Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 19, 2020

Daily Global Market Summary - 19 November 2020

US equity markets closed higher, while APAC was mixed and Europe was lower on the day. US and benchmark European government bonds closed higher. European iTraxx credit indices were close to flat on the day and CDX-NA was slightly tighter across both IG and high yield. The US dollar closed flat, while gold, silver, and oil were all lower on the day.

Americas

- US equity markets closed higher; Nasdaq +0.9%, Russell 2000 +0.8%, S&P 500 +0.4%, and DJIA +0.2%.

- 10yr US govt bonds closed -3bps/0.84% yield and 30yr bonds closed -5bps/1.55% yield.

- CDX-NAIG closed -1bp/54bps and CDX-NAHY -6bps/328bps.

- DXY US dollar index closed flat/92.33.

- Gold closed -0.7%/$1,862 per ounce and sliver -1.6%/$24.05 per ounce.

- Crude oil closed -0.3%/$41.90 per barrel.

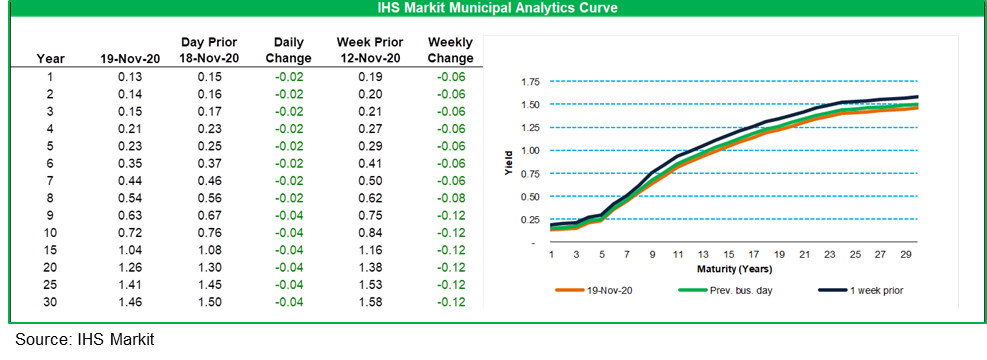

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

rallied 2-4bps across the curve today, with 9+ year maturities

12bps tighter week-over-week.

- Treasury Secretary Steven Mnuchin said he would allow several emergency Federal Reserve lending programs to expire, opening a divide with the central bank, which had pressed for an extension. As a result, on Dec. 31 several novel Fed programs that have backed corporate credit and municipal-borrowing markets and that have provided loans to small and midsize businesses and nonprofits during the coronavirus pandemic will end. (WSJ)

- Seasonally adjusted (SA) US initial claims for unemployment

insurance rose by 31,000 to 742,000 in the week ended 14 November,

increasing for the first time in five weeks. While claims are well

below the spring high, initial claims remain at historically high

levels—the high during the Great Recession was 665,000. The not

seasonally adjusted (NSA) tally of initial claims rose by 18,344 to

743,460. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 429,000 to 6,372,000 in the week ended 7 November. Prior to seasonal adjustment, continuing claims fell by 419,670 to 6,081,402. The insured unemployment rate in the week ended 7 November was down 0.3 percentage point to 4.3%.

- There were 320,237 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 14 November. In the week ended 31 October, continuing claims for PUA fell by 751,480 to 8,681,647.

- Pandemic Emergency Unemployment Compensation (PEUC) claims have been steadily rising as claimants are exhausting their regular program benefits. In the week ended 31 October, continuing claims for PEUC rose by 233,458 to 4,376,847.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 31 October, the unadjusted total fell by 841,245 to 20,319,615.

- US existing home sales increased 4.3% in October to a

6.85-million-unit annual rate—the highest reading since

November 2005. Single-family sales climbed 4.1% to a 6.12 million

rate—also the highest since November 2005; condo/coop sales

increased 5.8% to a 730,000 rate. Sales were up 26.6% from a year

earlier and 18.9% from February—the month before COVID-19 shut

down vast swaths of the US economy. (IHS Markit Economist Patrick

Newport)

- Sales were up or unchanged in all four regions for the fifth straight month; the Midwest and South recorded all-time highs.

- Inventory of single-family homes dipped to a record-low 1.2 million. Our seasonally adjusted single-family homes inventory estimate, 1.16 million, was also an all-time low. Unsold inventory of all homes amounted to a record-low 2.5-month supply at the current sales pace; a 5.0-month supply is considered normal.

- Home prices are soaring. The median price of a single-family home was up 16% from a year earlier, with more than half the entire increase coming since May. The median price of a single-family home was up 22% in the Northeast, 17% in the Midwest, 16% in the South, and 15% in the West.

- The Mortgage Bankers Association's seasonally adjusted purchase index remains elevated but has slipped 7% over eight weeks, suggesting that October may be near a high point for sales.

- Properties on average remained on the market for 21 days in October, down from 36 days in October 2019.

