Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 14, 2024

Will Short Sellers Rain on North American Retail's Holiday Parade?

Short interest climbs across North American retail as the holiday season edges closer.

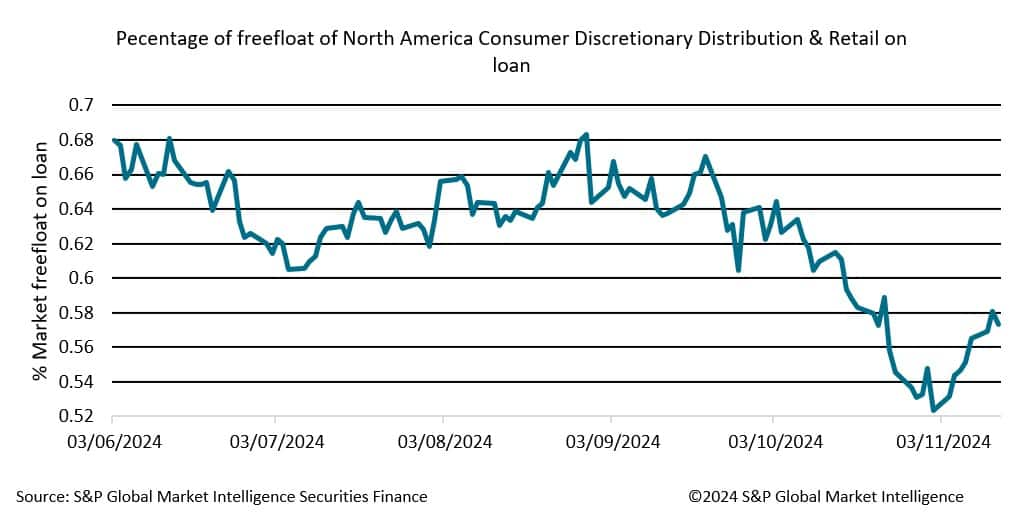

As the holiday season approaches, North American consumer discretionary distribution and retail sectors are feeling the pinch. With the percentage of this sector's free float on loan recently rising to 0.58%, market sentiment appears to be shifting as investors position themselves for potential downturns. The combination of higher interest rates, inflationary pressures, and changing consumer behavior is creating a perfect storm that could leave retailers in a tight spot this festive season.

The looming threat of economic uncertainty is prompting consumers to tighten their belts, which is particularly concerning for discretionary spending. Retailers, especially those in the consumer discretionary space, rely heavily on robust holiday sales to boost their annual revenues. However, with inflation eroding purchasing power, many consumers may opt for a more frugal approach this year, leading to concerns about inventory buildup and profit margins. Additionally, the shift towards e-commerce continues to pressure traditional brick-and-mortar stores, making it increasingly challenging for them to compete and maintain profitability.

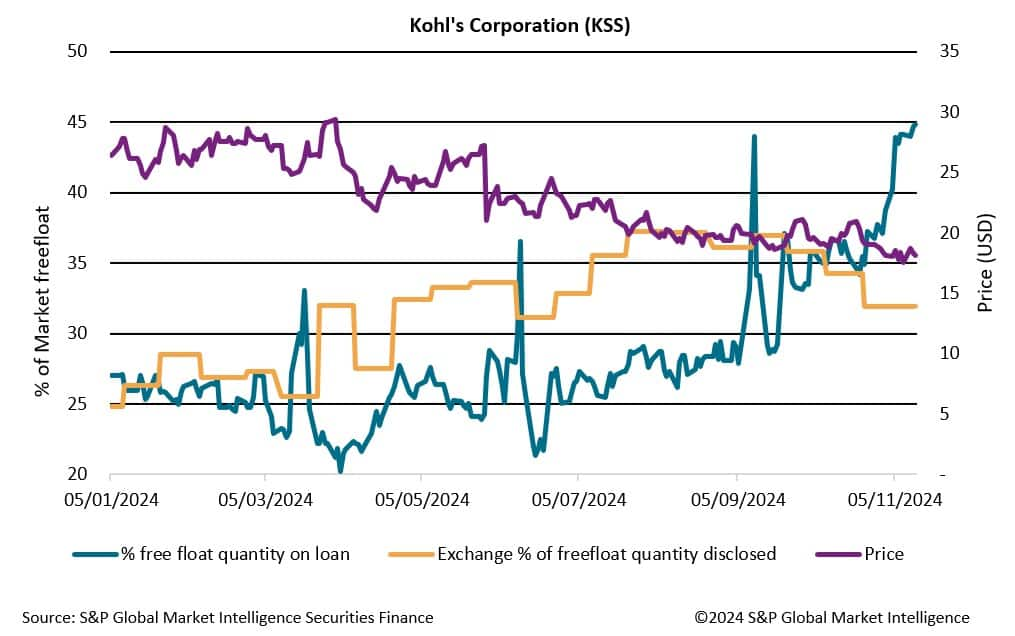

A specific case in point is Kohl's (KSS), which has been under significant pressure as it navigates these turbulent waters. The department store's short interest as a percentage of the free float has recently hit a staggering 45%, marking a 52-week high. This indicates that a substantial portion of investors are positioning against the stock, reflecting a lack of confidence in the company's ability to rebound. Throughout the year, Kohl's share price has been on a downward trajectory, further exacerbating concerns among stakeholders. As the holiday season kicks off, Kohl's faces the daunting task of enticing shoppers while contending with a high level of cynicism from the market.

As Thanksgiving, Black Friday, and year-end celebrations approach, the pressure intensifies for retailers to deliver strong sales figures. The holiday shopping season traditionally represents a significant portion of annual sales, and any missteps could lead to a lump of coal in their stockings. Retailers must not only compete for consumer attention but also manage their inventory effectively to avoid overstock situations that could further depress margins.

The North American consumer discretionary distribution and retail sectors are bracing for a holiday season filled with uncertainty. With short interest on the rise and Kohl's facing significant challenges, the outlook remains cautious. As retailers prepare for the festive rush, they must navigate a landscape marked by economic pressures and shifting consumer behaviours. The success of this holiday season will be crucial, as it could determine whether retailers end the year on a high note or find themselves facing a new year filled with challenges. As we approach the holiday shopping frenzy, the industry will be watching closely to see if retailers can unwrap the gifts of success or if they will be left with unsold inventory come January.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwill-short-sellers-rain-on-north-american-retails-holiday-para.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwill-short-sellers-rain-on-north-american-retails-holiday-para.html&text=Will+Short+Sellers+Rain+on+North+American+Retail%27s+Holiday+Parade%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwill-short-sellers-rain-on-north-american-retails-holiday-para.html","enabled":true},{"name":"email","url":"?subject=Will Short Sellers Rain on North American Retail's Holiday Parade? | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwill-short-sellers-rain-on-north-american-retails-holiday-para.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Will+Short+Sellers+Rain+on+North+American+Retail%27s+Holiday+Parade%3f+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwill-short-sellers-rain-on-north-american-retails-holiday-para.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}