Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 15, 2021

US equity investor sentiment slides to lowest for a year amid COVID-19 and policy concerns

A new survey from IHS Markit reveals that US equity investors' risk appetite has deteriorated to the worst level recorded over the past year as concerns mount over the ongoing pandemic and investors perceive falling equity market support from monetary and fiscal policy.

- Risk appetite sinks to lowest in 12 months

- Expectations of market returns turn negative

- Pandemic impact seen stretching into 2022, curbing macro environment at same time as policy support perceived to be waning

- Healthcare stocks remain in favor amid COVID concerns, though financials see strongest interest

- Consumer discretionary and industrials see sentiment at lowest for a year

Risk appetite wanes

The darkening picture of market sentiment is signaled by IHS Markit's new Investment Manager Index™ (IMI™) monthly survey, based on data from a panel of 100 institutional investors employed by firms which collectively represent approximately $845bn assets under management. The latest monthly data were collected between 7th and 13th September.

Data have been collected since October 2020, a period over which the US equity market has risen strongly to record highs following the presidential election and initial stimulus and vaccine-fueled economic recovery from the pandemic.

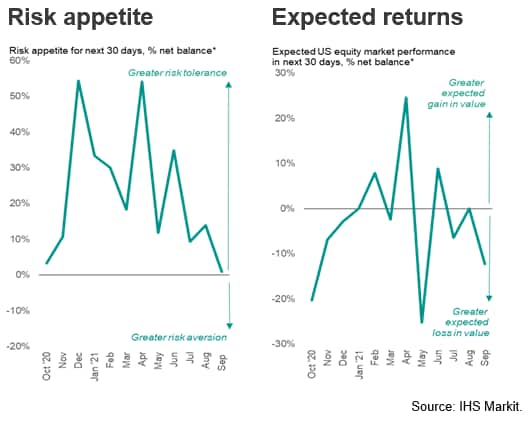

However, recent months have seen the survey indicate a cooling of investor sentiment from peaks recorded earlier this year, with strong risk appetite seen in prior months almost evaporating in September, accompanied by an increasingly bearish near-term outlook for equities.

The survey's Risk Appetite Index fell from +14% in August to +1% in September, barely above the zero level that separates risk tolerance from risk aversion and registering the lowest degree of risk appetite yet recorded by the survey.

At the same time, the survey's Expected Returns Index fell from zero in August to -12% in September, meaning more investors see returns falling in the next 30 days than anticipate a rise. The latest reading is the second lowest since last October, with pessimism exceeded only by that seen back in May, when the survey saw concerns flare up over inflation and central bank policy, as well as rising taxation. These concerns continued to dominate in September, exacerbated by worries about the lingering impact of COVID-19.

Sentiment hit by COVID-19 and policy concerns

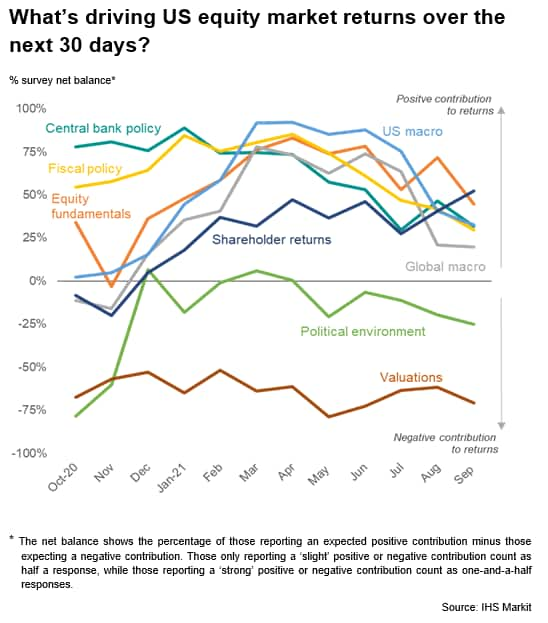

Central bank policy has seen the largest pull back in sentiment as a market driver over the past year, albeit remaining positive on balance in September amid some easing of investor concerns over inflation since the summer. The proportion of investors viewing the Fed as being forced into an early taper or making a larger policy error has fallen since June.

