Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 17, 2014

Eurozone drags on developed world growth

A flurry of data releases this week has further highlighted the divergence in economic growth across the developed world.

While US data have generally been positive, with initial jobless claims at a 14-year low and an eye-catching 1% increase in industrial production being notable highlights, data for the euro area have been far more disappointing, with exports and industrial output both down in August, according to official measures.

EZ growth forecast at 0.2% for Q3

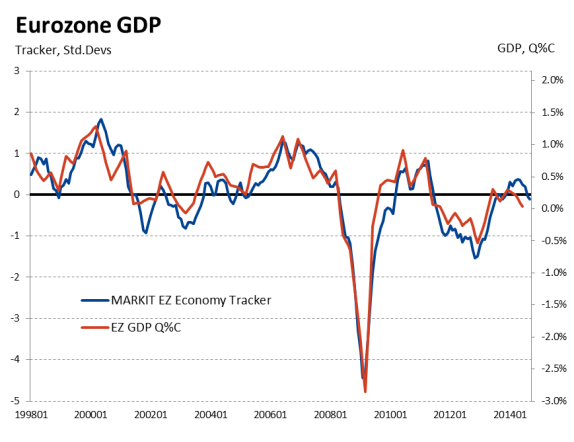

Both trade and industrial production will prove to be drags on eurozone GDP in the third quarter, and that's left our economy tracker for the single currency area at a 14-month low for September. Our nowcasting model is now pointing to growth of just 0.2% for the third quarter of 2014 (0.8% annualized). Any increase in GDP will most likely come from a combination of higher output in the region's periphery and modest growth in the service economies of France and Germany.

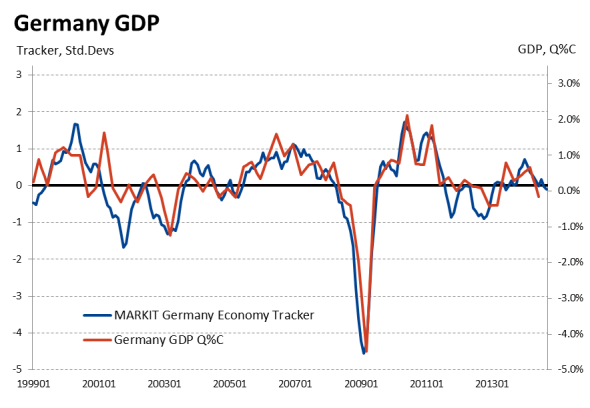

We're currently forecasting growth of +0.25% for Germany (1% annualized), with the economy tracker now at its lowest level since mid-2013 as the industrial sector slips into technical recession.

In France, we expect ongoing stagnation, with GDP to again post zero change on a quarterly basis. Whereas domestic output may provide some growth support, this is set to be offset by ongoing weakness in trade and industry.

Sources: Markit, Ecowin.

Sources: Markit, Ecowin.

UK and US to register growth of 0.8% in Q3

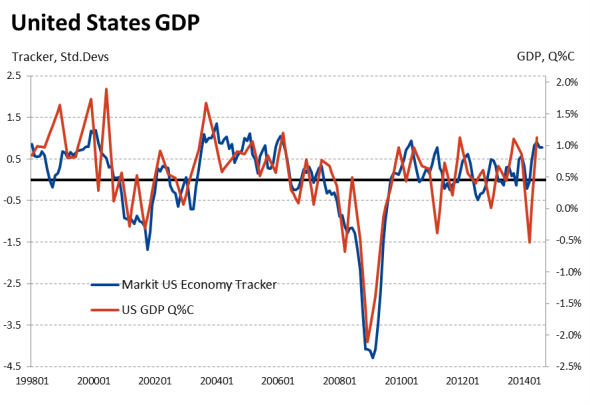

The fragility of the eurozone's economic performance contrasts sharply to the UK and the US, where growth rates for third quarter GDP should print in the region of +0.8% (3.2% annualized) in both cases.

While the UK's industrial sector has shown signs of slowing down (the Markit/CIPS Manufacturing PMI" down at a 17-month low in September and official production data signalling stagnation into August), domestic services output growth appears robust and is helping to drive job creation. Data this week showed unemployment below 2 million for the first time since late-2008, and the Markit UK Economy Tracker subsequently continues to run at a historically elevated level.

The US also continues to show signs of robust expansion with the best increase in industrial output for almost two years in September. The sector subsequently expanded 0.8% in the third quarter.

While separate data showed retail sales registering a monthly drop in September, sales were still up 1.0% compared to the second quarter, and with Markit's own domestically-focused Services PMI showing ongoing strength, we expect domestic consumption to have made a healthy positive contribution to the third quarter GDP figures.

Sources: Markit, Ecowin.

October Flash PMI" data

As we move into the fourth quarter, we look towards Thursday's flash PMI surveys for further insights into the health of the world's largest economies, with various data for the US, eurozone and Japan all available.

Particular attention will be paid for signs of meaningful improvement in the Eurozone's moribund recovery following recent ECB attempts to lift growth.

The release of flash PMI data for China will also be closely scrutinized for any pick up in its manufacturing economy - especially if GDP growth has shown to have slowed to an expected annual rate of 7.2% in the third quarter with the release of official figures on Tuesday.

Over in Japan, the flash PMI data for manufacturing will also be closely watched for signs of strengthening following the sales-tax induced second quarter downturn. We noted earlier in the week that any growth in the third quarter will be relatively modest, as poor industrial production data for August left the country struggling to avoid recession.

Finally, indications of whether weak global demand is also feeding through to the US economy will also be provided by the flash PMI data.

A full guide to economic releases for the week is available here.

Paul Smith | Economics Director, IHS Markit

Tel: +44 149 146 1038

paul.smith@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-economics-eurozone-drags-on-developed-world-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-economics-eurozone-drags-on-developed-world-growth.html&text=Eurozone+drags+on+developed+world+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-economics-eurozone-drags-on-developed-world-growth.html","enabled":true},{"name":"email","url":"?subject=Eurozone drags on developed world growth&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-economics-eurozone-drags-on-developed-world-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+drags+on+developed+world+growth http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-economics-eurozone-drags-on-developed-world-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}