Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 15, 2020

Daily Global Market Summary - 15 December 2020

All major US equity indices and most European markets closed higher, while most APAC markets were lower. US government bonds closed lower and benchmark European bonds were mixed. European iTraxx and CDX-NA credit indices closed tighter across IG and high yield. The US dollar continued to sell-off, while oil, gold, silver, and copper were higher. Investors will continue to focus on the ongoing US congressional stimulus bill negotiations for any signs that some form of a bill will pass before the recess and on tomorrow's statement from the final scheduled FOMC meeting of the year.

Americas

- US equity market closed higher; Russell 2000 +2.4%, Nasdaq/S&P 500 +1.3%, and DJIA +1.1%.

- 10yr US govt bonds closed +1bp/0.91% yield and 30yr bonds closed +3bps/1.66% yield.

- CDX-NAIG closed -2bps/53bps and CDX-NAHY -6bps/298bps.

- DXY US dollar index closed -0.3%/90.47, which is the lowest close since April 2018.

- Gold closed +1.3%/$1,855 per ounce, silver +2.5%/$24.64 per ounce, and copper +0.3%/$3.54 per pound.

- Crude oil closed +1.3%/$47.62 per barrel, which is the highest close since 26 February.

- The index of US import prices inched up 0.1% month on month

(m/m) in November following a 0.1% decline in October. The index's

12-month growth rate was unchanged at -1.0%. (IHS Markit Economist

Gordon Greer)

- Among imported fuel price categories, natural gas price growth came in at a booming 49.1% m/m after falling 14.7% m/m in October, while imported petroleum price growth registered at 2.1% m/m. Excluding petroleum, monthly import price growth was flat in November.

- Excluding fuels, imported goods prices declined 0.3% m/m in November, while 12-month growth came in at 1.6%. Industrial supplies and materials price growth came in at 1.1% m/m. Prices of automotive goods declined 0.1% m/m while those of capital goods inched up 0.1% m/m.

- The value of the US nominal trade-weighted dollar dropped 1.5% m/m in November and has given up all the appreciation seen starting in March during the initial response to COVID-19, yet it remains elevated in historical context, which will continue to weigh on import price growth. The import price index excludes tariffs.

- The index of exported goods prices increased in November, with the index's m/m change registering at 0.6%. The increase in this index was driven by growth in both agricultural and nonagricultural commodities prices.

- Agricultural prices growth came in at 3.7% m/m and marked a 4.4% 12-month increase, while nonagricultural commodities growth came in at 0.3% month on month and was down -1.7% versus November in the prior year. Industrial supplies and materials export prices jumped 1.3% m/m.

- Capital goods prices decreased 0.2% m/m, consumer goods prices dropped 0.8% m/m, and automotive goods prices rose 0.2% m/m.

- Total US industrial production (IP) rose 0.4% in November,

reflecting increases in manufacturing (0.8%) and mining (2.3%)

activity that were partially offset by a decline in utilities IP

(4.3%). (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- The details in this report that feed into our GDP tracking were, on balance, weaker than we had assumed and lowered our forecast of fourth-quarter GDP growth by 0.1 percentage point to 5.5%.

- The increase in manufacturing IP was several tenths of a percentage point above both our estimate and consensus expectations. The increase in November was in line with the average monthly increase over the prior three months (August through October) of 0.9% per month.

- This rate of increase, in turn, is considerably below the 5.2% average per month over the prior three months (May through July), as the recovery in manufacturing appears to have proceeded in two distinct phases: a phase of rapid improvement as the economy was "reopening," and phase of slower improvement since.

- Over the seven months through November, manufacturing output had reversed 82% of the two-month contraction through April. The level of manufacturing IP in November was still 3.7% below February.

- The sharp drop in utilities IP in November reflected a decline in demand for heating, as temperatures switched from unusually cool in October to unusually warm in November.

- The increase in mining activity in November was broadly based, reflecting increases in, among other industries, oil and gas extraction and coal mining.

- The US Food and Drug Administration (FDA) has approved a pig that has been genetically engineered not to produce a certain sugar that can trigger a food allergy to red meat and other mammal products, clearing the animal for food and medical uses. Revivicor's GalSafe pig is the first intentional genomic alteration (IGA) in an animal approved by FDA for both human food consumption and human therapeutics, a decision FDA Commissioner Stephen Hahn touted as a "tremendous milestone for scientific innovation." Prior IGAs in animals include GE goats, chickens and rabbits developed for medical purposes and AquaBounty's GE salmon, which was approved for food consumption in 2015. While undeniably a landmark announcement for FDA - and Virginia-based Revivicor - the impacts of the decision for ag interests keen to see more GE animals come to market is far from clear. The GalSafe pig appears more geared toward the biomedical field, not the agriculture industry, and use of the animal for food may be largely a secondary issue. The pigs have been genetically engineered to eliminate alpha-gal sugar on the surface of the animals' cells. Individuals with Alpha-gal syndrome (AGS) - most often caused by the bite of a Lone Star tick - have mild to severe allergic reactions to alpha-gal sugar found in pork, beef and lamb. Recent estimates find some 5,000 people worldwide may have AGS. FDA says GalSafe pigs may potentially provide a source of porcine-based materials to produce human medical products, such as the blood-thinning drug heparin, that are free of detectable alpha-gal sugar. In addition, tissues and organs from the pigs could potentially address the worry of immune rejection in patients receiving xenotransplants. The specific therapeutic uses of the GalSafe pigs will still need further FDA approval. (IHS Markit Food and Agricultural Commodities' JR Pegg)

