Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 09, 2026

Global manufacturing PMI data hint at shifting global growth trajectories in 2026

Worldwide manufacturing business survey data showed ASEAN factories reporting the strongest output growth in 2025 on average, while eurozone producers reported the weakest expansion. However, forward-looking sentiment data put eurozone producers on the best footing for growth in 2026 of the major regions, contrasting with below-average sentiment in North America and Asia, albeit with some important divergences within these regions.

While India reported by far the largest output gain in 2025, Thailand enters 2026 with the strongest tailwind of optimism.

PMI signals weaker production growth in December, rounding off another tepid year for manufacturing

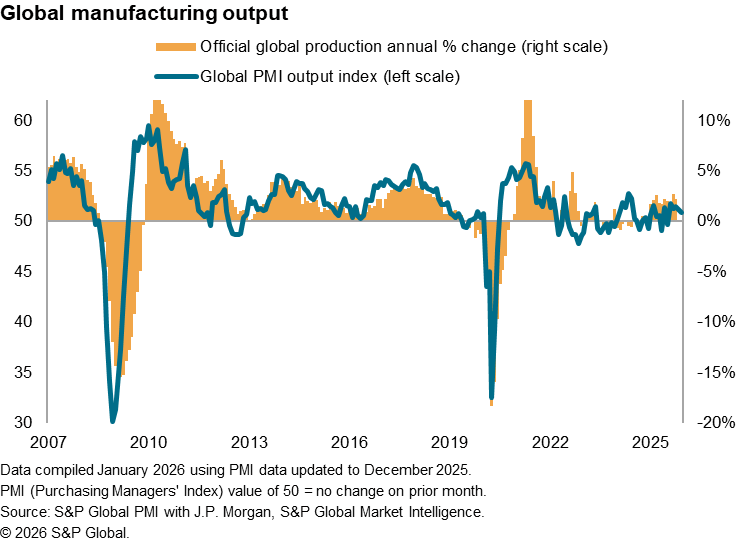

Global manufacturing output rose for a fifth successive month in December, according to PMI data sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, though the rate of growth was the weakest recorded over this period. The sluggish closing month of 2025 rounds off a second year of only marginal manufacturing production growth on average, albeit representing an improvement on the marginal declines recorded in 2022 and 2023.

Since the strong expansion seen in 2021, during the COVID-19 pandemic upswing in demand for goods, the PMI has signalled a largely unchanged global production run on average, as some brief periods of upturns have been countered by downturns.

India led the 2025 manufacturing expansion

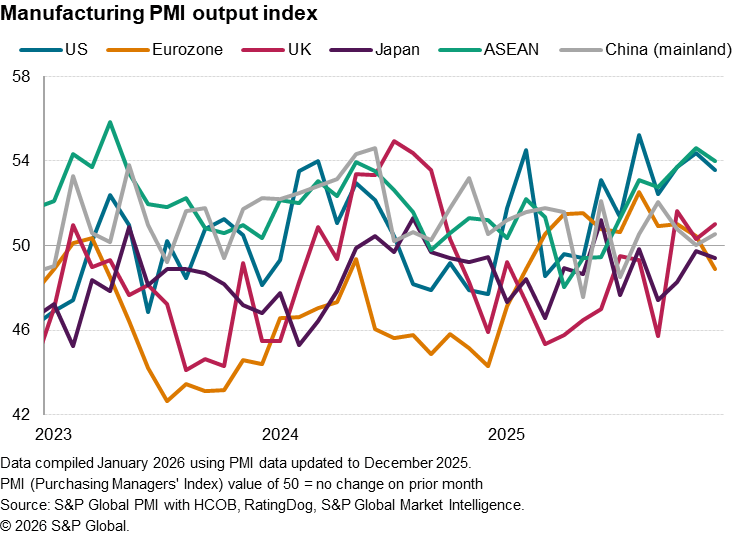

There were very mixed performances on average in 2025. By far the greatest expansion was recorded by India, followed by Thailand. However, two eurozone economies - Ireland and Greece - reported the third and fourth best expansions of the 33 economies covered by the S&P Global PMIs, followed by Pakistan. The US recorded the sixth strongest performance, hence leading the G7 economies.