- Seasonally adjusted US e-commerce retail sales registered

$209.5 billion in the third quarter of 2020. Growth was 36.7% year

on year (y/y), a step down from the 44.5% rate in the second

quarter, which was by far the fastest growth in two decades. (IHS

Markit Economist James Bohnaker)

- E-commerce retail sales were 1.0% lower in the third quarter than in the second quarter, when widespread business closures funneled more retail sales online.

- The e-commerce share of total retail trade decreased from 16.1% to 14.3%. This is still about two percentage points higher than the share would have been without the COVID-19 pandemic.

- Among retail categories for which detailed e-commerce data are available, only nonstore retailers and motor vehicle and parts dealers saw an increase in e-commerce sales from the second to third quarters.

- E-commerce retail sales edged lower in the third quarter of 2020 as business restrictions eased and consumers became somewhat more willing to shop at physical store locations.

- The quarterly decline of 1.0% in e-commerce sales still left year-over-year sales up 36.7%—more than twice the rate of growth one would expect in a normal, COVID-free year.

- As a result, e-commerce as a share of total retail sales remained elevated at 14.3%, below the 16.1% mark it hit during the second quarter but well above the pre-pandemic share of 11.3%. In other words, the online versus physical retail mix began to normalize in the third quarter but remains heavily skewed toward e-commerce.

- Brick-and-mortar retail sales continue to be hamstrung by COVID-19 and containment measures that limit in-person socializing. While containment measures for most types of retail shopping are not as restrictive as those for dining, entertainment, and other socially dense services, the threat of the disease is a significant limiting factor.

- California has announced new incentives to support its aggressive plans for electric vehicle (EV) adoption, as well as for hybrid and plug-in hybrid adoption. Called the California Clean Fuel Reward, the program is available to all California residents who buy or lease a new EV with a battery capacity greater than 5 kilowatt hours. Depending on battery size, owners can get as much as USD1,500; buyers do have to buy through a participating retailer, although there are no income or location restrictions to qualify, but the vehicle must be registered in the state of California, to avoid someone who lives in a neighboring state buying with the credit and then taking the car out of the state. Hybrid and plug-in hybrid vehicles are also eligible. California electric utilities participate by offering information on at-home charging. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The chemical industry's focus on sustainability has continued

to strengthen despite disruptions caused by COVID-19, according to

Dow CEO Jim Fitterling. Speaking on 18 November at the Chemical

Industry Financial Outlook and Sustainability Forum and Awards

2020, held online by Chemical Week, he said the industry has

continued to develop its strategy and to set new targets for

reducing plastic waste and carbon dioxide emissions. However, the

transition to sustainability has a cost, and smart policy-making

will be key to encouraging the necessary investment, he added. (IHS

Markit Chemical Advisory)

- "I think a lot of people, their natural reaction would be we've been so focused on COVID that we forgot about plastics and we forgot about the climate," Fitterling observed. "My sense is that isn't the case. We've seen much stronger engagement in Europe, much stronger engagement here [in the US] around the issues."

- The pandemic has drawn attention to the importance of plastics in daily life and the role they play in safety, security, and protection, but that hasn't taken attention from the problems of plastic waste and climate change, he noted. "I'd say we haven't slowed down at all. If anything, we've doubled down on those issues, and we raised some new targets for the industry."

- Every brand owner in the value chain, from producer to retailer, is "consumed" with the question of how to become more sustainable, he said, and coming to terms with the cost of doing so. "It's driving us to look at technologies that maybe we thought were too expensive. And I think one of the mindset shifts that has happened is everybody's got their head around the fact that doing all this is not going to be cheaper than the way we do it today."

- Fitterling highlighted the positive role of government in addressing cost. "How do we put the right policies in place--the right energy policies, carbon policies, recycling policies—that not only push us to new technology, but also create a market opportunity? Because what we really want is to be able to unleash the capital markets on these challenges," he said. "The cash is there … but if the policies aren't smart, nobody will just throw the money in and take the risk."

- There has to be a clear path to a return on investment, he noted. "That challenge I think has become much more in focus. There's a lot of engagement on the public side, on the financial services side, and on the business side on how to address that. The consumer's there, but now all the other parts of the equation are coming together.

- At the same time, Fitterling pointed to the consequences of policy overreach in the realm of energy decarbonization. Pushing alternative energy sources and electrification of the economy without addressing reliable baseload supply and the limitations of the power grid leads has led to rolling brownouts in California and increased coal-burning in Germany, he noted. "Even within Dow, we've made a big move towards alternative power as part of our climate change initiatives, but I'll hit a wall at about 15% renewable energy because it is not available and dispatchable 24/7 like we need to run big, energy-intensive assets," he said.

