Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 21, 2025

UK flash PMI signals weakened growth, steep job losses and cooler inflation

November's flash PMI surveys brought disappointing news on the UK economy. Economic growth has stalled, job losses have accelerated, and business confidence has deteriorated.

Some of this malaise has been blamed on paused spending decisions ahead of the Autumn Budget, but there's a real chance this pause may turn into a downturn. The drop in confidence about the year ahead reflects a growing conviction that business conditions will deteriorate further in the coming months, largely linked to speculation that further demand-dampening measures will be introduced in the Budget.

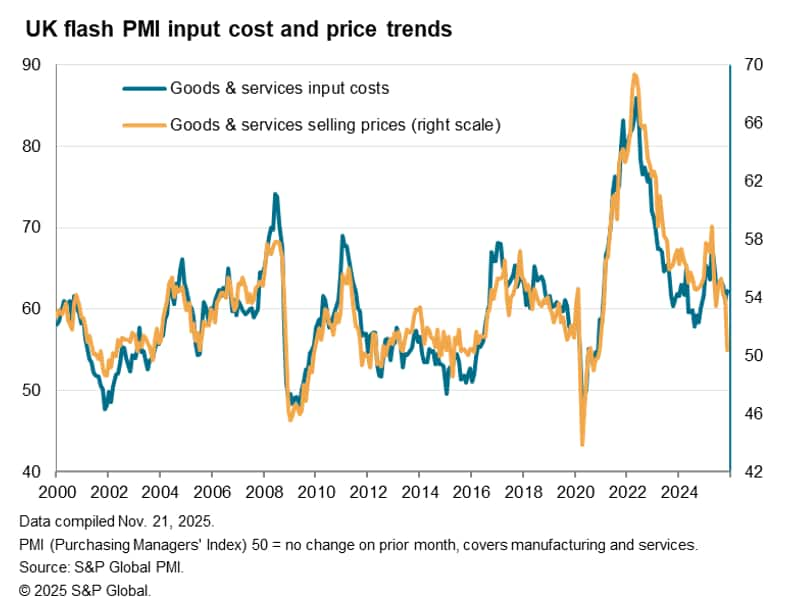

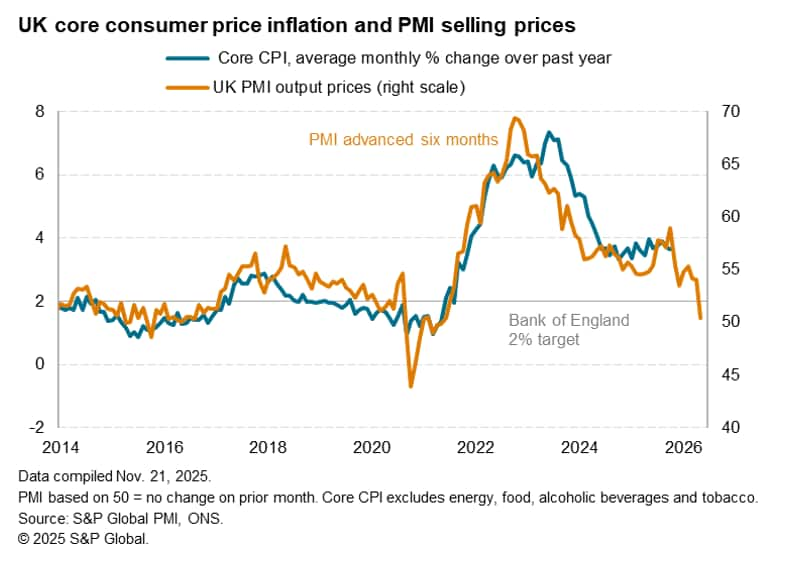

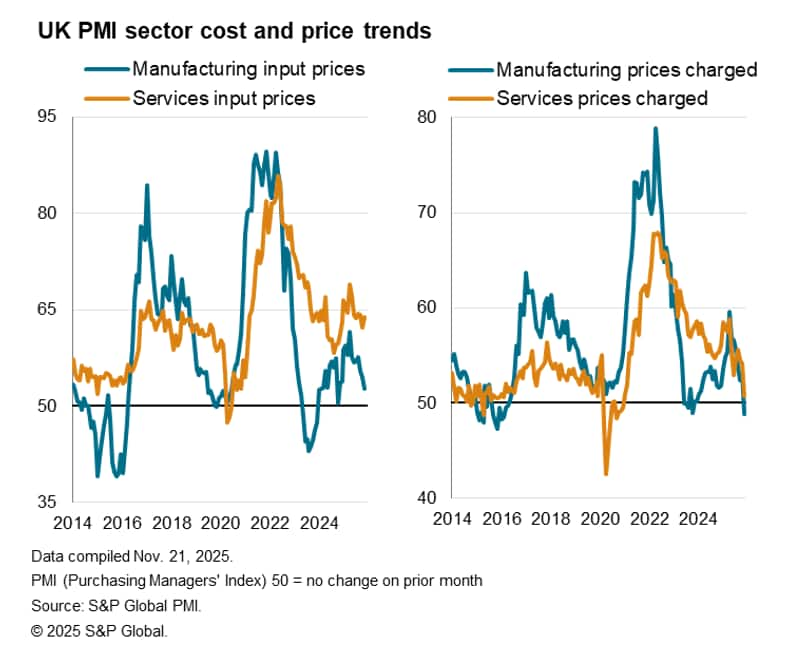

Concerns over the inflation outlook will meanwhile be further assuaged by a marked drop in selling price inflation to the lowest for nearly five years. Faced by weak demand and intensifying competition, firms are cutting prices to win sales. Prices