Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 16, 2020

Daily Global Market Summary - 16 December 2020

Most major APAC and European equity markets closed higher, while the US was mixed. Benchmark European government bonds closed lower, while US government bonds closed almost flat on the day after yields whipsawed higher then lower post-FOMC meeting. iTraxx-Europe and CDX-NAIG credit indices closed flat, while their high yield counterparts were slighter wider on the day. Oil, gold, silver, and copper all closed higher. The markets will closely be watching tomorrow's US jobless claims report for additional signs of deterioration, with the possibility of a second consecutive week of sizable job losses potentially accelerating the passage of the $900 billion stimulus bill that could be up for a vote before the end of this week.

Americas

- US equity market closed mixed, but with all major indices rallying from near the lows of the day at that start of the 2:30pm EST FOMC press conference; Russell 2000 -0.4%, DJIA -0.2%, S&P 500 +0.2%, and Nasdaq +0.5%.

- 10yr US govt bonds closed +1bp/0.92% yield and 30yr bonds -1bp/1.65% yield. 10s sold off 3bps on the FOMC statement and then rallied 3bps between 2:27pm and 3:13pm EST.

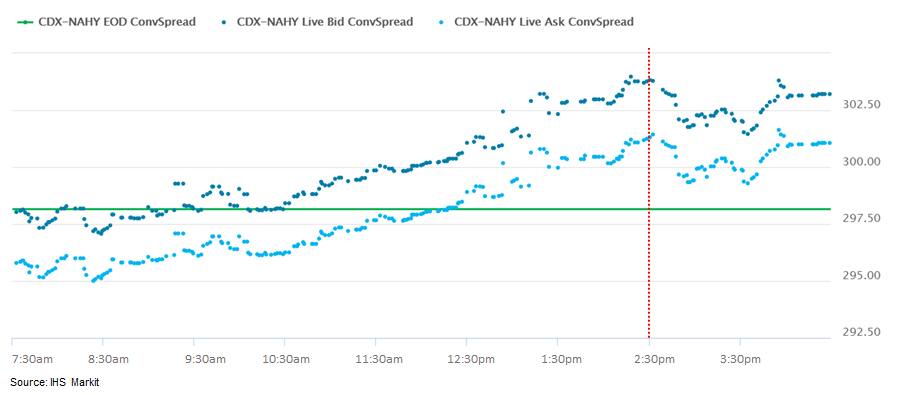

- CDX-NAIG flat/53bps and CDX-NAHY +4bps/302bps. CDX-NAHY was 2bps tighter an hour after the start of the FOMC press conference, but most of those gains were lost by 4:00pm EST.

- DXY US dollar index closed flat/90.45.

- Gold closed +0.2%/$1,859 per ounce, silver +1.7%/$25.05 per ounce, and copper +0.6%/$3.56 per pound.

- Crude oil closed +0.4%/$47.82 per barrel.

- Congressional leaders closed in on a roughly $900 billion coronavirus relief deal that includes another round of direct payments to households, according to lawmakers who aimed to pass the aid package before the week's end. The package under discussion was expected to include, along with direct checks, $300 a week in enhanced unemployment insurance, funding for vaccine distribution, schools, small businesses and health-care providers, and other relief measures. (WSJ)

- The Federal Open Market Committee (FOMC) concluded its scheduled two-day meeting this afternoon (16 December). As expected, it kept the target for the federal funds rate at a range of 0.00-0.25%. In the statement issued at the conclusion of today's meeting, the FOMC also clarified to some extent its plans with respect to purchases of Treasury and agency mortgage-backed securities, in essence committing to continue purchases for what is likely to be at least a couple years. There was only one substantive change to the post meeting statement, which provided updated guidance on plans to continue the Fed's large-scale asset purchases. The guidance commits the Federal Reserve to continue asset purchases most likely at least at current rates for a considerable further period, likely to be measured in years, not months. Previously the FOMC had indicated only that it expected to continue asset purchases at least at current rates over coming months. Today's guidance commits the Fed to continue those purchases until "substantial further progress" is made on getting to maximum employment and at least 2% inflation. (IHS Markit Economists Ken Matheny and Kathleen Navin)

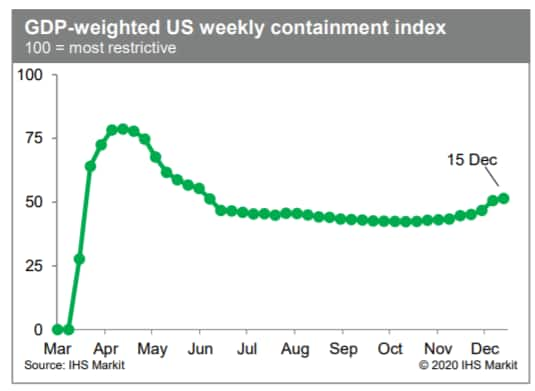

- The IHS Markit GDP-weighted US weekly containment index rose 0.8 point this week to 51.4, continuing a run of increases since mid-October amid surging confirmed COVID-19 cases. The increase this week reflected tightening containment efforts in North Carolina, Virginia, Massachusetts, and Delaware and was on the heels of a large increase the prior week. The aggregate containment measure is at its highest level since early June. Meanwhile, average consumer credit- and debit-card spending rebounded during the week ending 6 December following a week that likely was depressed by unusually low Black Friday spending. A shift away from in-person Black-Friday spending to online outlets and to days and weeks surrounding Black Friday could account for this sort of volatility. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Adjusted for seasonal factors, the IHS Markit Flash U.S. Composite PMI Output Index posted 55.7 in December, down from November's 68-month high of 58.6. The rate of expansion was sharp overall, despite easing to a three-month low. The loss of momentum was most notable in the service sector, where additional restrictions and softer demand impacted consumer-facing business once again. (IHS Markit Economist Chris Williamson)

- The seasonally adjusted IHS Markit Flash U.S. Services PMI Business Activity Index registered 55.3, slipping from 58.4 in November. The rate of growth was the slowest for three months, albeit solid. As reported virus cases increased once again, firms stated that restrictions and softer demand weighed on total activity.