- May Mobility has partnered with public transit technology firm Via Transportation to expand its on-demand autonomous shuttle operations to new cities in 2021, starting with Arlington (Texas, US). May Mobility will integrate its autonomous vehicles (AVs) into Via's existing on-demand public transit service in Arlington, in partnership with the City of Arlington and University of Texas at Arlington. To achieve this, May Mobility's AVs will be connected with Via's platform, which handles booking, routing, passenger and vehicle assignment. The companies will provide students and faculty with free rides during the test phase, all integrated into Via's app. This one-year pilot program, called Arlington Rideshare, Automation, and Payment Integration Demonstration (RAPID), is expected to launch in March 2021. The pilot program has received a USD1.7-million grant from the Federal Transit Administration's Integrated Mobility Innovation Program. Daniel Ramot, CEO and co-founder of Via, said, "Our partnership with May Mobility is the next step in Via's vision to use technology to expand access to public transit across the globe. When autonomous vehicles are efficiently shared and on-demand, they are a solution that municipalities can use to strengthen and complement their existing transit networks, ushering in a new generation of flexible mobility offerings." Via's real-time ride-sharing services integrate with existing fixed-route transportation infrastructure, enabling commuters to hail a ride using an app. Its technology also helps aggregate multiple passengers into shared vehicles, reducing single-occupancy vehicle trips and thereby alleviating traffic congestion. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Carnival is seeking to borrow $1.6bn in a bond offering not backed by its cruise ships, a first for the company since the pandemic wreaked havoc on the travel sector. The group is selling the debt in US and European high yield bond markets, according to a term sheet seen by the Financial Times. It marks the clearest sign yet that recent vaccine developments have eased constraints for groups hard hit by the pandemic, including those in the hospitality and travel businesses. (FT)

- According to data from the Colombian National Administrative

Department of Statistics (Departamento Administrativo Nacional de

Estadística: DANE), industrial production fell 8.6% year on year

(y/y) in September, while retail sales contracted by a mere 0.8%

y/y. (IHS Markit Economist Lindsay Jagla)

- Colombia's total industrial production remained 8.6% below September 2019 levels in September 2020, driven primarily by low levels of production in mining and quarrying. Coal mining and crude oil extraction remained the biggest negative drivers, contracting by 61.2% and 14.3% y/y, respectively.

- Still, Colombia's industrial production index has shown signs of recovery, albeit unevenly, with quick monthly rebounds in May, June, and July followed by a slight downturn in August. September saw a return to positive monthly growth, with industrial production increasing 1.73% month on month (m/m), due largely to the m/m recovery in the manufacturing sector (up 6.9% m/m).

- Retail sales recovered by 14.1% m/m in September and remained only narrowly below September 2019 levels (-0.8% y/y). Nine out of 19 merchandise lines grew in yearly terms, boosted by a 50.2% y/y increase in sales of technology and communication equipment and a 19.3% y/y rise in sales of household appliances and furniture.

- The areas where sales remained weak were fuel purchases (-5.6% y/y) and clothing and textiles (-15.2% y/y).

- After hitting rock bottom in April, when industrial production fell 29.4% y/y and retail sales declined 42.3% y/y, monthly improvements in these indicators signal a gradual recovery for Colombia. However, following the quick initial rebounds for various indicators in the early months after the economy was reopened following the COVID-19 virus-related lockdown, monthly growth will continue to slow and taper off, resulting in a drawn-out recovery.

- The Central Bank of Chile (Banco Central de Chile: BCC) has

reported that the Chilean economy advanced by 5.2% in the third

quarter of 2020 in comparison with the April-June quarter,

reflecting the effects of partial closures, limitations on

mobility, and a gradual reopening of the economy during the

COVID-19 virus pandemic. (IHS Markit Economist Claudia Wehbe)

- Chile's economy grew by 5.2% quarter on quarter (q/q) on a seasonally adjusted basis during the third quarter of 2020. On the upside, the advance resulted from the gradual lifting of COVID-19 virus-related confinement measures, but on the downside the moderate overall performance was still dampened by mobility restrictions and partial closures due to the pandemic.

- Commerce, manufacturing, and personal and business services made the largest contributions to the quarterly advance, pulled down by a negative contribution from construction. Household consumption of both durable and non-durable goods expanded, while accelerating machinery and equipment demand drove an advance in investment. However, construction performed negatively. The country recorded lower exports and higher imports during the quarter, mainly led by industrial goods.

- In unadjusted terms, the economy fell by 9.1% year on year (y/y) in the third quarter. Similar to the y/y results observed in the second quarter, the worst-hit sectors included personal and business services, construction, transportation, and restaurants and hotels. From an expenditure perspective, the contraction in domestic demand - still driven by limited activity in services and a contraction in construction - was partially offset by positive net exports.

- After bottoming out in May, the economy continued to recover into September. Although IHS Markit expects the moderate recovery to continue into 2021, we do not project that the economy will be back to its end-2019 levels until 2022. We currently forecast real GDP to decline by 6.1% in 2020, before advancing by 6.1% in 2021.

- Chinese ride-hailing giant Didi Chuxing (DiDi) has launched operations in Argentina, reports Xinhua News Agency. The company has introduced rideshare service DiDi Express and taxi service DiDi Taxi in La Plata, capital city of Argentina's Buenos Aires province, and in Greater Buenos Aires. To ensure safety, the company will offer personal accident insurance to users and drivers for each trip and will also provide access to a 24/7 local emergency hotline. In Latin America, DiDi's services are available in Brazil, Chile, Colombia, Costa Rica, Mexico, Panama, and now in Argentina. DiDi has tapped into many markets worldwide by either launching its own services or by investing in local ride-hailing firms. Globally, DiDi has over 31 million drivers registered on its platform and has attracted 550 million customers who are using the company's range of app-based transportation options. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- European equity markets closed lower across the region; Germany -0.9%, UK -0.8%, France -0.7%, Spain -0.6%, and Italy -0.4%.

