Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 16, 2016

Valuable signals in crowded short trades

Although unusual terminology, factor crowdedness, provides quantifiable clarity into which factors short sellers are targeting. Assigning sentiment to strategy, factor crowding presents investors with exclusive insights and trading signals.

- Short sellers shift from growth to value in a trend last seen during financial crisis

- Trend reversal sees short demand across value stocks more than double by utilisation

- Stock selection overlaid with utilisation enhances growth and value returns as well as risk profiles

To access the full research report on Factor Crowdedness, please contact us.

Factor Crowdedness refers to the difference of utilisation* levels between groups of stocks that contain or exhibit certain qualities or factors. Factor Crowdedness surfaces the thematic sentiments of short sellers, providing actionable information to both the short, long and neutral investor. Even after accounting for borrowing costs, since July 2014 a long short strategy across value stocks ranked by utilisation has delivered returns of 50% on an annual basis.

Gauging for 'crowdedness' using utilisation levels is possible by leveraging two distinct data sets;Markit Research Signalsand Securities Finance data. Post September 2014 across a universe of 1000 large cap US companies, short sellers who were previously crowded around growth stocks began to shift towards value stocks. This reversal is similar to the trend that played out during the financial crisis.

Assessing cumulative returns across the entire universe of stocks reveals that growth has outperformed the universe with value significantly underperforming since 2014, adding further credibility to Factor Crowdedness. Increased utilisation levels in value stocks during this time indeed underperformed. Currently across value stocks, utilisation levels remain high.

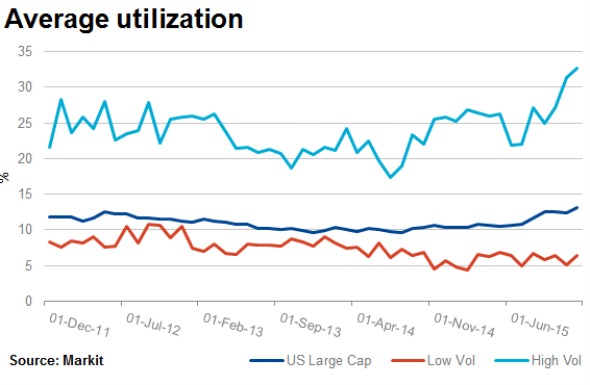

The four factors recently analysed include; Book to Market, Price Momentum, Beta and Realised Volatility. The test period was conducted with monthly data from December 2011 to 2015. In general, growth stocks (ranked by the Book to Market factor), high momentum, high beta and volatile stocks carried higher utilisation levels than the universe during this time frame.

The sharp rise in average utilisation in value stocks shown below (in blue) quickly overtook both the average of the universe and growth stocks in 2015. Average utilisation across value stocks more than doubled between September 2015 and the end of 2015.

Since 2013 and up to the end of 2015, short sellers have almost consistently increased exposure to high beta stocks. Considering the recent market selloff in 2016 this indicates that these were timely shifts, pre-empting recent market movements.

Short sellers additionally increased positions in stocks with higher levels of volatility and the average difference in utilisation between the least and most volatile stocks reaching the highest levels seen in over five years.

Filtering growth stocks by low utilisation returns over the test period are enhanced. The same is true for value stocks however, additionally, with a long, short strategy, long value stocks with low utilisation and short value stocks with high utilisation can achieve a higher Sharpe ratio than buying all value stocks. In other words, a market neutral strategy within the value universe, using utilisation pays even more than the value universe overall.

*Utilisation specifically measures how much stock is sold short out of the total available in securities lending pools, and provides clarity on supply and demand dynamics.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032016-Equities-Valuable-signals-in-crowded-short-trades.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032016-Equities-Valuable-signals-in-crowded-short-trades.html&text=Valuable+signals+in+crowded+short+trades","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032016-Equities-Valuable-signals-in-crowded-short-trades.html","enabled":true},{"name":"email","url":"?subject=Valuable signals in crowded short trades&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032016-Equities-Valuable-signals-in-crowded-short-trades.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Valuable+signals+in+crowded+short+trades http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032016-Equities-Valuable-signals-in-crowded-short-trades.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}