- Manufacturing firms indicated the second-fastest improvement in operating conditions since April 2018, as highlighted by the IHS Markit Flash U.S. Manufacturing Purchasing Managers' Index (PMI) posting 56.5 in December, down slightly from 56.7 in November.

- Consequently, input costs increased further in December, and at the sharpest rate since April 2018. Firms were able to partially pass-on higher costs to clients, however, as selling prices rose at the steepest pace since April 2011.

- Although input buying rose once again, supplier delays led to the continued depletion of inventories, with stocks of finished goods falling at a sharper pace.

- Total US retail trade and food services sales declined 1.1% in November after a downwardly revised decrease of 0.1% in October. These declines were the first since April, but retail sales through November remained 3.6% ahead of the pre-pandemic February level. (IHS Markit Economists James Bohnaker and David Deull)

- The unexpected declines in October and November core retail sales resulted in a 1.3-percentage-point downward revision to our fourth-quarter forecast of real personal consumption expenditures (PCE) growth, from 6.2% to 4.9%.

- Nonstore retail sales (mostly online) rose 0.2% from an already-elevated level to +29.2% on a 12-month basis. Holiday shoppers are doing more gift-buying online relative to previous years to avoid crowded physical retail locations, especially around the usual Black Friday rush.

- Outside of online sales, home improvement remains a top-performing segment of retail; November sales at building material and garden supply stores increased 1.1% and were 18.7% higher than 12 months earlier. Homeowners are likely gearing up for an active spring housing market and the possibility of more time spent at home amid worsening virus counts.

- The restaurant industry's retrenchment accelerated in November as food services and drinking places sales fell 4.0%. Cooler weather has limited outdoor dining, and tighter restrictions on indoor dining spells more pain for the industry over the winter months.

- Retail sales were due for a breather after running hot throughout the summer. Waning fiscal stimulus, slowing job growth and elevated COVID-19 concerns will keep a lid on retail in the near term.

- On Dec. 11, the same day that Pfizer's vaccine was approved for use by the FDA, the number of bookings made across Marriott, Intercontinental Hotel Group, Kayak, and Priceline's websites—among those of many other boldface industry names—took a sudden and sharp turn upwards. According to RateGain, the travel technology company that powers bookings for the aforementioned brands as well as Hotwire, Trivago, Hyatt, and Accor, last Friday represented the largest number of daily bookings since the pandemic began in March, with 9,512 transactions processed in the U.S., across all its partner sites. That number is even comparable to a typical day's sales in Nov. and Dec. 2019, which generally saw between 8,500 to 10,000 bookings; the busiest day in Dec. saw 12,117 bookings. (Bloomberg)

- US biotech ImmunityBio has reported promising preclinical primate data for an oral version of its next-generation COVID-19 vaccine hAd5-S-Fusion+N-ETSD. This adenoviral-based candidate is engineered to eliminate any issues of pre-existing immunity (from previous common colds) and to display both the spike and nucleocapsid proteins, with an enhanced T-cell-stimulating domain. An injectable formulation of the vaccine has been in Phase Ib development in 35 participants in the US since October. In the preclinical study, five primates received subcutaneous doses on days 0 and 14 followed by an oral tablet on day 28, and the other five received a single injected primer dose and then two oral boosters. Results indicated that the oral version raised levels of anti-spike antibodies in almost all of the 10 recipients, particularly after the first or second booster. Following challenge with SARS-CoV on day 56, viral load and replicating virus in nasal passages and lungs fell more rapidly in vaccine cohorts versus controls. ImmunityBio plans to move the oral formulation into Phase I testing, both alone and as a booster to the injectable version already in trials, according to a Fierce Pharma report. In addition, the firm plans Phase II/III recruitment for the injectable version shortly, according to the source. (IHS Markit Life Science's Sacha Baggili and Janet Beal)

- The headline US housing market index fell four points to 86—still marking the second-highest reading in its 35-year history. A reading above 50 says that more builders view conditions as good rather than poor. (IHS Markit Economist Patrick Newport)

- Coincidentally, all three sub-indexes dropped four points from record highs. The current sales conditions index fell to 92, the index measuring sales prospects over the next six months slipped to 85, and the traffic of prospective buyers' index dropped to 73.

- All four regions fell from record highs. The West fell from a near-perfect score of 98 to 96; the South, the Northeast, and the Midwest all shed three points to still solid figures of 87, 78, and 82, respectively.

- Builder sentiment ended the year on a solid note—the second-highest reading on record—despite two headwinds: soaring lumber prices and an economy mired in a pandemic. Random Lengths lumber prices were above $650 per thousand board feet last week—down from a record $950 per thousand board feet in September—but up from $400 per thousand board feet in February. Tariffs on Canadian softwood lumber were cut from 20% to 10% earlier this month—that will help matters some.

- Why is housing demand so strong? Part of the story is mortgage rates dropping to all-time lows; another is that social distancing is possible in building homes; a third is bidding wars brought about by record-low interest rates and inventories, and pent-up demand from bidders displaced from the market earlier this year. And a fourth, perhaps pivotal—but hard to measure—is demand from those working remotely because of the pandemic wanting to relocate.

- With little fanfare, Amazon has posted a new policy that bans certain chemicals, including PFAS, lead, phthalates and BPA, in food packaging for products sold under its Amazon Kitchen brand. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- Amazon first posted a long list of restricted chemicals the company will "seek to avoid" for its Amazon-owned Private Brand Baby, House Cleaning, Personal Care and Beauty products in the US and EU.

- And earlier this month the online retail giant came out with a new list of chemicals it has restricted from being added to food packaging for its Amazon Kitchen brand, which includes Amazon Go, Amazon Go Grocery, Amazon Fresh, and Fresh grocery delivery.

- "We define chemicals of concern as those chemicals that: (1) meet the criteria for classification as a carcinogen, mutagen, reproductive, or other systemic toxicant; or (2) are persistent, bioaccumulative, and toxic."

- The list includes heavy metals (lead, cadmium, hexavalent chromium, mercury), arsenic, ortho-phthalates, per- and polyfluoroalkyl Substances (PFAS), perchlorate, five bisphenol compounds (A, B, F, S, A diglycidyl), and benzophenone. The list also includes four selected solvents: 2-ethoxyethanol, 2-methoxyethanol, N-methyl-2-pyrrolidone, and toluene.

