Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 27, 2020

Week Ahead Economic Preview: Week of 30 March 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report (including Special Reports) please click on the 'Download Full Report' link.

- Final PMIs covering over 40 economies eyed for broader economic impact of COVID-19

- China PMI surveys

- US nonfarm payrolls

- Eurozone confidence surveys

- Singapore and India monetary policy

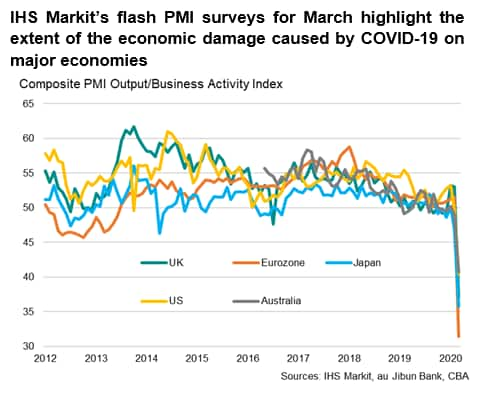

Final PMI data will be keenly anticipated for the extent of the broader economic impact of the coronavirus disease 2019 (COVID-19) outbreak around the world after flash PMI data showed business activity in major economies slumped in March. China PMI updates in particular will be scrutinised for signs of recovery amid reports of an accelerated increase in the number of industrial firms resuming work. Meanwhile, the focus on the recent US dollar strength will remain due to US liquidity concerns as well as the impact on emerging markets that hold excessive dollar-denominated debt.

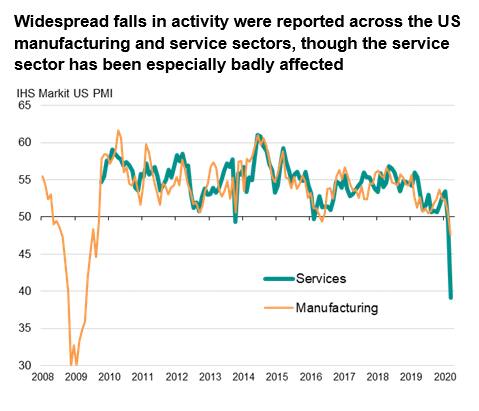

In the US, with the flash IHS Markit US PMI reporting the steepest downturn since the global financial crisis during March, markets will look to forthcoming data, including non-farm payrolls, regional Fed surveys and the ISM PMI results for virus impact in March, even as they eye fresh developments on the massive fiscal stimulus plan that has now moved to a vote in the lower house on Friday 27 March, after being unanimously approved by the Senate.

The flash Eurozone and UK PMIs had meanwhile shown business activity crumbling across Europe, as expanding lockdowns and stricter anti-virus measures were implemented in response to a widening spread of COVID-19. Analysts will closely monitor upcoming data that include Euro area surveys on consumer and business confidence, while also eyeing any fresh policy responses to stem the negative COVID-19 impact on economic activity.

In Asia, the March PMI updates will come on the heels of February numbers which had indicated a much sharper contraction in Asian manufacturing output, primarily led by China. Singapore and India will decide on monetary policy, with the former bringing forward its semi-annual meeting from the usual April date. Both central banks are widely expected to ease policy, joining the increasing number of countries launching significant monetary measures.

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

Recent week ahead economic previews

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-march-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-march-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+30+March+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-march-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 30 March 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-march-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+30+March+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-march-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}