- 10yr European govt bonds closed higher; Germany/France -2bps and UK/Italy/France -1bp.

- iTraxx-Europe +1bp/51bps and iTraxx-Xover +2bps/283bps.

- Brent crude -0.3%/$44.20 per barrel.

- Prysmian has signed a preferred bidder agreement with RWE Renewables Sofia Offshore Wind Farm, the world's second biggest offshore wind farm developer, for the development of the turn-key high voltage submarine and land export cable connection worth over USD 237 million (€200 million) for Sofia Offshore Wind Farm project. The contract is subject to final negotiations and final investment decision by RWE. Located 195 km from the nearest point on the UK's North East coast, the 1.4 GW Sofia offshore wind farm, sited on the shallow central area of the North Sea known as Dogger Bank, is RWE Renewables' largest single offshore wind project under development so far, as well as the farthest from shore. Once it becomes operational in 2025, it will be able to generate enough power to supply over 1.2 million homes with renewable electricity. With the contract signature and notice to proceed both expected in the first quarter of 2021, Prysmian will be responsible for the design, supply, installation and commissioning of an HVDC symmetrical monopole cable system that will connect Sofia's offshore converter station with the onshore converter station in Teesside, UK. The project involves more than 440 km of ±320 kV submarine export cables with XLPE insulation, and 15 km of ±320 kV land cables with P-Laser insulation. All submarine cables will be produced at Prysmian Group's center of excellence in Pikkala, Finland, while the land cables will be manufactured at the Gron plant, France. The offshore cable operations will be performed using the Leonardo da Vinci, Prysmian's cable laying vessel. Some of Prysmian's offshore wind farm projects are: Hornsea 2, Wikinger, Ostwind 1, Borssele III & IV, Horns Rev 3, Merkur, BorWin2 & BorWin3, Helwin1 & Helwin2, SylWin1 and DolWin3. (IHS Markit Upstream Costs and Technology's Helge Qvam)

- UK electric van startup Arrival is to go public through a merger with a special-purpose acquisition company (SPAC). The merged company is to be listed on the NASDAQ stock exchange in the United States, under the ticker ARVL. Arrival is to merge with CIIG Merger Corporation, in a deal reported to be valued at USD5.4 billion. Arrival is expected to receive about USD660 million from the deal, which has been approved by CIIG's shareholders. The USD660 million will include USD260 million that CIIG raised in an initial public offering (IPO) and USD400 million from other institutional investors. Arrival says it will use the funds to increase production capacity. Arrival has reported previously that it has received an order for 10,000 vehicles delivery company UPS, which has an option to double the order. The deal is expected to be closed in the first quarter of 2021. The deal appears to be structured in the same way as earlier similar deals by other startups using SPACs to become publicly traded companies. (IHS Markit AutoIntelligence's Stephanie Brinley)

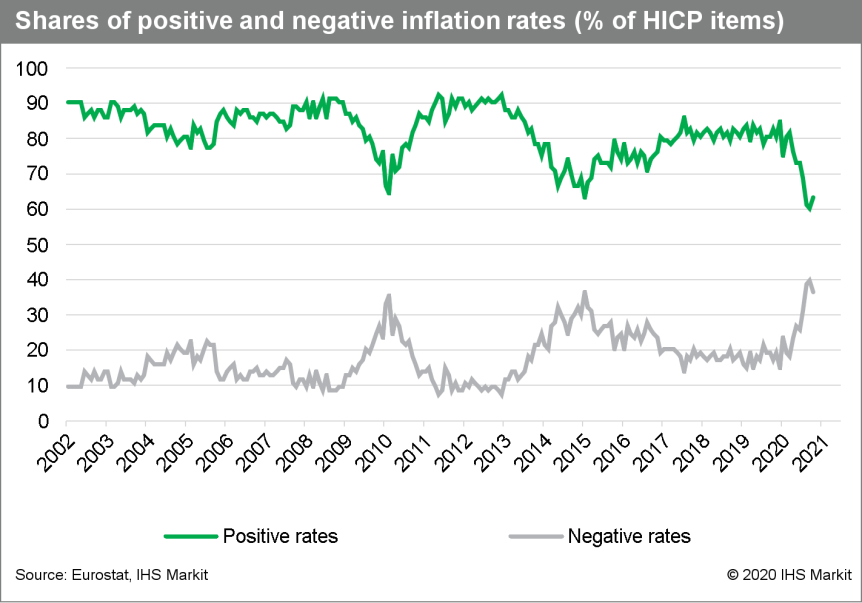

- The Eurozone deflation vulnerability index has risen markedly

over the first half of 2020, primarily because of tumbling

inflation and a surging output gap, the index remained in the

"moderate" risk zone in the third quarter. Further increases are

likely, however. (IHS Markit Economist Ken Wattret)

- We have previously highlighted our concern over the vulnerability of the eurozone to deflation and its consequences. This vulnerability reflects a range of factors including persistent low inflation expectations, prior policy errors, and a series of adverse economic shocks, including the most recent, the COVID-19 virus pandemic.