- Along with those chemicals, Amazon is banning several non-recyclable materials for the Amazon Kitchen brand food contact packaging: polystyrene or expanded polystyrene; polyvinyl chloride; polyvinylidene chloride; polycarbonates; polyhydroxyalkanoates and polylactic acid as a rigid structure.

- The retailer signaled the list is likely to expand. "These policies are in addition to applicable local legal requirements and associated compliance plans, and will be expanded to additional brands, product categories, and geographies over time," the company said on its website.

- Gatik AI and Walmart has announced that their delivery pilot in Bentonville (Arkansas, US) is going driverless, starting in 2021. Last year, the companies partnered to transport orders on a two-mile route between a dark store, one that is not open to the public, and a neighboring market. Since then, the vehicles have logged 70,000 miles in autonomous mode with a safety driver. Next year, the companies intend to use autonomous trucks without safety drivers for deliveries in Bentonville. In addition, beginning early next year, the companies will expand the service area to Louisiana to test a longer delivery route. The autonomous vehicles, featuring a safety driver, will operate on a 20-mile route taking customer orders from a Walmart Supercenter in New Orleans to a customer pick-up location in Metairie (Louisiana). Significance: With these two autonomous delivery pilot schemes, Walmart aims to save time for its customers, as well as gaining more of an insight into how customers use the service. Walmart has also previously partnered with multiple tech startups and automakers on autonomous delivery programs. Gatik has deployed its autonomous vehicle system in the Ford Transit, which can drive up to 200 miles a day. To date, the company has raised USD29.5 million in funding. Recently, Gatik has launched an autonomous delivery service for Loblaws Inc., Canada's largest grocer. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Peru's National Institute of Statistics and Information (Instituto Nacional de Estadística e Informática: INEI) reports that monthly output rose in October at a seasonally adjusted rate of 3.2% month on month (m/m), corresponding to a 3.8% year-on-year (y/y) decline. (IHS Markit Economist Jeremy Smith)

- In yearly terms, Peru's best economic performance since the start of the coronavirus disease 2019 (COVID-19)-virus pandemic took place in October. The 3.2% m/m expansion made October the first month since June in which growth exceeded that of the previous month.

- As recently as August, only three sectors - finance and insurance, telecommunications, and public administration and defense - made positive y/y contributions to economic activity. By October, this had increased to seven sectors and each has shown improvement. Although service industries such as hotels and restaurants (-44.4% y/y), and transportation and storage (-23.1% y/y) continued to lag behind, copper mining (+1.9% y/y) and construction (+8.8% y/y) made notable gains.

- Labor market conditions similarly improved in the moving quarter ending in November; total employment rose by 7.0% m/m, more than twice the October rate. In addition, the unemployment rate declined significantly from 16.4% to 15.1% as the number of new hires started to outpace workers returning to the labour force.

- Nonetheless, the INEI considers as many as 49.8% of employed workers to be underemployed, an improvement from the 54.1% recorded in the previous month but far worse than the 34.9% figure from the same time last year.

- COVID-19 cases are declining in Peru, allowing the country to progress to Phase 4 of its economic reopening plan. To date, Peru has secured enough vaccine doses for 11.5 million citizens in 2021 and is exploring options to cover the remaining adult population. According to the Ministry of Health, some doses may arrive as early as this month, but mass immunization will not take place until the second half of 2021.

- Based on the publicly available information from Peru's Ministry of Economy and Finance, IHS Markit assesses that through late October, as much as half of the government's fiscal stimulus package, worth around 18% of GDP, was still unspent. Most of this will take the form of social transfers as well as infrastructure projects under the new Arranca Perú program. These initiatives will boost consumption and investment in 2021.

- As a result, IHS Markit has upgraded the December forecast for GDP outlook to an 11.9% contraction in 2020 and 9.4% growth in 2021.

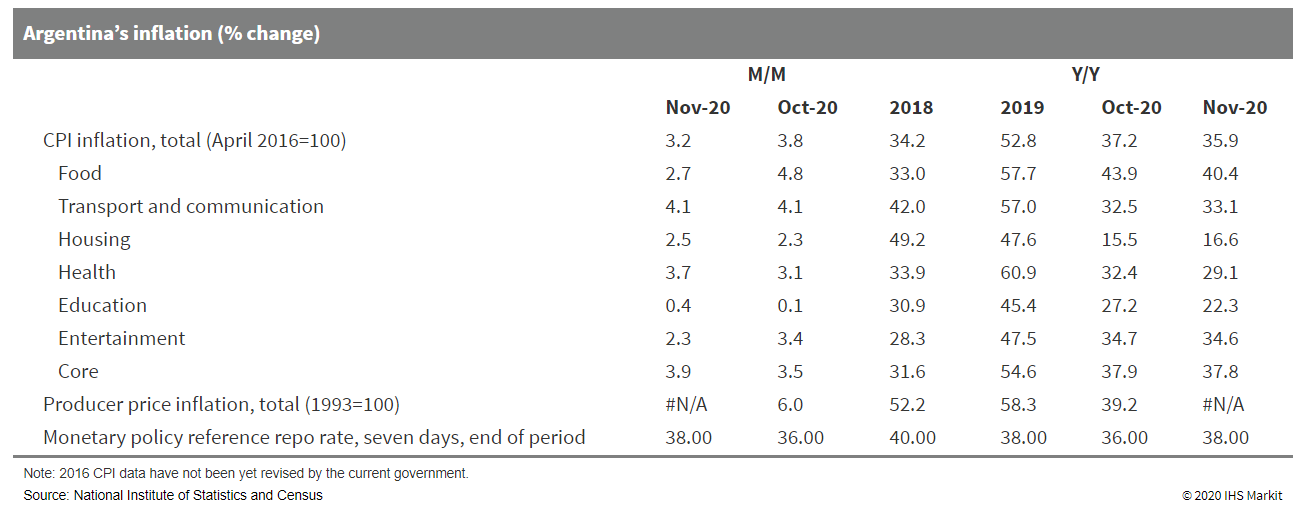

- Argentina's consumer price index increased by 3.2% month on month (m/m) during November. The increase in consumer prices was most pronounced in the leisure and culture activities, food and beverages, clothing and apparel, and home furnishings and maintenance sectors. (IHS Markit Economist Paula Diosquez-Rice)

- Argentina's inflation rate in August was driven by price increases in the food and beverages category, with significant price rises for beef and deli meats, dairy products, fresh fruit, and canned tomatoes, as well as rises in the recreation and leisure, clothing and apparel, and home furnishings and maintenance sectors. The rise in the transportation component was mainly driven by the increase in vehicle prices (up by 62.8% year on year in November).

