound up by 5.2% q/q in the third quarter following a 6.0% q/q drop in the second.

- A breakdown of mainland GDP shows that the arts and entertainment industries and accommodation and food services recovered during the third quarter after enduring unprecedented drops in activity in April and May.

- The easing of the coronavirus disease 2019 (COVID-19) containment measures led to solid growth in May and June, but the pace of recovery appeared to slow through the latter stages of the third quarter.

- Specifically, mainland Norway's GDP rose for the fifth straight month when declining by 0.6% month on month (m/m) in September. Nevertheless, the level of activity in September was still close to 3% lower than in February, the pre-pandemic level.

- The expenditure breakdown reveals household consumption was the main engine of growth during the third quarter (see chart below). Specifically, it grew by 9.6% q/q during the third quarter, clawing back most of the 10.5% q/q loss in the second quarter.

- The consumption of goods rose by 6.0% q/q during the third quarter and was 10% higher than its level in the final quarter of 2019. Meanwhile, the consumption of services increased by 12.4% over the same comparison in line with the gradual reopening of businesses in the second quarter, as well as further easing of restrictions during the third.

- Mainland investment activity continued to be squeezed during the third quarter, falling by 0.4% q/q to remain 7.5% lower than a year ago. Statistics Norway argues that the COVID-19 shock has diminished the appetite to invest, alongside the completion of many large investment projects within the manufacturing and electricity power generation industries during 2019.

- Fixed investment in the crude oil and natural gas extraction and transport via pipeline sectors has fallen notably in the first three quarters of 2020, and was down by 4.6% q/q in the third quarter.

- Net exports were a drag on the pace of the GDP rebound during the third quarter. Total exports of goods and services grew 5.0% q/q in the third quarter, primarily led by strong natural gas sales. Meanwhile, imports jumped higher, rising by 10.3% q/q in the third quarter but still remained well below its level in February.

- Statistics Norway reports broad-based improvement across the main industrial sectors during the third quarter. Service industries output declined notably in April and May before reporting the strongest recovery during the third quarter (up by 5.5% q/q). Nevertheless, the sector's output remained below its pre-pandemic level in February.

- Industries reporting more modest declines during the toughest phase of the COVID-19 restrictions, such as manufacturing, construction, and education all reported more limited output gains during the third quarter, but all trailed their February levels.

- The positive surprise was again the extraction of crude petroleum and natural gas, which rose by almost 2% between the second and third quarters and stood 5% above the level from February. Statistics Norway reports that natural gas production increased by just over 15% y/y to 55.2 million standard cubic meters of oil equivalents during the third quarter.

- Norwegian GDP losses in 2020 are likely to be lower when compared with elsewhere in Europe

- According to our November forecast, the Norwegian economy is set to contract by 3.8% in 2020, but this is likely to be revised after GDP developments in the third quarter were stronger than expected.

- Estonia-based ride-hailing service Bolt has announced that it will invest over EUR100 million (USD118 million) in micro-mobility in 2021. The company plans to deploy 130,000 scooters to more than 100 European cities in 2021. Markus Villig, CEO and co-founder of Bolt, said, "Our cities are suffering from traffic, emissions and lack of public space caused by parking. We believe that the future of urban transport is a network of on-demand services — ride-hailing, electric scooters, bikes and other light vehicles. The days where every person needs to buy a car are over." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- On 13 November, Bloomberg reported that Nigerian President

Muhammadu Buhari had signed into law an amended banks and other

financial institutions bill (BOFI). The bill intends to introduce a

credit tribunal with the aim to improve loan recovery and establish

a fund to support failing or distressed lenders. The Central Bank

of Nigeria (CBN) is expected to contribute NGN10.0 billion (USD26.2

million) yearly, and the Nigerian deposit insurer NDIC is to

contribute NGN4.0 billion. Commercial banks and other lenders are

expected to pay annually 10 basis points of their total assets into

the fund, and lenders will not be allowed to pay dividends if they

fail to contribute. (IHS Markit Banking Risk's Ana Souto)

- The introduction of the credit tribunal to speed up loan recoveries is credit positive, given that banks are battling with asset quality problems because of the country's economic issues following the outbreak of the coronavirus disease 2019 (COVID-19) virus and plunge in oil prices in March-April.

- Although the non-performing loan (NPL) ratio has been reducing since September 2017 from 15.1% to 6.4% in June 2020, the Nigerian banking sector has implemented forbearance measures since the global decline in oil prices in 2014; as a result, the sector holds a large proportion of restructured loans mostly in the oil and gas sector, which likely masks the true levels of problem loans in the banking sector and limits IHS Markit's ability to accurately assess the risk that bad loans present to capital buffers.

