Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 17, 2025

US equity market investor sentiment improves with reduced macro concerns

While the latest S&P Global Investment Manager Index (IMI) indicated that risk sentiment improved markedly among US equity investors in early November, only limited improvements in expected returns for the near-term were observed, reflecting concerns over valuations and the political environment's impact on US equities.

An assessment of the market performance in conjunction with PMI data meanwhile reinforced the apprehension towards greater market gains in the near-term, with the equity market trend deviating from economic fundamentals. That said, views from US equity market investors suggest that economic conditions may have improved so far in November.

US equity investor risk appetite picks up in November

The November S&P Global Investment Manager Index survey, which tracks views from a panel of just under 300 participants employed by firms that collectively represent approximately $3,500 billion assets under management, revealed that risk sentiment improved to the highest so far this year. The IMI's Risk Appetite Index rose to +18% from +4% in October. The risk-on mood was boosted by accommodative central bank policy plus better perceptions towards equity fundamentals and shareholder value post the third quarter earnings season. Concerns have also eased regarding the macroeconomic environment, according to the survey.

While the IMI's Risk Appetite Index showed a notable rise, the corresponding Equity Returns Index, which tracks US equity investors' views towards expected market performance in the next 30 days, barely increased from October. This signalled that, despite an improvement in risk tolerance among money managers, the US equity market is not expected to edge significantly higher in the near-term.

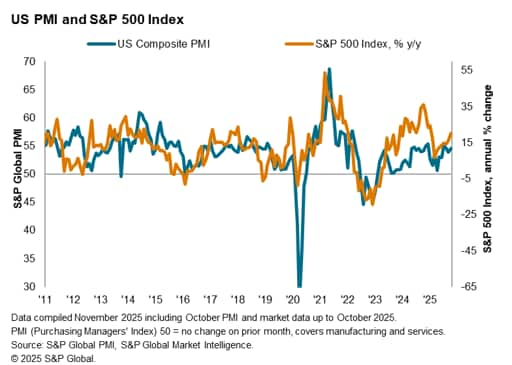

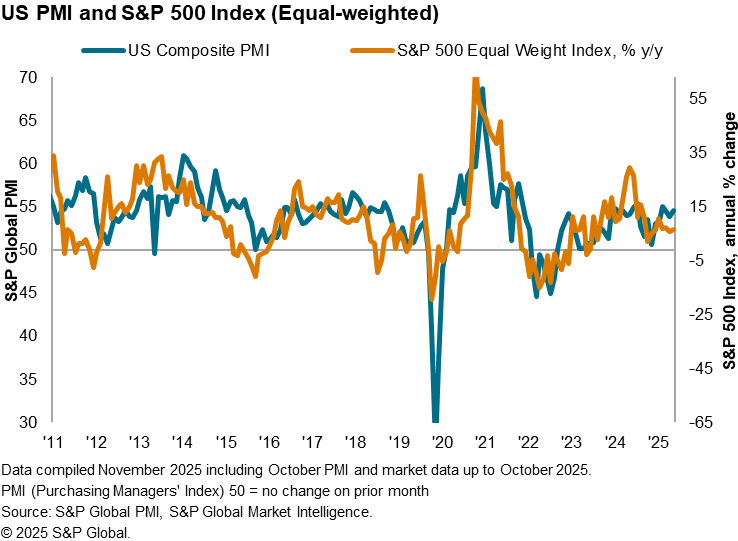

US PMI and the S&P 500 index

A comparison of the S&P 500 index and the US PMI revealed that the divergence in trend further widened in October, thereby reinforcing these concerns over elevated prices. This was despite a period of market adjustment midway through October.

Turning to a comparison between the equal-weighted S&P 500 index and the US PMI, however, the divergence has been on the flipside. This outlined the concentration of gains among a handful of stocks, as has been the case over 2023 and 2024. While it remains to be seen when and whether the two in the above chart will reconverge to the downside, such as in the case at the start of 2025, the latest PMI data have certainly helped to outline reason for caution towards further market gains in the near-term especially among key large-cap names for investors.