charged for goods fell at the sharpest rate since 2016, and service providers are likewise reporting much-reduced pricing power. While this is good news for inflation, it's bad news for business profits, hiring and investment.

The PMI data therefore suggest the policy debate will shift further away from inflation worries toward the need to support the struggling economy, hence adding to the chances of interest rates being cut in December.

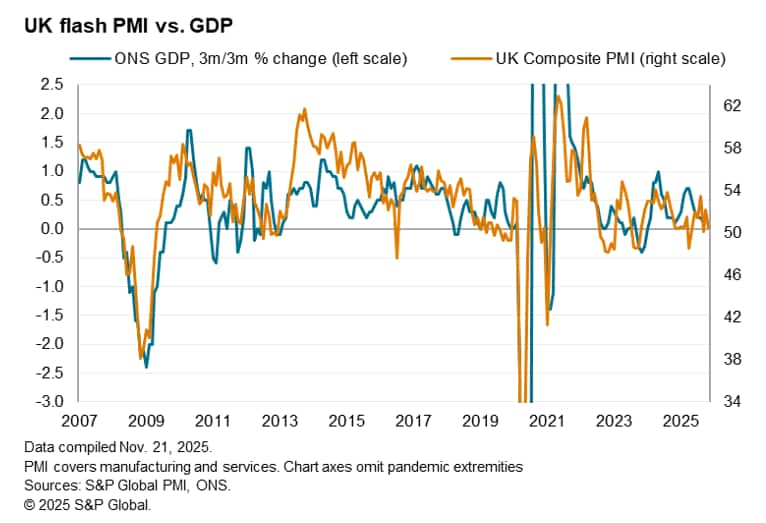

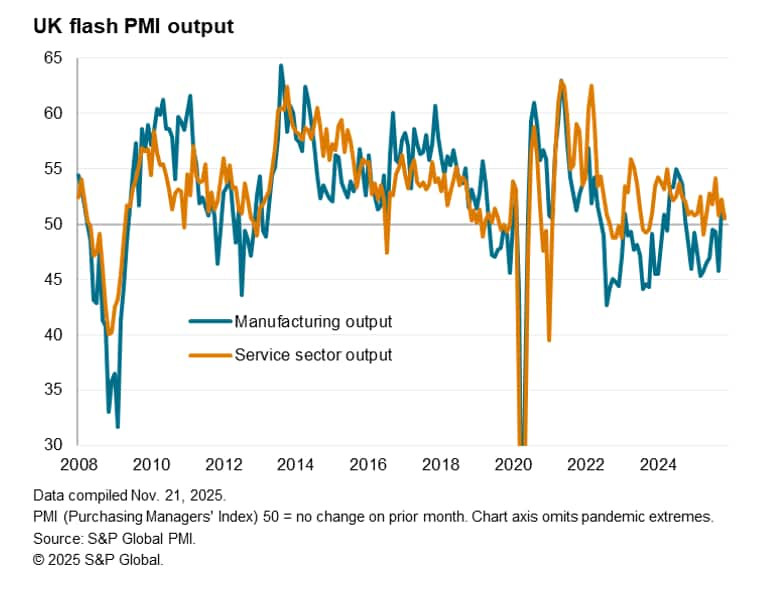

Economy Largely Stalled

UK business activity growth slowed to only a very modest pace in November, widely linked to uncertainty ahead of the upcoming Budget. At 50.5, down from 52.2 in October, the PMI headline composite output index was the second-lowest seen over the past six months, according to the initial flash estimate. At this level, the PMI is broadly consistent with GDP stalling in November and having grown at a 0.1% quarterly pace so far in the fourth quarter. This follows a 0.1% rise in GDP in the third quarter (as had been signalled in advance by the PMI).