- Amazon's Zoox has unveiled an electric autonomous robotaxi that can transport four people at speeds of up to 75 miles per hour. The vehicle employs bidirectional driving capabilities allowing it to change direction without the need to reverse. This feature, combined with four-wheel steering functionality, allows the vehicle to maneuver through compact spaces, making it fit for dense urban environments. The vehicle is compact, just 3.6 meters long, and is equipped with a 133 kilowatt-hour battery that allows it to operate for up to 16 hours on a single charge. The vehicle has an airbag system for bidirectional vehicles and carriage seating that envelops passengers. The vehicle deploys cameras, radar and LiDAR that gives it a 270-degree field of view on all four corners of the vehicle, thereby helping to eliminate blind spots and detect objects around it. Aicha Evans, CEO of Zoox, said, "We are transforming the rider experience to provide superior mobility-as-a-service for cities. And as we see the alarming statistics around carbon emissions and traffic accidents, it's more important than ever that we build a sustainable, safe solution that allows riders to get from point A to point B." Zoox, an autonomous vehicle (AV) technology startup that was acquired by Amazon this year, plans to develop fleets of small, on-demand AVs that do not have a steering wheel or interior controls. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Electric vehicle (EV) maker Rivian is planning to create a network of charging stations near recreational sites as well as along interstate routes, using charging technology developed in-house, reports Techcrunch.com. Rivian CEO RJ Scaringe confirmed the plans for the charging stations near recreational sites during an interview with Techcrunch.com, according to the report. Scaringe reportedly said work on the charging stations has begun. Rivian plans the charging network to include fast-charging stations along interstate routes, but also EV chargers at adventure activity destinations. The executive did not indicate how many charging stations the company plans in 2020, but the report states that Rivian is planning to build dozens of charging stations in the United States in 2021, with each station having an average of six charging connectors. Scaringe said that, by 2023 or 2024, Rivian planned to have a dense coverage of stations. Scaringe reportedly said, "We're excited about the opportunity to create Rivian charging locations that aren't on the interstate, that help draw you or enable you to go to places that normally are not the kinds of places that invite or welcome electric vehicles because of charging infrastructure. We've spent a lot of time thinking about how you can essentially create these curated drives where, depending on your point of interest, you can pick different paths. If you want to stop midway through the trip for a one-mile, two-mile or five-mile hike, you know, here's a route that you want to take and here's a charging location right next to it." The plan is based on a two-tier set-up, with fast-charging stations on highways and "destination chargers" at locations where a fast charge is less important; for example, at the start of a hiking trail. Scaringe reportedly called the process of assessing the best places to locate charging stations along particular routes as a "really interesting and challenging real estate" problem. The report states that Rivian has also developed the charging technology in-house, including the high-speed DC charger, and that the platform and hardware for the charging stations is being developed with fleet customers in mind. (IHS Markit AutoIntelligence's Stephanie Brinley)

- GM released a statement on the opening of a new Additive Industrialization Center on 14 December. The 15,000-square-foot facility is a ground-up facility "exclusively dedicated to productionizing 3D printing technology in the automotive industry," GM said. The facility includes 24 3D printers creating polymer and metal solutions. Processes at the facility include laser sintering, selective laser melting, Multi-Jet Fusion and fused deposition modeling. GM has increased use of 3D printed functional prototypes, building on history with 3D-printed rapid prototypes designed to check form and fit. The functional prototypes can be used in testing just as a conventional part, and eliminate early expensive tooling costs, GM says. GM is also using 3D printed tools for assembling vehicles, and says that it saved more than two months of tooling construction during the launch of the company's all-new full-size SUVs. As GM also recently announced, the Cadillac CT4-V Blackwing and CT5-V Blackwing will be the first production GM vehicles to have 3D-printed parts. Relative to the new Additive Industrialization Center, GM did not outlay a specific investment amount. The facility is supported in part by GM Research and Development as well as GM Ventures, the company's start-up investment fund. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US nutrition firm White Dog Labs (WDL) has gained investment from a group of venture capitalists based in Oman. The start-up has developed a fermentation technology that produces a variety of nutritional products for humans and animals. The investment will help WDL repurpose a recently purchased biorefinery in Minnesota for the production of high-quality animal-free protein. The company will use this protein to produce a line of dairy and meat substitute products, with production scheduled to begin in the second half of 2021. At full capacity, the biorefinery could produce protein equivalent to one billion burgers per year. The retrofit will commence "soon". New Castle, Delaware-headquartered WDL is initially targeting the US market but "is also looking for international production and distribution partners". Founded in 2011, WDL has been applying expertise in anaerobic microbiology, microbiomes and fermentation to address challenges related to food sustainability and climate change. Sustainable Investments led the consortium of backers. Financial terms of the investment were not disclosed. WDL initially bought the Minnesota plant earlier this year to produce its ProTyton sustainable premium protein for aquaculture and MiruTyton - a naturally produced butyrate animal feed additive. Bryan Tracy - the firm's founder and chief executive - told IHS Markit Animal Health the facility will continue to produce ProTyton, MiruTyton and the WDL's human protein ingredients. The company has an off-take agreement with Cargill for ProTyton. WDL is also currently negotiating a MiruTyton off-take deal with an undisclosed "major feed additive company". Mr Tracy added: "This investment helps us continue our drive to introduce the most nutritious, delicious and versatile animal-free protein that is packed with 80% protein and all the essential amino acids. It is also non-allergenic and formulates well with other ingredients." Mohab Ali Al-Hinai - co-founder of Muscat-based Sustainable Investments - remarked: "Food security is an ongoing concern in the gulf countries, so a sustainable, alternative protein has been of great interest to us. We have selected WDL because it has developed a premium alternative protein that is price competitive with plant-based protein and it can be produced in existing infrastructure throughout the world." (IHS Markit Animal Health's Joseph Harvey)