- Given the potentially severe implications of deflation for the eurozone, IHS Markit created a deflation vulnerability index (DVI) to monitor this risk, based around 10 economic and financial indicators.

- The methodology, pioneered by the International Monetary Fund (IMF) to better understand what led to the onset of deflation in Japan, divides the DVI readings into four categories of risk: minimal, low, moderate, and high.

- The eurozone DVI rose markedly over the first half of 2020 to its highest level since 2016, although it remained below its historic peaks and within the "moderate risk" category (see chart below).

- The key factors generating the increase in deflation vulnerability were the plunge in the harmonized index of consumer price (HICP) inflation rate and collapsing GDP, which led to a surge in the output gap. These factors continued to contribute to the DVI in the third quarter, although the index remained unchanged at 0.4 as there were no additional contributions.

- Over the coming quarters, the DVI is likely to rise further for

a number of reasons.

- First, there are significant lags between the maximum intensity of negative shocks and subsequent peaks in the DVI. This was the case in the aftermath of the two previous major adverse shocks, the global financial crisis (GFC) in 2008-09 and the subsequent eurozone crisis in 2011-12

- Second, the factors already contributing to the DVI are likely to continue to do so in the coming quarters. Although GDP rebounded more strongly than expected in the third quarter, it remained well below its pre-pandemic level and the output gap remained very large. With a "double dip" in train, it will widen further.

- Third, other indicators are also likely to start pushing up the DVI, including the core HICP inflation rate, which has recently fallen to record lows (not fully captured in the third quarter's data).

- The DVI's threshold for the appreciation of the real effective

euro exchange rate (which has risen towards its historic highs) is

also likely to be met in the fourth quarter, meaning that the

eurozone DVI could rise into the "high risk" bracket for the first

time in its history. We will update the various inputs to the DVI

for the fourth quarter in three months' time.

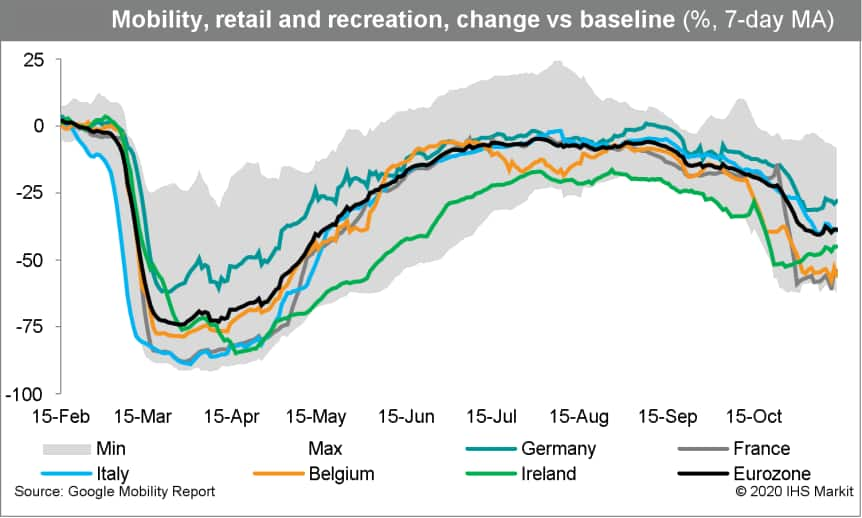

- We expect the partial recovery in the third quarter will be

followed by another contraction for Ireland in the fourth quarter

and the rebound in economic activity to start only at the end of

the first quarter of 2021 after a difficult winter period

(December-February). (IHS Markit Economist Daniel Kral)

- A set of releases by the Central Statistics Office (CSO) reveals that the Irish economy posted a recovery in the third quarter. However, the economy likely still remained below the pre-COVID-19 virus peak.

- Industrial production has followed different dynamics compared with that in other European economies owing to the heavy weight of pharmaceuticals and chemicals in the index. However, the traditional sector, which strips these out, by September recovered to February's levels after contracting by a quarter in April-May.

- Retail sales volumes were above the levels prior to the COVID-19 virus pandemic. However, they captured only goods consumption, while spending on services likely remained depressed.

- After almost a total collapse in April, car sales rebounded strongly through the third quarter. This reflects pent-up demand and consumers making delayed purchases.

- Goods exports, measured by the customs methodology, have remained strong throughout the pandemic, also reflecting Ireland's specialization in pharmaceuticals and other goods in high demand. Imports of goods remained below pre-COVID-19 virus levels.

- According to the third quarter's labor force survey, total employment grew by 3.3% quarter on quarter (q/q), after a decline of almost 6% in the first half of 2020. Compared with the fourth quarter of 2019, the largest losses in employment occurred in accommodation and food services (-17.2%), administrative and support services (-15.6%), and construction (-7.1%).