Investor perceptions of how fiscal policy can help drive the market have also fallen to the lowest since the survey began. Initial optimism earlier this year centered on the new administration's fiscal stimulus plans has given way to worries regarding the funding of that stimulus and the potential for overheating.

The political climate is now seen as representing an increasing drag on returns, albeit much less so that a year ago.

Concerns have also risen over the lingering impact of COVID-19. The spread of the Delta variant means some 66% of survey respondents now expect COVID-19 to still be having a high or moderate impact on the US economy at the turn of the year, up sharply from 25% back in June.

Most visibly, the positive effect of global and US macroeconomic drivers is perceived to have diminished compared to elevated levels seen earlier in the year, due to the Delta wave. As recently as July, the US macro environment was seen as the single-largest driver of US equity returns, having displaced central bank and fiscal policy from the top spots early in the year, but in September shareholder returns and equity fundamentals are now seen as the biggest positive drivers of the market.

Valuations remain the biggest drag, however, serving as a reminder of the elevated market.

Sector sentiment shifts

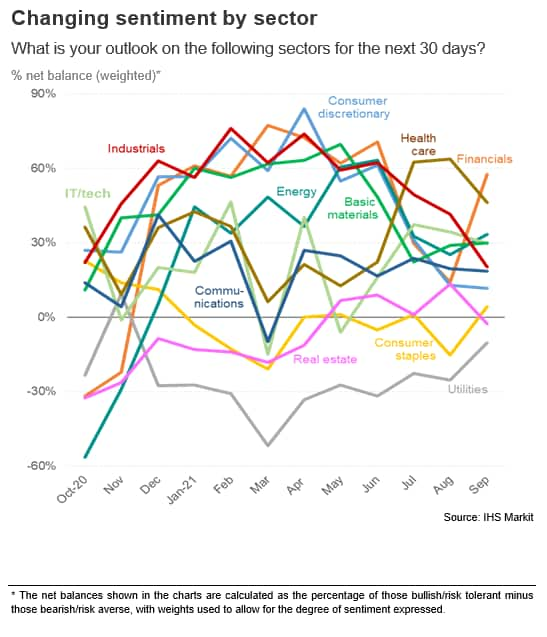

Similarly, September has seen a further shift in investor sentiment towards different sectors amid the Delta wave. Healthcare remains close to the top of favored sectors, beaten only by financials in terms of having the best outlook for the next 30 days.

COVID-19 worries have kept consumer staples in favor but have knocked sentiment towards consumer discretionary and industrials to the lowest yet recorded by the survey, the latter likely hit by additional concerns over supply chain disruptions.

Sentiment towards IT/tech, real estate, and communications services have also fallen compared to August, though only utilities and real estate are seeing overall net bearish sentiment.

For a copy of the full report and accompanying data, please contact economics@ihsmarkit.com.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-investor-sentiment-slides-to-lowest-for-a-year-amid-covid19-and-policy-concerns-Sep21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-investor-sentiment-slides-to-lowest-for-a-year-amid-covid19-and-policy-concerns-Sep21.html&text=US+equity+investor+sentiment+slides+to+lowest+for+a+year+amid+COVID-19+and+policy+concerns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-investor-sentiment-slides-to-lowest-for-a-year-amid-covid19-and-policy-concerns-Sep21.html","enabled":true},{"name":"email","url":"?subject=US equity investor sentiment slides to lowest for a year amid COVID-19 and policy concerns | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-investor-sentiment-slides-to-lowest-for-a-year-amid-covid19-and-policy-concerns-Sep21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+equity+investor+sentiment+slides+to+lowest+for+a+year+amid+COVID-19+and+policy+concerns+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-investor-sentiment-slides-to-lowest-for-a-year-amid-covid19-and-policy-concerns-Sep21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}