- In November, Canada's housing starts reached 246,033 units, for

an increase of 14.4% month on month (m/m). (IHS Markit Economist

Jeannine Cataldi)

- Urban starts were higher by 15% m/m, reaching 233,106 units. Gains were driven by the multifamily segment, which increased 22.5% m/m to 177,661 units. These gains follow two months of declines.

- Rural housing starts also increased over the previous month, up 3.5% m/m to 12,927 units in November after decreasing for two months.

- On a year-to-date basis, housing starts are 2.9% higher than in 2019 with both multifamily and single-family starts growing. This growth is led by Saskatchewan, Ontario, and Quebec along with the Atlantic provinces of Nova Scotia and New Brunswick. All other areas are lower year-to-date.

- Housing continues to lead the recovery; however, there are downside risks as renewed restrictions limit activity across the country as the year ends.

- Urban multifamily starts were the main driver this month as Alberta was the only province to see a decline in the multifamily segment, with starts lower by 30.6% m/m.

- Urban single-family starts declined by 3.8% m/m to 55,445 units following two months of gains. Nova Scotia and Alberta were the only provinces to record m/m growth in November, up 16.3% and 1.2%, respectively. Declines were largest in Quebec and Manitoba, both of which turned down after two months of growth.

- Home building in the last quarter is coming in stronger than estimated in the December forecast. This puts more upward pressure on the residential investment and real GDP outlooks. A low-interest rate environment will continue to support this segment as it moves into 2021. However, housing starts will begin to pull back from these higher levels with weakening population growth.

- Mexican bankers on 14 December met with the Treasury Committee

of the House of Representatives, seeking to block proposals

obliging the Bank of Mexico (Banco de México: Banxico) to purchase

from banks US dollars whose origins have not been verified. This

will prevent their conversion through commercial banks, which apply

anti-money laundering (AML) controls that require details regarding

the source of funds. The bill has already been approved by the

Senate and will be enacted if approved by the lower house, with a

vote on approval expected later today (15 December). Bankers say

that the bill risks triggering AML sanctions against Banxico, would

damage Mexico's overall AML standing, and threatens the central

bank's independence. (IHS Markit Banking Risk's Alejandro

Duran-Carrete)

- The bill was introduced by Senator Ricardo Monreal, a member of the left-wing ruling party National Regeneration Movement (Movimiento de Regeneración Nacional: MORENA), who has been the main exponent of change to banking legislation within Congress (see Mexico: 25 November 2020: Mexican banks to further reduce fees as response to government pressure, impact to profitability likely to be moderate). He stated that that the purpose of the bill is to resolve the lack of access to financial institutions faced by multiple beneficiaries of remittances, who are unable to prove the remittances' origin. Banxico denies that this is a generalised problem in the sector and has suggested that such problems apply primarily to a single financial institution (with sources citing Banco Azteca).

- Banco Azteca is the ninth-largest bank by assets in the country, owning 2% of total assets in the banking sector, and has expressed favourable opinions regarding the relevant bill. According to Banxico, between January and September, Banco Azteca accumulated USD10 million in unconverted dollars.

- While the proposed legislation aims to help lower income groups who receive remittances, IHS Markit shares the view that the obligation for Banxico to accept and convert such funds would reduce its independence; accepting funds without seeking information about their origin would also represent significant weakening in Mexico's anti-money laundering/combating the financing of terrorism (AML/CFT) controls.

- The obligation for Banxico to purchase US dollars without due review of their origin would encourage the use of Mexico as a systematic money-laundering hub. This would generate a high risk of Banxico, or the broader banking sector in Mexico, facing significant sanctions from the United States and being singled out by the Financial Action Task Force (FATF) for its inadequate AML regime, implying the threat of wider sanctions. Major banks would face pressure to tighten their own AML procedures, seeking to limit the scope of potential sanctions, with the sector also facing increased regulatory and reputational uncertainty.