- According to the standard International Labour Organization (ILO) methodology, the unemployment rate for those aged 15-74 was 7.1% in the third quarter. However, based on the adjusted methodology, which takes into account recipients of the Pandemic Unemployment Payment, the unemployment rate at the end of September was 15.9%.

- Ireland was the first European country to go into a full

lockdown during the second wave of the pandemic in mid-October.

This will affect activity in the fourth quarter, reversing some of

the earlier gains.

- The BMW Group has said that it will alter all its German factories' production facilities to produce electric vehicle (EV) drivetrains, according to a Reuters report. The company is planning to focus its internal combustion engine (ICE) production at its plants in Austria and Hams Hall in the UK. In a statement Milan Nedeljkovic, BMW's board member responsible for production, said, "By the end of 2022 all our German factories will make at least one fully electric car." BMW's Munich plant, which currently makes four-, six-, eight- and 12-cylinder combustion engines, will be retooled with EUR400 million in investment until 2026, to make battery electric vehicles (BEVs) and their drivetrains. The production of eight- and 12-cylinder engines will move from Munich to Hams Hall, and other engines will be made in Steyr (Austria), although the V8 is a low-volume powertrain and only a handful of the BMW brand's forecast production of 2.3 million vehicles in 2020 will be fitted with V12 powertrains. (IHS Markit AutoIntelligence's Tim Urquhart)

- Panasonic has announced that it has signed a memorandum of understanding (MoU) with Norwegian energy company Equinor and Norwegian industrial group Hydro regarding exploring the establishment of battery business in Norway. According to a statement, it will target manufacturing lithium-ion batteries based on Panasonic technology for the European market to supply battery electric vehicles (BEVs) and other applications. The companies will also investigate the potential for an integrated battery value chain and for "co-location of supply chain partners". This findings from this exploratory phase, due to the end in mid-2021, will form the basis for future decisions. (IHS Markit AutoIntelligence's Ian Fletcher)

Asia-Pacific

- APAC equity markets closed mixed; India -1.3%, Hong Kong -0.7%, Nikkei -0.4%, South Korea +0.1%, Australia +0.3%, and Mainland China +0.5%.

- Chinese exporters are facing a serious container shortage and rocketing freight charges. The problem of temperature-controlled containers is more acute for food and agricultural products, IHS Markit was told by local exporters. Several ports such as Shanghai, Ningbo, Qingdao and Lianyungang reported that the situation worsened last week, causing delays and booking chaos. Sea freight from Qingdao to Kelang port at Malaysia has risen from USD600 per container three months ago to USD3,200. Rates to other popular ports in south-east Asia also doubled or tripled, according to Zhang Shuhan, sales manager from Jining Greenstream Fruit & Vegetable Co Ltd, who commented: "Freight cost to Europe has increased by 20%." Space on the Sino-Europe railway is becoming tight as Chinese exporters are looking for alternative routes to reduce transport costs, a local logistic agent said. Logistics agents have to participate in the 'lottery' to be able to get their ideal slots. The pandemic has affected the global supply chain, disrupting the usual scheduled docking of ships/containers. It took time to re-schedule the flow and re-balance global demand at different ports. Meanwhile, some ports might see oversupplies while China has noted a shortage. Chinese inspections of all imported frozen and chilled foods have probably contributed to the chaos. Some industry sources commented that reefer containers may not need to be returned to China as imports of temperature-controlled foods have reduced. Subsequently, some Chinese exporters have switched to quoting fob prices and only reluctantly quote cif. One shipping company has warned customers that prices may continue to rise until the Chinese New Year, 12 February 2021. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Chinese electric vehicle battery-maker SVOLT Energy Technology gave an update on its planned European plants on 17 November. The battery-maker said it is to invest up to EUR2 billion (USD2.4 billion) in Germany to build a factory for battery pack and module manufacturing, as well as a plant for battery cells in Saarland (Germany). The battery pack and module factory, which is due to begin production in mid-2022, is to be located in the Heusweiler district of Saarbrücken, using an existing site. The company plans to start battery-cell production in Germany at the end of 2023, at a facility to be established near the town of Überherrn. In its final stage of expansion, the battery-cell production plant is expected to achieve a production capacity of 24 GWh to power between 300,000 to 500,000 electric cars annually. SVOLT first broke the news about its plan to build a battery plant in Europe in July last year. By confirming the locations of the two new facilities in Germany, the company is a step closer towards launching production in Europe. The company, a spin-off from Chinese automaker Great Wall Motor, began production in Changzhou, Jiangsu province (China), in November 2019. SVOLT currently mainly supplies batteries for Great Wall's new energy vehicles. Unlike China, where the manufacture of EV batteries is dominated by market leaders such as Contemporary Amperex Technology Co Limited (CATL) and LG Chem, Europe presents greater opportunities for Chinese battery-makers to enter the market. (IHS Markit AutoIntelligence's Abby Chun Tu)

