Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 06, 2025

Week Ahead Economic Preview: Week of 9 June 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US and mainland China CPI, plus UK GDP and employment data in focus

Inflation updates for the US will be under close scrutiny alongside GDP and labour market numbers for the UK, trade and CPI statistics for mainland China, plus eurozone production and trade data.

After a below-consensus ADP private sector payrolls count, President Tump piled additional pressure on Fed Chair Jerome Powell to cut interest rates, citing the series of cuts that have already been made by the European Central Bank. The ECB has cut seven times since rates peaked in late 2023, totalling 175 basis points (bps) of cuts compared to just 100 bps in the US. And while eurozone rates have been trimmed three times so far in 2025, US rates were on hold.

Although both the US and the eurozone have faced weakening demand conditions, encouraging a tilt towards looser monetary policy, not only has the US economy shown some signs of encouraging resilience to allay recession worries, there has also been a big difference in inflation pressures between the two economies. The eurozone is facing disinflationary forces, reflecting lower energy prices, weak demand, cooling wage pressures, and the diversion of trade flows of many goods away from the US to avoid Trump's tariffs. Those tariffs have in turn caused a combination of worrying inflation drivers to have resurfaced in the US, unnerving policymakers who are still wary after the inflationary supply shock of the pandemic.

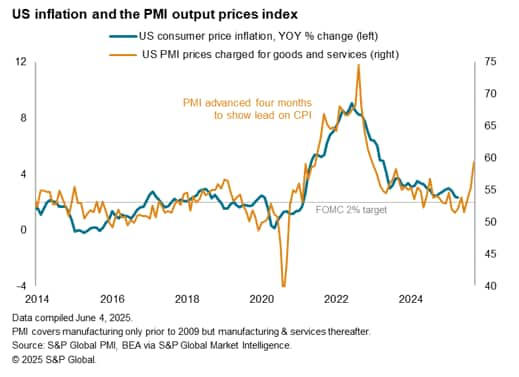

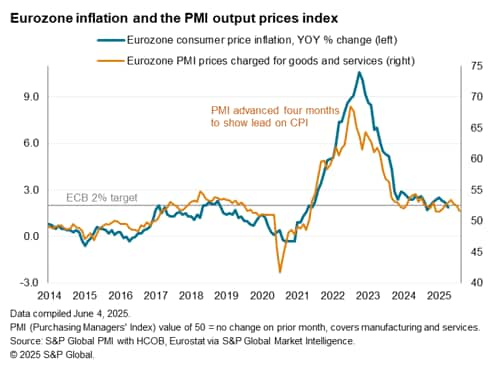

PMI survey respondents in the US have noted how suppliers are hiking prices due to tariff-related supply shortages as well as the direct tariff price rise. This led to the largest rise in prices charged by US companies for their goods and services since September 2022. In contrast, eurozone companies have reported improved supply availability, encouraging discounting and leading to one of the smallest rises in prices charged seen this side of the pandemic.

The PMI prices index for the eurozone has in fact fallen to a level consistent with inflation below the ECB's target in May, where it has been in four of the past nine months. Eurozone inflation is already down to 1.9%, in line with these PMI readings. The equivalent price index for the US, in contrast, is indicative of inflation running well above the Fed's target. Whether these US survey-based price pressures feed through to actual higher CPI readings will be eagerly awaited in the coming week as they will clearly provide an important insight into whether the Fed has scope to lower rates.

