Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 10, 2020

COVID-19 outbreak dampens output across all sectors in Asia except healthcare

- Asia Composite PMI lowest since January 2009

- Sector data points to broad-based weakness as coronavirus disrupts supply chains and hits demand

- Rising backlogs and positive outlook suggest recovery in certain sectors possible on improved COVID-19 situation

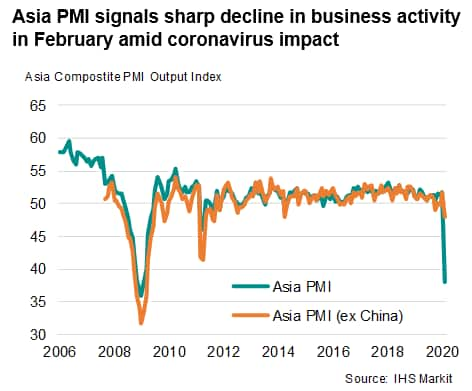

Asian economic activity shrank sharply in February, according to the latest PMI surveys, contracting at the quickest pace since the depths of the global financial crisis. The surveys also brought signs that most sectors of the economy were affected by measures taken in response to the outbreak of the coronavirus disease 2019 (COVID-19).

The headline Asia Composite PMI, compiled by IHS Markit, plunged 13.8 points to 37.9 in February, its lowest reading since January 2009. The fall was driven by sharp declines in both manufacturing output and services activity as coronavirus-related measures such as factory shutdowns and travel restrictions hit supply chains and demand.

Broad sectoral weakness

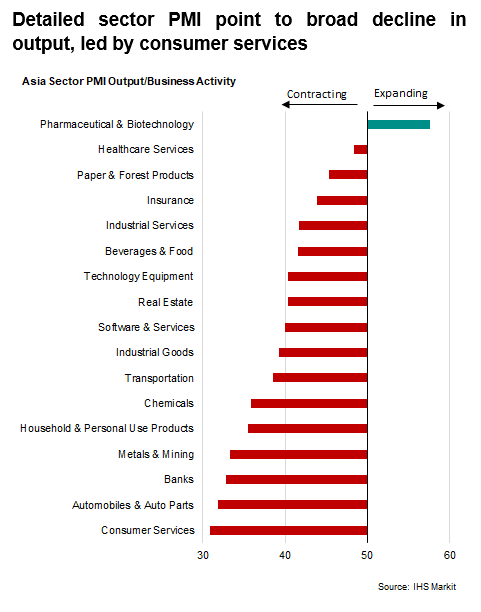

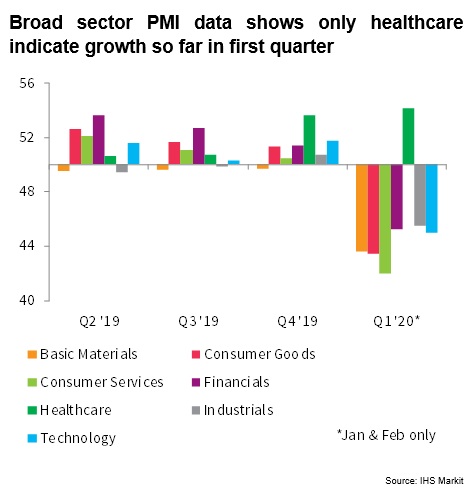

Delving deeper into IHS Markit's Asia Sector PMI data allows us to drill down into detailed industry trends and highlight how the virus epidemic has impacted many sectors of the economy during February. The latest numbers showed output fell in all but one of the 17 monitored sub-sectors from just four in January.