The data therefore point to an economy that has been broadly stalled on average so far over the second half of 2025.

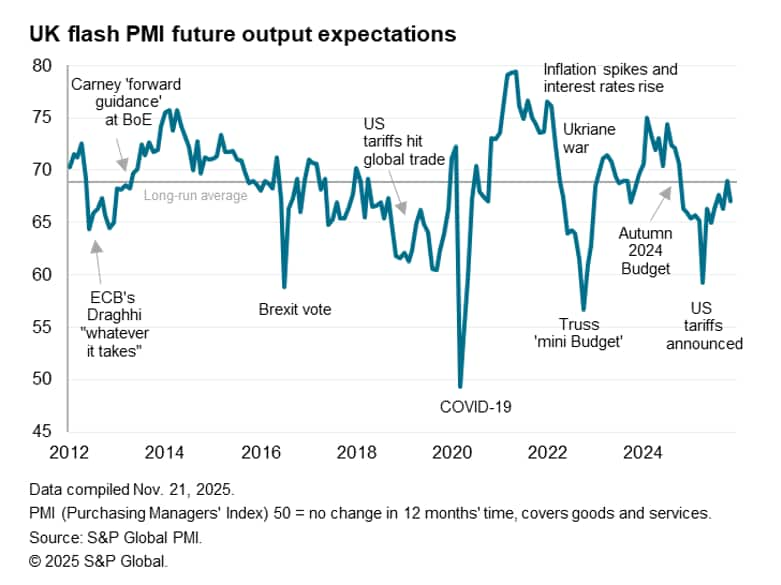

The survey's forward-looking indicators suggest that business conditions may remain subdued into the year end. New orders measured across manufacturing and services fell back into decline after having risen in October, causing backlogs of work to be depleted at a rate not seen since August 2023, when peaking inflation and interest rates had hit demand. Before then, only the height of the pandemic and global financial crisis have seen steeper drops in backlogs of work.

Furthermore, after having revived to a one-year high in October, future output expectations worsened in November, dropping back below the survey's long-run average.

Business sentiment about the year ahead was dented primarily by concerns and uncertainty over potential new policies in the upcoming Autumn Budget, with higher staffing costs from last year's Budget also continuing to contribute to worries over profitability. However, concerns over the broader global economic environment, and in particular US trade policies, have shown signs of easing in recent months.

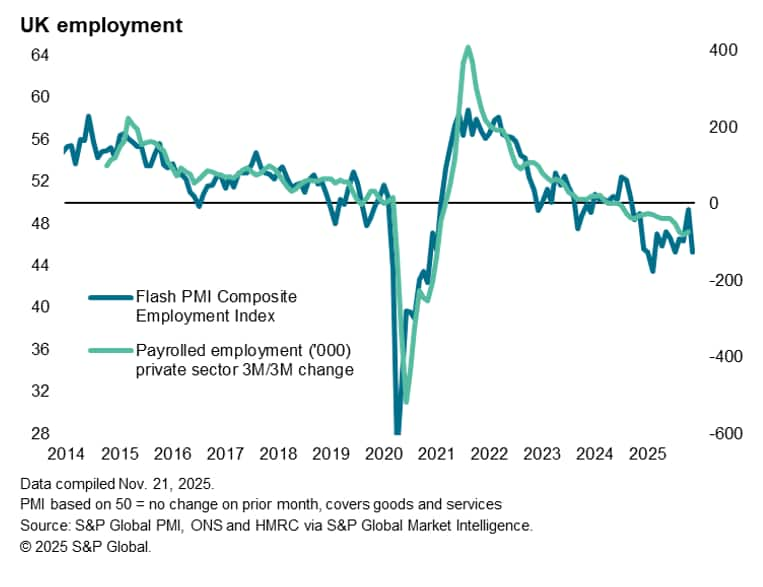

Job losses accelerate

The lack of orders and loss of optimism about the business outlook, combined with the increase in staffing costs stemming from last year's Budget, were all cited as reasons for an increased rate of job losses in November. Employment fell at the fastest rate since July, and one of the steepest rates seen since the pandemic. The PMI panels have reported a continual fall in employment since October 2024, when policy measures including higher employer National Insurance contributions and an increased Minimum Wage were announced.

Prices rise at slowest rate since 2020

Weak demand and stiff competition were meanwhile key reasons commonly cited for a lack of pricing power. Average prices charged for goods and services rose only slightly in November, the rate of inflation slipping sharply compared to October to register the smallest increase in prices since December 2020. Despite reports of stubborn wage pressures contributing to an increased rate of overall input cost inflation (albeit still well below recent highs), the November survey saw increased reports of companies having to squeeze margins or offer reduced prices to win sales.