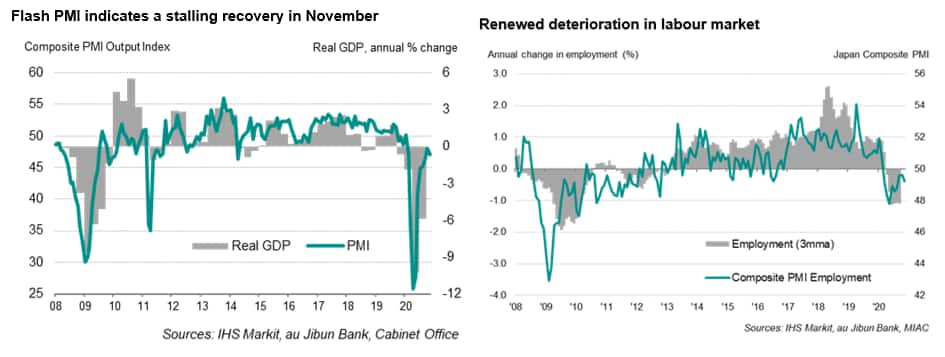

- The au Jibun Bank flash Composite PMI, compiled by IHS Markit

and based on 85-90% of responses received from the monthly surveys,

dropped from 48.0 in October to 47.0 in November. The latest

reading signaled a further and faster decline in private sector

output across both manufacturing and services. (IHS Markit

Economist Bernard Aw)

- The data suggest that the pace of recovery is stalling, putting the economy on track for a subdued fourth quarter. At 47.5, the average PMI so far for the fourth quarter is just a mere 1.9 points higher than the 45.6 in the third quarter, far underwhelming the gain of 14.1 points recorded in the three months ending September.

- Although recent GDP data showed the economy expanding 5.0% in the third quarter, that followed an 8.2% decline in the second quarter and left GDP still 5.9% below levels of a year ago, underscoring the sluggish recovery to regain pre-pandemic output levels.

- Stubbornly weak demand may also limit the extent to which activity rebounds in December. Inflows of new business fell further and at a marked rate in November, reflecting subdued domestic and foreign demand as rising COVID-19 infections in many countries, including Japan, dampened activity.

- The labor market meanwhile also deteriorated in November amid weakening sales and rising spare capacity, representing a setback to the recent move towards stabilization signaled by the PMI's employment index. The decline in overall employment accelerated from October, with the service sector seeing a renewed fall in workforce numbers.

- Looking ahead, the path to recovery remains fraught with

challenges, notably as a recent rise in local infections could

re-ignite cautious consumer behavior alongside a subdued labor

market and a weak outlook for wages. Reintroduced lockdown measures

in many countries due to second waves of new COVID-19 cases could

also weigh on foreign demand for Japanese goods and services.

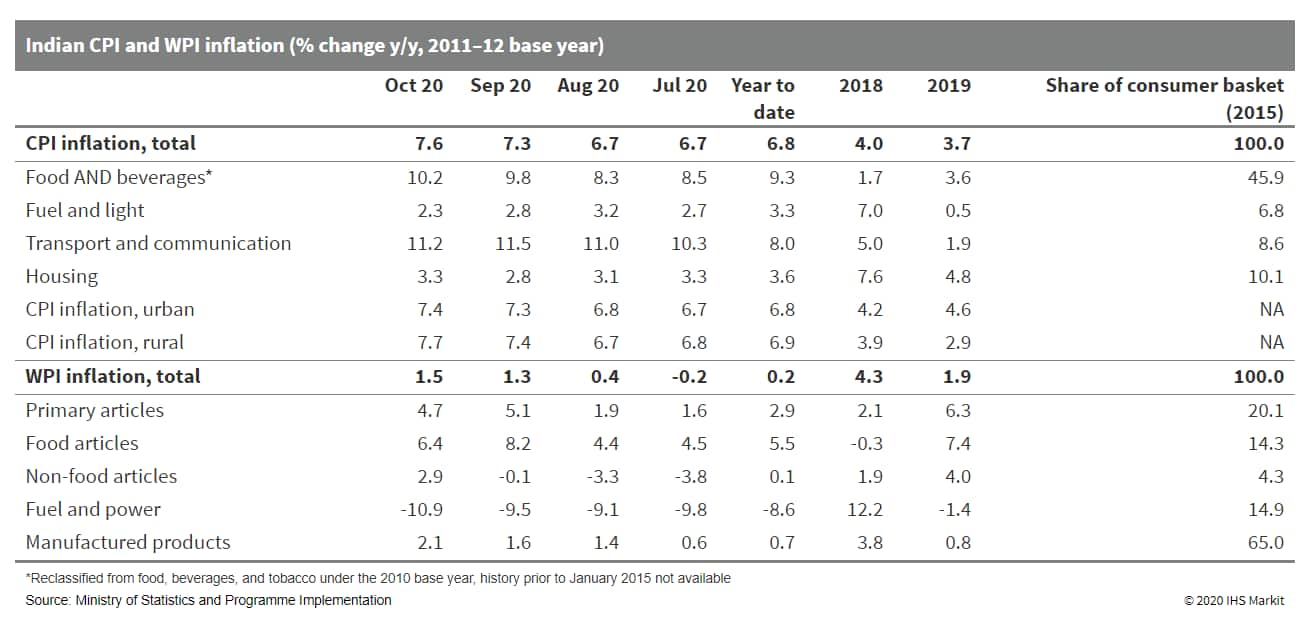

- India's index of industrial production (IIP) returned to growth

in September following six months of contraction, supported by

further easing of the lockdown restrictions and a pre-festive boost

to consumer demand. However, both retail and wholesale inflation

edged up again in October, likely delaying additional monetary

policy easing. (IHS Markit Economist Hanna Luchnikava-Schorsch)

- The IIP grew 0.2% year on year (y/y) in September, recovering after six months of decline compared with a 7.4% y/y contraction recorded in August.