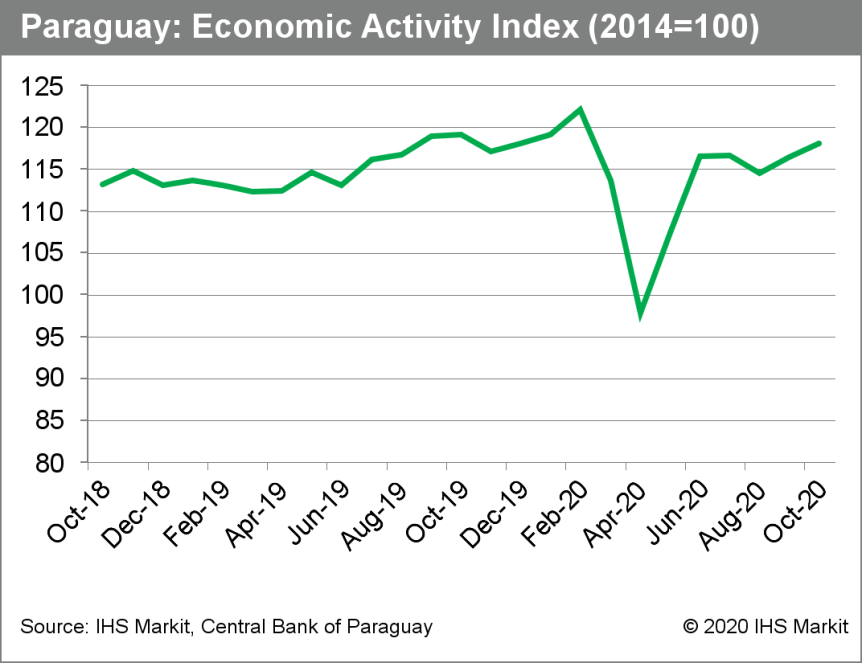

- According to the Central Bank of Paraguay (Banco Central del

Paraguay: BCP), the seasonally adjusted monthly index of economic

activity recorded 1.4% month-on-month (m/m) and -0.9% year-on-year

(y/y) growth in October. (IHS Markit Economist Jeremy Smith)

- Paraguay's rapid economic rebound in May and June expanded to a 0.3% m/m increase on average from July to October. As of October, economic activity was 0.9% below 2019 levels and 3.3% below the historical peak in February this year.

- Owing to weakness in restaurants and hotels, wholesale and retail sales, and transportation, the service sector continues to be the worst performing area of the economy. The BCP also noted declines in agricultural production and hydroelectric output from Paraguay's binational dams; excluding these two sectors, economic activity was only 0.1% below that of October 2019.

- Notable bright spots include construction, bolstered by ongoing public and private projects, and telecommunications, driven by remote work and education.

- These trends are further reflected in the monthly index of business sales. Although sales in large stores declined by 12.3% y/y in October, purchases of construction materials and mobile phone services rose by 13.0% y/y and 7.5% y/y, respectively. The index, as a whole, nearly equaled the -0.2% y/y level recorded in 2019.

- The state of the COVID-19-virus pandemic in Paraguay, along with the country's ability to secure a vaccine, will be key determinants of the recovery path.

- Overall, Paraguay has mounted a comparatively successful response to the COVID-19-virus outbreak; however, recent increases in infections may cause concern. On 27 November, Minister of Health Julio Mazzoleni announced a delay in reopening the country's economy through the end of the year.

- To date, Paraguay has not signed a bilateral advanced purchasing agreement for a COVID-19 vaccine, and officials have stated that the country's storage and distribution capabilities may not be suitable for early vaccine candidates that require ultra-cold refrigeration. Paraguay participates in the COVAX Facility and the Pan American Health Organization expects immunization roll-out to begin in the second half of 2021.

- Although the recent COVID-19-virus developments pose a downside

risk to the outlook, the Paraguayan economy continues to beat

expectations overall. IHS Markit forecasts -1.9% GDP growth in 2020

- a shallower contraction compared with the rest of the region -

and 3.6% growth in 2021.

Europe/Middle East/Africa

- Most European equity markets closed higher except for UK -0.3%; Germany +1.1%, Italy +0.8%, Spain +0.1%, and France flat.

- 10yr European govt bonds closed mixed; Italy -3bps, Spain -2bps, France flat, Germany +1bp, and UK +4bps.

- iTraxx-Europe closed -1bp/49bps and iTraxx-Xover -11bps/249bps.

- Brent crude closed +0.9%/$50.76 per barrel.

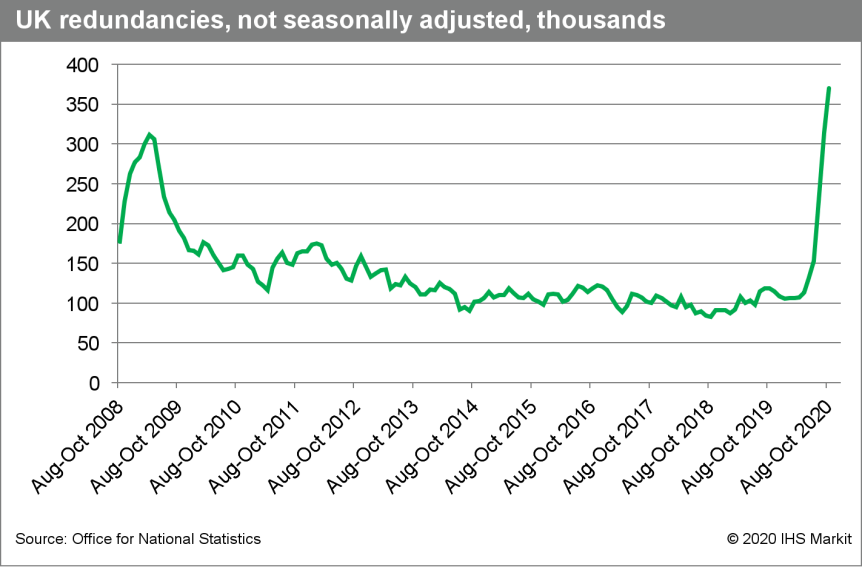

- According to the UK's Office for National Statistics (ONS), the

early estimate for November suggests that the number of workers on

payroll plunged by 781,000 over the 12-month period to 28.2

million. It fell for the ninth straight month on a monthly basis,

falling by 0.1% month on month (m/m) during the month, equivalent

to 28,000 people. (IHS Markit Economist Raj Badiani)

- The new release is based on the experimental data of the number of employees on payroll using the HM Revenue and Customs' Pay As You Earn Real Time.

