Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 10, 2014

Production rises sharply at global tech equipment firms

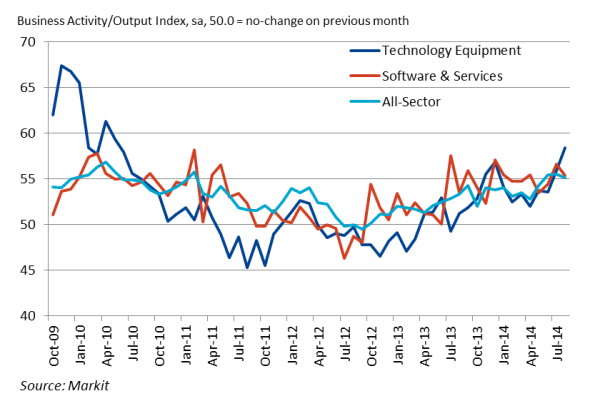

Global sector PMI" data from Markit signalled that technology equipment companies saw the strongest performance of all manufacturing-based sectors in August, and came in third place in the overall global sector rankings. In contrast, business activity growth eased in the technology sector's services counterpart, software & services. Furthermore, technology equipment firms registered the strongest rate of output growth since May 2010. Meanwhile, the pace of new order growth rebounded from July's ten-month low to the strongest in 2014 so far, suggesting that growth momentum is likely to be sustained in coming months. Data also suggested that capacity pressures continued to build in the sector, with backlogs of work rising solidly in August, indicating that employment growth may soon pick up from its current sluggish pace of expansion.

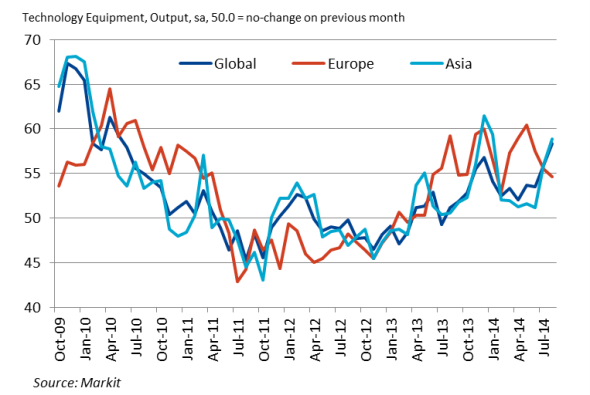

Technology equipment growth led by Asia and the US

At the regional level, PMI data suggested that technology equipment firms in Asia and the US were key drivers of global activity growth in August. Global technology equipment PMI data are calculated from individual responses from technology equipment companies participating in Markit's national manufacturing and whole economy PMI surveys. These responses are weighted by country, based on GDP and the value added of the technology equipment sector in each country. Unsurprisingly, the US has the biggest technology equipment weight of any country monitored by the PMI surveys.

Although US technology equipment sector PMI data are not available as a published stand-alone series, comparable data for Europe showed weaker growth momentum than indicated in the global series, so US strength can be inferred from a comparison with global data. Technology equipment firms in Asia also reported robust growth in August, where the rate of output expansion hit a seven-month high.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092014-production-rises-sharply-at-global-tech-equipment-firms-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092014-production-rises-sharply-at-global-tech-equipment-firms-.html&text=Production+rises+sharply+at+global+tech+equipment+firms","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092014-production-rises-sharply-at-global-tech-equipment-firms-.html","enabled":true},{"name":"email","url":"?subject=Production rises sharply at global tech equipment firms&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092014-production-rises-sharply-at-global-tech-equipment-firms-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Production+rises+sharply+at+global+tech+equipment+firms http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092014-production-rises-sharply-at-global-tech-equipment-firms-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}