Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 20, 2025

Week Ahead Economic Preview: Week of 23 June 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI surveys to gauge business morale amid rising global tensions

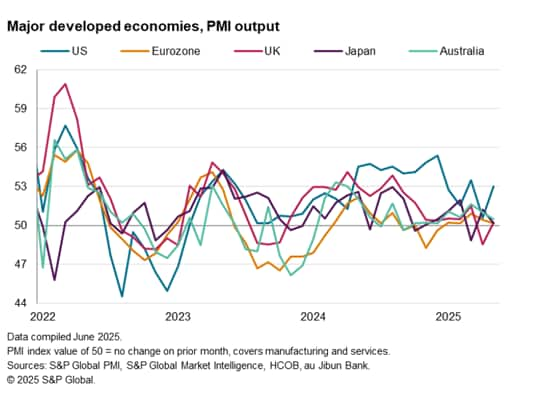

Early PMI survey data for the US, eurozone, UK, Japan, Australia and India will provide eagerly awaited insights into global economic trends and business confidence in June. The data have been collected as ongoing tariff uncertainty has been exacerbated by escalating tensions in the Middle East.

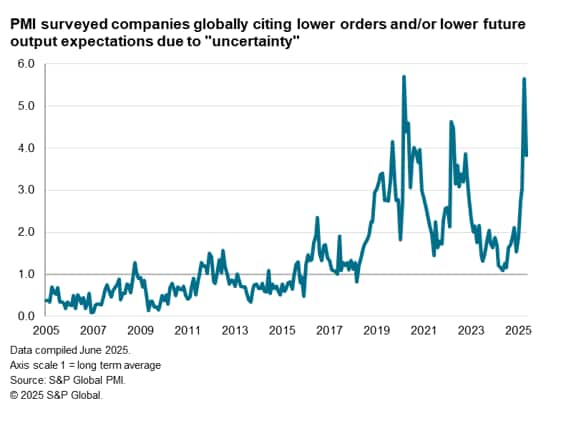

The global PMI data for May signalled improvements in terms of current and expected future output growth worldwide. The rebound in future expectations was especially pronounced, linked to easing concerns over US tariffs. Steep tariff rises announced in early April had been paused later that month. However, with these pauses on higher-rate tariffs due to lapse in early July, the survey data have generally remained subdued by long-run standards amid highted uncertainty (see chart), adding fuel to expectations of weak global economic growth this year.

Moreover, with tensions rising in the Middle East, pushing oil prices sharply higher, the flash PMI data will be keenly assessed to see whether April really represented "peak gloom" in terms of business confidence, or whether executives consider the economic and political environment to have deteriorated further.

The surveys have nonetheless picked up some bright spots. Stronger output gains have notably been seen in the US service sector and eurozone manufacturing, the latter buoyed by expectations of greater fiscal spending (particularly in Germany). UK growth also lifted higher in May to assuage downturn fears, and the June data will be important to gauge any impacts from the US-UK trade deal, April's tax rises and recent government spending review.

The spike in oil prices meanwhile threatens to drive inflation higher. Brent Crude has risen almost 10% on average so far in June compared to May. These higher oil prices come after the May PMI surveys showed a broad disinflationary trend in much of the world, though notably bar the US and Canada, where tariffs had reportedly pushed up firms' costs and fed through to higher selling prices.

The upcoming release of fresh official inflation data for both the US and Canada will therefore also be keenly awaited during the week and will help steel expectations of monetary policy, as will consumer confidence surveys from both the Conference Board and University of Michigan, and US trade data, the latter to be eyed for the impact of tariffs.

PMI surveys showed the US outperforming compared to broadly stagnant growth in Europe, Japan and Australia in May, though even in the US the pace of growth was much weaker than seen on average in 2024.

