Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 16, 2021

Week Ahead Economic Preview: Week of 20 September 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

An action-packed week ahead promises an abundance of central bank meetings, including the US Fed FOMC, BOE and BOJ policy meetings, while flash September PMIs offer all-important fresh clues on economic conditions.

Given signs of stagflation gleaned from recent PMI and official data, positioning by central bankers in the week ahead will be crucial in guiding monetary policy expectations and market movements alike. Following the ECB's 'recalibration' of its asset purchases, the US Federal Reserve's September FOMC meeting is widely expected to give an update on the timing of its asset purchase tapering, but no significant changes are meanwhile expected from the BOE, BOJ and APAC central banks. In the main, policymakers are likely to be eager to seek more clarification on growth and inflation trajectories after the Delta wave fades, keeping all options open in the meantime.

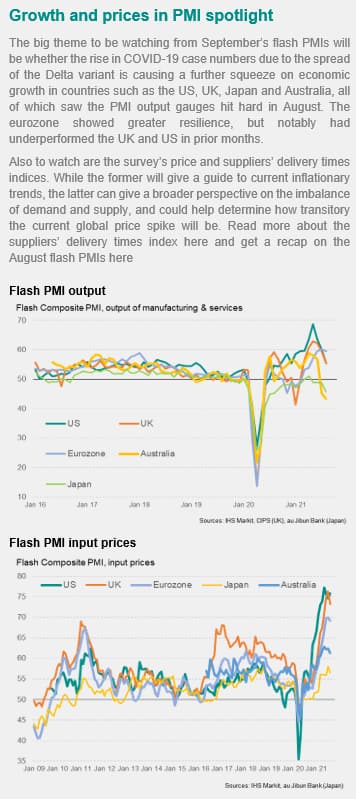

Some clarification may come from the flash PMIs, which will offer a first glimpse of economic conditions in September across the world's largest developed economies. The extent to which supply constraints continue to affect Western economies will be especially in focus in the manufacturing PMIs, providing a key bearing on inflationary pressures, just as the services PMIs will be studied for their reflections of how on-going COVID-19 Delta variant spreads have affected consumer demand into September.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-september-2021.html&text=Week+Ahead+Economic+Preview%3a+Week+of+20+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-september-2021.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 20 September 2021 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+20+September+2021+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}