Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 22, 2021

Construction output rebounds at end of first quarter

Total activity expands at sharpest rate for six-and-a-half years

Strong, sustained increase in housebuilding led growth in March

IHS Markit estimates activity will not return to pre-pandemic levels until 2027

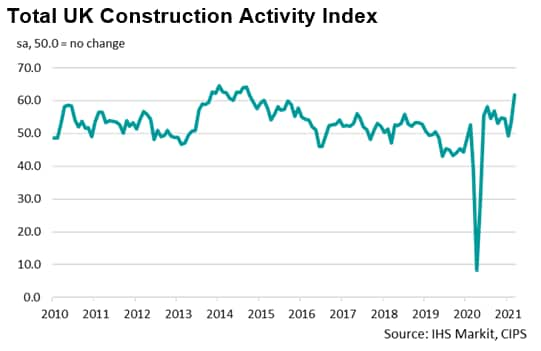

The UK's construction sector recovery gathered momentum in March, according to IHS Markit/CIPS PMI data, as robust increases in output across all monitored sub-sectors pushed overall activity growth to a six-and-a-half year high. Despite the impact that COVID-19 restrictions had on the wider UK economy, the construction sector has been deemed an essential sector, and remained open throughout 2021 to date. This contrasts with the situation a year ago, when many contractors opted to close sites during the first lockdown in 2020, which drove a record drop in output.

Survey data from the Office for National Statistics indicated that 80% of construction sector firms had been trading in the two weeks leading to 4th April (including the first easing of restrictions). That said, the same survey noted that 10% of businesses had paused trading in this period and intended to remain closed for a minimum of two weeks. This is in comparison to 26% during the first lockdown.

Construction activity continues to recover

The IHS Markit/CIPS UK Construction PMI Total Activity Index registered well above the neutral 50.0 level at 61.7 in March, up sharply from 53.3 in February. The latest survey highlighted much-improved trends for output, order books and employment, despite headwinds stemming from sustained supply chain disruption and the sharpest price hikes in nearly 13 years. Nonetheless, the headline index reached the highest level since September 2014 to point to a rapid increase in overall activity. Encouragingly, the data suggest that the catch-up effect from recent lockdowns gave way to stronger order books, as planned projects paused due to uncertainty came to tender and helped to drive the recovery.

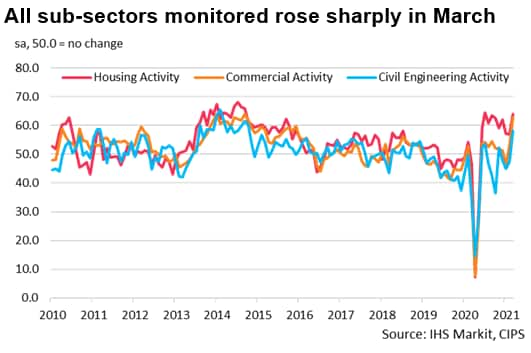

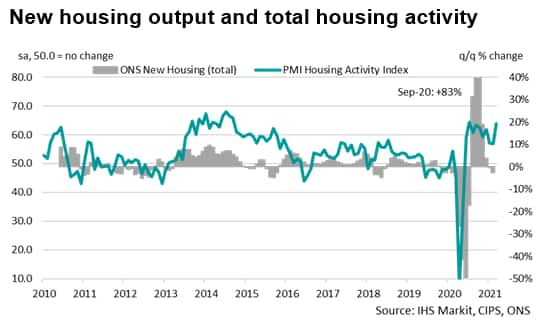

Data broken down by sub-sector once again showed that growth in UK construction activity was led by a marked rise in housebuilding, which has now increased sharply in each of the last ten months. Moreover, output in March was well supported by robust expansions in both commercial construction and civil engineering work, with both sub-sectors expanding at the strongest rate since the second half of 2014.