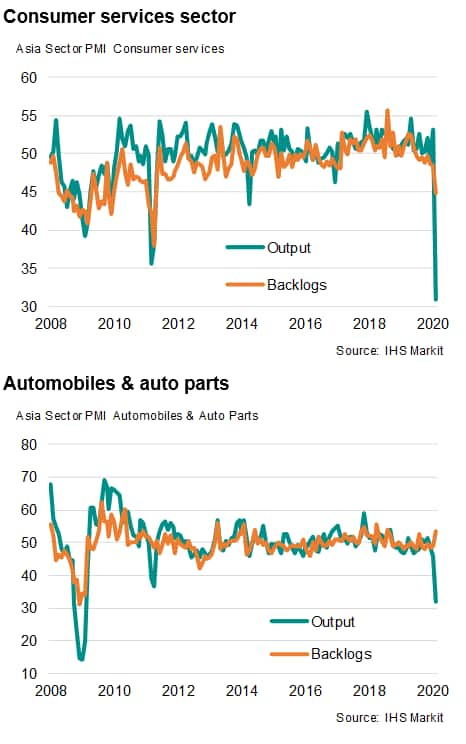

The downturn was led by consumer services - a key barometer of domestic demand and tourism-related services - with the sub-sector recording a severe decline in business activity after a solid expansion at the start of the year. The weakness in consumer services activity was related to the spread of the coronavirus weighing on outbound tourism from China and many other Asian countries.

The automotive sector remained stuck in a downturn for a third straight month, registering the second largest fall in output among the 17 monitored sub-sectors. Auto production contracted at the fastest pace since the start of 2009, surpassing the steep decline seen during April 2011 when supply chains were disrupted by Japanese earthquakes and Thai floods.

With auto companies already being adversely affected by slowing global demand and trade war tensions for most of last year, the disruptions to supply chains and demand brought on by the coronavirus countermeasures dealt a second blow to the sector early this year.

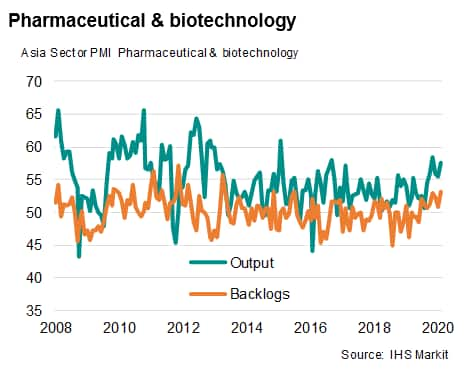

By contrast, pharmaceutical & biotechnology firms topped the detailed sector growth rankings in February. Not only was it the sole sub-sector not struggling, its output rose at one of the fastest rates for nearly three-and-a-half years amid the public health crisis. Increased production of drug-makers was accompanied by a marked rise in new orders.

Countermeasures hit demand

Measures to contain the spread of the coronavirus, including work suspensions and travel restrictions, alongside a general fear of being infected weighed heavily on sales in many sectors. Most sectors tracked in the Asia Sector PMI survey reported a contraction in new orders, except in three categories: Pharmaceutical & Biotechnology, Construction Materials, and Technology Equipment. The sharpest decline in new business was seen in Banks, Metal & Mining, and Transportation sectors during February.

Recovery

Public health measures designed to halt the spread of COVID-19reportedly led to a severe disruption of supply chains, and in turn contributed to the development of capacity pressures, as signalled by a rise in backlogs of work in 12 of the 17 sub-sectors. In a sign of potential recovery in the coming months, the vast majority of sub-sectors remained positive that output would increase over the next year. Only two were pessimistic, of which the insurance sector was the most downbeat.

Bernard Aw, Principal Economist, IHS Markit

bernard.aw@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-outbreak-dampens-output-across-all-sectors-in-asia-except-healthcare-mar20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-outbreak-dampens-output-across-all-sectors-in-asia-except-healthcare-mar20.html&text=COVID-19+outbreak+dampens+output+across+all+sectors+in+Asia+except+healthcare+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-outbreak-dampens-output-across-all-sectors-in-asia-except-healthcare-mar20.html","enabled":true},{"name":"email","url":"?subject=COVID-19 outbreak dampens output across all sectors in Asia except healthcare | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-outbreak-dampens-output-across-all-sectors-in-asia-except-healthcare-mar20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=COVID-19+outbreak+dampens+output+across+all+sectors+in+Asia+except+healthcare+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-outbreak-dampens-output-across-all-sectors-in-asia-except-healthcare-mar20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}