- The creation of the resolution fund will support stability in the sector as it will prevent small and medium banks that are more vulnerable to the current economic situation from failing, given that their business model relies heavily on borrowing to the low-income segment.

- However, banks' contribution to the fund will put additional pressure on the sector's earnings at a time when banks' earnings are already under pressure because of a reduction in loan growth, lower interest rates, and higher provisions.

- As per IHS Markit's Coal, Metal and Mining database, during

week-46, RB 6000 NAR, RB 5700 NAR, RB 5500 NAR and RB 4800 NAR

thermal coal prices stood at $67.05 (up 9% w/w), $60.40 (up 6%),

$49.66 (up 4%) and $38.37/t (up 6%), respectively. Apart from

increased demand for RB coal from the Indian sponge iron industry,

there has been a surge in demand from China (Mainland) which

significantly contributed to the recent surge in RB coal prices.

China had stopped importing South African coal way back in 2015 on

trace elements issue. (IHS Markit Maritime and Trade's Rahul Kapoor

and Pranay Shukla)

- Indian steel mills commenced exports of semi-finished steel products to China (Mainland) in small quantities from September last year. However, shipments accelerated from June 2020 as Chinese steel mills found it economical to buy cheap semis from the Indian mills. Even after COVID-19 related restrictions were relaxed in India, leading to an increase in domestic demand, Indian mills continued to export semis to China (Mainland).

- Chinese steel mills continued drive to buy semi-finished steel products from India has indirectly benefitted South African coal. Indian sponge iron producers buy South African coal due to its high fixed carbon versus coal from other origins. As per IHS Markit's GTA, imports of semi-finished steel products into China (Mainland) during the nine months of this year stood at 13.6mt versus just 1.2mt in the previous year. The top three origins of imported semi-finished products (HS Code 7207) into China (Mainland) were Russia (20% share), India (19%), and Vietnam (15% share).

- India's sponge iron industry appetite for RB coal has remained strong as the country moved into high demand season domestically in addition to exports of semis to China (Mainland). Sponge iron prices in India (ex-Raipur) in the last one month have increased 20% to year high level of INR 24,500/ton (USD 329/ton, USD/INR ~74.51).

- As per IHS Markit's Commodities at Sea, during week 46, RBCT coal shipments increased to 1.6mt (6.9mt on a 30-day basis) versus 1.4mt (5.8mt on a 30-day basis) a week before. TFR railings during the reported period increased to 1.4-1.5mt levels versus 1.3-1.4mt a week before. Thermal coal stocks at the Richards Bay Coal Terminal (RBCT) are presently standing at 4.2-4.3mt (versus 4.1-4.2mt a year ago

Asia-Pacific

- APAC equity markets closed mixed; India +0.7%, Japan +0.4%, Australia +0.2%, Hong Kong +0.1%, and Mainland China/South Korea -0.2%.

- An outage that forced the Australian Securities Exchange (ASX) to first pause and then abandon trading on Monday has been traced to a software bug on its refreshed equity trading platform. In a statement apologizing for the market disruption, the exchange blamed the outage, which began shortly after the exchange opened at 10am, on "software issues". (iTnews)

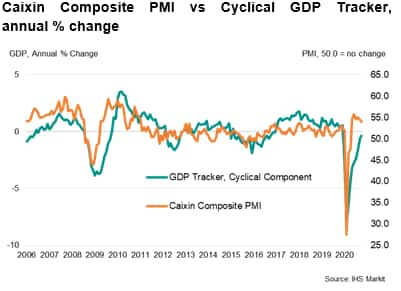

- Prior to the global pandemic, China's GDP growth figures

exhibited a noticeable degree of stability, with underlying growth

tending to ease in a gentle and broadly predictable pattern over

the decade leading up to the start of 2020. In contrast, higher

frequency indicators - such as the Caixin China Composite PMI

(compiled by IHS Markit) and, for that matter, many official data

statistics - have described more typical cyclical changes in

economic activity, for example indicating slowdowns in growth in

2015 and 2018. With little cyclicality apparent in the official

headline GDP growth statistics, in response - and as a means of

providing timelier and higher frequency estimates of changes in GDP

- there is a growing literature on alternative ways to track

economic performance in China. Two such approaches have been

undertaken by the San Francisco Federal Reserve Bank and the New

York Federal Reserve Bank. (IHS Markit Economist Paul Smith)

- There has been a notable development during recent years in the scope and range of economic indicators available for China. From these available data sources, we pick 12 that appear particularly useful in tracking economic activity. These include indicators of electricity production, industrial production, household consumption, freight traffic, trade and investment*. Note that the PMI survey data have been excluded as one of the intentions is to compare the performance of the new indicator against our own PMI, and to thereby create an time series against which PMI data can be more accurately benchmarked than GDP.