- The claimant count, which measures the number of people claiming benefit principally for being unemployed, increased slightly to 2.7 million in November but still represented an increase of 114.8%, or 1.4 million, since March. The claimant count also includes the increasing number of people becoming eligible for unemployment-related benefit support despite still being employed.

- The ONS also published its traditional headline employment and unemployment data for the three months to October.

- According to the ONS, total UK employment (all aged 16 plus) shrunk by 144,000 to 32.522 million in the three months to October compared with the three months to July.

- In annual terms, the number of employed people in the three months to October was 0.9% lower compared with a year earlier.

- The number of unemployed people based on the Labour Force Survey (LFS) or the International Labour Organization (ILO) measure increased by 241,000 in the three months to October, standing at 1.692 million.

- The unemployment rate increased to 4.9% in the three months to October, up from 4.2% in May-July. In addition, the ONS estimates the unemployment rate was above 5% during most of October.

- The unemployment rate among young people (aged 18-24) was far higher, standing at 13.2% in the three months to October, reflecting the high incidence of young workers in the hospitality and retail sectors.

- The pace of job losses is accelerating. Specifically, the number of redundancies increased by a record 217,000 to an all-time high of 370,000 in August-October compared with the three months to July (see chart).

- The ONS's director of economic statistics confirms that the hospitality sector has been the hardest hit by the COVID-19 virus containment measures, saying, "If you look at the number of people losing their jobs, the number of people on furlough and the vacancies available for people looking for jobs in the hospitality sector, all that adds up to a very difficult time for that industry."

- The ONS reports that the hospitality and retail sectors have shed 456,837 out of the 819,000 jobs lost during the pandemic. Meanwhile, the health and social care sector has added 74,342 jobs.

- More encouragingly, the number of job vacancies continued to recover after falling sharply during the lockdown. Specifically, it rose by 230,000 to 547,000 in the three months to November compared with the record low in April-June. However, it had stood at 818,000 in the three months to February.

- Nominal- and real-wage developments were stronger. Average annual weekly earnings (total pay including bonuses) growth accelerated sharply to 2.7% in the three months to October. In addition, regular pay (which excludes bonus payments) growth rose for the fourth time in 12 months and at a quicker pace, standing at 2.8% year on year (y/y) in the three months to October.

- Furthermore, total pay in real terms rose by 1.9% y/y in the three months to October, which was the second gain since March.

- We continue to anticipate tougher labor market conditions in

the next few quarters.

- France's EU-harmonised price index rose by 0.2% year on year

(y/y) in November. Prices had increased by 0.1% y/y in October and

stagnated in September. (IHS Markit Economist Diego Iscaro)

- Excluding July, when inflation rose to 0.9% as a result of the change in the timing of the summer sales, inflation has stood between 0% and 0.4% since March.

- Food price inflation accelerated from 1.5% in October to 2.0% in November, a five-month high, boosted by higher prices of fresh vegetables (+20.1% y/y) and fruits (+9.7%).

- Service price inflation also accelerated in November from 0.4% to 0.7%, a three-month high. The decline in transport prices moderated from -5.4% in October to 3.7% in November, while communication costs, which had fallen by 1.6% in October, rose by 1.1% in November.

- On the other hand, the prices of manufactured goods declined by 0.3% in November, following a fall of 0.1% in October. The prices of clothing and footwear fell by 1.8% (-1.5% in October), while the prices of manufacturing products classified as 'other' rose by just 0.3% (+0.6% in October).

- Energy prices continued to be a major drag on inflation, declining by 7.8% (unchanged from October).

- Core inflation, meanwhile, edged upwards from 0.3% to 0.4%. Core inflation had ranged between 0.3% and 0.7% in the three months to July.

- IHS Markit expects food price inflation to continue driving a very gradual increase in headline inflation over the coming months. The drag from oil prices will also become less intense, and oil prices are likely to start growing on a y/y basis from February 2021.

- Nevertheless, we also expect labor market conditions to worsen, keeping underlying inflation extremely low, while a strong euro should also help to limit inflation at the start of 2021.

- Portugal's consumer price index (based on the EU-harmonised

definition) fell by 0.4% year on year (y/y) in November. It had

declined by 0.6% y/y in October and 0.8% y/y in September. (IHS

Markit Economist Diego Iscaro)

- The moderation in the pace of deflation was triggered by higher prices in restaurants/hotels (+0.5% y/y, following a fall of 0.4% y/y in October) and higher health-related costs (+2.3% y/y, following a rise of 1.4% y/y). On the other hand, food price inflation moderated from 2.5% to 2.1%, while transport prices declined by 3.2% y/y (-2.9% y/y in October).

- Core inflation was also in negative territory in November. It declined by 0.2% y/y, slightly below a fall of 0.1% in October. Underlying inflation had been below 1.0% y/y since early 2018 and negative during the last four months (see chart).

- The November figure was within expectations and will not drive a revision of IHS Markit's estimates for 2020 and 2021.

- Oil prices, which have been a major drag on inflation in 2020, should start putting upward pressure on the headline inflation rate, particularly from February 2021.

- Nevertheless, underlying inflation is expected to remain well below headline inflation in 2021, limited by difficult labor market conditions.

