Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 05, 2014

Italian homebuilding contracts at fastest pace in 17 months

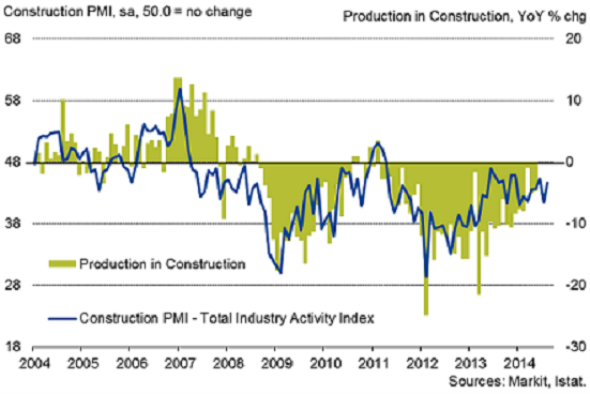

Construction activity in Italy continued to contract during August, led by a sharp and accelerated decrease in residential building work. New orders also fell considerably on the month, helping suppress constructors' expectations regarding their future performance to the lowest in 11 months. Employment and purchases of materials were reduced accordingly, with the latter contributing to a slight fall in input prices.

The headline Markit Italy Construction Purchasing Managers' Index" (PMI") - which is based on a single question asking panellists to report on the actual change in their total construction activity compared to one month ago - registered 44.6 in August. This was an improvement on July's six-month low of 41.5 but indicative of a solid rate of contraction in activity, nevertheless. The current downturn in total construction work now extends to 41 months.

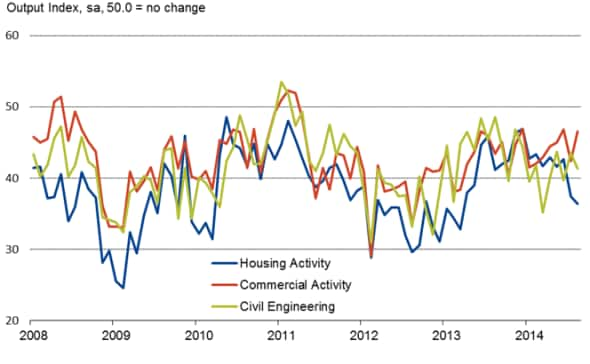

The main weakness highlighted by August's survey was a sharp and accelerated decrease in the level of housing activity. Work on housing projects in fact fell to the greatest extent since March 2013. Civil engineering activity likewise contracted at a faster rate, whereas the downturn in commercial building work eased.

Activity levels fell amid a further reduction in new work in the sector. New orders have now decreased for 41 months in a row. Although slightly weaker than in July, the rate of decline nonetheless remained sharp and faster than the long-run series average. Among those panel members that reported lower new orders there was mention of a lack of liquidity, waning interest in new projects and generally weak demand.

As well as impacting on current activity levels, falling new order intakes also affected businesses' assessment of the outlook for activity in the year ahead.

Construction PMI vs. official data

Housing sector leading downturn

Sentiment on this front was the weakest in 11 months in August, and only just inside positive territory.

Employment in the sector decreased during August as constructors sought to adjust operating capacity in line with lower workloads. The overall rate of job shedding was solid and only slightly slower than in July, with more than three-times as many companies having cut staff numbers as raised them.

Constructors also reduced their purchasing activity in August. This further decrease in demand for materials led some suppliers to offer promotional prices in order support buying levels, thereby contributing to an overall decrease in average purchasing costs faced by constructors - the second in successive months.

Suppliers' delivery times meanwhile deteriorated sharply, with the rate of decline the most marked since last November. A lack of stock at vendors was one reason behind the deterioration in lead times, according to anecdotal evidence.

Phil Smith | Economist, Markit

Tel: +44 149 1461009

phil.smith@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014Italian-homebuilding-contracts-at-fastest-pace-in-17-months.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014Italian-homebuilding-contracts-at-fastest-pace-in-17-months.html&text=Italian+homebuilding+contracts+at+fastest+pace+in+17+months","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014Italian-homebuilding-contracts-at-fastest-pace-in-17-months.html","enabled":true},{"name":"email","url":"?subject=Italian homebuilding contracts at fastest pace in 17 months&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014Italian-homebuilding-contracts-at-fastest-pace-in-17-months.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Italian+homebuilding+contracts+at+fastest+pace+in+17+months http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014Italian-homebuilding-contracts-at-fastest-pace-in-17-months.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}