Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 09, 2014

Bank of England holds rates as growth worries emerge

The Bank of England held interest rates at their record low of 0.5% at its September Monetary Policy Committee meeting amid mixed signs on the health of the economy.

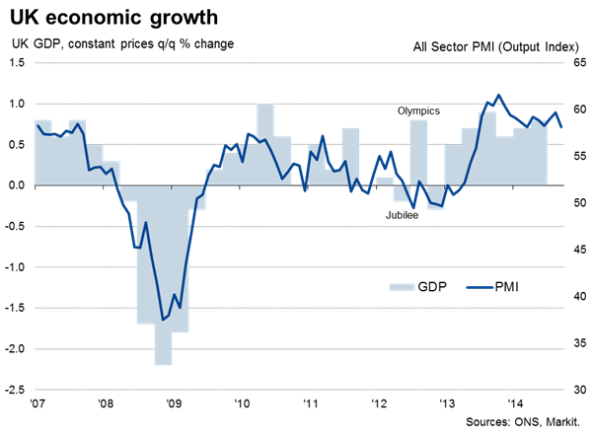

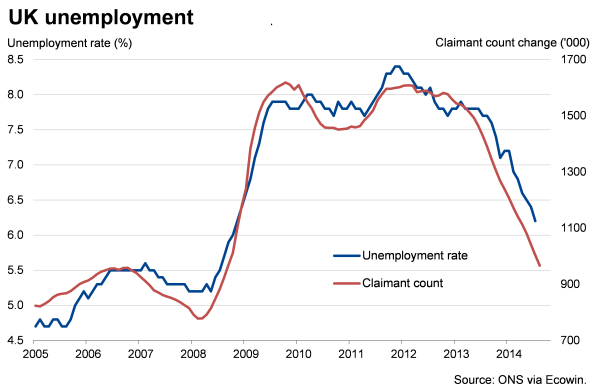

On one hand, the economy as a whole shows signs of continuing to grow strongly. Survey data point to a 0.8% rise in GDP in the third quarter, building further on an economic recovery that was recently revealed to have been stronger than previously thought. Unemployment has continued to fall, down to 6.2% in the three months to July with buoyant recruitment industry survey reports suggesting the jobless rate will have continued to fall at least up to September. Such buoyancy has already led two of the nine MPC members to vote for higher interest rates in previous meetings.

On the other hand, economic growth looks uneven. Although services and construction continue to fare well, manufacturing growth has slowed sharply. The deteriorating picture seen in the goods-producing sector is to a large extent due to renewed weakness in the UK's main export market, the eurozone.

Policymakers are concerned about the impact that slower growth in the euro area could have on the UK, and also that this weakness of the goods-producing sector could become more entrenched and spread to other sectors.

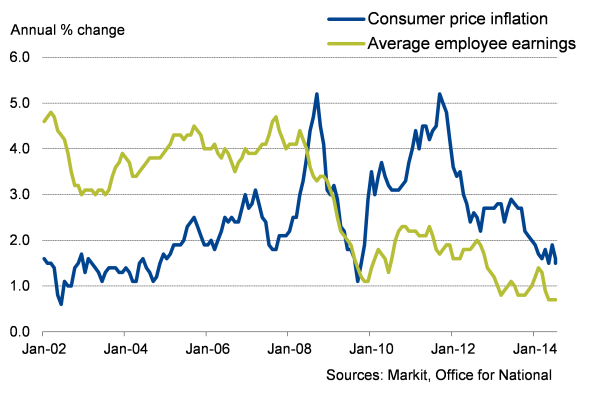

Alongside these growth concerns, inflation remains benign at 1.5%, well below the Bank's 2% target, and wage growth is dismal. The latest data showed regular pay growth at a record low of just 0.7%. At the same time, the housing market - the buoyancy of which is an area of concern among policymakers - is also now showing signs of cooling. Both mortgage lending and house prices are now declining, according to data form the Council of Mortgage Lenders and the Nationwide, respectively.

Pay and inflation

Although the economy as a whole is continuing to recover at a solid pace, there are many reasons why the MPC may decide that there is no rush to raise interest rates, allowing the recovery to gain further traction.

It seems most likely that wage growth will inevitably pick up, though probably not until annual pay reviews start to feed into the data in the new year. That leaves the first quarter of 2015 as the most likely scenario for a first rate rise.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-Bank-of-England-holds-rates-as-growth-worries-emerge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-Bank-of-England-holds-rates-as-growth-worries-emerge.html&text=Bank+of+England+holds+rates+as+growth+worries+emerge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-Bank-of-England-holds-rates-as-growth-worries-emerge.html","enabled":true},{"name":"email","url":"?subject=Bank of England holds rates as growth worries emerge&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-Bank-of-England-holds-rates-as-growth-worries-emerge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+holds+rates+as+growth+worries+emerge http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-Bank-of-England-holds-rates-as-growth-worries-emerge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}