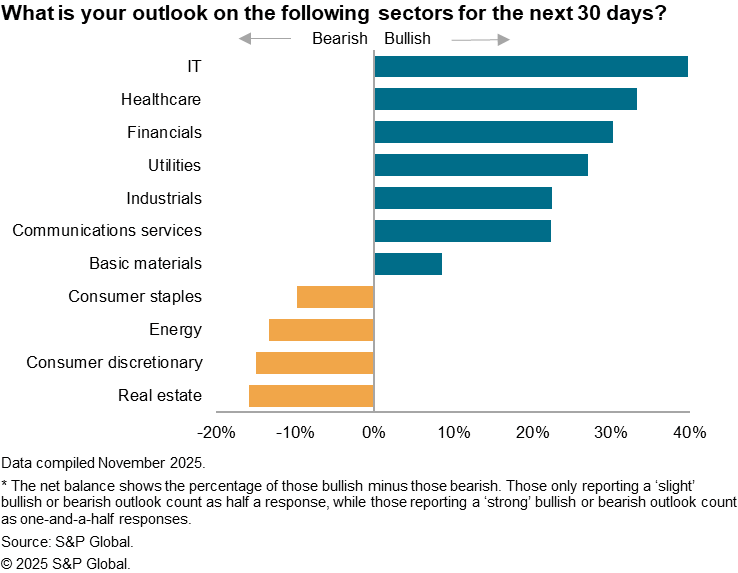

Technology sector in favour

Despite rising concentration risk in October, sector preferences among US equity investors in the penultimate month of 2025, pointed to information technology (IT) as the most favored among the 11 sectors tracked. The surge in positive sentiment was supported not only by ongoing positive sentiment circling the AI-led technology cycle but also renewed optimism regarding US economic growth in November.

While the broad improvement in risk sentiment not only benefitted the IT sector, it also lifted risk sentiment for all bar the basic materials sector.

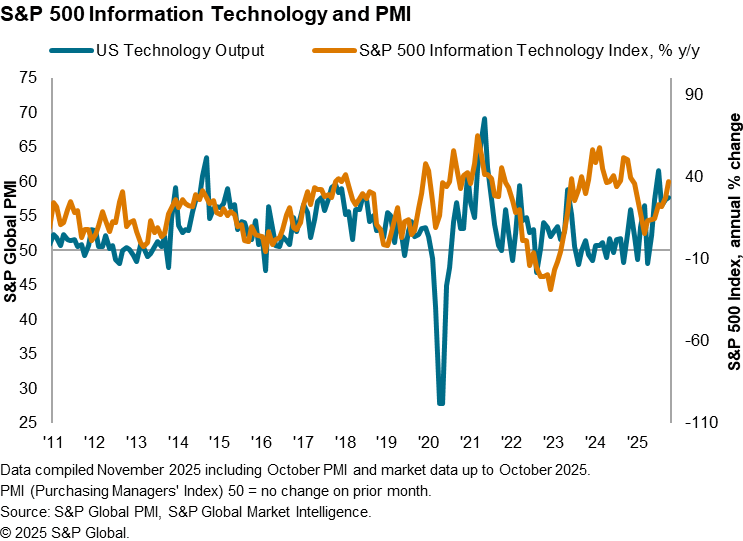

However, a comparison between the S&P 500 technology sector index and the US Technology sector PMI highlighted a divergence in trends going into the start of the fourth quarter, with IT stocks rising at a pace much faster compared to the trend for the technology sector output in October. This will be worth monitoring with increased risk of equity prices deviating further from economic performance under the lead of the IT sector.

