Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 12, 2025

Week Ahead Economic Preview: Week of 15 December 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI surveys, US payrolls and CPI, plus trio of key policy meetings

The coming week sees policy decisions from no fewer than nine central banks including the European Central Bank, the Bank of England and the Bank of Japan, as well as a slew of economic data releases such as December's flash PMI surveys, US nonfarm payrolls, plus inflation for the US, UK and eurozone.

After the US Federal Reserve cut interest rates at its December meeting, the focus shifts to the other major central banks for which varying paths are expected to be taken.

Policymakers at the Bank of England have been heavily split on whether interest rates need to fall to support subdued economic growth and slumping employment, or whether sticky inflation requires a more hawkish approach. Our analysts are leaning into the rate cut argument, especially given the weakness of recent survey data on output, hiring and prices. However, policymakers will have the benefit of seeing updates to official labour market and inflation data, as well as the December flash UK PMIs, before announcing their decision on Thursday. The latter will provide the first indication of how businesses reacted to the Autumn Budget.

The European Central Bank is meanwhile expected to keep rate on hold, and in fact do so throughout 2026. Inflation has been broadly in line with its 2% target in recent months and economic growth has been showing signs of reviving. Key releases leading up to Thursday's policy announcement will be the flash PMI, inflation and industrial production.

In contrast, the Bank of Japan is expected to hike rates on Friday as it continues its tentative monetary tightening. Recent survey data have brought news of accelerating economic growth, improved confidence and rising price pressures. However, another rate hike does not look likely until late in 2026, given the drag to economic growth created by geopolitical uncertainty, both on Japan's goods exports and inbound tourism. In addition to the flash PMI, Japan also sees the Tankan survey, inflation and trade data updated to help with the assessment of the current macro environment.

Other key data releases to watch are Monday's industrial production and retail sales for mainland China, but, perhaps most importantly, we will see the delayed US employment report for October, including payrolls on Tuesday, alongside retail sales numbers. US CPI inflation data are then out on Thursday. September's payrolls data surprised to the upside with a 119k rise, while inflation had accelerated to 3.0%; neither arguably in rate cut territory.

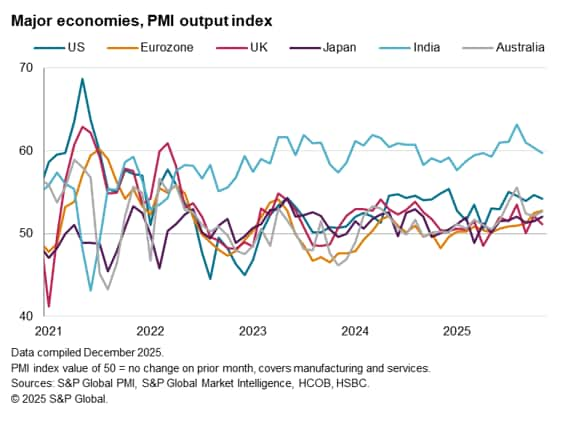

Flash PMI surveys for December will provide insights into key economic indicators for the US, eurozone, UK, Japan, India and Australia. While the US continued to lead the major developed markets during November, and India sustained its lead in the emerging markets, both saw rates of expansion moderate. Growth meanwhile accelerated in the eurozone and Australia but slowed amid policy-related uncertainty in the UK. Read our global PMI wrap up for November here.

Key diary events

Monday 15 Dec

Americas

- Canada Inflation (Nov)

- US NY Empire State Manufacturing Index (Dec)

- US NAHB Housing Market Index (Dec)

EMEA

- Germany Wholesale Prices (Nov)

- Eurozone Industrial Production (Oct)

- UK Consumer Sentiment Index* (Nov)

APAC

- Japan Tankan Index (Q4)

- China (Mainland) House Price Index (Nov)

- China (Mainland) Industrial Production, Retail Sales, Fixed Asset

Investment (Nov)

- China (Mainland) Unemployment Rate (Nov)

- India WPI (Nov)

- Hong Kong SAR Industrial Production (Q3)

- India Unemployment Rate (Nov)

- India Balance of Trade (Nov)

Tuesday 16 Dec

Australia S&P Global Flash PMI, Manufacturing &

Services*

Japan S&P Global Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Americas

- US ADP Weekly Employment Change

- US Building Permits, Housing Starts (Nov)

- US Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings

(Nov)

- US Retail Sales (Oct)

EMEA

South Africa Market Holiday

- UK Labour Market Report (Oct)

- Germany ZEW Economic Sentiment (Dec)

APAC

- Singapore NODX (Nov)

Wednesday 17 Dec

Americas

- US EIA Crude Oil Inventories

EMEA

- UK Inflation (Nov)

- Germany Ifo Business Climate (Dec)

- Eurozone Inflation (Nov, final)

APAC

- Japan Balance of Trade (Nov)

- Japan Machinery Orders (Oct)

- Thailand BoT Interest Rate Decision

- Indonesia BI Interest Rate Decision

Thursday 18 Dec

Americas

- US CPI (Nov)

- US Initial Jobless Claims

- US Philadelphia Fed Manufacturing Index (Dec)

EMEA

- Switzerland Balance of Trade (Nov)

- Sweden Riksbank Rate Decision

- Norway Norges Bank Interest Rate Decision

- UK BoE Interest Rate Decision

- Eurozone ECB Interest Rate Decision

APAC

- New Zealand GDP (Q3)

- Taiwan CBC Interest Rate Decision

Friday 19 Dec

Americas

- Mexico Banxico Interest Rate Decision

- Canada New Housing Price Index (Nov)

- US UoM Sentiment (Dec, final)

EMEA

- Germany GfK Consumer Confidence (Jan)

- Germany PPI (Nov)

- UK Retail Sales (Nov)

- Switzerland Current Account (Q3)

- Italy Business Confidence (Dec)

- Eurozone Consumer Confidence (Dec, flash)

APAC

- New Zealand Balance of Trade (Nov)

- Japan Inflation (Nov)

- Japan BoJ Interest Rate Decision

- Malaysia Trade (Nov)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Download

full report

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-15-december-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-15-december-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+15+December+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-15-december-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 15 December 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-15-december-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+15+December+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-15-december-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}