Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 27, 2025

Week Ahead Economic Preview: Week of 27 October 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Rates setters meet in the US, Eurozone, Japan and Canada

It's a busy week ahead for the markets with interest rates decisions due from policymakers in the US, Canada, Eurozone and Japan.

A 'data dependent' FOMC faces a challenging environment given the disruption to official data releases caused by the ongoing government shutdown. However, with inflation coming in below expectations at 3.0% in September, and the flash PMI data showing a further cooling of price pressures in October as firms squeeze their margins, it is no surprise that markets are currently fully pricing in a 25 basis point cut at the October meeting. That would take the federal funds rate to a range of 3.75% to 4.00%, its lowest since late 2022.

In the likely continued absence of official data releases (the week was scheduled to see updates to GDP and PCE inflation), the US nevertheless gets some news on the economic front from regional Fed surveys in Dallas and Richmond, as well as Case-Shiller house prices and consumer confidence data. These surveys follow the PMI showing the US economy enjoying an encouragingly strong start to the fourth quarter, albeit with lacklustre hiring. Policymakers will be hoping to see the release of more official data before their December meeting, for which a further rate cut is by no means certain.

The odds also favor a 25 basis point rate cut by the Bank of Canada, though there are concerns over a recent rise in inflation. The central bank's updated projections will also be eagerly awaited, especially as uncertainty grows over US trade policy after the US abruptly cancelled trade talks.

No change in monetary policy is meanwhile expected at the ECB, where the October flash PMI data showed benign inflationary pressures accompanying an upturn in the pace of economic growth to one of the highest over the past three years. The region also sees third quarter GDP estimates released alongside October's official flash inflation print.

Things are more nuanced at the Bank of Japan, where views are evenly spread on whether the October policy meeting will see interest rates raised again, or whether policymakers will decide to await more signs that the economy is sufficiently resilient in terms of economic growth before hiking. While flash PMI data pointed to another uptick in price pressures, supporting calls for a further tightening of policy, the survey also showed a weakening of output growth amid heightened international economic uncertainty.

US sustains its lead among developed economies

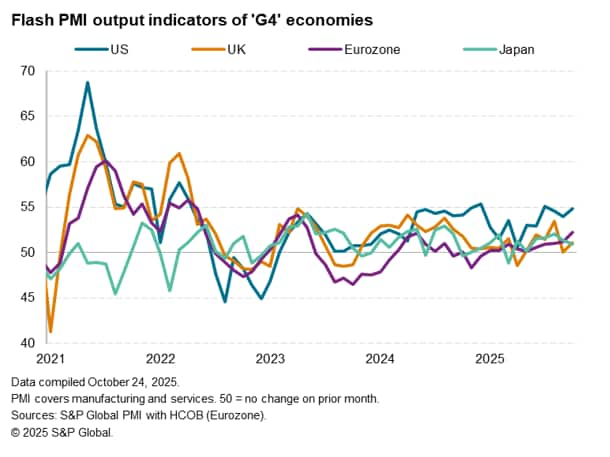

S&P Global's flash PMI surveys showed the US sustaining a solid lead in terms of output growth among the major developed economies in October. Growth accelerated across the combined US goods and services sectors to one of the strongest rates seen over the past three-and-a-half years. However, growth also accelerated in the eurozone to the joint-fastest in almost two-and-a-half years, as improving domestic demand in the single currency area helped drive a stronger service sector expansion and a further recovery of manufacturing output. While relatively lacklustre performances were meanwhile seen in the UK and Japan, both continued to expand.

Measured across all four major developed economies, output growth in October was the fastest since August of last year.

Key diary events

Monday 27 Oct

Americas

- Mexico Balance of Trade (Sep)

- Canada New Housing Price Index (Sep)

- US Durable Goods (Sep)

- US Dallas Fed Manufacturing Index (Oct)

EMEA

- Germany Ifo Business Climate (Oct)

APAC

New Zealand Market Holiday

- China (Mainland) Industrial Profits (Sep)

- Thailand Trade (Sep)

- Hong Kong SAR Trade (Sep)

Tuesday 28 Oct

Americas

- Mexico Unemployment Rate (Sep)

- US S&P/Case-Shiller Home Price (Aug)

- US CB Consumer Confidence (Oct)

- US Richmond Fed Manufacturing Index (Oct)

EMEA

Türkiye Market Holiday (Partial)

- Germany GfK Consumer Confidence (Nov)

- Italy Business Confidence (Oct)

APAC

- South Korea GDP (Q3, adv)

- Thailand Trade (Sep)

- India Industrial Production (Sep)

Wednesday 29 Oct

Austria Bank Austria Manufacturing PMI*

Americas

- US Goods Trade Balance (Sep)

- US Wholesale Inventories (Sep)

- Canada BoC Interest Rate Decision

- US Pending Home Sales (Sep)

- US Fed FOMC Interest Rate Decision

EMEA

Türkiye Market Holiday

- Sweden GDP (Q3, flash)

- Spain GDP (Q3, flash)

- UK Mortgage Lending and Approvals (Sep)

APAC

Hong Kong SAR Market Holiday

- Australia Inflation (Q3)

- Japan Consumer Confidence (Oct)

Thursday 30 Oct

Americas

- Mexico GDP (Q3, prelim)

- US GDP (Q3, adv)

EMEA

- France GDP (Q3, prelim)

- Spain Inflation (Oct, prelim)

- Germany Unemployment Rate (Oct)

- Germany GDP (Q3, flash)

- Italy GDP (Q3, adv)

- Eurozone GDP (Q3, flash)

- Eurozone Unemployment Rate (Sep)

- Italy Unemployment Rate (Sep)

- Germany Inflation (Oct, prelim)

- Eurozone ECB Interest Rate Decision

APAC

Thailand Market Holiday

- Philippines Trade (Sep)

- Singapore Unemployment Rate (Q3, prelim)

- Japan BoJ Interest Rate Decision

- Thailand Industrial Production (Sep)

Friday 31 Oct

Americas

- Brazil Unemployment Rate (Sep)

- Canada GDP (Sep, prelim)

- US core PCE Price Index (Sep)

- US Personal Income and Spending (Sep)

EMEA

Sweden Market Holiday (Partial)

- Germany Retail Sales (Sep)

- Türkiye Trade (Sep, final)

- UK Nationwide Housing Price (Oct)

- France Inflation (Oct, prelim)

- Eurozone Inflation (Oct, flash)

- Italy Inflation (Oct, prelim)

APAC

- Japan Industrial Production, Retail Sales, Unemployment Rate

(Sep)

- Australia PPI (Q3)

- China (Mainland) NBS PMI (Oct)

- Hong Kong SAR GDP (Q3, adv)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Download full report

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-october-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-october-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+27+October+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-october-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 27 October 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-october-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+27+October+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-october-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}