Easing macroeconomic concerns

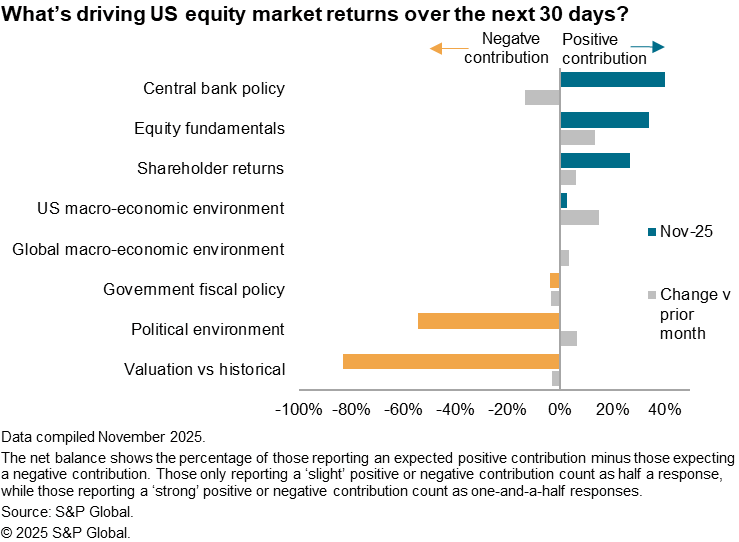

Finally, the IMI survey also sheds light on the key drivers for equity market performance in the near-term, according to US equity investors. The biggest changes observed from November's data were the easing of macroeconomic concerns, followed by rising optimism regarding equity fundamentals post the earnings season. Additionally, there was also a reduction in positive sentiment towards central bank policy amid uncertainties over Fed cuts.

Sentiment towards the US macroeconomic environment notably turned positive for the first time since February, as investors now expect the domestic economy to be a supportive factor for market returns in the near-term. This was while views regarding the global macroeconomic environment became neutral, marking an end to a 16-month period of net negative perception.

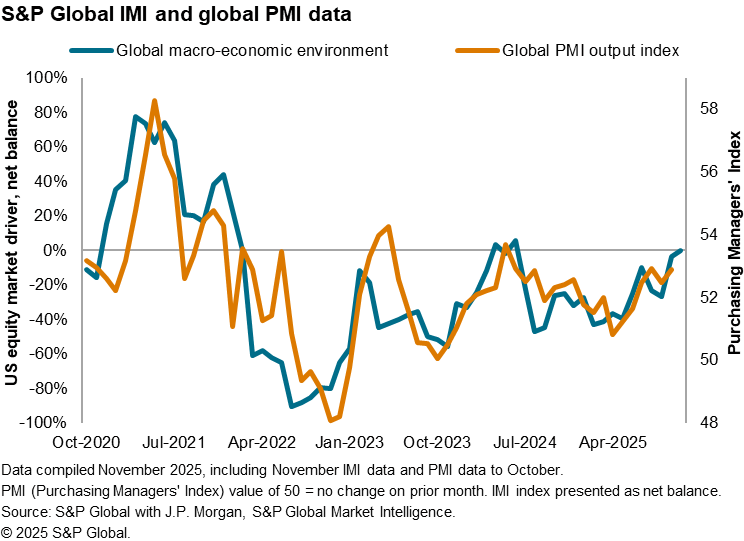

A comparison between the net balance for the global macroeconomic environment and the J.P. Morgan Global Composite PMI Output Index meanwhile suggested that equity investors are seeing the likelihood for global growth to pick up pace in November from the joint-highest rate of growth recorded in October. If it materializes, that will help to buoy investor sentiment going into the end of the year. With that in mind, we will be looking closely to the flash PMI releases across major economies on November 21st for confirmation and the earliest insights into economic conditions.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investor-sentiment-improves-with-reduced-macro-concerns-Nov25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investor-sentiment-improves-with-reduced-macro-concerns-Nov25.html&text=US+equity+market+investor+sentiment+improves+with+reduced+macro+concerns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investor-sentiment-improves-with-reduced-macro-concerns-Nov25.html","enabled":true},{"name":"email","url":"?subject=US equity market investor sentiment improves with reduced macro concerns | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investor-sentiment-improves-with-reduced-macro-concerns-Nov25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+equity+market+investor+sentiment+improves+with+reduced+macro+concerns+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investor-sentiment-improves-with-reduced-macro-concerns-Nov25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}