Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2025

Japan flash PMI reveal mixed picture as accelerating output growth contrasts with falling optimism levels and export orders

Japan's private sector expanded at a quicker pace at the end of the second quarter, according to the flash PMI. Faster services activity growth and a renewed rise in manufacturing production underpinned the latest uptick in output growth.

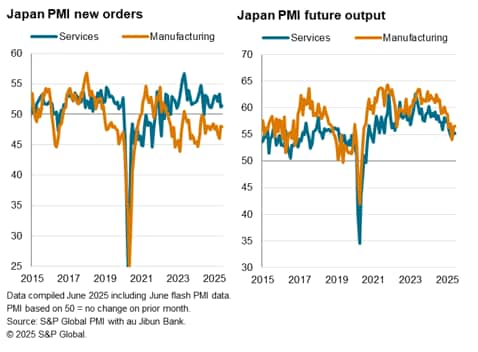

That said, subdued confidence coupled with near-stalled new business growth outlined a less optimistic picture for output expansion in the coming months. This was as new export orders fell for a third successive month, reflecting weak external demand conditions amid trade tensions.

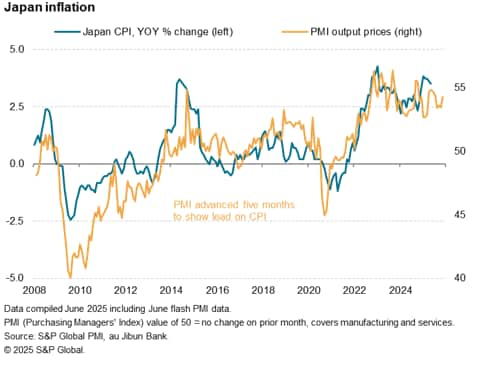

While cost pressures eased for Japanese businesses, selling prices rose at a more pronounced pace in June, hinting at higher inflation in the coming months. Despite accelerating output growth and rising inflation supporting the Bank of Japan on its rate hike path, uncertainty regarding the outlook continues to signal the need for caution over any near-term changes to monetary policy settings.

Japan's flash PMI point to fastest rise in output in four months

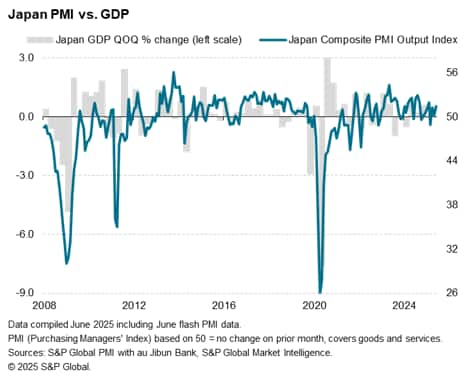

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, rose to 51.4 in June, up from 50.2 in May. Posting above the 50.0 neutral mark for a third successive month, the latest reading signalled that Japan's private sector remained in expansion. Moreover, the rate of growth was the quickest since February, with broad-based improvements in both the manufacturing and service sectors.

At current levels, the latest PMI reading is indicative of GDP growing at a quarterly rate of about 0.5% in June. The latest acceleration also brought the average growth rate in the three months to June above that recorded in the first quarter of 2025.

Broad-based expansion in output

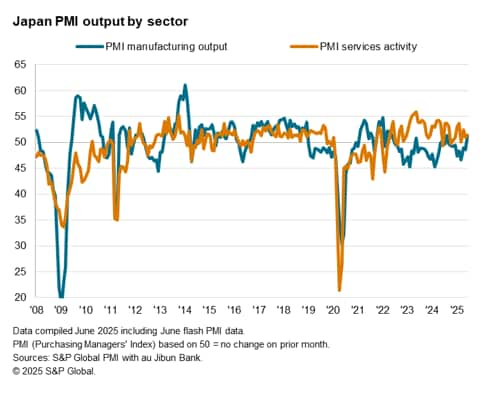

Services remained the better performer in June despite a renewal of manufacturing production growth during the months that brought the rates of output expansion for the sectors close to each other.