- After Hungary's robust third-quarter rebound, rising infections

and tighter social restrictions will weigh on the fourth quarter

but should be partially offset by manufacturing remaining

operational. Sluggish activity and elevated COVID-19 virus-related

restrictions will erode the first-quarter 2021 outlook. (IHS Markit

Economist Dragana Ignjatovic)

- The Central Statistical Office (KSH) has published detailed data for economic activity in the third quarter of 2020. Real GDP fell by 4.6% year on year (y/y), 0.1% stronger than the flash estimate released in November indicated. This brings the average decline in the first nine months of 2020 to 5.4% y/y. This is the second consecutive quarter of economic contraction in annual terms. In quarter-on-quarter (q/q) terms, real GDP soared by 11.4%, the strongest quarterly growth ever recorded.

- Domestic demand has helped lead the quarterly revival, with private consumption rising by nearly 8% q/q boosted by the easing of COVID-19-related restrictions and pent-up demand in the third quarter. This was, however, offset by a 2% q/q fall in government spending as pandemic support measures for households and businesses were rolled back. Furthermore, gross capital formation fell 1.8% q/q, reflecting ongoing investor wariness since the start of the year as the pandemic spread from Asia to Europe as well as reduced absorption of EU funds.

- Meanwhile, despite soaring quarterly performance, net exports made no contribution to headline growth. Exports jumped 29% q/q in the third quarter while imports were up by an equally robust 19% q/q. This reflected the reopening of borders, supply chains and factories following the easing of the most stringent lockdown requirements. In addition, pent up consumer demand has helped boost demand for Hungarian good in key European markets.

- Across sectors, the easing of COVID-19 virus-related restrictions is also clearly visible, with growth driven by industry which jumped 24% q/q as factories reopened. Within industry, manufacturing jumped 27% q/q, with the revival of the automotive sector key to the resurgence. The service sector also noted a strong rebound, rising by 10% q/q as the easing of social restrictions allowed for the reopening of non-essential shops and the hospitality sector. These positive developments were offset by the ongoing fall in construction, which was down 4% q/q a reflection of falling investment.

- In a separate release, Hungary's unemployment rate dipped to 4.4% in the third quarter, 0.2 percentage points down compared with April-June 2020. The improvement reflects the easing of economic pressures as COVID-19-related lockdown measures were loosened.

- The outlook, however, remains challenging for Hungary and Europe as a whole. The fourth quarter of 2020 is likely to be dragged down by restrictive domestic measures reintroduced in November to stem the second wave of COVID-19 infections, which will weigh heavily on already fragile domestic demand and service-sector activity. However, the impact is likely to be more limited than in the second quarter of 2020, since manufacturing has avoided a shutdown. This will also help support exports, since manufacturing has remained online throughout Europe despite the increased social restrictions resulting in more contained supply chain disruption than earlier in the year.

- The weakness of the fourth quarter is likely to carry over into the start of 2021, with the increased social interactions of the festive season to result in an increase in infections and therefore restrictions through the first quarter. Base effects and the arrival of a COVID-19 vaccination program have led IHS Markit to forecast real GDP growth of 4.8% in 2021, however risks are weighed to the downside, with investment likely to remain sluggish, particularly amid ongoing tensions with the EU, and elevated unemployment eroding fragile confidence.

- Daimler is investing HUF50 billion (USD171 million) in its plant in Kecskemet (Hungary) to prepare the facility to manufacture the EQB battery electric vehicle (BEV), according to an MTI daily bulletin report. The investment was announced by Hungarian Minister of Foreign Affairs and Trade Peter Szijjarto after Daimler confirmed the EQB will be manufactured in Hungary. He said that the Hungarian government will support the investment, which will "cement the future of more than 4,400 jobs", with a HUF15-billion grant. (IHS Markit AutoIntelligence's Tim Urquhart)

- Russia's wheat is facing strong pressure ahead, as the state grain export quotas are due to come into effect early next year. A unified EUR25 per ton export duty on wheat is to operate from 15 February to 30 June and will be accompanied by a 17.5 million-ton grain export quota, according to SovEcon. This was officially confirmed on 14 December by the country's agriculture and economy ministries. Quotas and duties are introduced to lower domestic grain prices and reduce food inflation, but SovEcon believes the Russian wheat market will come under pressure from this policy change. The duty will be primarily absorbed by grain sellers and only partially mitigated by slight growth in export quotations, which have grown USD2-4/ton since the middle of last week. Average prices EXW (European part of Russia) for 3rd class wheat fell by RUB225 to RUB15,725/ton last week; 4th class - by RUB200 to RUB15,700/ton; 5th class - by RUB50 to RUB14,925/ton (excluding VAT.) The downside potential for ruble prices is estimated at about 10% from the current levels. The weakening of prices for barley and corn, which are not subject to export quotas, is likely to be less pronounced. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- El Nasr Automotive Manufacturing Company is in the process of signing a partnership contract with Dongfeng in December, reports Zawya citing CEO and Managing Director of El Nasr, Hany El Kholy. According to the agreement, the manufacturing company will produce 25,000 electric vehicles (EVs) at an estimated cost of EGP2.5 billion (USD158.7 million). According to the source, El Nasr is preparing the manufacturing facility to install production lines in the second quarter of 2021. Hany El Kholy said, "Egypt's Ministry of Public Business Sector is financially participating in this national project with up to 50%." He also urged the private sector as well as banks and businessmen to be part of the project adding that "the experimental production phase will last for up to eight months." In December, Chinese automaker Dongfeng announced the signing of a memorandum of understanding (MoU) to study the manufacturing of electric vehicles (EVs) in Egypt. The negotiations were restarted in March 2020 after they were halted due to the coronavirus disease 2019 (COVID-19) pandemic, which hit China at the very start of the year. The Egyptian government has stepped up efforts to attract automakers to build vehicles in the country. It has been a hub for vehicle exports to other Middle Eastern and African countries in recent years. Recently announced projects including Mercedes-Benz's planned new assembly center in Egypt, and a deal between Chinese automaker Foton Motor and Egypt's Ministry of Military Production to manufacture electric buses in Egypt. The co-operation between Dongfeng and El Nasr will help bring back production and jobs to the troubled Egyptian automaker. El Nasr Automotive Manufacturing Company is one of the oldest companies in the country's automotive industry, but production has been suspended since 2009 under a liquidation decision. (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- Most APAC equity markets closed lower on the day; Hong Kong -0.7%, Australia -0.4%, Japan/South Korea -0.2%, Mainland China -0.1%, and India flat.