- Prices of regulated items increased by 1.2% m/m, while prices of seasonal items rose by 2.0% m/m. The core inflation rate stood at 3.9% m/m. Meanwhile, wholesale prices climbed by 39.2% y/y in October, a significant acceleration when compared with the previous month. The annual consumer price inflation rate in November was 35.8%, a deceleration compared with October.

- Inflation expectations for the next 12 months came down in November; Torcuato Di Tella University reported a median of 40% y/y, a decrease from 45% in October. The average expected annual inflation rate is 44.5%. However, the inflation expectation survey by the Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA) shows a median of 52.5% in November.

- The cost of a basic food basket that keeps an adult above the extreme poverty line increased by 42.9% y/y in November, faster than the annual headline inflation rate. At the same time, the price of a basket of basic goods that keeps an individual above the poverty line increased by 37.7% y/y in November.

- Wage indexation is lagging consumer price inflation and more so in terms of prices of food and essentials. Meanwhile, pandemic relief is set to retreat with the loosening of the activity restrictions, which, while reducing the fiscal deficit, will bring more popular discontent as the economy is still on shaky ground.

- The inflation rate remains high despite all the price controls in place; retailers anticipate a higher cost of restocking, partly because of the lack of clear policies that would take the country out of the vicious cycle of high inflation and strong depreciation. Although the monetary policy is currently in positive territory in real terms, Argentina continues with its expansionary monetary approach with monetary aggregates increasing above 88% y/y in November 2020.

Europe/Middle East/Africa

- Most European equity markets closed higher except for Spain -0.2%; Germany +1.5%, UK +0.9%, France +0.3%, and Italy +0.2%.

- 10yr European govt bonds closed lower; France/Spain +5bps, Germany +4bps, Italy +2bps, and UK +1bp.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover -2bps/246bps.

- Brent crude closed +0.6%/$51.08 per barrel.

- At 50.7 in December, the seasonally adjusted IHS Markit/CIPS Flash UK Composite PMI - based on approximately 85% of usual monthly replies - was up from 49.0 in November and back above the crucial 50.0 no-change mark to indicate a very modest renewed expansion. (IHS Markit Economist Chris Williamson)

- The improvement in the PMI coincided with an easing of some COVID-19 containment measures compared to November, which had seen a national lockdown. In December, a new tiered system of containment measures was introduced to better target local outbreaks, which collectively represented a modest easing of national restrictions.

- The recovery lacked vigor, however, as the service sector remained under particular strain, contracting marginally again as ongoing social distancing measures due to the new tiered lockdowns continued to hit many parts of the economy. Services activity has now fallen for two months as the new lockdowns have hit, following four months of expansion. Consumer-facing services, notably hotels, restaurants and tourism, reported further marked declines in output during December, largely offsetting renewed growth in business services, transportation and manufacturing.

- The manufacturing and transport sector improvements were linked to reviving global trade and a short-term boost from Brexit-related stockpiling, which reportedly buoyed order books and exports during the month. Around 20% of manufacturers, for example, reported that activity had increased during the month due to Brexit and related stockpiling.

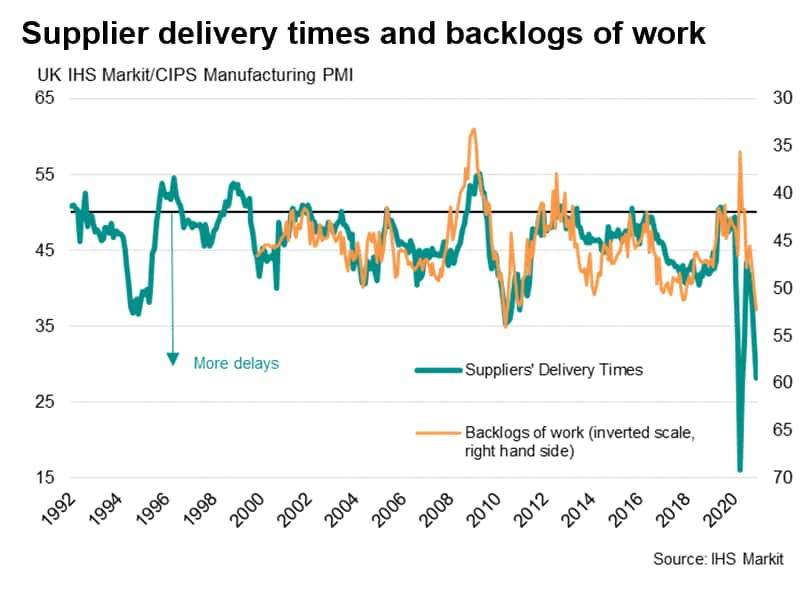

- Brexit stockpiling appears to have exacerbated existing global supply chain delays, constraining output at some manufacturing firms. Around 45% of the survey panel reported longer wait times from suppliers, while only 2% saw an improvement. The resulting lengthening of lead times in December was the third-steepest since the survey began in 1992, exceeded only by those seen amid COVID-19 shutdowns in April and May.

- While job losses continued to be reported during the month, it was encouraging to see the rate of job cutting ease to the lowest since the start of the pandemic. Business optimism about the year ahead also remained buoyant, reflecting the light at the end of the tunnel created by the roll-out of the COVID-19 vaccines. Optimism waned slightly compared to November, however, largely due to rising concerns over a no-deal Brexit.

