Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 08, 2014

Signs of renewed life as China PMI surveys signal best quarter since early-2013

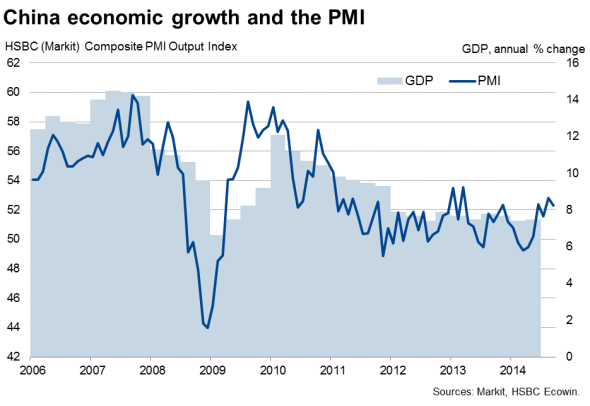

The economic situation in China appears to be improving since earlier in the year. The HSBC PMI surveys, produced by Markit, collectively suggest that economic growth picked up in the third quarter to the fastest since early 2013.

Manufacturers are benefitting from a revival in exports growth to the fastest since early 2010 and service companies are also enjoying a strengthening of domestic demand, most likely arising from the government's mini-stimulus measures.

However, while the government may be on course to meet its growth target for the year, the upturn remains fragile and vulnerable to set-backs.

Business activity on the rise

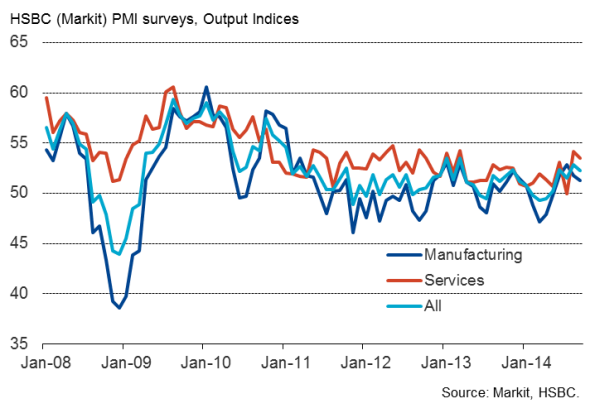

A weighted average of the output indices from the HSBC manufacturing and service sector PMI surveys registered 52.3 in September, dipping from 52.8 in August but remaining above the 50.0 no change level to signal an ongoing expansion. The average reading for the third quarter, at 52.2, was up from 50.7 in the second quarter and the highest quarterly average seen since the first quarter of 2013.

The improvement points to gross domestic product rising in the third quarter at a faster rate than the 7.5% annual expansion seen in the second quarter.

If the pace of expansion holds up as we move towards the end of the year, the survey data suggest that the government may meet its growth target of GDP to increase by 7.5% in 2014. With inflows of new business rising again in September, the survey data certainly bode well for the upturn to persist.

Output by sector

Weak domestic demand

There are, however, still areas of concern which highlight the fragility of the upturn. Domestic demand clearly remains in the doldrums. The manufacturing upturn, for example, is being driven by exports, which saw the steepest rate of growth since March 2010 in September. Despite this rise in export orders, overall manufacturing order books grew only very modestly, dragged down by weak domestic sales.

In the service sector, inflows of new business rose at a historically weak pace, as has been the case throughout much of the past four years, again stymied by lacklustre domestic demand.

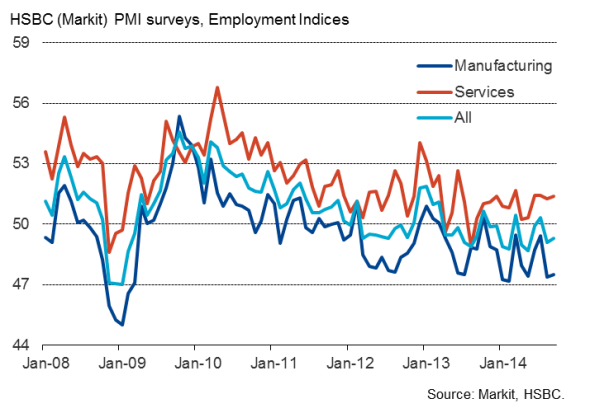

Job losses

The weakness of demand caused firms to trim headcounts again, which adds to a downbeat outlook for consumer confidence and spending in coming months. Employment measured across both sectors fell marginally for a second successive month, as an upturn in service sector payroll was offset by a cull to manufacturing workforce numbers.

Employment

Worst over?

The weakness of growth and the drop in headcounts remain a worry, but the overall picture from the PMI surveys is possibly one which the Chinese authorities will be fairly relaxed about. After all, some growth sacrifice was inevitable as the government seeks to encourage a switch in the economy from its reliance on export- and investment-led expansion.

Mini-stimulus measures implemented earlier in the year therefore appear to have had the desired effect of preventing growth from slowing down too far during this transition period, measures instigated when it became clear that China was suffering its worst spell since 2009. Further action may therefore only be deemed necessary if China suffers a renewed drop in the PMI below 50.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102014-Economics-Signs-of-renewed-life-as-China-PMI-surveys-signal-best-quarter-since-early-2013.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102014-Economics-Signs-of-renewed-life-as-China-PMI-surveys-signal-best-quarter-since-early-2013.html&text=Signs+of+renewed+life+as+China+PMI+surveys+signal+best+quarter+since+early-2013","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102014-Economics-Signs-of-renewed-life-as-China-PMI-surveys-signal-best-quarter-since-early-2013.html","enabled":true},{"name":"email","url":"?subject=Signs of renewed life as China PMI surveys signal best quarter since early-2013&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102014-Economics-Signs-of-renewed-life-as-China-PMI-surveys-signal-best-quarter-since-early-2013.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Signs+of+renewed+life+as+China+PMI+surveys+signal+best+quarter+since+early-2013 http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102014-Economics-Signs-of-renewed-life-as-China-PMI-surveys-signal-best-quarter-since-early-2013.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}