At its current level, the PMI selling price index is consistent with consumer price inflation broadly meeting the Bank of England's 2% target.

Weakened service sector

Much of the malaise in November could be attributed to a weakened expansion of the service sector, where business activity came close to stalling. With the exception of the slowdown seen in Apil following the announcement of US tariffs, November's rise in service sector output was the smallest for just over two years.

Inflows of new business into the service sector fell for the first time in four months, leading to a steepening rate of decline in backlogs of work and mounting job losses. Prices charged for services meanwhile rose only slightly amid widespread reports of weak demand and intensifying competition, albeit with costs rising at an increased rate due mainly to higher staff costs.

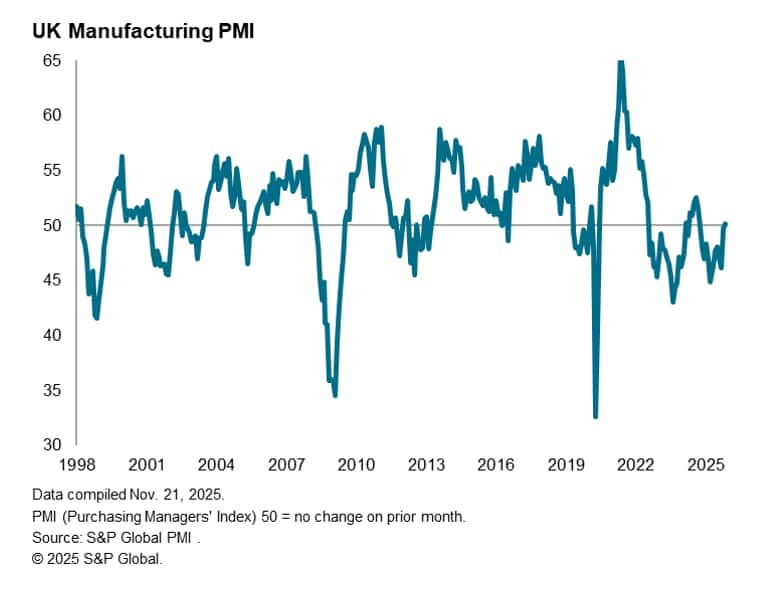

Manufacturing PMI above 50, fueled by price cuts

There was better news in manufacturing, where the headline PMI came in above the 50.0 no change level for the first time since September 2024. Output rose for a second straight month after 11 successive monthly declines, and new orders rose for the first time in 14 months, though both gains were only marginal, led by a further marked drop in exports. Some of the output gain could also be attributed to the restoration of auto production and accompanying supply chains following JLR's September shutdown. Backlogs of work and employment consequently fell again.

The rate of input cost inflation meanwhile fell to its lowest since October 2024, and prices charged for goods leaving the factory gate declined for the first time since October 2023, dropping at a rate not seen since February 2016 as producers cut prices to win new orders.

Rate cut odds shorten

The November flash PMI survey data will likely add to expectations of interest rates being reduced, possibly as soon as December, especially if next week's Budget introduces more measures that may further dampen growth.

Since August 2024, the Bank of England has reduced its Bank Rate five times, which now stands at a two-year low of 4.00%. Recent policy meetings have seen split decisions, however, as rate setters balance concerns over stubborn inflation against signs of sluggish economic growth and falling employment.

The weak economic growth signalled by the PMI, combined with the slide in price pressures and further steep reduction in employment seen in the November survey, will therefore likely tip the scales further in favor of another reduction in interest rates.

The flash PMI data follow news of a fall in inflation from 3.8% to 3.6% in October, which had already raised market's pricing of the probability of interest rates being cut in December to 85%.

Read the press release here.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-weakened-growth-steep-job-losses-and-cooler-inflation-Nov25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-weakened-growth-steep-job-losses-and-cooler-inflation-Nov25.html&text=UK+flash+PMI+signals+weakened+growth%2c+steep+job+losses+and+cooler+inflation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-weakened-growth-steep-job-losses-and-cooler-inflation-Nov25.html","enabled":true},{"name":"email","url":"?subject=UK flash PMI signals weakened growth, steep job losses and cooler inflation | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-weakened-growth-steep-job-losses-and-cooler-inflation-Nov25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+flash+PMI+signals+weakened+growth%2c+steep+job+losses+and+cooler+inflation+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-weakened-growth-steep-job-losses-and-cooler-inflation-Nov25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}