- London is considering charging non-resident drivers to enter the city, reports Autocar. Under the proposal being looked at by Mayor Sadiq Khan, those living outside the city would be charged up to GBP3.50 per day to use the roads within the Greater London Authority boundary on weekdays. According to Transport for London (TfL) analysis, this would raise around GBP500 million per annum. However, it is also said that it would reduce the number of trips into the boundary by 10-15%, as well as reducing air pollution. The proposal comes as Khan is seeking to plug a huge shortfall in TfL's funding in the wake of the COVID-19 virus pandemic and a reduction in public transport usage. (IHS Markit AutoIntelligence's Ian Fletcher)

- The PMI survey data suggest that the eurozone economy is faring better than expected in December. The IHS Markit flash composite PMI came in at 49.8, ahead of consensus expectations of 45.8, as polled by Reuters. As such, the data hint at the economy close to stabilizing after having been plunged back into a severe decline in November amid renewed COVID-19 lockdown measures. (IHS Markit Economist Chris Williamson)

- The fourth quarter downturn consequently looks far less steep than the hit from the pandemic seen earlier in the year. Although down from 52.4 in the third quarter, the fourth quarter average of 48.4 is far higher than the mean of 31.3 seen in the second quarter.

- The picture is nevertheless very mixed by sector. Although manufacturing output growth accelerated in December, having slowed in November, the service sector saw output contract for a fourth successive month, albeit with the rate of decline easing markedly to the slowest since September as fewer companies reported output to have been hit by lockdown restrictions compared to November.

- In fact it was this sharp easing in the service sector which was the main driver behind the PMI coming in higher than anticipated: analysts were merely expecting the services PMI to rise from 41.7 to 41.9, but the flash reading came in at 47.3. However, note that at 55.5 the headline manufacturing PMI also beat expectations (53.0).

- Germany reported an expansion of output for the sixth successive month, its flash composite PMI rising from 51.7 to 52.5 in December. Manufacturing output growth cooled for a second month running but remained among the highest seen in the survey's history, accompanied by a moderation in the service sector's downturn.

- Output meanwhile continued to fall in France for a fourth successive month, though the flash composite PMI jumped from 40.6 to 49.6 to indicate a sharp easing in the rate of contraction to the slowest seen over this period of decline. Manufacturing output returned to modest growth and service sector activity came close to steadying.

- In addition to the fourth quarter coming in ahead of consensus expectations, companies have also become increasingly optimistic about the year ahead, with vaccine roll-outs expected to help restore businesses to more normal trading conditions as 2021 progresses. Business expectations about output in the coming 12 months rose to the highest since April 2018. Sentiment about future prospects hit a 27-month high in the service sector and a 34-month high in manufacturing.

- Eurozone GDP will still suffer a large quarter-on-quarter (q/q) contraction in the fourth quarter of 2020, with the chances of another decline in the first quarter of 2021 increasing given recent announcements. (IHS Markit Economist Ken Wattret)

- Following a 1.5% month-on-month (m/m) rise in October's retail sales volumes, subsequent eurozone industrial production and export data continued the strong start to the fourth quarter, with both rising by 2.1% m/m in October, their sixth consecutive m/m increases.

- However, eurozone industrial production (-3.5%) and exports (-6.2%) remained some way below their pre-coronavirus disease 2019 (COVID-19) virus pandemic February levels, in contrast to retail sales (+3.1%).

- Production of consumer durable goods continued to outperform (see first chart below), with output in this sub-sector above February's level (+1.4%), while production of capital goods has underperformed (-5.4%) despite a strong rise in October.

- The eurozone's seasonally adjusted trade surplus rose to EUR25.9 billion (USD31.6 billion) in October, its highest level since March and well above the average of EUR22.1 billion in the final quarter of 2019 (see second chart below).

- Imports to the eurozone rose by 1.0% m/m in October in value terms and remained more than 7% below their level in February.

- Although the fourth quarter started brightly, it will end on a very weak note given that COVID-19 virus-containment measures have been ramped up subsequently in many eurozone member states, and a sizeable q/q contraction in eurozone GDP looks very likely.

- Our recently updated baseline forecast assumes a 2.6% q/q decline, much reduced from the second quarter's extreme drop given the less widespread restrictions this time around. Unlike during the prior lockdown period, for example, manufacturing businesses generally remain operational during the current phase, reflected in the recent resilience of IHS Markit's PMIs for the sector.

- Production of chemicals, including pharmaceuticals, will increase 1.5% in Germany in 2021, and sales generated by the German chemical-pharmaceutical industry will rise 2.5%, according to industry association VCI (Frankfurt). Demand for chemical products is largely stable at the end of 2020, it says. "Business sentiment is now confident in most of our companies," says VCI president and Evonik Industries CEO Christian Kullmann. "More than half of them expect sales to go up next year both in Germany and abroad." (IHS Markit Chemical Advisory)

- The industry in Germany has had a "difficult year" in 2020 due to COVID-19, VCI says. The period has been "characterized by marked ups and downs in the four quarters," it says. Due to weaker demand, chemical production including pharmaceuticals has decreased by 3% overall in 2020, with all sectors recording losses, VCI says. The decline is in line with VCI's latest forecast. Losses by sector ranged from a minor slip in the output of pharmaceuticals of 0.5% to a slump of 6.5% in polymers production. Total output of chemicals excluding pharmaceuticals has decreased 4% in Germany this year, VCI says.

- VCI says that a "corona-related lack of orders" has caused sales by Germany's chemical-pharmaceutical industry to fall 6.0% in 2020, to €186.4 billion ($227.4 billion), with domestic sales down 5.5% and export sales lower by 6.5%. A 2% fall in producer prices helped drive the decline. "The strain on our member companies is considerable," says Kullmann. "However, our industry as a whole has been hit less hard than other sectors of the economy."

- VCI projects a slight drop in employment of 1% in Germany's chemical industry in 2021, due to the "structural change in the industry which is being accelerated by the corona crisis." Employment in the industry is currently stable at 464,000 compared with a year ago, "irrespective of the weak chemicals business," VCI says.

- The latest VCI members' survey shows that many chemical companies operating in Germany will need some time to overcome the crisis. Only 17% of member companies participating in the survey believe they will return to pre-crisis levels in 2020 and about 25% expect to be able to make up for the decline by the end of 2021. The largest number of businesses surveyed, 47%, think they will have overcome the crisis in 2022 at the earliest.

