Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 18, 2016

Valeant bonds muted; euro primary market ignited

This week's credit wrap: Valeant's bonds remain calm despite share price tumbling; Fed signals caution and AB Inbev gets in on primary issuance post ECB meeting.

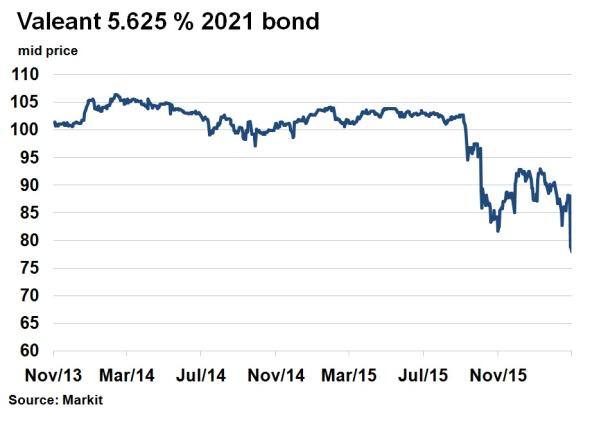

- Valeant's share price fell over 50% this week but it's bonds held up better than expected, falling only just over 10%

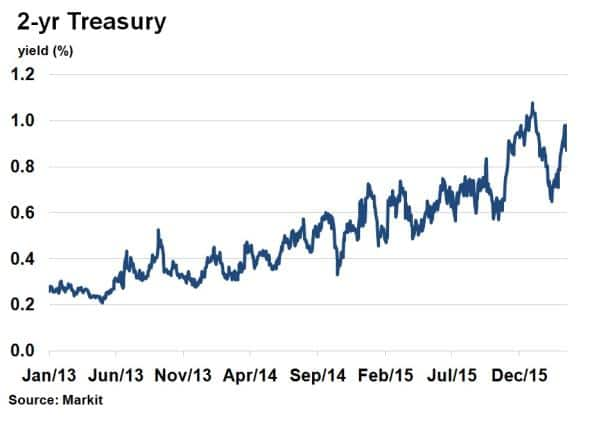

- 2-yr US treasury yields fell on the back of a more cautious tone from the Fed, despite positive economic data

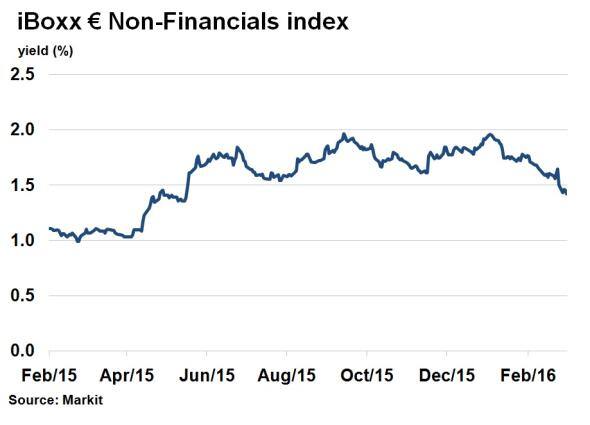

- Markit iBoxx " Non-Financials index saw yields fall to 1.43% this week, the lowest since May last year

Valeant bonds remain firmer

US Pharmaceuticals giant Valeant saw its share price plunge 51% on a single day this week after profits and forward guidance was slashed. It also delayed the release of its annual financial report. Despite this, the reaction from bond holders was more muted.

The firm has been under heavy scrutiny this past year from prosecutors' claims of overpricing and a SEC investigation regarding its relationship with a distributor, Philador. Valeant's share price is down 83% over the past year as the market has lost confidence in the stock, much to the detriment of investors such as renowned activist Bill Ackman of Pershing square, who is a major shareholder.

Attention has now turned to whether the company can remain solvent, and its ability to service $30bn of junk bonds outstanding. If the company fails to release its annual financial report, bond covenants would be breached resulting in a technical default. Bondholders would then be allowed to demand accelerated payment if another 60 days pass without Valeant providing the documents.

Despite the concerns, bond markets have had more of a muted response. Valeant's 5.635% bond maturing in 2021 saw its price fall to 77.95 from 88 at the start of this week, according to data from Markit's bond pricing service. While this represents distressed levels (usually below 80), levels would be much lower if bondholders expected the company to default.

Fed keeps rates on hold

Despite a more positive global outlook, less volatile markets and continuing strength in the US job market, the US Fed kept rates on hold this week, sending short term bond yields lower.

Since the last meeting in January, financial market volatility has subsided and key US economic indicators have continued to signal strength in the US economy. Unemployment is at 4.9%, and core inflation (excluding energy, food), the feds preferred inflation measure is just below the target 2%. 2-yr US treasury yields which are most sensitive to interest rates reflected the positive sentiment and they rose to 0.97% from 0.65% in mid-February.

However, the two day FOMC meeting ended with interest rates held at 0.5%, and 2-yr treasury yields fell to 0.87%, as the market reacted to the cautious approach from the Fed.

Bond markets are now predicting the next rate rise to occur in September, according to the futures market. That would mean two rate rises this year provided there are no bumps, a sharp contrast to the four rate rises touted by the Fed in December.

This was demonstrated this week by AB Inbev who delved back into the market with a several jumbo sized deals. The company was involved in a significant merger deal with SAB Miller last year, mostly debt funded.

Non-financial corporate debt in Europe as represented by the Markit iBoxx " Non-Financials, saw yields fall to 1.43% this week, the lowest since May last year, demonstrating the fall in risk in the region.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032016-Credit-Valeant-bonds-muted-euro-primary-market-ignited.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032016-Credit-Valeant-bonds-muted-euro-primary-market-ignited.html&text=Valeant+bonds+muted%3b+euro+primary+market+ignited","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032016-Credit-Valeant-bonds-muted-euro-primary-market-ignited.html","enabled":true},{"name":"email","url":"?subject=Valeant bonds muted; euro primary market ignited&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032016-Credit-Valeant-bonds-muted-euro-primary-market-ignited.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Valeant+bonds+muted%3b+euro+primary+market+ignited http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032016-Credit-Valeant-bonds-muted-euro-primary-market-ignited.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}