- Both mining and power output returned to growth, growing by 1.4% y/y and 4.9% y/y respectively in September. Manufacturing output contracted by 0.6% y/y, but this was a sharp improvement from a 7.9% y/y fall in August (which was revised upwards from a contraction of 8.6% y/y).

- Separately released core sector output data for October showed coal output up by 21.2% y/y and electricity generation up by 3.7% y/y, while the Manufacturing Purchasing Managers Index (PMI) also improved sharply to 58.9 points in October - all of which likely indicates further improvements in all three sectors of industrial production in the following month.

- On a use-based approach, there were major improvements in production of consumer goods. Consumer durables output grew 2.8% y/y in September following a 9.6% y/y contraction in August, and non-durables output up by 4.1% y/y from a contraction of 2.3% y/y in August. These improvements were likely driven by manufacturers' inventory restocking ahead of the Indian religious festival holiday, which is the country's highest-spending season.

- On the downside, separately released inflation data showed consumer price index (CPI) inflation accelerating to 7.6% y/y in October, up from 7.3% y/y in September and further away from the central bank's inflation tolerance band of 2-6%.

- As in the previous month, headline inflation was spurred by rising food prices, with prices of vegetables, eggs, and meat up by 22.5%y/y, 21.8% y/y, and 18.7% y/y respectively. The lingering impact of the fuel tax hikes earlier in the year also led to higher inflation in the transport and communication category.

- Inflation in rural areas stood at 7.7% y/y, while prices for urban consumers grew by 7.4% y/y. This mainly reflected the higher prevalence of food in the rural consumer price basket, but also indicates faster demand recovery among rural consumers - a trend that was also observed in other high frequency indicators, such as vehicle sales. Rural consumption fared better during the pandemic, supported by a favorable monsoon season and numerous government social schemes.

- Wholesale price index (WPI) inflation also edged up to 1.5% y/y in October from 1.3% y/y in September. The food articles category again recorded the highest inflation, but at 6.4% y/y it was lower than in September, suggesting that the spike in food prices (both wholesale and eventually retail) may be coming to an end.

- Although an encouraging development, the boost to demand and

production will likely wane after the December quarter (the third

quarter of India's FY 2020). Supported by the pick-up in festive

demand, an easing of lockdown restrictions, and the government's

third mini-stimulus worth 0.4% of GDP announced in early October,

consumer spending will rebound in the third fiscal quarter.

However, a probable second wave of COVID-19 infections that is

already evident in some areas, including Delhi - and the still very

small fiscal stimulus - will weigh on further recovery in the

fourth fiscal quarter and in FY 2021.

- The Bank of Thailand (BOT) has left its monetary policy

unchanged. The bank maintained its outlook for a weak recovery and

preserved its limited policy space for downside risks. (IHS Markit

Economist Harumi Taguchi)

- The BOT maintained its monetary policy rate at 0.5% at its Monetary Policy Committee meeting held on 18 November. The bank assessed that it needs to support the recovery of the Thai economy with the continued low policy rate. The BOT expects the recovery to be moderate and vary significantly among economic sectors, despite stronger-than-anticipated improvement in the economy in the third quarter.

- The BOT maintained its view that it will take around two years for the economy to return the pre-pandemic level while headline inflation will rise gradually close to the lower boundary of its target range (1-3%) in 2021, as previously expected. The BOT is concerned that some businesses and households in need of liquidity do not have access to credit despite ample liquidity in the financial system and low financing costs. The bank is also concerned about the recent rapid appreciation of the baht.

- BOT's decision was in line with IHS Markit expectations, given that the economy improved at a faster pace than it anticipated but uncertainties over the recovery remain. While the BOT stressed that monetary policy must remain accommodative, the bank continued to emphasize the importance of fiscal measures to support the vulnerable target sectors.

- The Australian Capital Territory (ACT) has promised to introduce free registration and interest-free loans for electric vehicle (EV) purchases, according to CarAdvice. Under the agreement co-signed by the Labor Party and the Greens, people of Canberra will be able to receive zero-interest loans of up to AUD15,000 for EV purchases. They will also get free vehicle registration for new zero-emission vehicles for two years. The government is also planning to set up at least 50 EV charging stations in Canberra. (IHS Markit AutoIntelligence's Nitin Budhiraja)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-november-2020.html&text=Daily+Global+Market+Summary+-+19+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-november-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 19 November 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+19+November+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}