- The recent tightening of the EU emission-cut target from 40% to 55%, "must come with flanking measures to ensure that energy-intensive products can continue to be manufactured competitively in Europe," Kullmann says. VCI warns against the introduction of climate tariffs by the European Commission for imports of CO2-intensive basic materials into the EU. "Apart from a lack of controllability and trade conflicts, there is also a risk of a loss in competitiveness at downstream stages of value chains," Kullmann says. "Only more complex compensation models can be helpful to the chemical industry in Europe. Above all, climate tariffs cannot substitute existing compensation measures for rising climate protection costs of European companies."

- The Polish government-backed project to build a national battery electric vehicle (BEV), ElectroMobility Poland (EMP), has announced that it has selected a new site for the plant to build the vehicle, according to a Reuters report. The company has chosen the industrial region of Silesia as the location of the new plant. The new EV, which has already debuted in concept form and which will be built under the Izera brand name, will now go into production in 2024, as opposed to the originally slated timescale of 2023. Polish Climate Minister Michal Kurtyka said, "Izera is an opportunity for an efficiently functioning automotive industry here and for using the potential of electromobility, which fits perfectly into the economic landscape of the region." EMP is planning to launch two new models under the Izera brand name, with part of the rationale behind this bold government-backed project being to make Poland more attractive as a destination for EV manufacturers. To lessen the risk, EMP said it will license the vehicle's platform from a foreign partner, but has yet to say which this will be. (IHS Markit AutoIntelligence's Tim Urquhart)

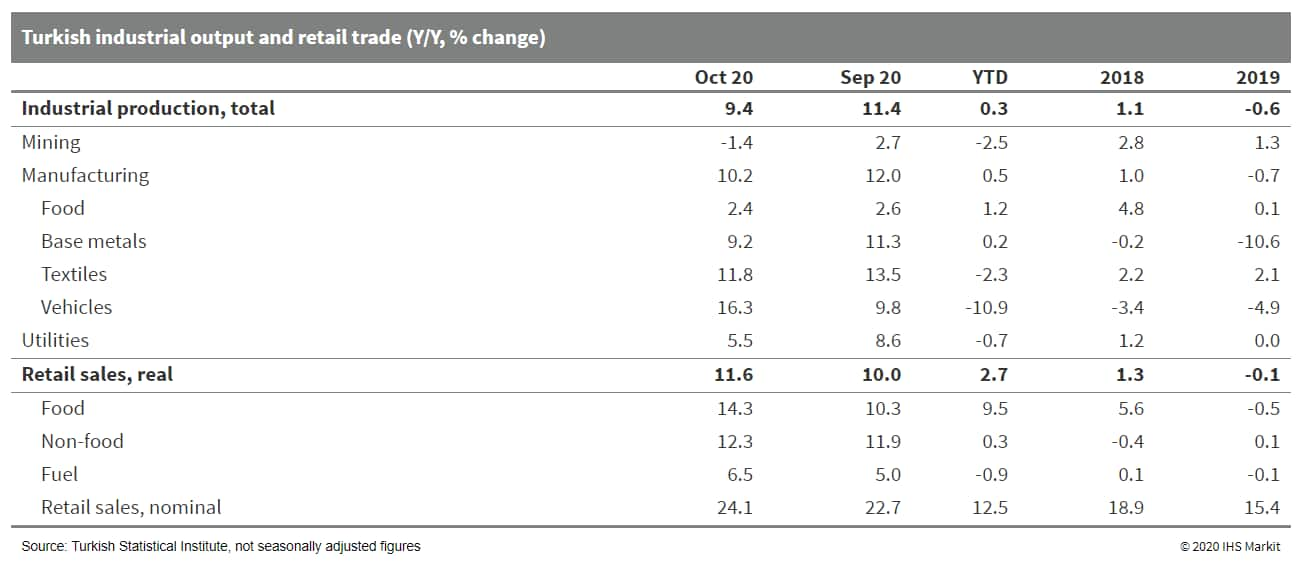

- The Turkish economic recovery continued into October, as expected given sustained expansionary economic policies into November. The tightening of monetary policy and slowing of credit growth will not begin to damage industrial production and retail trade until December. (IHS Markit Economist Andrew Birch)

- In October 2020, Turkish industrial production continued to push upwards, recovering from its second-quarter drop. The implementation of social distancing regulations to slow the spread of coronavirus disease 2019 (COVID-19) had reduced total industrial output by 35% in seasonally and calendar adjusted terms between February and April 2020. With the relaxing of those restrictions, production returned to pre-pandemic levels as of August and, as of October, total monthly output was up by 4.9% compared to February production.

- For the first 10 months as a whole, however, total industrial output remained slightly down, by 0.3% year on year (y/y). Raw data show a modest expansion of production, by 0.3% y/y.

- Meanwhile, expansionary economic policies also kept retail trade growing rapidly in October, also recovering from the COVID-19-induced, second-quarter drop. After dropping by 28.1% between February and April, total retail trade volume returned to pre-pandemic levels in September, rising by another 4.2% month on month (m/m) in October.

- In November, both industrial production and retail trade growth may have begun to falter. Leading confidence indices, including the IHS Markit Purchasing Managers' Index, slipped as compared to October. The PMI faltered particularly badly, falling back to 51.4, its lowest level since May and continuing a clear downward trend since July.

- The falling lira is putting negative pressure on companies' external obligations, particularly those companies that see income in lira but have obligations in hard currencies. Meanwhile, the weaker lira is not necessarily buoying external demand, as in typical times. Instead, ongoing global demand softness due to COVID-19 is squeezing manufacturers who are facing higher input costs and external obligation pressures but not reaping stronger export earnings.

- Through November, retail and consumer confidence levels were more resilient, suggesting that while industrial gains may falter in November, retail trade should continue to grow relatively robustly.

