Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 21, 2020

Week Ahead Economic Preview: Week of 24 August 2020

For the full report with calendar, please click on the 'Download Full Report' link.

- GDP updates for the US, Germany and France

- Euro area economic sentiment and German Ifo

- US durable goods orders

- South Korea monetary policy

- Jackson Hole symposium

The coming week will see GDP estimate updates for the US, Germany and France for a more accurate view into the extent of the economic collapse during the second quarter. Markets will, however, focus their minds on business surveys and a virtual meeting of global central bankers to gauge recovery paths going forward as well as glean what monetary policymakers' latest view is regarding the global economy.

The Jackson Hole symposium, to be held virtually, will be watched for any signs of future policy changes at the Fed in particular, and broader guidance on global monetary policy.

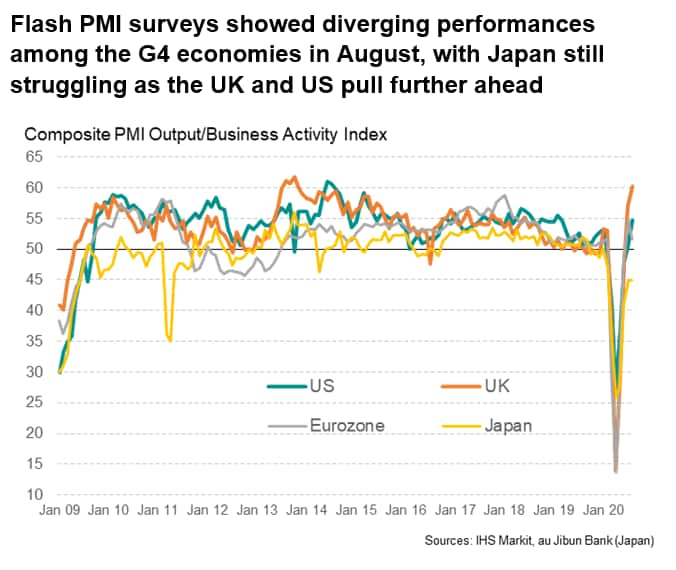

Flash IHS Markit US PMI indicated a solid rise in private sector growth during August, with services business activity returning to expansion. Alongside robust retail sales and housing data for July, eyes now turn to durable goods orders, personal income and spending updates for more clues as to the strength of the recovery heading into the third quarter. However, there remain concerns as to the durability of momentum gained amid efforts to contain COVID-19 infection cases. The Republican National Convention meanwhile will also gather interest in the run up to November's election.

In Europe, after flash PMI data signalled a loss of momentum in eurozone growth in August, analysts will look to a slew of sentiment surveys across the eurozone's three largest economies for further guidance on the progress of any recovery. Meanwhile, a speech by the Bank of England governor will provide clues as to the central bank's latest thinking on negative interest rates as a viable policy tool.

In Asia, data releases on trade, industrial production and retail sales are among the highlights, but analysts will also be monitoring sentiment surveys in South Korea, Japan and Indonesia to appraise the prospect of further economic recovery in the region. Flash PMI data for Japan and Australia indicated weakness in economic activity midway through the third quarter.

Industrial profits for July in China will also draw scrutiny for signs of improvement in the industrial sector. A decision on monetary policy will meanwhile come from the Bank of Korea.

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-august-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-august-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+24+August+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-august-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 24 August 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-august-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+24+August+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-august-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}