Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 03, 2014

UK PMI surveys signal economic growth down to six-month low in September

September's PMI" surveys suggest that the UK most likely enjoyed another spell of above-trend economic growth in the third quarter, but that the pace of expansion is showing signs of moderating as we move towards the end of the year.

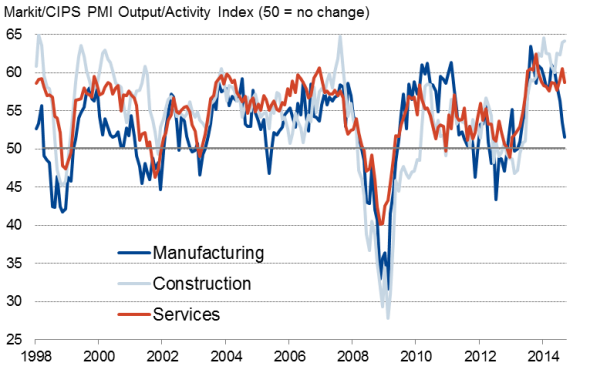

The weighted average output index from the three Markit/CIPS PMI surveys, which acts as a reliable advance indicator of GDP, fell from a nine-month high of 59.7 in August to a six-month low of 58.1 in September.

The slowdown is in line with Bank of England projections and, alongside record low pay growth, adds to the case for interest rates to remain on hold until next year and until there are at least clear signs of wages and household incomes rising in real terms.

Growth slowdown

The PMI surveys and other available economic data are signalling GDP growth of 0.8% in the third quarter, down from 0.9% in the three months to June but still robust by historical standards and signalling a continuation of the UK's strong economic growth spell.

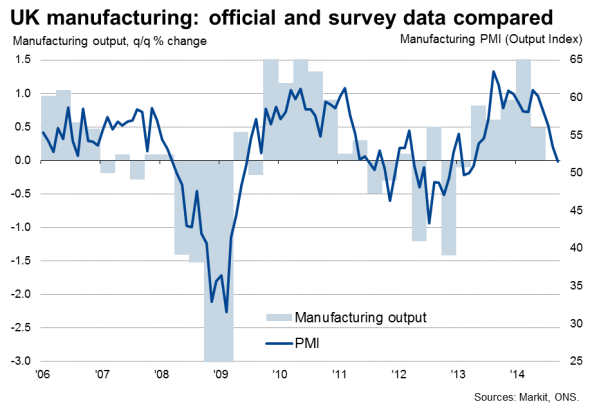

There are signs, however, that economic growth could slow further in the fourth quarter. In particular, manufacturing has seen a rapid pace of expansion earlier in the year fade to near stagnation in September, a slowdown which appears to be largely driven by weak demand from abroad. The PMI output index for manufacturing fell to 51.5 in September, its lowest since April of last year.

The impact of a stalling of economic growth in the euro area, the UK's largest export market, has been exacerbated by a marked appreciation in sterling in recent months, with the pound trading just over 6% higher against the euro on average in September compared to a year ago.

Broad-based upturn

Employment

Manufacturing, which the ONS estimates to have grown 0.5% in the second quarter, could see the pace of expansion slide in the third quarter and lose further momentum in the fourth quarter unless growth revives in the euro area.

The situation is looking better in the more domestically-focused services and construction sectors, though both are also showing some signs of potentially weakening.

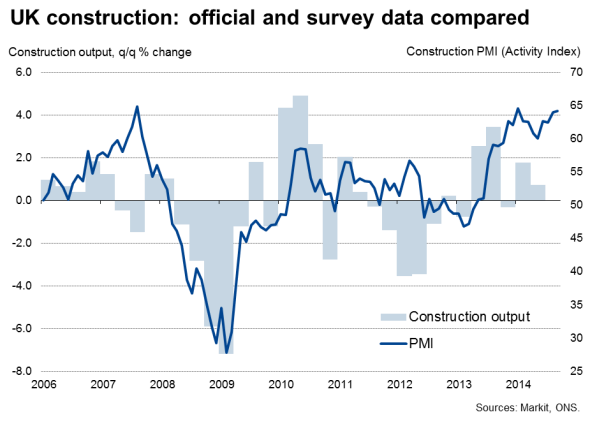

Construction output continued to surge in September, the headline PMI activity index rising to 64.2 and rounding off the best quarter of growth for just over 17 years. However, optimism about the year ahead waned to an 11-month low, suggesting companies have become cautious about the outlook and may rein in expansion plans accordingly.