Higher services new business inflows underpinned the rise in activity at the end of the second quarter. Anecdotal evidence revealed that improving client spending and an expansion of customer bases helped to spur growth in new sales. This included tourism activity which drove higher services export business despite a broader goods-led slowdown in export orders. Services new export business extended the growth streak that began at the start of the year but saw the rate of expansion ease to the slowest in the current sequence. Still, domestic demand more than made up for decelerating exports growth, helping overall new business expand at a rate faster than in May. In turn, service sector backlogs of work continued to accumulate, encouraging firms to hire additional staff to cope with the workloads.

Meanwhile the headline manufacturing PMI signalled improving factory conditions for the first time since May 2024, with output up for the first time since last August. While modest, the rate of output expansion was the joint-fastest seen in over three years. That said, a closer look at the other PMI sub-indices told a story of production rising due to the clearance of existing orders, with falling backlogs and incoming new work in contraction in June. This was corroborated by comments from panellists, stating that manufacturing work increased in the month leading up to the survey closing date of June 19th as goods producers attempted to clear existing work, some being rushed to meet the Expo 2025 event in Osaka.

Business confidence softens while new sales rise only marginally

Forward-looking indicators painted a picture of greater uncertainty pertaining to growth. Incoming new orders barely expanded for a second successive month in June, while the survey's only sentiment-based indicator - the Future Output Index - signalled that confidence eased slightly since May, remaining at a level close to post-pandemic lows.

Comments relating to pessimism regarding the outlook largely pointed to uncertainty regarding global trade, the economic growth and the impact of an ageing population in Japan.

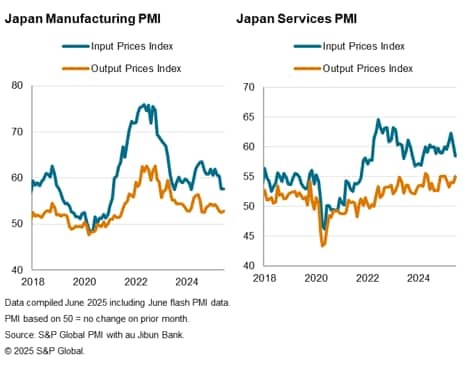

Cost pressures ease but selling price inflation intensify

Turning to prices, Japanese businesses were offered some semblance of reprieve from rising input prices as cost inflation slowed to the slowest in 15 months. This was attributed mainly to slowing service sector cost increases, though cost inflation for goods producers also remained little changed from May's 14-month low. The main sources of cost increases in June were rising energy and labour costs according to survey respondents.

Despite softer input cost inflation, Japanese companies raised their selling prices at a faster pace in June. Output price inflation across goods and services climbed to the highest level since February as firms opted to raise selling prices to shore up margins. This was apparent across both the manufacturing and service sectors, albeit with the former's rate of inflation still capped below its past year average. Subdued demand conditions reportedly often limited manufacturers' ability to raise output prices.

Overall, the latest PMI price gauges are indicative of inflation staying elevated above the 2.0% mark in the coming months. This continues to support the Bank of Japan's (BoJ) bias to lift interest rates. However, as mentioned, the broad improvement in the headline PMI masked the underlying uncertainty, as told by the forward-looking PMI sub-indices. The expectations for softer growth, especially in the goods producing sector, may keep the BoJ on hold in the coming months as policymakers await a clearer picture.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-reveal-mixed-picture-Jun25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-reveal-mixed-picture-Jun25.html&text=Japan+flash+PMI+reveal+mixed+picture+as+accelerating+output+growth+contrasts+with+falling+optimism+levels+and+export+orders+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-reveal-mixed-picture-Jun25.html","enabled":true},{"name":"email","url":"?subject=Japan flash PMI reveal mixed picture as accelerating output growth contrasts with falling optimism levels and export orders | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-reveal-mixed-picture-Jun25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+flash+PMI+reveal+mixed+picture+as+accelerating+output+growth+contrasts+with+falling+optimism+levels+and+export+orders+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-reveal-mixed-picture-Jun25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}