Key diary events

Monday 23 Jun

Colombia Market Holiday

Australia S&P Global Flash PMI, Manufacturing &

Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Singapore Inflation (May)

United States Existing Home Sales (May)

Tuesday 24 Jun

Malaysia Inflation (May)

Germany Ifo Business Climate (Jun)

Taiwan Industrial Production (May)

United Kingdom CBI Industrial Trends Orders (Jun)

Canada Inflation (May)

United States Current Account (Q1)

United States S&P/Case-Shiller Home Price (Apr)

United States CB Consumer Confidence (Jun)

Wednesday 25 Jun

Kuwait Market Holiday

New Zealand Trade (May)

Japan BoJ Summary of Opinions (Jun)

Australia Monthly CPI Indicator (May)

Spain GDP (Q1, final)

Thailand BoT Interest Rate Decision

United States New Home Sales (May)

Thursday 26 Jun

Jordan, UAE Market Holiday

Singapore Industrial Production (May)

Germany GfK Consumer Confidence (Jul)

Eurozone ECB General Council Meeting

Hong Kong SAR Trade (May)

Mexico Balance of Trade (May)

United States Durable Goods Orders (May)

United States GDP (Q1, final)

United States Chicago Fed National Activity Index (May)

United States Goods Trade Balance (May)

United States Wholesale Inventories (May)

United States Pending Home Sales (May)

Mexico Banxico Interest Rate Decision

Friday 27 Jun

Indonesia, Malaysia Market Holiday

Japan Retail Sales (May)

China (Mainland) Industrial Profits (May)

Japan Housing Starts (May)

United Kingdom Current Account (Q1)

United Kingdom GDP (Q1, final)

France Inflation (Jun, prelim)

Spain Inflation (Jun, prelim)

Eurozone Economic Sentiment (Jun)

United States Core PCE Price Index (May)

United States Personal Income and Spending (May)

United States UoM Sentiment (Jun, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

June flash PMI data

Flash PMI data for major developed economies and India will be published at the start of the new week for the earliest insights into June economic conditions. While May's global data broadly pointed to accelerating growth and rising price pressures, divergences were observed across regions and sectors. Ahead of the looming, albeit still highly uncertain, tariff deadline in early July, how businesses have positioned themselves and performed across these economies will be eagerly assessed with the flash data, released Monday.

Americas: US GDP, core PCE, durable goods orders, personal income and spending, existing and new home sales, consumer confidence data; Canada inflation

A series of economic data updates are anticipated in the US, including the final reading for Q1 GDP and May's core PCE price index. A more muted rise in core PCE is expected in line with the softer-than-expected core CPI data already released. Additionally, durable goods orders and personal income and spending figures will be closely watched for a check on economic conditions in May.

Separately, Canada releases inflation data for the month of May. S&P Global Canada PMI Output Prices Index, which precedes the trend for CPI, revealed a marked rise in inflationary pressures on the back of tariff impact.

EMEA: France and Spain inflation rate; UK GDP; Germany Ifo business climate, GfK consumer confidence

Besides the PMI, a series of economic data releases are anticipated in Europe. Preliminary June inflation data from France and Spain are due on Friday with the HCOB Flash PMI figures on Monday offering an early look into price trends for both economies. Germany flash PMI will also provide early insights into changes in business confidence via the Future Output Index ahead of the release of additional sentiment indicators. Finally, detailed UK first quarter GDP numbers will be refreshed on Friday.

APAC: BoT meeting, BoJ summary of opinions; Singapore, Malaysia inflation; Japan employment and retail sales data; Taiwan industrial production

Over in APAC, the Bank of Thailand convenes for their June monetary policy meeting following two consecutive cuts. A subdued inflation and growth outlook underpins expectations for Thailand's central bank to lower rates further this year.

Meanwhile inflation data are anticipated from Singapore and Malaysia. Taiwan and Singapore's industrial production data will also be tracked for insights into output conditions especially after the latest S&P Global Taiwan Manufacturing PMI alluded to falling new orders and production.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-june-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-june-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+23+June+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-june-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 23 June 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-june-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+23+June+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-june-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}