Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 21, 2021

Supply delays hit unprecedented levels, and look set to get worse

Daniel Yergin, Vice Chairman, IHS Markit

and author of The New Map: Energy, Climate, and the Clash of Nations

- Pressures on supply chains are increasing and global disruptions are likely to get worse as summer approaches and the economy booms

- Disruptions have converged at the same time in three important pillars of the global economy - shipping, computer chips, and plastics

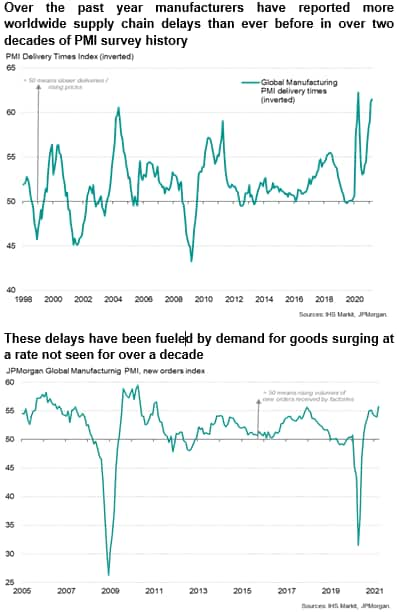

- Supply delays most widespread in 20 years

- The system will ultimately adjust, but that requires new investment in ports and capacity

If you're wondering why your new couch is going to take three or four months to arrive, not just a few weeks, the reason is simple: You are at the very end of a global supply chain that has buckled.

For similar reasons, GM and Ford and other automakers around the world are slowing down manufacturing, temporarily shutting auto plants, and furloughing workers.

A recovering world economy that depends upon the synchronized, smooth running of global supply chains is now being slammed by what has turned out to be synchronized disruptions.

Although the massive Ever Given container ship has been unstuck from the Suez Canal, its continuing impact is only adding to the woes.

As government stimulus seeks to fuel a hyper recovery and the world economy accelerates over the rest of this year, the pressures on supply chains are increasing and disruptions are likely to grow as we head into summer.

Recent IHS Markit worldwide PMI surveys of manufacturers find that the "stretching of supply chains" over the last year has extended delivery times to levels "unsurpassed in over 20 years of data availability."

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-delays-hit-unprecedented-levels-and-look-set-to-get-worse.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-delays-hit-unprecedented-levels-and-look-set-to-get-worse.html&text=Supply+delays+hit+unprecedented+levels%2c+and+look+set+to+get+worse+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-delays-hit-unprecedented-levels-and-look-set-to-get-worse.html","enabled":true},{"name":"email","url":"?subject=Supply delays hit unprecedented levels, and look set to get worse | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-delays-hit-unprecedented-levels-and-look-set-to-get-worse.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Supply+delays+hit+unprecedented+levels%2c+and+look+set+to+get+worse+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-delays-hit-unprecedented-levels-and-look-set-to-get-worse.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}