- To translate our derived monthly indicator into comparable annual GDP growth rates we have also constructed a 'pseudo' monthly GDP series from the official quarterly GDP data. Using interpolation techniques to estimate a monthly time-series from the quarterly GDP figures, this series is also detrended and the cyclical component extracted. Linking this series to the first principal component of our high frequency indicators through linear regression provides us a new series of year-on-year growth estimates based on the set of alternative indicators.

- Whilst not directly comparable with each other - PMIs tend to measure underlying changes in activity as opposed to the year-on-year growth rates indicated by the GDP tracker, which is why the PMI figures sometimes have a noticeable lead - the positive relationship between the cyclical component of GDP and the Caixin Composite PMI reinforces the usefulness of the business survey data in understanding short-term economic developments.

- Taking the latest signal from the monthly data shows that the

economy was growing at a year-on-year rate of just below 5.0%

during October, signaling a positive start to the fourth quarter of

2020 - albeit one below pre-pandemic trends as the recovery in

consumption continued to lag that seen in industry.

- Volkswagen (VW) has begun production of the APP 310 electric drive at its Chinese component factory in Tianjin. The permanent magnet synchronous motor can deliver an output of up to 150 kW with a maximum torque of 310 Nm, according to the automaker. The component will be used in the VW ID.4 variants introduced in China, the ID.4 CROZZ and ID.4 X produced by the automaker's joint ventures (JVs), FAW-VW and SAIC-VW. Electric drives produced at the Tianjin plant will supply the VW Group's future models for the Chinese market. VW's component factory in Kassel (Germany) currently produces the APP 310 motor for MEB-based models in Europe and North America. The two sites are said to have installed capacity of 880,000 electric drives per year. VW expects to expand the production capacity for electric drives to 1.4 million electric drives through its subsidiary, Volkswagen Group Component (VGC), as early as 2023. VW's Tianjin plant has been primarily engaged in production of transmissions for VW Group vehicles since 2014. The start of production of the APP 310 drive in Tianjin is laying another milestone in the Group's transition to electrification. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Denso has invested for unspecified stake in Envoy Technologies, an electric vehicle (EV) mobility startup that offer services to the commercial real estate (CRE) industry. This investment will allow Denso to offer mobility-as-a-service to businesses and will provide Envoy the ability to scale with its products and services. Yoshifumi Kato, a senior executive officer at Denso, said, "As mobility needs change, Denso continues to change along with them. Collaborating with Envoy allows us to combine our expertise in electrification and fleet management with their knowledge of commercial real estate, helping us both improve mobility for businesses so they can accomplish their goals more seamlessly." Envoy Technologies was founded in 2017 to offer electric cars-haring and EV charging services to CRE industry. The company is currently available in 14 markets across 10 states in the US including California, Washington, New York, and Virginia. Meanwhile, Denso noted that the mobility industry has evolved rapidly over the last decade, with new technologies such as internet of things (IoT) and artificial intelligence (AI) affecting the development of the automotive industry. Denso has invested in multiple mobility companies including MaaS Global, a Finland-based developer of all-in-one mobility app Whim and Bond Mobility, which offers micromobility services. This year, Denso collaborated with the Tokyo Institute of Technology (Tokyo Tech) to establish a mobility research center in the Ookayama campus of the institute. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The contraction of Thailand's real GDP softened to 6.4% year on

year (y/y) in the third quarter of 2020, following a 12.1% decline

in the previous quarter. The improvement largely reflected a softer

decline in private consumption and continued increases in

government consumption. Private consumption fell by 0.6% y/y,

softening from a 6.8% y/y drop in the previous quarter. This was

largely because of improved spending on vehicles, transportation

services, and recreation and culture - reflecting the easing

containment measures and the government's stimulus measures,

including a domestic travel campaign. Government expenditure also

continued to increase, moving up 3.4% after a 1.3% rise in the

previous quarter. (IHS Markit Economist Harumi Taguchi)

- Fixed investment continued to decline but the y/y contraction narrowed to 2.4% y/y from 8.0% in the previous quarter. Investment in construction rose by 10.7% y/y owing to increased public investment in construction (up by 18.6% y/y) and improved private construction, which increased by 0.3% y/y after a 2.0% y/y drop. However, the rise in construction was offset by a 14.0% y/y drop in private investment in machinery and equipment.

