Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 09, 2026

Week Ahead Economic Preview: Week of 12 January 2026

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Inflation updates in the US and Europe accompanied by UK GDP numbers

US and euro area inflation updates, alongside monthly UK GDP, will provide key insights and guidance for markets, the tone of which will be reflected in S&P Global's Investment Manager Index.

US policymakers get an inflation update via the consumer price index for December. Recent data have been affected by the government shutdown, which meant price statistics were not collected for October and led to some suspicions over the quality of November's data. Hence the drop in headline inflation to 2.7% in November, down from 3.0% in September, and the drop in core inflation to 2.6% (its lowest since March 2021), was treated by markets with caution.

December's CPI data will therefore provide more insights into the inflation trajectory, and to policymaking. Rate setters at the Federal Reserve have been split on whether to loosen policy to help shore up the labour market, or whether sticky inflation warrants more caution. At the time of writing, a cut in US interest rates is not widely expected until June, with rates having been cut by 25 basis points at each of the last three meetings. Updates to US retail sales, industrial production and producer prices will also be released through the week.

In the UK, official GDP data including monthly updates to manufacturing, services and construction for November are due and will give guidance on fourth quarter economic performance. Prior data showed GDP dropping 0.1% for a second successive month in October, having failed to grow since April. That pushed the three-month growth rate into negative territory (albeit just -0.1%) for the first time since late 2023. PMI data have been similarly subdued, indicating broadly stalled business conditions in both November and December to round off a year of only very modest growth. With changes to UK employment taxes and the minimum wage meaning job losses have been worryingly high over 2025, the KPMG/REC recruitment industry survey will also be keenly assessed for insights into December's job market.

Elsewhere in Europe, inflation data for Germany, Italy, France and Spain are released, with the overall message expected to be one of largely benign eurozone price growth.

In Asia, trade statistics for mainland China are accompanied by a preliminary reading of Q4 GDP in Malaysia, while rate setters in South Korea meet. Having held rates in November, further cuts are not expected imminently - especially amid signs of a stabilising manufacturing sector and sticky inflation - but have not been ruled out.

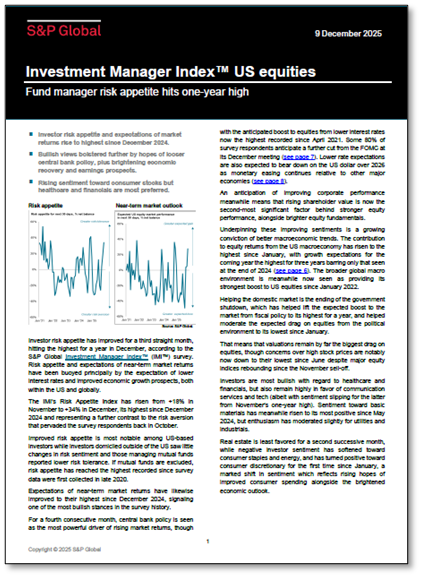

The tone of the US equity market will be reflected in S&P Global's Investment Manager Index (IMI) survey, the January results of which are published on Tuesday. Prior data showed risk appetite improving among fund managers, fuelled by expected market gains linked to looser monetary policy and improved economic growth prospects, both within the US and globally.

Key diary events

Monday 12 Jan

EMEA

- UK KPMG/REC Report on Jobs (Dec)

- Germany Current Account (Nov)

APAC

Japan Market Holiday

- Australia Household Spending (Nov)

- India Inflation (Dec)

Tuesday 13 Jan

GEP Global Supply Chain Volatility Index* (Dec)

S&P Global Investment Manager Index* (Jan)

Americas

- US ADP Weekly Employment change

- US CPI (Dec)

- US New Home Sales (Oct)

- US Monthly Budget Statement (Dec)

EMEA

- Türkiye Current Account (Nov)

APAC

- Australia Westpac Consumer Confidence Change (Jan)

- Japan Current Account (Nov)

Wednesday 14 Jan

Americas

- US PPI (Nov)

- US Retail Sales (Nov)

- US Existing Home Sales (Dec)

- US Business Inventories (Oct)

APAC

- South Korea Export and Import Prices (Dec)

- New Zealand Building Permits (Nov)

- China (Mainland) Balance of Trade (Dec)

- China (Mainland) M2, Loan Growth, New Yuan Loans (Dec)

- India WPI (Dec)

Thursday 15 Jan

Americas

- Brazil Retail Sales (Nov)

- US Export and Import Prices (Nov)

- US NY Empire State Manufacturing Index (Jan)

- US Philadelphia Fed Manufacturing Index (Jan)

EMEA

- Germany Wholesale Prices (Dec)

- Sweden Inflation (Dec, final)

- UK monthly GDP, incl. Manufacturing, Services and Construction

Output (Nov)

- France Inflation (Dec, final)

- Spain Inflation (Dec, final)

- Germany Full Year GDP Growth

- Italy Industrial Production (Nov)

- Eurozone Balance of Trade (Nov)

- Eurozone Industrial Production (Nov)

APAC

- South Korea BoK Interest Rate Decision

- India Balance of Trade (Dec)

Friday 16 Jan

Americas

- Canada Housing Starts (Dec)

- US Industrial Production (Dec)

EMEA

- Germany Inflation (Dec, final)

- Italy Inflation (Dec, final)

APAC

Indonesia Market Holiday

- Singapore Non-Oil Domestic Exports (Dec)

- Malaysia GDP (Q4, prelim)

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-january-2026.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-january-2026.html&text=Week+Ahead+Economic+Preview%3a+Week+of+12+January+2026+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-january-2026.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 12 January 2026 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-january-2026.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+12+January+2026+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-january-2026.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}