Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 17, 2019

Comstock Resources - Corporate Bond Pricing

Texas based Comstock Resources, Inc. announced on June 10, 2019 that it will purchase Covey Park Energy LLC for $2.2 billion in cash and stock. With this acquisition Comstock Resources will become the Haynesville Basin leader in shale development.

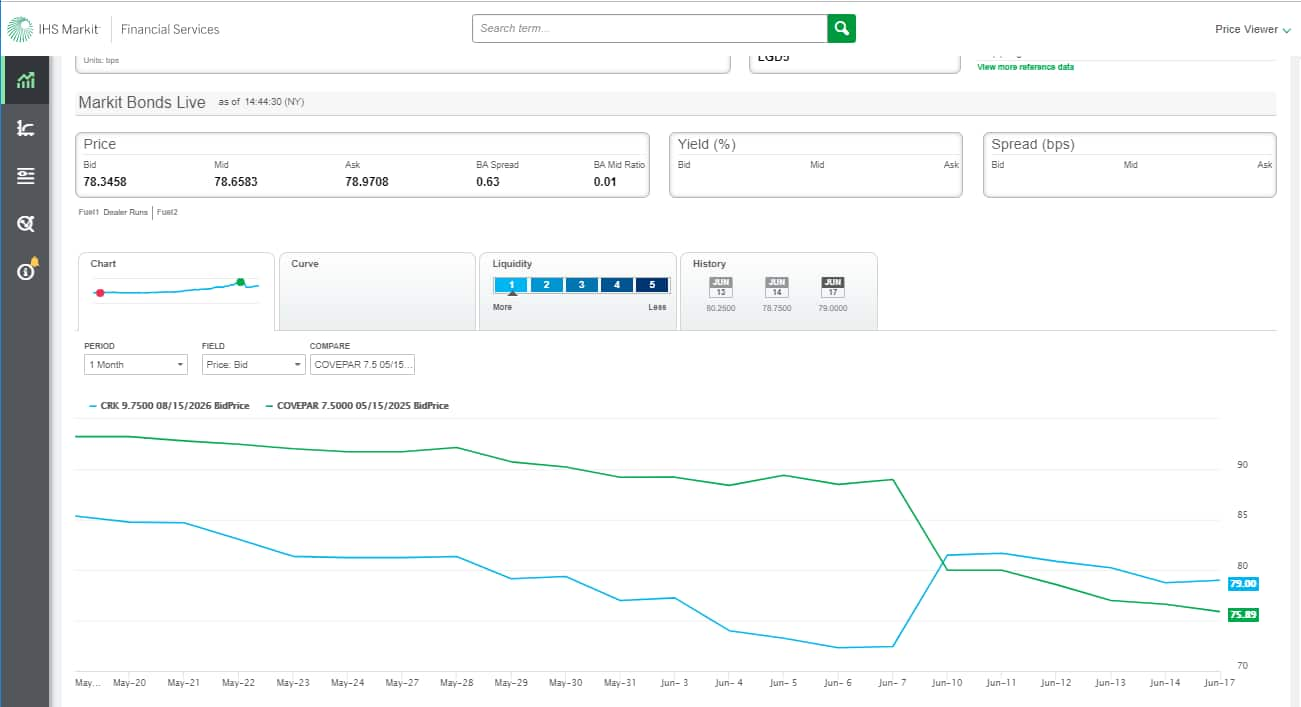

Following upon the announcement - looking below at IHS Markit's bond pricing data via Price Viewer - prices on the Comstock Resources 9.75% 2026 posted gains of roughly 8 points to 81.00 (from 72.36) while the Covey Park 7.5% 2025 prices had a corresponding downward move from 88.50 to 80 on the news.

At closing (expected on or before July 31, 2019) Comstock Resources will assume the existing Covey Park $625 million 7.5% senior notes, retire amounts outstanding under Covey Park's credit facility, and redeem all outstanding previously issued Covey Park preferred units.

This follows an April 2018 Comstock purchase to buy particular oil and gas assets in North Dakota from Arkoma Drilling and Williston Drilling for $620 million.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcomstock-resources--corporate-bond-pricing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcomstock-resources--corporate-bond-pricing.html&text=Comstock+Resources+-+Corporate+Bond+Pricing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcomstock-resources--corporate-bond-pricing.html","enabled":true},{"name":"email","url":"?subject=Comstock Resources - Corporate Bond Pricing | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcomstock-resources--corporate-bond-pricing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Comstock+Resources+-+Corporate+Bond+Pricing+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcomstock-resources--corporate-bond-pricing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}