Outlook for activity remains upbeat

Looking ahead, there are reasons to be optimistic that the recent soft patch for civil engineering in the second half of 2020 and start of 2021 proves temporary, with the pipeline of new work in this category set to provide a strong impetus for construction output growth in 2021. This is due to a range of high-profile, large-scale projects due to commence this year. Most notable are those related to the HS2 rail project, as well as ongoing work on the Hinkley Point C power station, the Thames Tideway tunnel and delivery of various five-year investment programmes within the regulated sectors of roads, rail, and water & sewerage.

Respondents to the Construction PMI survey have consistently cited new infrastructure projects and a subsequent turnaround in civil engineering activity as factors supporting their growth projections in 2021. Overall, survey participants expressed the strongest degree of confidence in the year-ahead outlook since June 2015, which also reflected confidence in the economic outlook as restrictions lifted and the pandemic subsided.

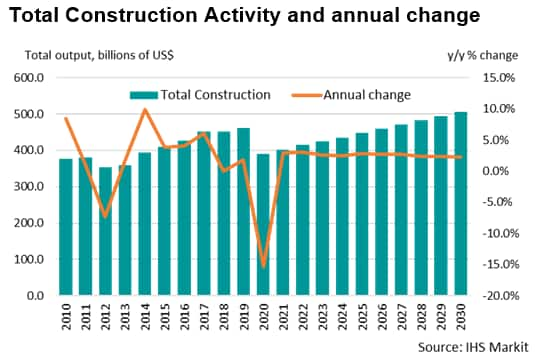

Overall, the Global Construction Outlook by IHS Markit estimates that UK construction output will expand 2.9% in 2021, following an unprecedented decline of 15.3% in 2020. Given such a dramatic shock to activity, the current expectation is that activity will not return to pre-pandemic levels until at least 2027, as construction firms adopt a wait-and-see approach to new projects. Although the latest PMI data indicated stronger order books among businesses, the average lead time between new contracts and orders being signed and work commencing often ranges from 6 to 18 months, with strong divergence between various sub-sectors of construction.

Within the latest IHS Markit forecasts, the key contributor to UK construction activity is expected to be housebuilding (4.1%). Accommodative government policy surrounding the housing market and ultra-low interest rates will continue to support housebuilding in 2021. While Help-to-Buy is scheduled to end in its current form at the end of March, to be replaced by a more restrictive iteration, a favourable policymaking backdrop, including the reintroduction of 95% loan-to-value mortgages and an extended stamp duty holiday, as well as resilient demand conditions, are likely to sustain activity throughout much of the year. Infrastructure spending is also set to grow 3.6% in the next five years - the highest in Western Europe.

Conclusion

As well as worries about tighter restrictions on site due to the lasting impact of the COVID-19 pandemic, there are a wide range of challenges ahead. These include adjusting to new trading arrangements with the EU and the uncertain impact of Brexit on labour availability, as well as the prospect of changes in policymaking in relation to regional "levelling up", net-zero commitments, and spending on large-scale infrastructure projects.

In the meantime, the next monthly release of IHS Markit's PMI surveys in April will offer the first glimpse of how the UK economy has fared during the first phase of the lifting of national restrictions, as well as the impact of accelerated vaccine roll-out progress on UK private sector expectations for business activity over the course of 2021. The UK Flash PMI will be released on 23rd April 2020, while the UK Construction PMI will be released on 7th May 2020.

Usamah Bhatti, Economist, IHS Markit

Tel: +44 1344 328 370

usamah.bhatti@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fconstruction-output-rebounds-at-end-of-first-quarter-Apr21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fconstruction-output-rebounds-at-end-of-first-quarter-Apr21.html&text=Construction+output+rebounds+at+end+of+first+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fconstruction-output-rebounds-at-end-of-first-quarter-Apr21.html","enabled":true},{"name":"email","url":"?subject=Construction output rebounds at end of first quarter | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fconstruction-output-rebounds-at-end-of-first-quarter-Apr21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Construction+output+rebounds+at+end+of+first+quarter+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fconstruction-output-rebounds-at-end-of-first-quarter-Apr21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}