At the other end of the scale, the steepest downturn over 2025 was recorded in Romania, followed by Mexico, Turkey and Canada. The downturns in Mexico and Canada were in part blamed by PMI respondents on US tariff policy.

ASEAN region outperformed while the eurozone lagged

The disappointing performances in Canada and Mexico also meant the ASEAN region pipped North America in reporting the strongest expansion of the world's major regions in 2025, but downturns in Japan, Taiwan, South Korea and Malaysia, as well as a subdued performance in mainland China, meant Asia as a whole reported only modest growth. However, the weakest performing major region was the eurozone. The weak growth of eurozone factory output over 2025 nonetheless represented its first annual expansion on average since 2021.

Eurozone optimism contrasts with pessimism in North America and Asia

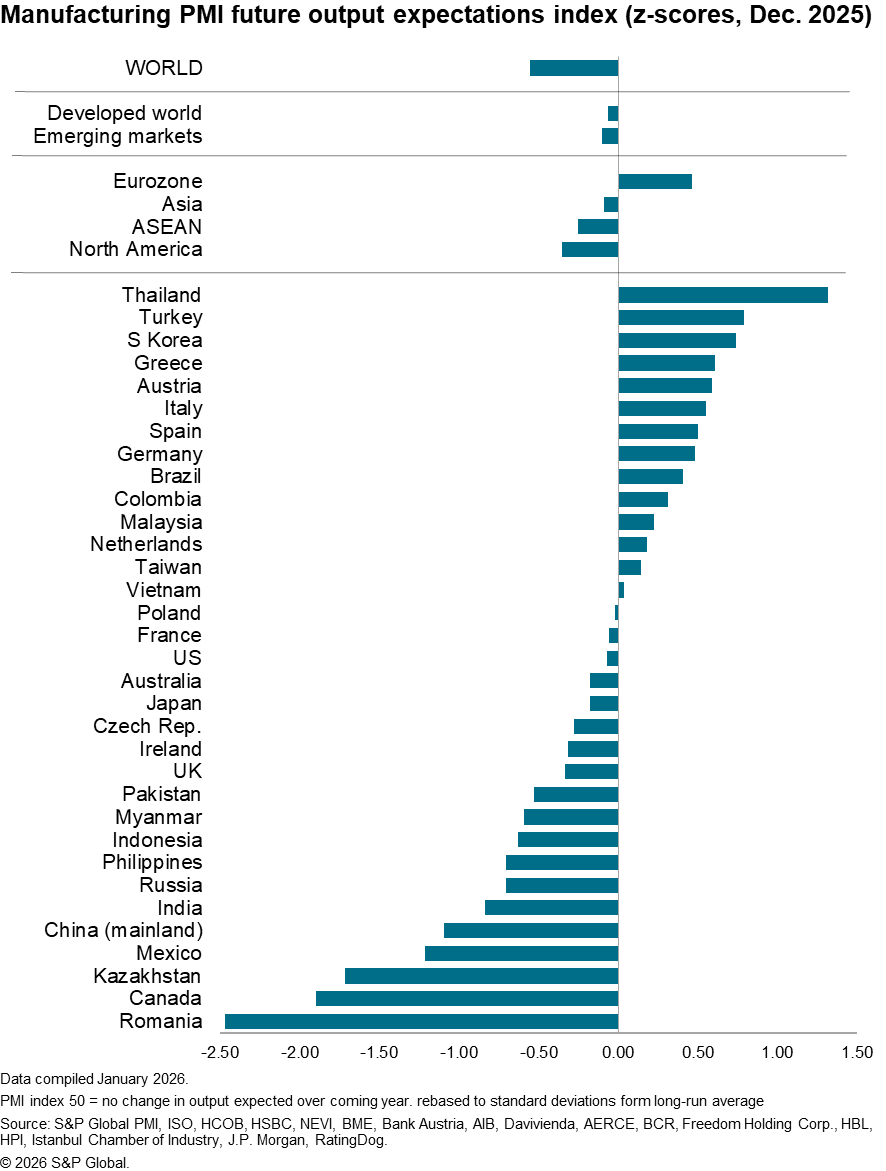

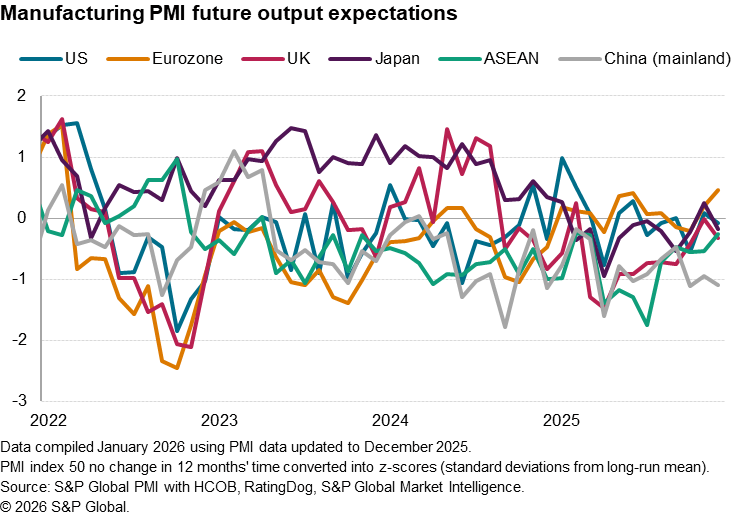

Clues as to how these performances and rankings might change in 2026 are provided by the PMI's Future Output Expectations Index. This is the only subjective measure tracked by the PMI surveys, asking respondents to take a view on how they expect output in their own companies to change over the coming 12 months.

To facilitate comparisons, we convert these indices into z-scores, which show standard deviations from long-run averages. Readings above zero indicate that manufacturers are more optimistic than 'normal' (as defined by the long run average) while readings below zero indicate that firms are more pessimistic than normal.

These scores reveal that, although eurozone manufacturers reported the weakest expansion of production of all major regions in 2025, they ended the year with the highest optimism of all regions. Eurozone output expectations in fact rose in December to their highest since February 2022. Firms in North America are meanwhile the most pessimistic relative to their long-run average. Pessimism in the latter is led by Canada and Mexico, but also extends to the US.

Both the ASEAN and broader Asian regions also saw manufacturers close off 2025 on a more pessimistic than normal footing, with producers in mainland China the most downbeat by long-run standards, with future sentiment down to the third lowest seen over 2025. However, sentiment in India notably fell to its lowest since July 2022, and confidence in Japan dipped back below its long-run average, having briefly risen into positive territory for the first time in ten months in November. In contrast, sentiment in South Korea rose to its highest since May 2022 and its highest since March 2024 in Vietnam, with a nine-month high meanwhile seen in Taiwan; in all cases taking expectations above their long-run averages. However, most upbeat by historical standards are producers in Thailand, where optimism over the closing quarter of 2025 has been running at its highest for three years to again lead the global rankings in December.

Access the latest global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-data-hint-at-shifting-growth-Jan26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-data-hint-at-shifting-growth-Jan26.html&text=Global+manufacturing+PMI+data+hint+at+shifting+global+growth+trajectories+in+2026++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-data-hint-at-shifting-growth-Jan26.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing PMI data hint at shifting global growth trajectories in 2026 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-data-hint-at-shifting-growth-Jan26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+PMI+data+hint+at+shifting+global+growth+trajectories+in+2026++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-data-hint-at-shifting-growth-Jan26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}