- Index provider MSCI said it would drop seven companies that the US government has labelled as having ties to the Chinese military from its indices, after Donald Trump barred US investors from holding stakes in such businesses. MSCI said the seven companies — which included SMIC, China's biggest chipmaker — would be removed from its global equity indices at the end of the trading day on January 5. The businesses will be dropped from MSCI's popular emerging markets indices. (FT)

- Chinese economic data continues to show signs of recovery and posted gains during November 2020 in both industrial production (up 7% y/y) and consumption (retail sales up 5% y/y). According to data released by the China Association of Automobile Manufacturers (CAAM), new vehicle sales in mainland China for the reported month on a wholesale basis increased by 12.6% y/y, while production rose by 9.6% y/y. The auto market of mainland China expanded eight months straight in November 2020. Amidst economic recovery as well as increased seasonal demand due to the arrival of winters the appetite for fuel in the country is increasing. Lately, the North Asian LNG prices rally gained pace on unplanned supply disruptions from the liquefaction side as well as colder weather in the region. JKM spot prices rallied above $12/MMBtu and now at levels seen way back in September 2018. In terms of solid fuel, imported thermal coal prices delivered in China continued to rise, fueled by deepening domestic coal shortages as well as surging coal consumption due to falling temperatures and robust industrial activities. On the Zhengzhou Commodity Exchange (ZCE), January 2021 futures contract traded at RMB760.5/t ($116.28/t) despite all government efforts to cool down super-heated domestic coal prices. As per IHS Markit's Coal, Metal and Mining database, Indonesian low-rank 4200 GAR material spiked to $43.00/t CFR, up 24% surge from a month ago, when the release of extra quotas allowed import bookings to resume. As per IHS Markit's Commodities at Sea, total coal imports into China (Mainland) during November 2020 continued to remain under pressure and only marginally increased to 11.1mt (up 3% m/m and down 42% y/y). In terms of Chinese regions, arrivals into North, East, and South China stood at 5.9mt (up 33% y/y), 3.3mt (down 53%), and 1.8mt (down 76% y/y). (IHS Markit Maritime and Trade's Pranay Shukla)

- Figures from the Chinese Commerce Ministry show average wholesale prices for pork rising by 6% w/w to reach CNY41.98 per kg (USD6.02/kg) in the first week of December. Agriculture Ministry data, which is collated slightly differently, shows prices making further gains to stand at CNY43.46 on Monday (14 December). Commerce Ministry figures show wholesale beef prices rising for four consecutive weeks to reach CNY71.13 per kg in the first week of December. Agriculture Ministry data shows this spike accelerating last week, when prices reached CNY76 per kg - up 8% on year-ago levels. Similar trends are apparent for sheep meat, which rose for a fourth straight week to reach CNY64.74 per kg in the first week of December. Again, the spike appears to be gathering pace with new Agriculture Ministry data showing lamb prices are now 3.5% above year-ago levels. Although China has been rebuilding its pig herd and ramping up production of other types of meat, the country still needs to import large volumes to avoid shortfalls - particularly during peak demand periods. For overseas suppliers, attention will be focused not on local wholesale prices but on average export prices in US dollars. New data from Brazil shows a recovery in prices paid for beef and pork shipped to China in November. Frozen pork fetched USD2,475 per ton - some USD300 per ton more than the average in June and July. Frozen beef shipped from Brazil to China rose by a similar amount to reach USD4,367 per ton - the highest level since May. In an analysis this week, the Chinese Agriculture Ministry said higher local pork prices were mainly due to tighter supplies of live pigs. It said large-scale farms were selling fewer animals and instead fattening them to heavier weights because of higher demand for large pigs. Markets have also been impacted by concerns that imported meat may contribute to the spread of Covid-19. China now requires all inbound consignments to be tested for the virus and suspends suppliers when tests come back positive. This causes congestion at ports and pushes up costs, while at the same time making some Chinese consumers wary of imported products. (IHS Markit Food and Agricultural Commodities' Max Green)

