Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 06, 2023

Week Ahead Economic Preview: Week of 9 January 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US and China inflation, UK GDP, plus Bank of Korea meeting

The coming week will see a number of key releases including US and China CPI data and China's trade numbers. In Europe, the UK publishes its monthly GDP figures for November while the eurozone's unemployment and industrial production statistics will also be due. On monetary policy, the Bank of Korea is expected to raise rates next week while attention will also be on comments from Fed speakers for insights into US policy. The first S&P Global Investment Managers Index report of 2023 will meanwhile provide fresh indications of US equity investors' expectations following the muted start to the year.

Ahead of US corporate earnings releases, the market can be seen treading water, caught between concerns over continued Fed hikes and hopes for a China reopening boost. The Hong Kong Hang Seng Index notably kicked off 2023 on a positive note, cheering the easing of COVID-19 curbs in mainland China. This also followed the release of the December China Caixin General Composite PMI, compiled by S&P Global, which saw business confidence about the year ahead soaring to the highest since May 2021. That said, the PMI's overall current business activity index remained in contraction territory amid the flaring up of COVID-19 cases. A return to expansion will be eagerly awaited in the coming months, but a fuller picture of economic conditions in December meanwhile becomes available with CPI and trade data in the coming week.

Meanwhile the latest Fed minutes from the December FOMC meeting reinforced the US central bank's commitment to targeting inflation and suggested that the Fed continued to view inflation as concerning despite the recent easing of inflationary pressures. The upcoming CPI release will therefore be of interest especially if the data should surprise on the downside, as hinted at by the S&P Global Flash US Composite PMI. The degree to which risk assets may positively respond to softening inflation indications appears more ambiguous now, post the caution from Fed officials on market rallies hindering the inflation-targeting operations.

Finally, the Bank of Korea will be an APAC central bank expected to lift rates for the first time in 2023. Positioning by the central bank will be watched given the stress for various APAC economies from both tightening financial conditions and a deteriorating global economic outlook.

US economy set to weaken amid financial services woes

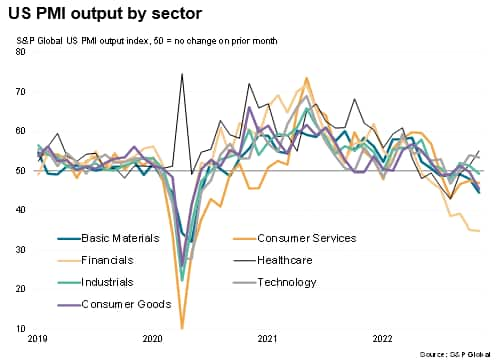

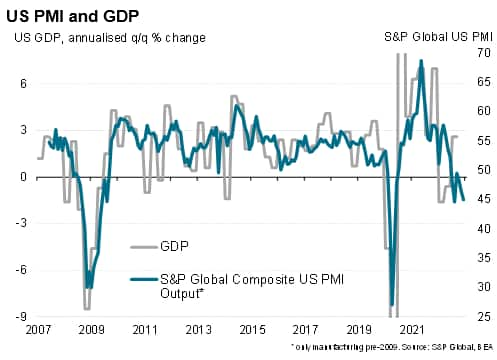

Official data have yet to indicate any significant impact from recent Fed rate hikes, with GDP likely to have risen at an annualised rate in excess of 2% in the fourth quarter. However, the dampening effect of tighter policy is becoming increasingly evident in the survey data, and especially where one would expect to see a detrimental impact from higher borrowing costs: financial services. S&P Global's PMI survey data, based on data collected each month from a representative sample of US companies, showed business activity falling sharply in December, with financial services recording by far the steepest rate of contraction. Consumer facing sectors also struggled, linked to the rising cost of living, and manufacturing faced additional headwinds from a slowing in global trade. While there was some good news from other sectors, notably tech and healthcare, which remained in expansion territory, the overall suggestion is that GDP growth could disappoint in the New Year.

