Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 28, 2020

Week Ahead Economic Preview: Week of 2 March 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report (including Special Reports) please click on the 'Download Full Report' link.

- Worldwide manufacturing and services PMIs to give clearer insights into initial coronavirus economic impact

- US payrolls report

A busy economic calendar starts with worldwide manufacturing and services PMIs and rounds off with the monthly US employment report, which includes non-farm payrolls and pay data.

Markets will be eager to see a fuller insight into economic trends amid the coronavirus outbreak, most notably for Asia-Pacific after flash PMI data for Japan and Australia signalled falling business activity. Especially closely watched will be PMI numbers for China, with manufacturing having seen extended New Year closures and many parts of the services economy having been hit by virus-related disruptions. Monetary policy meetings in Australia and Malaysia will also be keenly eyed for policymakers' reaction to the coronavirus outbreak. Hong Kong SAR retail sales and China's trade data are other notable releases, alongside fourth quarter GDP updates for Australia, Japan and South Korea.

Traders have meanwhile been raising their expectations of FOMC rate cuts as the coronavirus disrupts global supply chains and dents demand, meaning markets will be eager to ascertain the hit to the US economy via PMI data from both IHS Markit and the ISM. Early flash PMI numbers indicated that business activity contracted in February for the first time since 2013 in part due to virus-related factors. The regular monthly employment report will also be scoured for the latest US hiring and pay trends. The flash PMI hinted at an easing rate of job creation to around the 100k mark. In addition, the US news flow will be dominated by Super Tuesday, which sees roughly one-in-three primaries held, as well as trade and factory orders data.

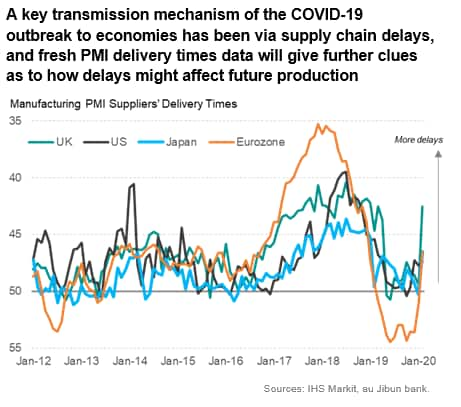

In Europe, the final PMIs will be awaited for confirmation of the encouraging resilience seen in the flash PMIs. The UK continued to show a post-election rebound and growth in the eurozone even picked up slightly. However, the surveys also found reports that the virus outbreak was causing supply delays and denting tourism numbers, the former boding especially ill for future production unless supply chains can be restored rapidly.

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

Recent week ahead economic previews

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-march-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-march-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+2+March+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-march-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 2 March 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-march-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+2+March+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-march-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}