- Mobileye plans to develop its own LiDAR sensors for an autonomous car system by 2025, reports Reuters. Mobileye says that its LiDAR sensors will work on the principle of frequency modulated continuous wave, which measures distance as well as instant velocity without losing range. This technology will enable Mobileye to bring down costs for autonomous vehicle systems for consumer cars. The company also says that its in-house-built LiDAR, in combination with cameras and radar, will be used in consumer vehicles and could replace Luminar's laser-based LiDAR sensors in robo-taxis. In November, Mobileye signed a LiDAR supply agreement with Luminar for use in its first generation of robo-taxis. Amnon Shashua, CEO of Mobileye, said, "We believe the cost of an entire self-driving system can be in the few thousand dollar range, and that brings us into a consumer vehicle position. If we can make this work, it will also be used for robo-taxis. But we have time to make that decision five years from today." Mobileye, an Israeli-based company acquired by US chip-maker Intel, develops advanced perception systems that enable drivers to detect nearby vehicles, other road users, and unexpected hazards. Mobileye is making rapid advancements in developing an autonomous vehicle system using cameras and a custom-made processor chip. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- Most APAC equity markets closed higher on the day; Hong Kong +1.0%, India +0.9%, Australia +0.7%, South Korea +0.5%, Japan +0.3%, and Mainland China flat.

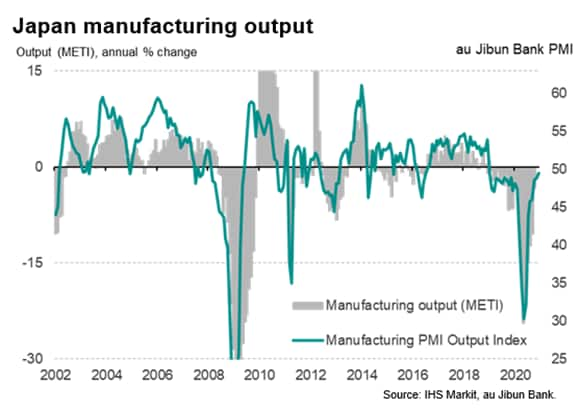

- The flash au Jibun Bank composite PMI, based on around 80% of normal monthly replies, edged lower in December, down to 48.0 from 48.1 in November, indicating a further deterioration of business conditions. The lackluster performance in December indicates a subdued end to 2020 for the Japanese economy, which has struggled to regain growth momentum as the COVID-19 pandemic continues to affect many businesses. (IHS Markit Economist Chris Williamson)

- Business activity continued to worsen in December due to an ongoing marked decline in new business inflows during the month, in turn reflecting weakened domestic and export demand. The survey's composite new orders index signalled falling inflows of news work for an eleventh successive month, in part due to a continued loss of new export sales, which have now fallen for some 25 straight months.

- Service providers reported an especially tough end to the year, with business activity having fallen continually since a modest rise recorded back in January, dropping in December at the fastest rate since September in response to a further steep worsening of order books.

- Manufacturing, in contrast, saw its PMI output index climb to the highest since December 2018, though remaining at a level which merely hints at production volumes approaching levels of a year ago. Although still deteriorating, the loss of new orders into the goods-producing sector was the smallest recorded over the past two years.

- The relatively better performance of manufacturing was reflected in the survey's employment indices, with factories reporting a net increase in staffing levels - albeit only very marginal - for the first time since February. The service sector, on the other hand, reported a further reduction in headcounts during the month, meaning jobs have now been cut in nine of the past ten months.

- Manufacturers also remained more optimistic about prospects for the year ahead than services providers in December, largely reflecting expectations of further COVID-19 restrictions in activities such as travel, tourism and other historical and recreational services. However, both sectors saw future expectations slip lower, despite the month seeing brighter news on vaccine developments, adding to the subdued picture for the economy at the end of the year.

- The survey also brought news of firms' costs increasing at the fastest rate since February, rising in both manufacturing and services, linked in part to higher commodity prices. However, average prices charged for goods and services fell at an accelerated rate, as increasing numbers of companies offered discounts in the face of sluggish sales and weak final demand. The divergence between the survey's cost and selling price indices naturally bodes ill for profits, suggesting firms' margins are being squeezed.

- Japan's trade balance was positive for the fifth consecutive month in November with a surplus of JPY367 billion (USD3.5 billon) on a non-seasonally adjusted basis. It rose by 57.5% month on month (m/m) to JPY570 billion on a seasonally adjusted basis. The sustained surplus reflects a softer year-on-year (y/y) decline in exports (down by 4.2% y/y) relative to imports (down by 11.1% y/y), although the contraction in exports widened from the 0.2% y/y drop in October. (IHS Markit Economist Harumi Taguchi)

- The wider y/y drop in exports reflects declines in exports to the United States and Asia, following rises in the previous month and a continued decline in exports to the European Union. Major factors behind the weakness were lower exports of mineral fuels, iron and steel, automobiles, and scientific optical instruments, which offset the higher exports of chemical, electrical machinery, and some other products.

- Since the contraction in import volumes narrowed to 2.4% y/y from the 5.7% y/y drop in October, the continued weakness in imports was largely due to lower prices, particularly of resources and mineral fuels. Mineral fuels contributed 8.2 percentage points to the contraction in imports. Other major contributors to the decline were imports of automobiles, medical products, and clothing and accessories, offsetting the increases in imports of mobile phones and other electrical machinery.

- Exports could weaken over the short term, reflecting the global resurgence of the COVID-19 virus pandemic and related containment measures. While sluggish imports were partially caused by a modest pace of the resumption of domestic economic activity, the November figures suggest that net exports are likely to contribute to the continued growth of Japan's real GDP in the fourth quarter, but to a more modest degree compared with that in the third quarter.

- Negative impacts of the pandemic remain a downside risk until vaccines are available for the population at large, which IHS Markit expects in mid-2021. The yen's recent appreciation could also be a negative factor for Japan's export competitiveness. Given that exporting enterprises' average exchange rate assumption for the second quarter of fiscal year 2020/21 (ending March 2021) is JPY106.55/USD1.00, whereas the current level is JPY103.58/USD1.00, persistent yen appreciation could lower corporate profits, weighing down on fixed investment and employment. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Japan Maritime United Corporation (JMU) has started fabrication of Shimizu's newbuild self-elevating jackup vessel for the offshore wind market. Early in November, JMU held a steel cutting ceremony at their yard in Kure, Japan. The jackup vessel will be built according to GustoMSC's SC-14000XL design, capable of installing 12 MW wind turbines and monopiles. The 130-person vessel will be equipped with a telescopic crane capable of lifting wind turbines weighing up to 1,250 metric tons at a height of 161 meters, as well as 2,500-metric-ton foundations at a height of 121 meters. Shimizu is aiming for the vessel to start working in October 2022. The vessel would establish Japan's nascent domestic supply of wind turbine installation vessels.