- Chinese electric vehicle (EV) startup NIO entered into a framework agreement yesterday (14 December) with State Grid EV Service, a wholly owned subsidiary of State Grid, China's state-owned utility provider. The two companies first announced a partnership in 2017, which was centered on projects related to building EV charging infrastructure and energy storage system development. According to a report by news source Sohu, under the framework agreement, the two companies will work together to set up 100 charging facilities across China in 2021. The new facilities will be able to provide fast charging and battery-swapping services to NIO customers. NIO currently operates 165 battery-swapping stations and 85 fast-charging stations in China. The newly announced 100 charging facilities will involve a joint investment by NIO and State Grid EV Service. NIO began deliveries of its first model, the ES8 electric sport utility vehicle (SUV), in 2018. The full-size electric SUV has introduced the NIO brand to the EV market, but what really drives NIO's sales growth are its two following models, the ES6, a mid-size electric SUV, and the EC6, a coupé-style variant based on the ES6. According to NIO's November sales report, its deliveries soared 109% year on year to 5,291 vehicles last month, the highest monthly delivery results achieved by the company during 2020. As of the end of November, accumulative deliveries of NIO's three models reached over 68,600 units. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Lynk & Co, the brand jointly introduced by Geely Auto and Volvo Cars, has begun pre-production testing of its Zero electric vehicle (EV). According to a company statement, the new model has already gone through high validation speed testing at the Yan Cheng test facility in Jiangsu province (China). The testing will help engineers to assess the vehicle's performance at high speeds. More physical testing, including wind tunnel, and cold and hot weather testing is expected to continue over the rest of 2020 and into early 2021, with the final model being confirmed for production in mid-2021. Under the current schedule, the automaker aims to begin deliveries of the Zero EV in the last quarter of 2021. Geely unveiled the Lynk & Co Zero EV as a concept vehicle in September during a media event in Beijing, when it also launched its SEA architecture for EVs. It seems the automaker is making good progress in its effort to bring to the market the production version of the Zero EV Concept. As the first battery electric vehicle (BEV) based on the SEA architecture, the launch of the Zero EV in late 2021 will be important for Zhejiang Geely Holding Group (Geely Group) as the model is designed to showcase the automaker's latest EV technologies, which will later be applied to brands across the group. The Zero EV will receive over-the-air (OTA) updates to software. The vehicle is claimed to have a range of 700 km under the NEDC testing cycle with an 800-volt battery pack. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Automakers present in South Korea plan to add new electric vehicles (EVs) to their line-up in 2021, reports Maeil Business Newspaper. Hyundai Motor Group plans to roll out new EVs built on its electric-global modular platform (E-GMP), a dedicated EV architecture. It plans to launch the IONIQ 5 in 2021, the first model under its new IONIQ brand dedicated for EVs. It also plans to launch the electric version of its G80 sedan, the eG80, and a new vehicle codenamed JW under its premium Genesis brand. Its affiliate Kia plans to launch an EV, codenamed CV, based on the E-GMP architecture (see South Korea: 16 September 2020: Kia to launch seven new BEVs by 2027). SsangYong also plans to launch its first EV model, the E100 sport utility vehicle (SUV), based on the platform of its popular Korando SUV. The report highlights that more than 10 new EV models, including foreign-imported models, are likely to be launched in the South Korean market in 2021, allowing consumers to have 30 options when choosing an EV next year. By introducing new EV models, automakers aim to capture growing demand for EVs in South Korea. As reported earlier, EV registrations in the country had surged by 54.4% year on year (y/y) to 128,258 units as of the end of October. This growth has come on the back of positive demand for new models, as well as favorable policies and infrastructure initiatives by the government. (IHS Markit AutoIntelligence's Jamal Amir)

- Ride-hailing firm Ola has announced plans to invest INR24 billion (USD326 million) in establishing a facility in Tamil Nadu, India. The facility will manufacture electric scooters with an initial annual capacity to produce two million of these vehicles. It will create almost 10,000 jobs as Ola prepares to launch the first of its range of electric scooters in the coming months. The facility will build electric vehicles (EVs) for India, as well as for sale in regions such as Europe, Asia, and Latin America. Bhavish Aggarwal, chairman and group CEO of Ola, said, "We are excited to announce our plans to set up the world's largest scooter factory. This is a significant milestone for Ola and a proud moment for our country as we rapidly progress towards realizing our vision of moving the world to sustainable mobility solutions across shared and owned mobility. This will be one of the most advanced manufacturing facilities in the world. This factory will showcase India's skill and talent to produce world class products that will cater to global markets." Ola already operates a two-wheeler service, Ola Bike, which is available in 150 Indian cities and towns. The company announced last year that it intended to grow this business threefold in the next year. Recently, Ola Electric acquired Dutch-based electric two-wheeler manufacturer Etergo for an undisclosed amount. Ola Electric is currently running several pilot projects to deploy EVs and has set up battery-swapping stations across several cities in India with a focus on two- and three-wheelers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Australian government's upcoming plan to increase electric vehicle (EV) uptake in the country has leaked and online news source ABC claims to have obtained a copy of the document. As per the document, the main policies include AUD72 million (USD54.3 million) in funding already announced for co-investing in charging infrastructure; a two-year trial of an electric car fleet for COMCAR, which provides cars and drivers for politicians; updating the 'Green Vehicle Guide' website; and asking energy agencies to look at options for vehicle-to-home and vehicle-to-grid battery use. There is, however, no indication of financial help for customers to switch to electric cars and no target for new electric car sales. (IHS Markit AutoIntelligence's Nitin Budhiraja)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-december-2020.html&text=Daily+Global+Market+Summary+-+15+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 15 December 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+15+December+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}