US treasury yields plunge; SA credit under scrutiny

In this week's credit wrap, non-farm payrolls misses, South Africa's investment grade status under threat and investors return to Asian bonds.

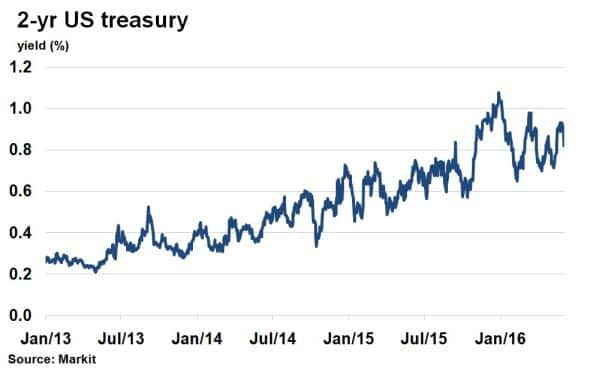

- 2-yr US treasury yields fell 8bps on the back of a weak jobs report

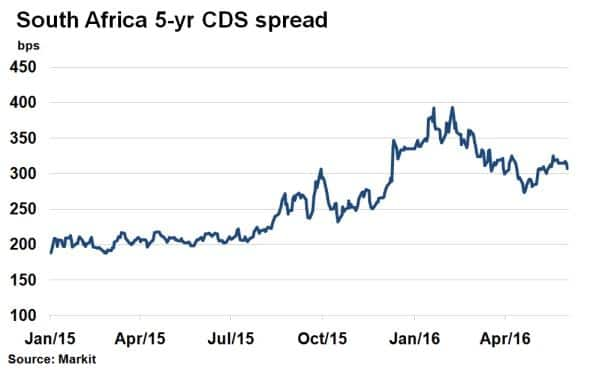

- South Africa's 5-yr CDS spread has widened 12% over the past six weeks

- ABF Pan Asia Bond Index Fund ETF has seen AUM grow 10% over the past month

US jobs report miss

Ahead of the Fed meeting next week, today's monthly jobs report came in below expectations, as non-farm payrolls totalled 38k for May. The figure was the lowest since September 2010 and probability of a summer interest rate hike subsequently plunged, according to the futures market.

2-yr US treasury yields, which are most sensitive to short term interest rates, saw yields drop 8bps on the back of the weak jobs number, according to Markit's bond pricing service.

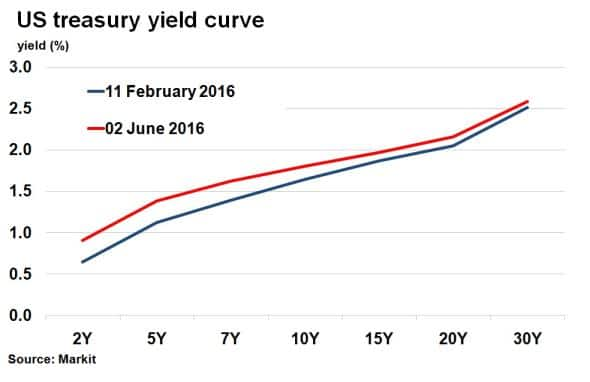

The report threatens to derail the hawkish sentiment delivered by the Fed over the past two months, which shifted the US treasury yield curve higher between mid-February and yesterday. With a general election approaching later this year, the Fed faces yet another conundrum.

South Africa

Nervy credit investors will be keeping a key eye on S&P's verdict on South Africa's credit rating today. Africa's second largest economy has suffered from low commodity prices and a falling rand over the past year. Political risk has only compounded woes and investors have been demanding more to hold on to South African government bonds.

South Africa's 5-yr CDS spread, a measure of perceived credit risk, has widened 12% over the past six weeks as rating agencies pile pressure on its investment grade status. While CDS spreads were even wider in January, they still imply sub-investment grade status according to Markit's CDS pricing service.

Pan-Asia confidence

Investor confidence in the Asian bond market has returned amid a brighter outlook for the region. State Streets' ABF Pan Asia Bond Index Fund ETF, which tracks Markit's iBoxx ABF Indices, was one of the best performing fixed income ETFs over the past week in terms of net inflows.

The index saw its assets under management (AUM) increase to $3.26bn on May 30th, from 2.96bn on May 9th, according to Markit's ETP analytics service. Asian bonds rallied post January's market volatility, but have faded over the past month, partly due to stronger US dollar. Given the sharp ETF inflows, investors in Asia are less worried of any further negative consequences stemming from the US dollar

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.