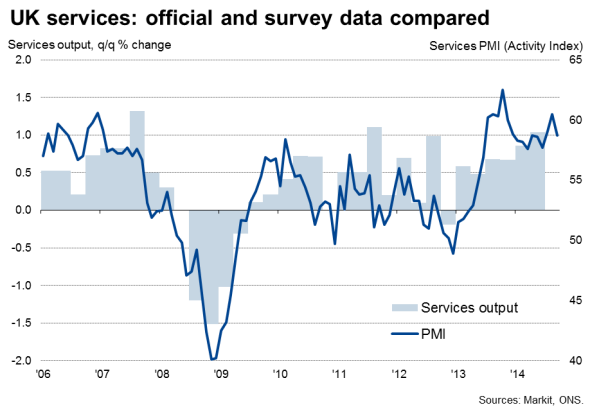

Services, which account for approximately two-thirds of GDP compared to only around 10% for manufacturing and 6% for construction, also continued to grow strongly in September, supported by buoyant domestic demand from consumer and business customers alike. The services activity index registered 58.7 in September, and signalled buoyant GDP growth of approximately 1.0% in the third quarter as a whole. With business expectations in the services economy picking up to a three-month high in September, companies are expecting strong growth to be sustained in coming months.

However, although still strong, the expansion of services activity in September was in fact the weakest since June, and the worry is that slower growth in the manufacturing sector, and potentially construction as well (notably the housing market), will feed through to a further slowdown in service sector growth.

Interest rates on hold

The suggestion is therefore that the economy is showing signs of slowing in the second half of this year, in line with Bank of England projections. This slowing, alongside official data showing wage growth stuck at an all-time low, will add to the majority view among policymakers that there is no rush to hike interest rates.

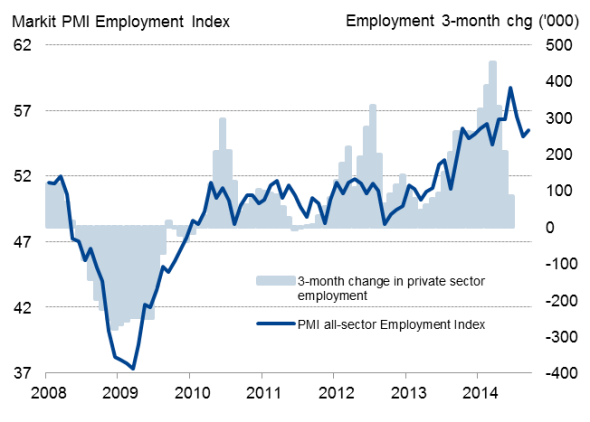

Wage growth will continue to provide the main steer for interest rate policy. A further marked rise in employment was signalled by the PMI in September: the all-sector employment index rose from 55.0 in August to 55.5 in September, still down on the peaks seen earlier in the year but continuing to run in a range rarely seen in the survey's history. Such strong job creation will inevitably eventually lead to higher pay growth and rising personal incomes, something which we expect to see materialise towards the end of the year and putting pressure on policymakers to raise interest rates in the first half of next year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-UK-PMI-surveys-signal-economic-growth-down-to-six-month-low-in-September.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-UK-PMI-surveys-signal-economic-growth-down-to-six-month-low-in-September.html&text=UK+PMI+surveys+signal+economic+growth+down+to+six-month+low+in+September","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-UK-PMI-surveys-signal-economic-growth-down-to-six-month-low-in-September.html","enabled":true},{"name":"email","url":"?subject=UK PMI surveys signal economic growth down to six-month low in September&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-UK-PMI-surveys-signal-economic-growth-down-to-six-month-low-in-September.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+surveys+signal+economic+growth+down+to+six-month+low+in+September http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-UK-PMI-surveys-signal-economic-growth-down-to-six-month-low-in-September.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}