Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 03, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Canada's largest newspaper printer and US bed maker most shorted in North America

- Short interest in Nordic airline SAS ahead of Remy Cointreau and AO World in Europe

- Japanese software firms among the most shorted stocks in Apac

North America

With currently 16.5% of shares outstanding on loan (short interest), Transcontinental features again leading the most shorted stocks ahead of earnings in North America.

The largest news print company in Canada, Transcontinental continues with its transformation from a traditional print and publishing business, currently representing 72% of revenues, into a more digital-media focused entity.

Flagged as potential short squeeze in August 2015 by Research SignalsShort Squeeze model, Mattress Firm continues to see high levels of short interest currently at 15.8%. The cost to borrow shares broke through 15% in April and remains near these high levels currently - indicating demand to short the bedding retailer remains strong.

Shares in Straight Path Communications have and recovered 287% after a sharp selloff in November 2015. Short sellers have however, continued to hold onto positions, with short interest remaining elevated at 14.9%.

Other notable names in North America include water management, construction and drilling firm Layne Christensen with short interest of 13.3% and apparel retailer Lululemon Athletica, which has seen shorts cover almost 30% of positions in the past six months as the stock continues surging, up by 46% currently.

Europe

There are only three stocks this week with significant levels of short interest ahead of earnings in Europe, led by Nordic airline SAS with 11.9% of shares outstanding on loan.

SAS posted a weak first quarter result with the company previously leading airline shorts in Europe.

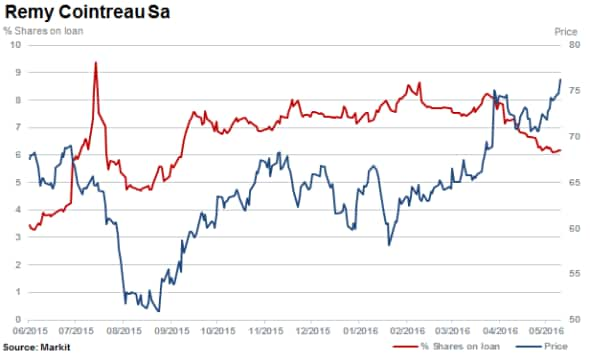

After coming under pressure in 2014, shorts have covered a quarter of positions in Remy Cointreau with 6.1% of shares outstanding on loan, while shares rallied by almost a fifth.

Shorts have also continued to cover positions in UK online household goods retailer AO World. Short interest has declined by a fifth over the past 12 months.

Apac

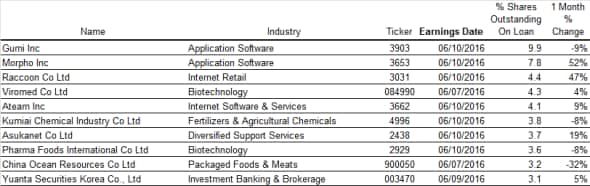

Most shorted ahead of earnings in Apac is recently listed Japanese social game and app developer Gumi. With 9.9% of its shares outstanding on loan, rising six fold in the past year, the companies' shares have meanwhile declined by 42%.

Since the beginning of April, short sellers have rushed back into Morpho, a Japanese headquartered image processing and software firm. Short interest has increased almost two fold while shares (inclusive of a recent pullback) have rallied by 7%.

Tokyo based online transaction service provider Raccoon has seen a spike in short interest levels lately, having already risen 180% over the past six months to 5.6%. Shares in the company have also risen, rallying higher by 62% over the same period.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}