- Exports fell by 23.5% y/y following a 27.8% y/y decline in the previous quarter. The milder contraction reflected the economic recoveries of Thailand's trade partners. However, exports were sluggish largely because of continued declines in service exports, reflecting border controls to contain the COVID-19 pandemic. According to the Office of the National Economic and Social Development Council, total revenue from tourism declined by 84.3% as the total number of foreign inbound tourists declined by 100% for a second consecutive quarter.

- The third-quarter results were better than IHS Markit expected, owing to a faster recovery in line with the domestic and global resumption of economic activity and government stimulus measures. However, the recovery is still patchy. Although the Thai economy rebounded by 6.5% from the previous quarter on a seasonally adjusted basis, the upward momentum of economic activity is likely to weaken in the coming quarters.

- Toyota has confirmed its plan to introduce the Toyota Mirai hydrogen fuel-cell vehicle (FCV) in Australia. According to CarAdvice, 20 units of the 2021 Mirai will be imported to Australia next year, apart from 20 units of the Nexo FCV to be introduced by Hyundai Motor in December. The vehicles, at this stage, will only be available for lease to government agencies and select business fleets. According to the report, the new-generation Mirai will initially not be available for private-market buyers owing to the lack of refueling stations in Australia. The arrival of the 40 FCVs introduced by the world's two leading automakers in the field of hydrogen FCVs will help raise public awareness and accelerate infrastructure investment to support the commercialization of FCVs in the country. The Australian government is accelerating investments in clean energy technologies, including hydrogen energy projects. In October, Clean Energy Finance Corporation, backed by the Australian government, announced AUD300 million (USD219 million) of investment funding for hydrogen energy projects. The fund will finance large-scale projects with the potential to substantially drive down the cost of hydrogen in Australia. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Australia's milk powder market will see its import duties to

China doubled under the China-Australia Free Trade Agreement

(ChAFTA), as trade relations between the two countries intensify.

(IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- Latest government figures show Australia sold a record amount of WMP to China this year - enough to trigger a 10% tariff on exports for the remainder of 2020, as expected by the Department of Agriculture Water and Environment (DAWE).

- A DAWE spokesman said the safeguard was an indication of China's strong demand for milk powder, the country's main dairy import category. He added: "The tariff volume for Australian milk powder in 2020 is 22,335 tons and exports to the end of September were 19,726 tons. Based on 2019 exports, we would see the volume likely reached in late October or early November."

- According to ABC Rural, under ChAFTA, signed in 2015, preferential tariffs can be withdrawn once a Special Agricultural Safeguard (SSG) is triggered. The SSG is expected, by the Australian side, to be triggered this month, which will result in doubling of tariffs on WMP from 5% to 10%. The safeguard has never been triggered on Australian milk powder under ChAFTA.

- According to latest trade data, China's total WMP imports in January-September reached 501,400 tons and were worth USD1.75 billion, the highest in the past five years.

- Preferential tariffs would be reinstated at the end of the calendar year.

- Despite the trade tensions accelerating for other agricultural industries, dairy trade has so far been left unharmed between Australia and China. However, a new Rabobank report highlights that the dairy industry plans to become less reliant on the Chinese market by focusing on ASEAN-6 countries. In 2019, approximately 35% of Australian dairy exports went to China, while the southeast Asian countries' share totaled 30%. Australia's market share in the ASEAN-6 dairy markets has fallen over the past decade as milk production has dropped and China has been prioritized.

- Paerata Rise, a housing development currently under construction in Auckland (New Zealand), will test an autonomous shuttle for residents. This is a result of a partnership between Think Robotics, Dense Air and Ohmio Automation to create the community as a "Smart Village". Residents can hail the autonomous shuttle ride through a smartphone app to move between facilities such as park and the Paerata train station, which is being developed. The shuttle is manufactured by Ohmio and the network is deployed by Dense Air. Currently, the companies are testing the technology and network, which is scheduled to go live in 2021. Chris Johnston, executive director for Paerata Rise, said, "Our goal is to be one of the most desirable places to live in Auckland and becoming a Smart Village is an extension of this. It means we are able to offer the utmost connection to our residents through a private network, and the most cutting-edge technologies." Ohmio has been trialing autonomous vehicles at Christchurch airport in New Zealand, and plans to launch more driverless cars in more closed facilities across the country, including airports, university campuses, retirement villages, and hospitals. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--17-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--17-november-2020.html&text=Daily+Global+Market+Summary+-+17+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--17-november-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 17 November 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--17-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+17+November+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--17-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}