- Chinese technology giant Baidu is considering making its own electric vehicles (EVs) and has held talks with automakers about the possibility, reports Reuters, citing sources with knowledge of the matter. Baidu is considering contract manufacturing, or creating a majority-owned venture with automakers, according to the report. Baidu has held preliminary talks with several Chinese automakers, including Zhejiang Geely Holding Group, GAC Motor Group, and FAW Group, about a possible joint venture (JV), although no decisions have been made at this stage. Over the past five years, Baidu has primarily been focused on the development of autonomous vehicle technologies and automotive-related connectivity solutions. The company is involved in extensive co-operation with automakers through its autonomous vehicle platform, the Baidu Apollo. Supported by the technology, automakers including Geely, Volkswagen, Ford, and Changan have begun pilot programs to bring robo-taxis to the road. Baidu also provides an artificial intelligence (AI)-backed vehicle connectivity system to automakers, which allows drivers to control the vehicle's features through voice command. These automotive-related technology solutions have helped Baidu to gain a unique position in the automotive industry, although it is not clear at this stage whether the company will become further involved in vehicle manufacturing through a JV with an existing automaker or through contract manufacturing. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Automated truck startup Plus has expanded its partnership with Chinese digital freight-matching platform Full Truck Alliance (FTA). Under this partnership, the FAW J7+ truck powered by Plus's automated vehicle system will be available for sale on FTA's platform. This will give Plus access to a sales channel that handled transactions for over 10 million truckers and 5 million shippers in 2020. The FAW J7+ intelligent truck, jointly developed by FAW Jiefang and Plus, will start mass production in the first half of 2021. Tianye Miao, senior vice-president at FTA, said, "As a strategic investor in Plus, we have long believed in the team and its ability to execute on being the first to commercialize automated trucks. We are excited to see mass production of the Plus automated trucking system start in 2021, and to realize our vision of bringing this transformational technology to the millions of truckers and shippers on our platform". Plus (formerly known as Plus.ai), which was founded in 2016, aims to make commercial freight transport safer, more efficient, and less expensive for its customers. The company has raised USD200 million in funding over three rounds. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- SsangYong has missed the repayment of KRW60 billion (USD54.9 million) of debt that was due on 14 December to its three creditors, reports the Yonhap News Agency. The automaker said that the outstanding loans amounted to KRW59.9 billion and that the interest was KRW600 million, accounting for 8% of its total equity. The debt includes KRW20 billion from JP Morgan, KRW10 billion from BNP Paribas, and KRW30 billion from Bank of America Merrill Lynch. "[The company] doesn't have enough funds to repay the debt due to worsening business conditions," said the automaker in a regulatory briefing, adding "We will try to extend the debt maturity with our creditors." SsangYong's KRW90-billion debt with the state-run Industrial Bank of Korea is due for repayment on 21 December. SsangYong is struggling and recorded a net loss for the 15th consecutive quarter in the third quarter of 2020. Furthermore, the automaker witnessed a 19.3% year-on-year (y/y) plunge in its global sales to 96,763 units during January-November, mainly owing to the COVID-19 virus pandemic, which has caused a contraction in consumer spending. (IHS Markit AutoIntelligence's Jamal Amir)

- Ashok Leyland's parent company Hinduja Group is looking at selling a minority stake in its newly created electric vehicle (EV) arm Switch Mobility, reports The Economic Times. People aware of the matter have told the newspaper that it is considering selling between 10% and 20% of the business, raising between USD200 million and USD300 million. It adds that it has been looking to generate interest from sovereign wealth funds in the Middle East such as Mubadala Investment Co, Qatar Investment Authority, Abu Dhabi Investment Authority, and Saudi Arabia's Public Investment Fund. The anonymous sources have also said that Google's parent company Alphabet, Microsoft and Softbank Group have also been approached. Switch Mobility was announced last month and comprises the assets of the automaker's UK bus-making arm Optare Group, which is already offering a range of electric powertrain options alongside its traditional diesel powertrains. (IHS Markit AutoIntelligence's Ian Fletcher)

- IHS Markit's flash PMI for Australia, measuring output across both manufacturing and services, rose from 54.9 in November to 57.0 in December, its second highest since June 2017 and indicating a marked acceleration of economic growth in the closing month of 2020. (IHS Markit Economist Chris Williamson)

- The rate of expansion signaled by the PMI has now accelerated for three successive months, underscoring how the recovery has continued to regain momentum after the initial rebound from the first lockdowns faded in August.

- December's improvement in the PMI coincided with a relaxation of virus-fighting measures. IHS Markit's COVID-19 Containment Index for Australia fell from 38 to 30 between November and December, indicating that virus-related restrictions are now the loosest since the pandemic started. The index peaked at 76 at the height of the initial lockdowns back in April, which led to the PMI falling to a survey-low of 21.7, pointing to a very steep deterioration in economic growth.

- The rise in the flash PMI, which is an early estimate based on around 80% of normal monthly replies, bodes well for GDP. According to the latest available official data, the economy rebounded in the third quarter, mirroring the recovery signaled in advance by the earlier PMI numbers, expanding by 3.3%. However, that expansion followed a 7.0% decline in the second quarter, and still left the economy 4.2% smaller than its peak seen at the end of 2019.

- It was not all good news, however, with exports of both goods and services continuing to decline during December. Services once again showed an especially steep fall, largely reflecting ongoing travel curbs associated with the pandemic, which hit tourism in particular. Encouragingly, though, the drop in services exports was the smallest recorded since the decline began back in February.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--16-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--16-december-2020.html&text=Daily+Global+Market+Summary+-+16+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--16-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 16 December 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--16-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+16+December+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--16-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}