Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 14, 2025

Week Ahead Economic Preview: Week of 17 November 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI survey updates to provide guidance on key policy decisions

Flash PMI data for November will provide key clues in the coming week as to likely policy paths for central banks in the world's largest developed economies.

With uncertainly still lingering over official data issuance despite the conclusion of the US government shutdown, the coming week at least sees a clutch of private sector data releases, including the flash S&P Global PMI and University of Michigan consumer confidence surveys, as well as surveys of business conditions from the New York, Kansas and Philly Feds. The FOMC also published the minutes from its last meeting, which saw policymakers cut the federal funds rate for the first time this year but at the same time dampen expectations of a further cut in December. While the US jobs market is showing signs of weakening to a degree that has concerned some policymakers, economic growth has been encouragingly robust and inflation sticky. The upcoming US flash PMI will therefore provide important indications of whether growth has shown further resilience in November, having accelerated in October, and to what extent changing labour market and inflation trends might support different policy paths.

Markets are meanwhile pricing in a greater likelihood of the Bank of England cutting UK interest rates again in December, following a split 5-4 decision to loosen policy in November. Doves are concerned about the labour market, which has deteriorated markedly so far this year, while also believing that inflation has peaked. Updated official inflation data will help further understand pricing trends, as will the flash PMI, which had shown a welcome cooling of price pressures alongside improved growth in October.

The flash eurozone PMIs will provide key signals as to whether ECB officials can remain content with recent signs of contained eurozone inflation and reviving economic growth. Of concern will be whether manufacturing growth might be cooling as tariff front-loading fades, and the degree to which political instability is subduing activity in France.

In APAC, we focus on Japan with the flash PMI issued on Friday following third quarter preliminary GDP data on Monday. Economic trends have been mixed in Japan, with robust services growth more than offsetting a weakened manufacturing sector, hit by global trade woes. If the coming week's data show further signs of economic resilience alongside ongoing price growth, the odds could shorten on the central bank cutting rates at its December meeting.

PMI surveys to give pointers to growth and confidence trends

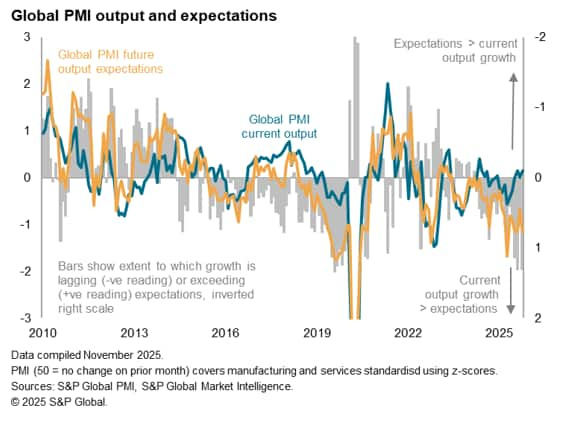

Flash PMI data for the US, eurozone, UK, Japan, Australia and India are issued for November on Friday. The preliminary survey data follow signs of robust and accelerating global economic growth in October's PMI releases, though with business confidence in the outlook having weakened to one of the gloomiest since the pandemic. A key theme to watch in the November PMIs will therefore be whether this lack of confidence has acted as drag on output, demand and hiring, or whether recent central bank rate cuts, an end to the US shutdown, and fewer concerns over US tariffs have helped restore some optimism to the business environment.

Key diary events

Monday 17 Nov

Americas

Colombia, Mexico Market Holiday

- Canada Inflation (Oct)

- US NY Empire State Manufacturing Index (Nov)

EMEA

- Switzerland GDP (Q3, flash)

- Italy Inflation (Oct, final)

APAC

- Japan GDP (Q3, prelim)

- Singapore Non-oil Domestic Exports (Oct)

- Thailand GDP (Q3)

- Japan Industrial Production (Sep, final)

Tuesday 18 Nov

Americas

- Canada Housing Starts (Oct)

- US ADP Weekly Employment Change

- US Import and Export Prices (Oct)

- US Industrial Production (Oct)

- US NAHB Housing Market Index (Nov)

EMEA

- Denmark Industrial Production (Q3)

APAC

- Australia RBA Meeting Minutes (Nov)

Wednesday 19 Nov

Americas

Brazil Market Holiday

- US Building Permits (Oct, prelim)

- US Housing Starts (Oct)

- US FOMC Meeting Minutes (Oct)

EMEA

- UK Inflation (Oct)

- Eurozone Inflation (Oct, final)

APAC

- Japan Balance of Trade (Oct)

- Japan Machinery Orders (Sep)

- Malaysia Trade (Oct)

- Indonesia BI Interest Rate Decision

Thursday 20 Nov

Americas

- US Initial Jobless Claims

- US Philadelphia Fed Manufacturing Index (Nov)

- US Existing Home Sales (Oct)

- US Kansas Fed Manufacturing Index (Nov)

EMEA

- Denmark GDP (Q3, prelim)

- Germany PPI (Oct)

- Switzerland Balance of Trade (Oct)

- Türkiye Consumer Confidence (Nov)

- Eurozone ECB General Council Meeting

- Spain Balance of Trade (Sep)

- Eurozone Consumer Confidence (Nov, flash)

APAC

- China (Mainland) Loan Prime Rate (Nov)

- Taiwan Export Orders (Oct)

- Hong Kong SAR Inflation (Oct)

Friday 21 Nov

Australia S&P Global Flash PMI, Manufacturing & Services*

Japan S&P Global Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Americas

- Mexico GDP (Q3, final)

- Canada New Housing Price Index (Oct)

- Canada Retail Sales (Sep)

- US UoM Sentiment (Nov, final)

EMEA

- UK Retail Sales (Oct)

APAC

- New Zealand Balance of Trade (Oct)

- Japan Inflation (Oct)

- Malaysia Inflation (Oct)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-november-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-november-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+17+November+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-november-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 17 November 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-november-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+17+November+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-november-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}