US inflation will be eagerly awaited amid pressure on the Federal Reserve to stimulate growth, but PMI data hint at rising US price pressures, in contrast to the disinflationary trend signalled in the eurozone

Key diary events

Monday 9 Jun

Australia, Denmark, Egypt, Indonesia, Norway, Pakistan, Qatar,

Saudi Arabia, Switzerland, Türkiye Market Holiday

Japan GDP (Q1, final)

China (Mainland) Inflation (May)

China (Mainland) Trade (May)

Taiwan Trade (May)

Saudi Arabia GDP (Q1, final)

Mexico Inflation (May)

United States Wholesale Inventories (Apr)

United States Consumer Inflation Expectations (May)

Tuesday 10 Jun

Pakistan, Saudi Arabia Market Holiday

Australia Westpac Consumer Confidence (Jun)

Australia NAB Business Confidence (May)

Norway Inflation (May)

United Kingdom Labour Market Report (Apr)

Switzerland Consumer Confidence (May)

Italy Industrial Production (Apr)

South Africa Manufacturing Production (Apr)

Brazil Inflation (May)

S&P Global Investment Manager Index* (Jun)

Wednesday 11 Jun

Malaysia Industrial Production, Unemployment Rate (Apr)

Japan Machine Tool Orders (May)

Mexico Industrial Production (Apr)

United States Inflation (May)

United States Monthly Budget Statement (May)

Thursday 12 Jun

Philippines Market Holiday

South Korea Unemployment Rate (May)

United Kingdom RICS House Price Balance (May)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Apr)

United Kingdom Balance of Trade (Apr)

Türkiye Industrial Production (Apr)

Hong Kong SAR Industrial Production (Q1)

India Inflation (May)

Brazil Retail Sales (Apr)

United States PPI (May)

Brazil Business Confidence (Jun)

Global GEP Supply Chain Volatility Index* (May)

Friday 13 Jun

Japan Industrial Production (Apr, final)

India Trade (May)

Germany Inflation (May, final)

France Inflation (May, final)

Spain Inflation (May, final)

Italy Balance of Trade (Apr)

Eurozone Balance of Trade (Apr)

Eurozone Industrial Production (Apr)

United States UoM Sentiment (Jun, prelim)

United Kingdom KPMG/REC Report on Jobs* (May)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US inflation, UoM sentiment, inventories; Brazil and Mexico inflation

US inflation figures will be released in the new week with the focus on core CPI after early PMI releases revealed that firms' selling prices rose at the most pronounced pace since September 2022 due to higher tariffs. In particular, manufacturing output prices rose at an especially sharp pace, the fastest in two-and-a-half years. Besides which, the University of Michigan consumer sentiment index will be published for June, with the markets focusing on inflation expectations as well as household confidence.

Inflation numbers will also be closely watched from Brazil and Mexico. Softening demand in Brazil notably led to an easing of price pressures in May, according to the PMI.

EMEA: UK labour market report and monthly output data; Eurozone industrial production and trade data

UK April employment and monthly GDP data will be released on Tuesday and Thursday respectively. According to S&P Global UK PMI data, the UK commenced the second quarter on weak footing with the first contraction in activity in one-and-a-half years, followed by a subdued performance in May. The PMI has also signalled steep declines in staffing levels across both the manufacturing and service sectors in April and May, with the KPMG/REC recruitment industry data to add further insights on Friday.

Eurozone production and trade data will also be key economic releases to watch in the fresh week for a check on the latest conditions. While eurozone manufacturing output remained in growth in May, PMI export orders contracted at a marked pace again amid higher tariffs, thereby hinting at weak trade performance.

APAC: China inflation and trade; Japan GDP; India CPI

In APAC, the key economic updates include the release of mainland China's trade and inflation numbers. According to both official and the Caixin PMI updates, subdued trade conditions were observed in May. Meanwhile final Q1 GDP from Japan and industrial production data will be due alongside India's inflation numbers, completing the set of data to anticipate in the new week.

Investment Manager and Supply Chain Volatility Indices

June's S&P Global Investment Manager Index will be released Tuesday for an update of investment managers' views towards risk, expected returns and sector preference. Insights into the short-term drivers for the market will also be watched alongside a quarterly update of medium-term market views. On the back of tariff impact, the GEP Supply Chain Volatility Index will help to shed light on changes to supply conditions in May.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-june-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-june-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+9+June+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-june-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 9 June 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-june-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+9+June+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-june-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}