Key diary events

Monday 9 January

Japan Market Holiday

Australia Building Approvals (Nov)

Switzerland Unemployment Rate (Dec)

Germany Industrial Production (Nov)

Switzerland Forex Reserves (Dec)

Eurozone Sentix Index (Jan)

Eurozone Unemployment Rate (Nov)

Canada Leading Index (Dec)

Canada Building Permits (Nov)

S&P Global Metals PMI* (Dec)

S&P Global Electronics PMI* (Dec)

Tuesday 10 January

Japan All Household Spending YY (Nov)

Japan CPI, Overall Tokyo (Dec)

United Kingdom S&P Global/REC Report on Jobs* (Dec)

Norway Consumer Price Index (Dec)

United States S&P Global Investment Manager Index* (Dec)

United States Wholesale Inventories (Nov)

China (Mainland) M2, New Yuan Loans, Loan Growth (Dec)

Wednesday 11 January

Australia Retail Sales (Nov)

Malaysia Industrial Output (Nov)

Thursday 12 January

Japan Current Account (Nov)

Australia Trade Balance (Nov)

China CPI, PPI (Dec)

Norway GDP (Nov)

India CPI (Dec)

India Industrial Output (Nov)

United States CPI (Dec)

United States Initial Jobless Claims

Friday 13 January

Japan M2 Money Supply (Dec)

Japan Broad Money (Dec)

China Trade (Dec)

South Korea Bank of Korea Base Rate (Jan)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Nov)

United Kingdom Goods Trade Balance (Nov)

Eurozone Total Trade Balance (Nov)

Eurozone Industrial Production (Nov)

United States Import Prices (Dec)

United States UoM Sentiment (Jan, prelim)

Canada House Starts (Dec)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Americas: US CPI, UoM sentiment, Fed comments

The final US CPI figure from 2022 will be released in the coming week and watched intently for further signs of inflationary pressures easing. The consensus points to a 0.1% month-on-month (m/m) rise for headline CPI and a quicker 0.3% m/m uptick for core CPI. With the Fed closely watching the inflation trend, this will be an important reading following the jobs report this week. Several Fed appearances are also scheduled with comments scrutinised for insights into the rate hike path in 2023. S&P Global Market Intelligence expects the Fed to raise the policy rate to 4.75-5.00% by March before reversing course in May 2024.

Meanwhile the preliminary January University of Michigan consumer confidence survey will also be released, while insights into US equity investors' sentiment will be gleaned from Tuesday's S&P Global Investment Manager Index.

Europe: UK monthly output and trade figures, Eurozone unemployment and industrial production data, German industrial output

In the UK, official November monthly GDP, output and trade figures will be updated on Friday. This comes after November's S&P Global / CIPS UK Composite PMI revealed that private sector output fell for a fourth straight month with the manufacturing output contraction outpacing that of services. Export orders meanwhile declined for a fifth consecutive month in November and at a faster rate compared to the month prior.

November's eurozone unemployment and industrial production figures will also be due in the coming week.

Asia-Pacific: Bank of Korea meeting, China CPI and trade data, India inflation

In APAC, the Bank of Korea convenes for the first time in 2023 following a 25-basis point hike in November 2022 and the 50 bps prior rise in October. With the Monetary Policy Board expected to further lift rates, another 25 bps hike in January should not be ruled out. Read more in our special report on the South Korean economy.

China's CPI and trade data for December will also be highlights in the coming week following the easing of COVID-19 restrictions. Caixin China General Manufacturing PMI data had so far alluded to a sustained fall in export orders.

Special reports

Global Price Pressures Cool Further as End of 2022 Sees Manufacturers Cut Capacity - Chris Williamson

South Korea's Economy Faces Growing Headwinds in 2023 - Rajiv Biswas

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-january-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-january-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+9+January+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-january-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 9 January 2023 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-january-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+9+January+2023+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-january-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}